Radiology software company Pro Medicus (ASX: PME) today released its half year results to December 2021, reporting a 40% increase in revenue to $44.3 million and a 52% increase in profit after tax, to $20.7 million. This result was better than I had expected due to the fact that Pro Medicus increased its EBIT margins to slightly over 66%, up from around 63% in the immediately preceding half.

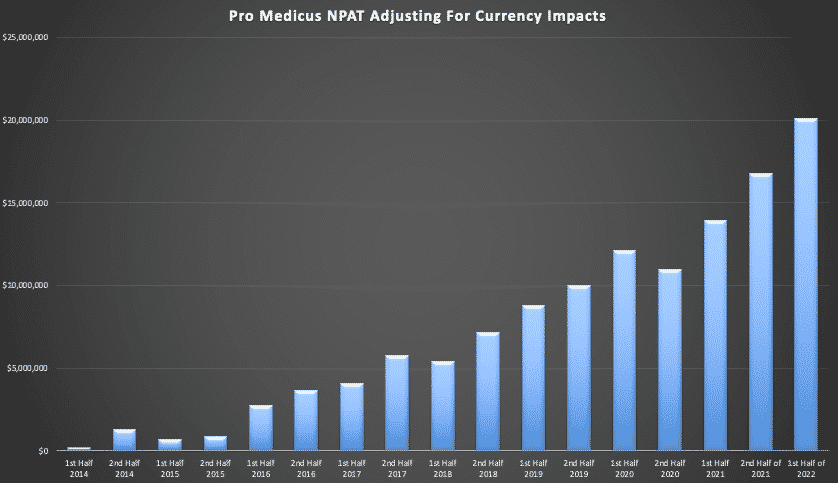

In order to track normalised growth rates, I also consider net profit adjusted to exclude currency gains or losses. As you can see below, even adjusting the net profit down by ~$0.6m to exclude a currency gain, this half Pro Medicus achieved a record half year profit and a record half-on-half increase in profit (in absolute terms). Even in percentage terms the growth was impressive, with half-on-half growth at almost 20%, compared to an average of about 16% half on half profit growth, in the last 3 years.

There can be no doubt that this result exceeded my expectations. However, I suspect it also exceeded the company’s own expectations, since they had previously indicated they thought that EBIT margins would moderate slightly. It is anyone’s guess how long the company can maintain such high margins, though it now seems like EBIT margins can remain above 60%, unless Pro Medicus initiates a new, lower margin product or service.

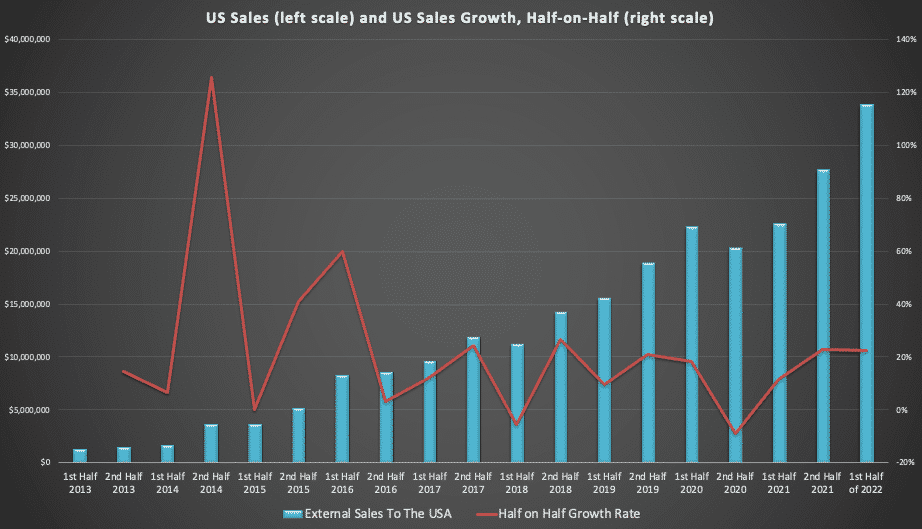

The company managed small revenue gain in its Australian business of around 7%. The even smaller European segment managed a hefty 40% increase in revenue, but this was largely due to a one-off $1.3 million up front licence sale when a German hospital client extended the scope of its contract. The core driver of growth was the North American market, as usual. This half was a particularly good one, as you can see below.

This strong half on half revenue growth of over 20% is a testament to the fact that the company continues to demonstrate a competitive advantage (better technology and reputation) that allows it to exercise pricing power. For example, on the conference call, the Pro Medicus CEO Sam Hupert mentioned that they had renewed their contract with Allegheny Health Care, with an increased price per transaction.

Since Pro Medicus has been increasing prices over the past few years, the new price it charges new customers is quite a bit higher than the old price that Allegheny was paying. Happily, the company was able to negotiate a price increase that improves revenue per transaction for Pro Medicus, but acknowledges the loyalty of Allegheny by allowing a lower price than a new client would pay. The fact that Pro Medicus is rewarding its early customers in this way is a good thing, because it creates an extra incentive for companies to be early adopters of its new products, such as the AI breast density algorithm it has developed.

