Yesterday, Playside Studios (ASX: PLY) unveiled its FY23 full-year results, revealing a 31% increase in revenue to $38.4M alongside a loss of $6.79M.

Despite management’s favoured ‘normalised’ figures— where they exclude the impact of last year’s NFT win, Beans— reflecting an impressive 90% growth in revenue, the market response was not enthusiastic. Shares in Playside dipped by 5% following the announcement, though it is worth noting that the decrease occurred on relatively low trading volume.

Playside Studios FY 2023 Results Summary

I don’t personally agree with management’s decision to exclude the NFT figures from last year’s comparisons. While NFT games might not be a focus in the near future, I believe that the revenue generated from them last year was indeed legitimate. It’s not entirely dissimilar to what a successful mobile game release might contribute in the future. From my perspective, they shouldn’t have the privilege of having it both ways. Thus, I’ve made adjustments to their announced figures accordingly.

- Revenue of $38.4 million (prior year comparison: $29.2 million, +31%)

- Original IP revenue of $14.9 million (prior year comparison: $19.0 million, -22%)

- Work for Hire revenue of $23.5 million (prior year comparison: $10.2M, +130%)

- Underlying EBITDA loss of $1.7 million, with a positive EBITDA of $1.0 million achieved in the second half

- Net operating cash outflow of $1.6 million, while realising positive operating cash flow of $3.7 million in the second half

- Cash balance of $32.2 million

I believe these results are very good, though not extraordinary. Additionally, it’s reasonable to anticipate sustained moderate performance in their Original IP games, given their focus on transitioning to PC and console games. These platforms require lengthy development times, consequently delaying their impact on revenue.

Playside’s Share Price

From December 2022 to the beginning of March 2023, Playside shares declined from 70c to 30c, resulting in a 60% reduction in its market capitalisation. This drop was mainly attributed to management’s emphasis on prioritising the Work-For-Hire Business over their Original IP business in the short term.

Investors reacted unfavourably to this shift. The reaction highlights the distinction between a game creator and a game-making studio, evident in their respective profit margins. While Playside doesn’t provide a detailed breakdown of margins per segment, we can speculate that work-for-hire margins might align with consulting gross profit margins, likely around 30% (approximately, give or take 10%).

The reported figures demonstrate that growth in the work-for-hire segment has outpaced the Original IP segment this year, although this can still vary significantly in the future. It’s challenging to predict precisely which parts of their business will experience growth and at what rate that growth will come in.

Milestones throughout the Year

This year offered some nice milestones for Playside, here are a few worth noting:

- October 21, 2022: PlaySide extends and expands work-for-hire agreement with Meta, extending to December 2023.

- November 22, 2022: Mixed Reality Game Development Partnership established with Meta.

- December 12: Playside signs a game licence and publishing agreement for Dumb Ways to Die with Netflix.

- May 24, 2023: First title by the publishing division, Dynasty of the Sands, signed for PC release in 2024.

- July 26: PlaySide Studios signs a game licence and publishing agreement with Meta for Dumb Ways to Die.

We can see many of the milestones were associated with Meta. This is positive due to Meta’s strong brand, but it’s also introducing client concentration risk for Playside. If issues arise, it could have a substantial negative impact.

What can we expect at the bottom line in the future?

With a strong second-half performance on the bottom line (EBITDA of $1 million and NPAT at only -$1.5 million), investors may be curious about Playside’s upcoming strategic direction with profitability.

During the call, CFO Ben Skinner emphasised that hockey stick growth at the bottom line shouldn’t be anticipated. The focus will be on maintaining a relatively stable bottom line to facilitate investments in growth opportunities. This approach seems fitting to me. Considering the potential ahead in work for hire, the ongoing momentum in the gaming industry, and Playside’s position in its business lifecycle, and the healthy $32M cash pile, I think they’re making the right decision.

