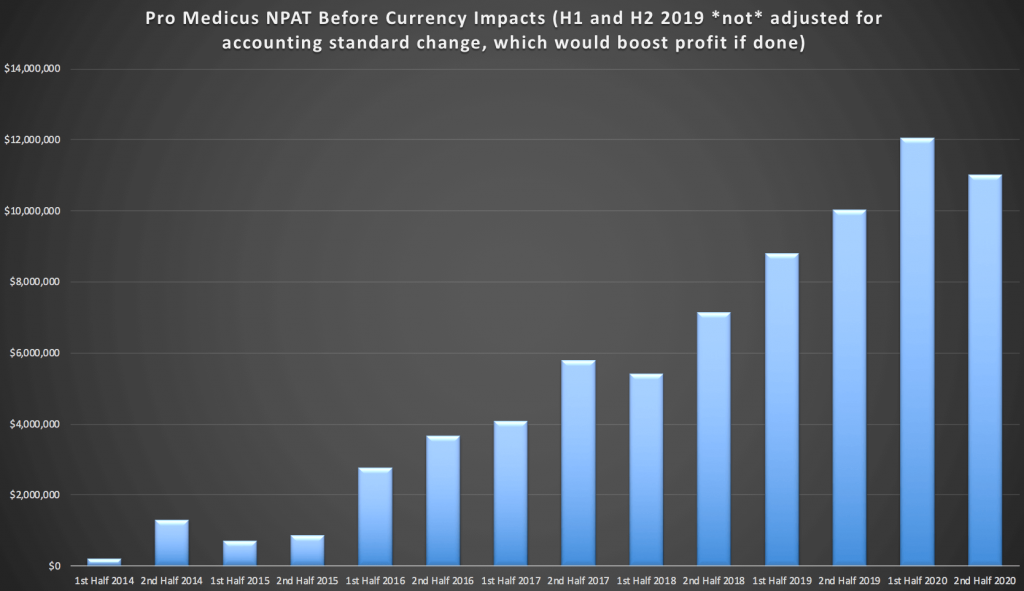

Yesterday, Pro Medicus shares dropped as much as 7.5% on delivering its results for FY 2020. While the record profit of $23 million was an increase of about 20% on the prior year, the second half profit was actually down on the immediately preceding half. Happily, free cash flow was very strong at $23.7m and the company finished the year with cash reserves of $43.4 million.

The main reason for the reduced half-on-half profit was the impact of the coronavirus pandemic, which the company estimated reduced second half profit by $1.2m. Without that impact, the second half would have been mildly better than the first half, but not a lot better.

However, there were a number of drivers of lower profit growth in FY 2020 compared to FY 2019. The biggest single reason was that the company received a $3m point in time payment for a German installation in FY 2019, and this was not repeated in FY 2020.