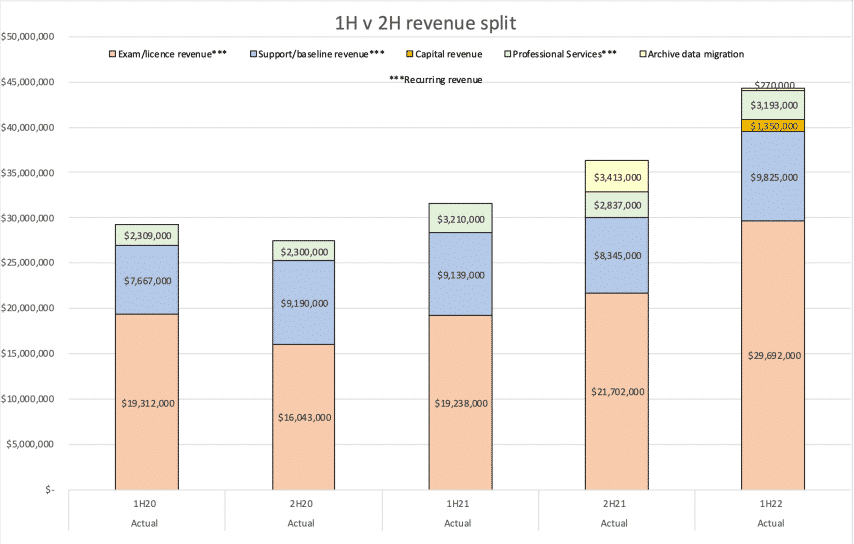

The majority of Pro Medicus’ revenue is transactional revenue, which automatically grows with demand for radiology studies. As you can imagine, the long term illness associated with Covid is likely to continue to drive even more demand for diagnostic scans, especially since it is so poorly understood how Covid impacts the body in the long term. You can see below how the transactional revenues make up the majority of the Pro Medicus revenues. I note that the support and maintenance revenue is also rather recurring in nature, with only the upfront license fees, data migration, and professional services revenue being truly one-off in nature.

What is Pro Medicus’ Competitive Advantage And Is It Getting Stronger Or Weaker?

Pro Medicus has many forms of competitive advantage. First and foremost, they have top quality reference sites because they count the most famous large academic hospital networks as clients. However, they also have a technological advantage over competitors, which allows radiologists to work seamlessly from home or the office, and view ever larger radiology files even more quickly.

While these are the most obvious advantages, there are also other advantages that are actually improving the quality of the business.

As software investors will know, one of the biggest differentiators between winning companies and struggling ones is how easily and reliably the company can implement their products. On the results presentation call, Pro Medicus CEO Sam Hupert said that “We have never missed a date or had a failed implementation regardless of size or complexity”.

While data migration to a vendor neutral archive is a large job, the viewer and workflow software can be implemented even more quickly now that more of the clients are moving to the cloud. Since the CEO said that, “We are seeing increased interest in RFPs where cloud is mandated as part of the RFP response”, it is fair to assume that more and more of the company’s implementations will take place in the cloud.

This trend means that Pro Medicus will be able to implement large contracts even more quickly. The CEO said on the call that the the company implemented Intermountain Health, one of their biggest contracts, over two seperate one week “go live” periods. The CEO said that “whilst you can do that with on prem [meaning on premise], it’s most probably easier with cloud.” This means that the implementation advantage is probably increasing, not decreasing, over time.

Furthermore, the company is getting closer to commercialising its AI breast density algorithms. We covered how Artificial Intelligence can make the Pro Medicus platform even more powerful in our recent AGM update, so I won’t rehash it now.

Today on the conference call, the CEO said that the commercialisation will most likely be transaction based and while they company could offer it to clients who are not using Visage, they definitely will not do so initially. This means that this potentially game-changing add-on product will only be available to Pro Medicus clients.

Obviously, that creates another reason for radiologists to want to use Visage, but it is more important than that. You see, while the company does sell to smaller healthcare groups, these groups are becoming fewer as smaller radiology companies are being rolled up by private equity.

Prima facie, consolidation is helping Pro Medicus, because it already has some of the biggest healthcare networks, and these ones, such as Novant and Intermountain, are continuing to acquire competitors. If these transactions go through, then it increases the number of scans using Visage, growing Pro Medicus’ revenue automatically.

However, the idea of only allowing existing customers to use the AI algorithms is tantalising, because it may actually encourage the success of PME clients versus competitors. Ultimately, Pro Medicus shareholders may consider the possibility that AI will be doing more and more of the work, and that AI empowered radiology companies will grow much faster than those without AI. If that turns out to be true, the Pro Medicus shares may turn out to be cheap, today. It’s hypothetically possible that a fewer number of larger, more technologically proficient hospital groups will end up doing the lion’s share of radiology exam studies, in the future.

