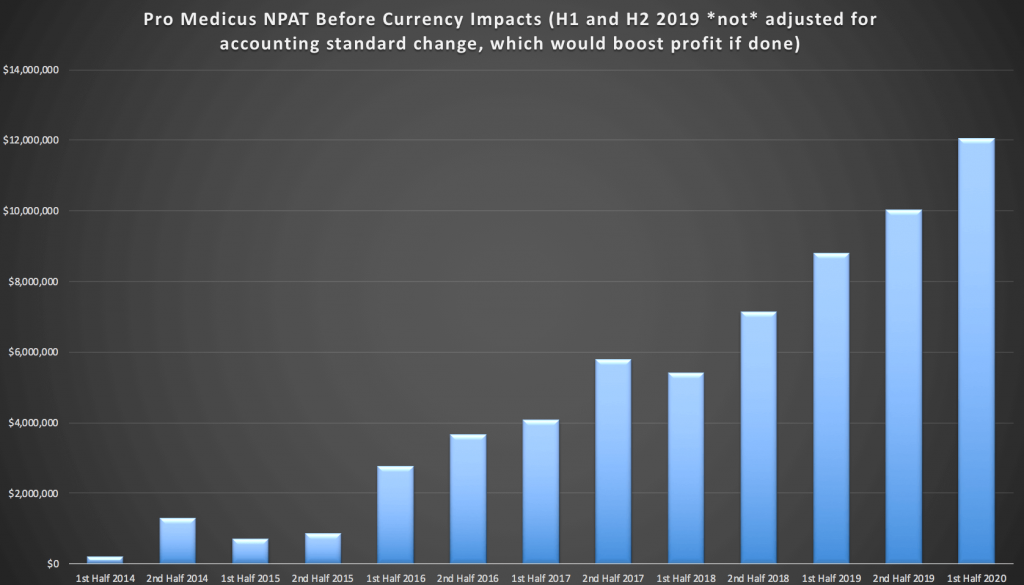

I have owned ASX-listed radiology imaging software company Pro Medicus Limited (ASX: PME) since 2014, and it’s one of my largest holdings as a result of share price appreciation. Today, it released its first half results for the 2020 financial year, boasting profit of $12 million, a 32% increase on the prior corresponding, and a 20% increase on the previous half. The chart below shows its steady half-on-half profit growth over the last couple of years, though it’s well worth noting that the current half benefitted from a lower tax rate. The result would have been roughly flat, half on half, but for a lower tax rate.

Historically, Pro Medicus has always had some lumpy contracts, where it received a larger payment for the implementation and licensing of a system. In particular, government clients often prefer pay like in this manner, and that explains why profit growth has been bumpy in years gone by. Notably, the first half last year actually benefitted from a large up-front contract, and profit growth would have been higher if not for this unusual boost to the prior corresponding period. As more of the company’s revenue comes from smoother transaction-based contracts (where Pro Medicus is paid per case-study viewing), these lumpy contracts will be less detectable in the final results.

Pro Medicus essentially has three main products; Visage 7, its state of the art radiology viewing platform, Visage VNA, its image storage solution for large enterprise, and Visage RIS, its radiology information system which is mainly deployed in Australia (and evolved from its original products).

