In the last few weeks, we have seen a disappointing emergence of a new covid variant called Omicron. Unfortunately, it seems almost certain that prior infection and vaccination are not able to prevent infection by Omicron, in the same way that this immunity could prevent infection by Delta. This means that we should prepare for a new wave of infections.

Importantly, prior immunity likely gives some protection from severe disease, and so, on average, it seems possible that Omicron will lead to a lower fatality rate, though this is not yet certain, because there is a 2 to 3 week lag between infection and deaths. Furthermore, it seems that Omicron may be more severe in children than Delta was.

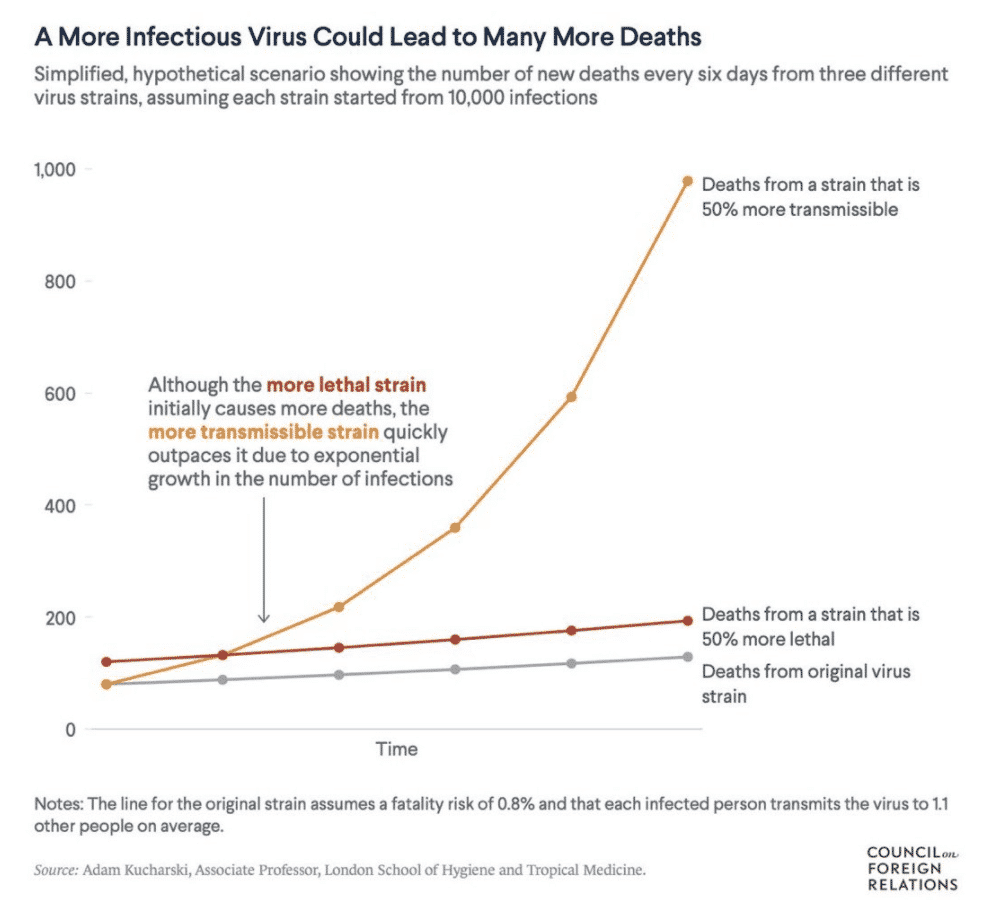

Ultimately, a combination of severity and transmissibility will determine whether Omicron overwhelms health system and thus leads countries back into lockdowns. Importantly, higher transmission with lower severity can still lead to greater strain on health systems, because transmission is exponential but severity is arithmetic, a dynamic you can see in the (purely hypothetical) example below:

Overall, it seems to me that there’s at least some chance that the world grapples once more with lockdowns and travel restrictions (though we are unlikely to see anything as severe as what we’ve been through already). Indeed, we already see some travel restrictions in response to Omicron.

How Does This Impact My Portfolio?

The most pronounced impact of the Omicron strain seems to have been on Camplify (ASX:CHL), which had already enjoyed a strong share price run, perhaps making it extra susceptible to profit taking. Camplify does poorly in a lockdown situation, as people are simply not allowed to travel to many of the places they wish to go. On the flip side, Camplify can actually benefit if people are doing domestic travel but not international travel, especially since taking your family on a camping trip is much lower risk than going overseas.

Still, Camplify loses out if there is a big wave of covid because some people will cancel their bookings, for sure. That probably explains the share price decline of around 20% since Omicron was first reported. And to be quite frank, it probably makes sense to take some profits in this environment. I will consider selling a few shares myself.

However, longer term, I don’t think Omicron will stop an (eventual) recovery in outdoor tourism, which should benefit Camplify.