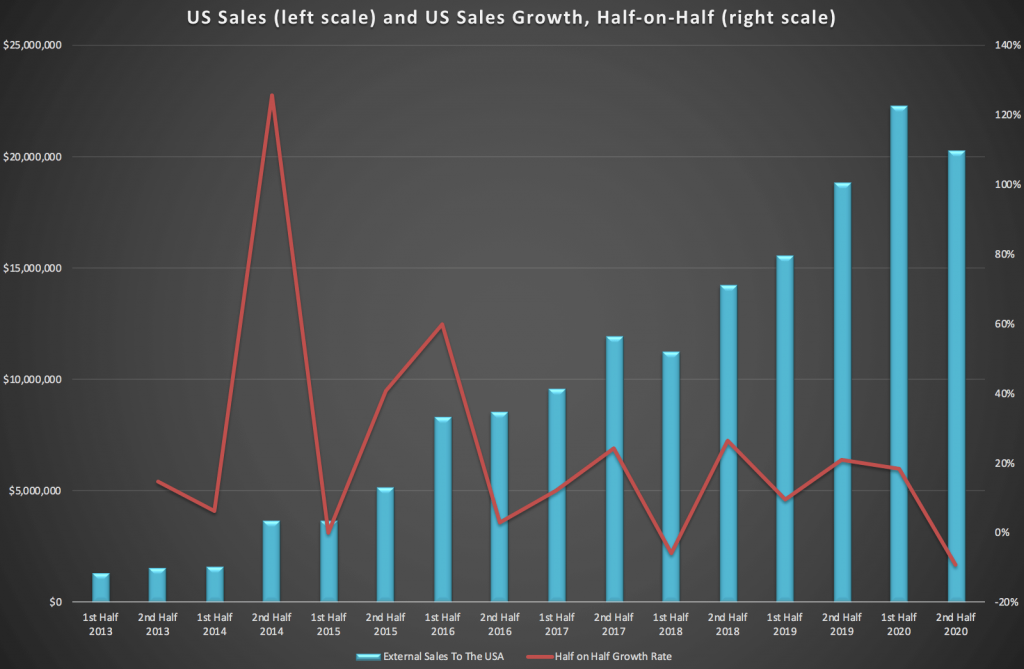

Comparing the first and second halves, European and Australian revenue was largely flat, half-on-half, while the biggest hit was felt in the USA, where sales actually dropped for the first time since 2018.

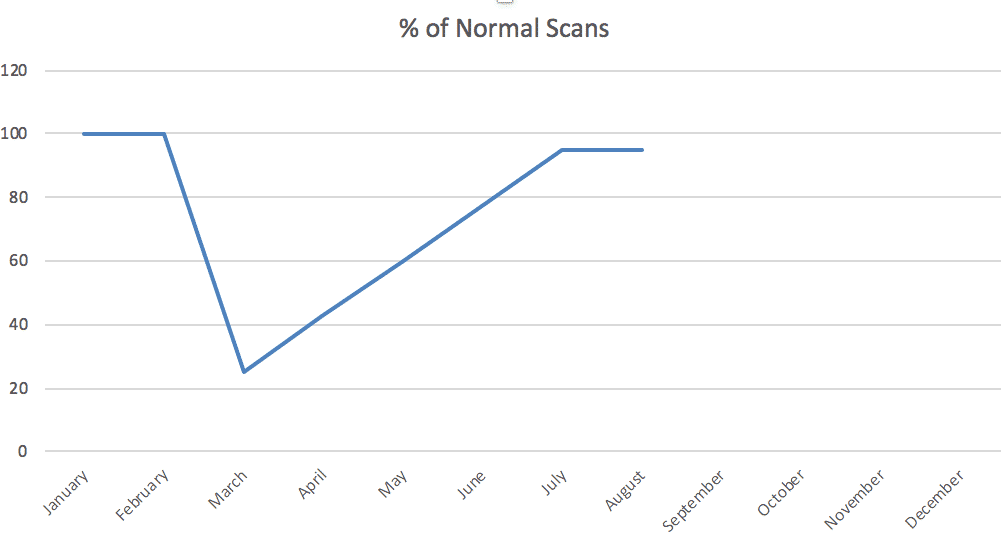

As long term shareholders will recall, Pro Medicus charges per scan, and although many investors focus on the guaranteed minimums announced in each contract, I believe all, or virtually all clients operate above those minimums. Therefore, as scan volumes drop, that hits Pro Medicus’ bottom line.

Now, there are a couple of factors to dig in to here. Based on what the company has said, scan volumes took a dive in March then started recovering in April. They haven’t been too specific, but it might look something like this.

We could safely assume that the lower-than-normal scan volumes at the moment may partially reflect a decision by physicians to lean towards avoiding scans that may be in the grey area of whether they are necessary or not. A 5% reduction in scans probably falls within a reasonable judgement call.

However, clearly from March to July a lot of scans were missed. Some of these will need to be caught up on, while others will never be done because the patient may have passed away, or because the patient may simply need a scan every month anyway, so lost scans will never be caught up on. While one might reasonably factor in “catch up scans” I definitely think that only a certain percentage will ever be caught up on.

In any event, the company’s growth continues.

During the half year, Pro Medicus announced it had won a major contract worth $22m with Northwestern Memorial Care and that all its implementations remain on track. There was a slight delay in one of them, but that was at the request of the client. Importantly, Pro Medicus has not lost any contracts from its pipeline. As a result, all available evidence suggests the company continues to have the best implementation track record for the best product in its main radiology image viewing niche.

In terms of technical innovation, the company continues to leverage its team to improve its viewing platform (and conduct largely remote implementations while working from home), but is at least 2 years away from deriving any revenue from its ability to run AI algorithms on its platform. In the meantime, it awaits FDA approval for its in-house density algorithm and continues to partner with AI researchers and on-board them into its AI accelerator program. The main barrier to commercialisation of this tech is that it is new and there is no existing remuneration model — it’s not clear who pays, and insurance companies are often slow to accept new services. I won’t hold my breathe short term, but I would struggle to think of any team I would trust more to commercialise this tech than Pro Medicus. Most of the time, AI is little more than a buzz word.