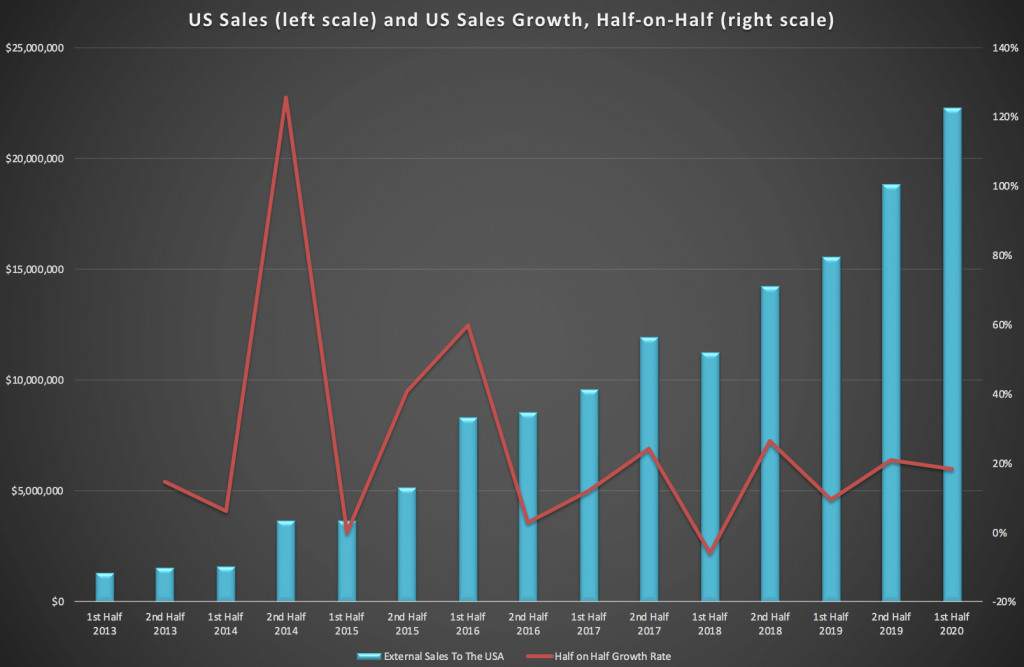

The most important of these is Visage 7, followed by Visage VNA, because these products are driving international growth. While the headline 15% revenue growth figure may discourage many investors, these parts of the business are growing much faster. For example, the company disclosed that the Visage 7 product increased revenue by about 25% against the prior corresponding period. Furthermore, the company has now grown sales to the USA by about 20% half-on-half for four consecutive halves, as you can see below.

Pleasingly, free cashflow came in at $12.4 million, running ahead of the half year profit. This was expected, and resulted from a forecast reduction in receivables from over $17 million to $11 million. When the company last reported results, skeptics were rather focussed on the ballooning receivables despite management explaining the situation was temporary and that they would be able to reduce receivables. This is yet another example of the company doing exactly what management said it would.

Zooming out, there is plenty to be optimistic about in terms of the quality of the business. The balance sheet remains rock solid, with almost $39 million in cash. This provides plenty of room to grow, as well as to fund dividends and share-buy backs, although the company has been fairly cautious here. There’s no doubt that some degree of financial strength also helps win contracts with large customers, who are assured that Pro Medicus is a strong company with plenty to lose.

Importantly, the company continues to sign new deals including a rather intriguing deal with a tele-radiology start-up called Nines. To my mind, this is potentially exciting because I think that tele-radiology itself can be a growing and disruptive field. It’s good to see Pro Medicus on the cutting edge. I’ll certainly update this post if the CEO shares more information about this deal on the conference call.

This is certainly not a recommendation or advice, but now that I have reduced the stock to under 15% of my portfolio, I cannot imagine being enticed to sell more shares at the current price. Nonetheless, I find the price a little too optimistic for my liking at present, but I would certainly like to buy more shares at under $20, all else being equal. When the share price gained 5% this morning, Pro Medicus was briefly my largest individual shareholding. But after the conference call the share price reversed quickly, falling well below the opening price.

Click here for my target buying range for Pro Medicus (ASX: PME)

Conference Call Notes

A large part of the conference call was an opportunity for the CEO to present the business to investors, but he also covered some of the important points that allow existing shareholders to check up on the health of the business.

First of all he said that, “We still think we are 18-24 months ahead, [and] we’ve released more new product and more enhancement to existing products [this year] at the RSNA than any year in the past”. That should provide some comfort that the development team is still operating smoothly.

In terms of implementations, everything is on track, and the Duke healthcare system will go live next week. On top of that, the remaining 30% of the Partners contract should go live over the next 9 months, so there is a certain degree of growth already baked in to the next couple of halves.

The company also re-iterated that they expected stronger margins in the second half, which means it is on track for record EBIT margins given they already recorded an impressive margin of 50.5% in the first half.

On a qualitative level, the deal with tele-radiology startup Nines points to the market-leading nature of Pro Medicus technology, but is unlikely to make any significant revenue contribution in the near term, in my opinion.

Looking into the next half, we should see some uplift from Wexler and the renewal of contracts signed 5 to 7 years ago, if Pro Medicus is able to achieve some small price rises. No clear guidance was given on pricing, but it’s clear large long-term clients can expect to be paying less than new clients. I’d suggest a 5% – 8% price rise would be easily possible, but that is pure speculation.

In terms of product development, I thought it was interesting to see that Visage 7 now offers a worklist function, frawing on the company’s experience building the Visage RIS (which is mainly in Australia). Unfortunately, there was nothing new to report about the company’s push into other -ologies, but as long as ocular CT scans become more widespread, it seems reasonable for the company to chase expansion in this way.