Edit at 2pm, Wednesday 8 December: today, Camplify held its AGM. The Chairman’s address talked about “post pandemic” and “recovering from the pandemic” which makes me think that the company thinks the pandemic is over. Conversely, it had no mentions of Omicron. This makes me think the company may be overly optimistic. Therefore, I will take some profits today, and will sell about 19% of my shareholding by the end of the week.

Obviously, my overseas holding in Lastminute.com will also suffer, because it is in the leisure travel industry.

On top of that, I also have a few companies that have complained of negative impacts during covid spikes, and these ones may again suffer. Specifically, that would include companies like Eroad, Austco Healthcare, MSL Solutions, Volpara, Nanosonics, Control Bionics and PTB Group. Now, I’m not yet so sure that this companies actually will suffer, because much of the negative affect of infection waves could be attributed to the lockdowns and restrictions associated with them, rather than the waves themselves.

With vaccines so readily available in the developed world, I suspect that governments will be much gentler with restrictions going forward. For example, universal masking, and government mandated ventilation or air filtration would seem to be likely, while hard lockdowns and border closures probably less likely.

Of the companies I’ve mentioned that I think are vulnerable to an Omicron wave, the only one that I’ve changed my view on is Control Bionics (ASX: CBL). The reason for this is that their clients are by definition quite vulnerable, and likely to go into their own self-imposed lockdowns if there is a large Omicron outbreak.

In the company’s most recent quarterly, it blamed lockdowns for weak sales in Australia, but pointed to optimism that its new distributor would start making serious sales in FY 2022. In my view, an Omicron outbreak, which looks increasingly likely, will only hamper their efforts to get scale.

Worse than that, the company seems to think that we are “post COVID-19” already, which is extremely lazy, since we are not “post COVID-19”. Or alternatively, they are not planning to grow until we are “post COVID-19”.

Sadly, despite almost 2 years of the a pandemic, the company doesn’t seem to have figured out that the pandemic is an ongoing state of affairs. It’s simply not acceptable for a cash burning company to keep blaming the pandemic for a lack of sales growth. Sure, the pandemic may indeed be impacting sales, but you can’t change that.

The Low-IQ (at best) talk about “Post COVID-19” makes me think the company is completely unprepared for an ongoing pandemic, with an unknown number of new waves and variants, such as we are experiencing.

Any decent company has by now figured out ways to operate in a pandemic. Blaming the pandemic for flat sales points to ineptitude. Just as I have reduced my Eroad holding due to the management’s decision to blame weak sales on covid, I am going to sell my Control Bionics shares.

In this day and age it simply doesn’t make sense to own stock of a company that is incapable of growing in a covid-ridden world. Because that is the world we live in.

Going forward, I’ll be automatically reducing my holdings in companies that blame covid for poor sales unless there is a demonstrable impact on demand, arising from covid. For example, if Nanosonics blames covid for poor sales, I will likely sell some shares, because covid does not reduce demand for infection control (except if hospitals are overwhelmed). However, if PTB Group details how less travel has meant less demand for them to service aircraft, then I would not blame the company for blaming covid for weak sales. The reason for this is that PTB Group cannot control demand fluctuations, but Nanosonics can adapt its sales process to an outbreak situation given the various tools like vaccination, masking, ventilation and rapid antigen testing.

The point here is that by now companies should have figured out how to operate in a covid-ridden environment. All of the companies above could be negatively impacted either by a lack of demand, or a lack of attention from clients who may have ‘bigger fish to fry’ during an outbreak. The former is categorically out of their control, but the latter is something that they should be able to confront by now.

Whereas previously regulatory lockdowns prevented non-essential activities, it is less likely we will see those kind of restrictions now that adults (in the developed world) have had a chance to be vaccinated.

A Bit Of Good Fortune

Usually, I would be a bit worried about the impact of the current sell-off on my portfolio. However, it just so happens that I have been taking profits fairly consistently since we bought our second house earlier in the year. At this point, my debt is well under control and thanks to my plans to start an SMSF, I will soon have access to plenty of new capital to deploy. That’s important, because it means I have plenty of dry powder to take advantage of any sell off. For that reason, I’m not particularly motivated to sell stocks at the moment, even though the short term prognosis for markets is likely to be negative.

When I moved drastically to cash when the pandemic started, I saved myself plenty of money. However, I then cost myself heaps by keeping a large portion of my portfolio in gold for too long. This time, I won’t bother, because the likely impact of Omicron is likely to be far less than the initial impact of covid. Rather, I’ll take this as a reminder that the pandemic isn’t over, and it’s not going to be, for quite some time. As a result, it’s best to invest in companies that won’t be bothered by that fact. In the longer term, it is likely that we will move past the pandemic worries within the next few years, and as long as companies are doing their best to adapt to the world as it is today, I’m willing to hold them throughout the Omicron wave.

What I won’t accept is management that perpetually blame the pandemic for bad results, without adapting their businesses to the pandemic reality.

Please remember that these are personal reflections about stocks by the author. At the time of writing I own shares in all the companies mentioned, but am about to sell my Control Bionics shares. I am also likely to trim my Camplify shares today or tomorrow, though I will continue to hold the stock. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.