But Pro Medicus have a history of delivering. They bought and developed Visage, before commercialising it. They recently commercialised their newly rebuilt RIS product in Australia, after a multi-year project. And of course they commercialised their original systems in the 1980s which started the company in the first place. These guys have a track record of building and commercialising innovative tech in this industry. That’s not possible to reasonably dispute — and you’d struggle to find a company in this space that has done so much of its own product development in-house. Most make large acquisitions of companies that already have customers. Pro Medicus has only ever bought tech (and the team that built it) — not a product and certainly not any customers.

Should I Buy More Pro Medicus (ASX: PME) Shares?

At the current price of around $24.50, Pro Medicus trades on a price to earnings ratio of 110. This implies that it can at least 5x its profit before reaching maturity, preferably in the next few years. Given the nature of its business, Pro Medicus does receive system growth even once mature, but clearly it will need to increase its number of customers by 3x or 4x.

On the conference call, CEO Sam Hupert said that they were far from saturating their market and were closer to the beginning than the end. This implies that there is at least a 2x gain possible in terms of image viewing customers, but I would hope it would be more than that. In any event, we can reasonably expect some uplift from the open archiving product, and if it were a priority I’m sure they could build out the RIS product for a north American customer base.

In terms of costs, I think the company will be in a good position as the world undergoes the digital transformation even faster, and it should end up saving on marketing costs as the big RSNA conference it attends will be online this year.

While I’d never thought I’d be buying Pro Medicus on ~100x earnings, I actually think that the stock is probably a buy under $24, though I only picked up a tiny amount of shares when it sold down, yesterday. I consider a price under $24 reasonable to add, but am actually looking for closer to $18 for a conviction buy. At $18, I’d make it a 15% position, and at $14, I’d seriously consider making it a 25% – 30% position. It feels like we’ll never see that in the current stock market mania, but anything is possible. I did buy a smidgen at $14.70 in March. I just wish I’d bought more.

Now I know some people will read that and think that I am crazy. And that may be so. But you also have to consider that money will be invested in stocks and ultimately active managers are choosing between stocks. By way of comparison, fund managers piled into shipping software company Wisetech Global (ASX: WTC) pushing it to a P/E ratio of 150. To underestimate the herd mentality of index hugging fund managers is a mistake. Pro Medicus is still under-owned and is a far higher quality business than Wisetech Global. Pro Medicus is growing its profits faster, growing organically, not via acquisitions, its management does not constantly issue shares, and has far more sophisticated technology, from what I can tell. Obviously, relative undervaluation does not mean a company is undervalued at an absolute level.

I also note that all valuations of high quality businesses are stretched at the moment due to the massive fiscal and monetary stimulus unleashed in response to the pandemic. As a result, I am conservatively positioned in my portfolio with high holdings of gold and cash. However, for the at-risk part of my portfolio, Pro Medicus remains my preferred ASX pick. Ultimately, I believe the spoils of automated radiology tools will fall to very few companies.

With commercial and knowledge-sharing relationships already in place with some of the most advanced institutions in the world, I struggle to think of a better company to benefit from this trend than Pro Medicus. It is true that PME is not going to be able to win contracts with hospitals all around the world because the expense of radiologists’ time is a huge part of their value proposition. Where radiologists are cheaper, Visage has less value.

However, longer term, I believe Visage-powered teams will increasingly take market share through computer enhanced advantage, giving them greater efficiency and accuracy. Companies winning contracts in Qatar or Ecuador may have decent quality businesses, but they are less likely to the be the eventual leaders in AI radiology than the company serving radiology images to the most advanced medical institutions in the USA, Germany and Australia. If I’m going to pay eye-watering multiples for any ASX stock, then Pro Medicus is it.

Brokers are likely to downgrade (previously overly optimistic) price targets for Pro Medicus. If this puts downward pressure on the share price, I intend to very slowly and cautiously increase my position. [Edit: To clarify, price targets are generally well above current price, so I would expect most “buy” ratings to stay in place].

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not intended to be financial advice, and you should click here to read our detailed disclaimer.