Problems with Original IP

This year has exposed potential vulnerabilities and associated risks within Playside. A series of underperforming original IP games could result in write-offs, poor investments, and adverse effects on margins and growth.

On the results call yesterday, management openly acknowledged that both the Legally Blonde and Godfather games fell short of their expectations. While no official statements were given about World Boss, clear signs of underperformance against expectations emerged with its release this year, which garnered harsh reviews. Bluntly Honest Reviews gave it a 2/10 rating and expressed its opinion using vivid language:

“World Boss has almost no chance of survival, and I wish the developers would pull it from Steam before users waste their hard-earned money on microtransactions for a game that may be dead and buried by year’s end. – BHReviews”

Online charts confirm the game’s lack of success:

Source: Steam Charts

World Boss is only a single game, and the CEO commented in an interview with Equity Mates (link here) that World Boss was a bit of a wildcard that hadn’t cost them too substantial an investment. However, with three titles now exhibiting similar trends, the risk of such occurrences in the future becomes apparent.

Dumb Ways to Die: The Gift that keeps Giving

Expanding on the earlier theme of Original IP’s success, this year exemplified both the positive and negative outcomes for Playside.

The year’s accomplishments in Original IP were largely attributed to Dumb Ways to Die’s resurgent popularity. The revival was sparked by the viral spread of the Dumb Ways to Die song on TikTok and Instagram Reels, showcasing comical mishaps synchronised with the audio. This resurgence contributed to the subsequent announcements involving Meta and Netflix.

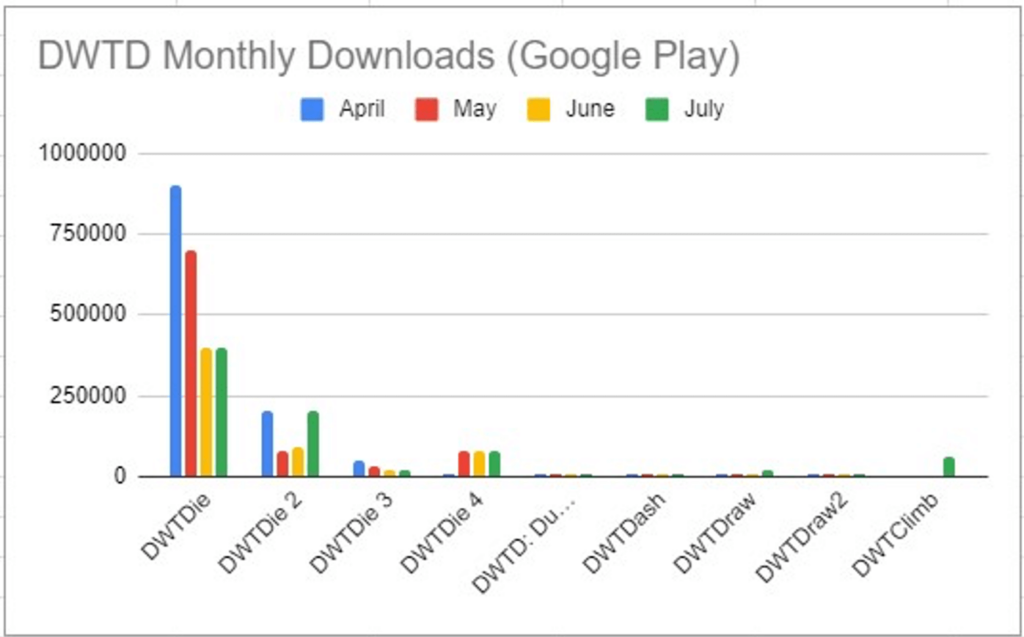

We can see the popularity trend by month on this graph:

Source: Google Play Console

Given that Dumb Ways to Die has risen to become the fourth-largest gaming account on TikTok, it’s truly impressive what management has achieved with the game. Whilst it’s good to see Playside is effectively capitalising on this opportunity, investors now want to envision them replicating this success in other areas with a new title. The upcoming year will determine if they can continue to execute on that front.

Strong Guidance for Next Year

On July 26, when Playside unveiled the Meta Quest announcement, the market responded positively to the company’s cheeky insert of guidance in the comments. They revealed “PlaySide expects FY24 revenue to be in the range of $50-55m.”

Considering this year’s data, accomplishing this would lead to top-line growth ranging from 35% to 45%, which would be quite remarkable. However, this doesn’t address potential gross margins associated with this revenue, an aspect requiring careful monitoring.

If Playside now generates more revenue from Work-For-Hire as opposed to Original IP, we can expect a negative impact on margins.

Playside Publishing Kicks Off

PlaySide Publishing made its initial foray into the gaming scene with the signing of its debut title, Dynasty of Sands, in May. Marketed as a ‘a relaxing, creative strategy game to life’, the game’s trailer failed to personally captivate me, although I acknowledge that strategy games aren’t really my thing.

Playside announced one more publishing title since, and hinted strongly that another title is expected to close soon.

Stepping back, the evolution of PlaySide’s publishing division in the upcoming years will be interesting to watch. Publishing works this way: in the realm of gaming, developers often initiate the game’s inception and then proceed to market it (through platforms like Twitter / X). This is where publishers step in, offering financial backing, advice, localisation expertise, and marketing support. In return, they earn a substantial share of the profits. According to Gerry Sakas, as shared on the Equity Mates podcast, game publisher Team17 can achieve profit margins of up to 30%.

However, a potential hurdle arises in the form of capital investment, which is often required as early as two years before any revenue generation begins. Fortunately, PlaySide boasts a healthy cash position.

Playside Marketing Spend

The final two quarters of the year proved to be cash flow positive for Playside. A quick review of their expenses reveals that this accomplishment was primarily attributed to reduced marketing expenditures.

While this demonstrates prudent financial management, it carries both positive and negative implications. On the positive side, it reflects that management can be judicious with spending when necessary. However, on the downside, it might indicate that Playside perceives its current titles as not meriting further promotion. Also, it may simply result in lower future game downloads, and therefore less future revenue.

This dynamic also underscores the likelihood of inconsistent quarterly cash flow outcomes. It’s foreseeable that certain quarters will remain cash flow negative as the company invests in promoting promising titles at strategic points in their release lifecycle.

The recent shift towards PC and console games will also impact their marketing approach. Unlike mobile games that often receive promotion after launch, larger games require the establishment of their brand during the development phase. This means we need to closely monitor how their efforts to establish these bigger titles are perceived in the market.

What I’ll Be Watching

Over the next 12 months, I’ll closely monitor their progress against their provided guidance of $50m – 55m in revenue, roughly equal between work for hire and original IP (with a stronger first half).

Companies venturing into guidance for the first time often set high expectations, and investors quickly anticipate nothing less. If the trend of the quarterly reported revenue doesn’t align with the guidance (accounting for some regular seasonality), I will consider this very concerning, especially since a substantial portion of results are anticipated from their Work for Hire division.

Additionally, I’m eager to witness their ability to replicate the success of Dumb Ways to Die with another original title. While their achievements with Dumb Ways to Die are commendable, it is hard to know how much of the success is due to their expertise, and how much is due to luck.

Lastly, it will be important to see the continued momentum of big strategic partnerships in the Work for Hire sector. As this segment significantly funds the business, sustaining its momentum is imperative in the near future. Past achievements indicate they have the capability to do this, but it would be a real bonus if they could build up their relationships with companies other than Meta.

If Playside performs well agains these benchmarks, then I believe it will emerge as an attractive founder-led business operating in a fast growing industry.

To access all our subscriber only content, join the waitlist to become a supporter, via this link.

Disclosure: The author of this article Jean-Philippe Picard owns shares in PLY. The editor Claude Walker does not own shares in PLY. Neither will trade PLY shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.