What Is The Pro Medicus Free Cash Flow Looking Like?

In this most recent half, Pro Medicus recorded free cash flow of about $22.4 million, which was actually stronger than its profit. This phenomena seems to have been driven by a slight increase in tax payable and deferred tax, but seems to be strong evidence of impressive cash conversion. This is worth recalling if there is ever again a half in which cash conversion falls, since it is normal for cash conversion to fluctuate somewhat.

The company also increased its dividend to 10c per share. If this is repeated in the second half, the company would yield about 0.4% at the share price of $50, so it’s hardly a dividend stock.

Pro Medicus had over $75 million in cash at the end of December 2021, which is largely earmarked for opportunistic acquisitions when they come up. On the call, the CEO made clear that the company would not be buying customer relationships. Rather, Pro Medicus is looking for either polished technology it can add on to its existing tech stack, or development teams working on relevant software, or both.

Should I Buy Pro Medicus Shares?

There can be no doubt that this set of results increases my valuation of the company. However, zooming in on this half, we have free cash flow of around $20m and revenue of around $45 million. These would annualise to $40m in free cash flow or $90m in revenue, respectively.

At the current share price of about $50, Pro Medicus has a market cap of about $5.2 billion. That means, based on these numbers, it is trading at around 130x free cash flow, around 130x profit, and around 58x revenue, based on a point in time snapshot of the business.

Now clearly, Pro Medicus is a fast growing company with great long term prospects. However, that does not mean any price is a bargain and these multiples are still a bit too high for me to be buying shares (notwithstanding it is still one of my largest holdings).

While I have publicly stated I was selling shares above $50, and did so, I am no longer a seller at current prices of around $50. The reason for this is I have reduced my position significantly, already, and I believe these results are further evidence that Pro Medicus is the highest quality business on the ASX.

Is Pro Medicus The Highest Quality Business On The ASX?

Please note: Stating a company is high quality does not mean shares are cheap. Rather, the framework of business quality is one I use to rate the long term potential for a business to increase profit and free cash flow. The framework uses quantitative and qualitative factors to try to expose the companies that might do best in the very long term. It is not a measure of value, but rather, of business resilience and potential.

Based on the heuristics I have developed over the last decade, Pro Medicus scores better than any other business on the ASX. Here are some of the reasons why. Pro Medicus demonstrates:

- Aligned founder-led management who run the business like the true long term owners they are.

- Benefits from powerful long-term tailwinds including:

- ageing population

- worsening health due to covid and obesity

- inflation in healthcare costs in America

- shift to cloud storage (healthcare companies are generally late movers)

- rise of artificial intelligence

- Ridiculously high EBIT margins, likely to be sustainable over 60%, but almost definitely sustainable over 50%

- Global growth runway

- Potential to become a platform business if it can sell AI algorithms developed by independent third parties on its platform

Now, if you think you know of a better quality business on the ASX, please tell me. I have been making this claim for years now and the only real contender to challenge Pro Medicus is Xero (ASX: XRO), which I admit scores better as a platform business. However, its founder stepped down from leading the company.

To hear Matt Joass, Andrew Page and I discuss the Pro Medicus business quality in more detail check out the recent podcast below. However, please note that it was recorded before these results, and as you will note my own prognostications about EBIT margins were clearly wrong and too conservative!

What Are The Biggest Risks Facing Pro Medicus?

In terms of the actual business, the most glaringly obvious risk is retaining the team that has built the company so far. On the conference call today the company stated that it had not lost any of its key Berlin-based Visage development team led by Malte Westerhoff. However, the company also faces key personnel risk in sales and marketing (Sean Lambright and Brad Levin), and in upper management, particularly CEO Sam Hupert, CFO Clayton Hatch, Chairman Peter Kempen, and co-founder Anthony Hall. All of these people have been with the company for a decade and there are many more long serving employees not named here who are enormously valuable assets.

Now, the company is expanding. Importantly, it is building up its US presence and we would hope there are already players who are creating massive value, despite being at the company for less than a decade. But the point here is that an exceptional group of people have created exceptional value over the last decade and, well, if you can keep a group together for more than 10 years you are doing something darn special. Long may it continue.

Secondly, the high multiple is obviously a risk for shareholders since increasing inflation fears are seeing all the growth stocks sold off viciously. Pro Medicus should be no exception and yet it continues to trade at the very high multiples I mentioned above. Perhaps that means the pain is in the future, not the past. On the bright side, a valuation crunch should create more opportunities for the company to make useful acquisitions, so in the very long term, a bear market might be a good thing.

Thirdly, I have seen broker reports that seem too optimistic about the cadence of contract wins. I would consider a 5 contract year to be an incredible year, with 3 contract wins closer to the norm, and 2 large contract wins to be satisfactory, while anything less would be a (potentially short term) disappointment. I’m guessing that in the absence of new contract wins the share price will slip lower; but that might be when I get interested. The reality is PME can’t control when it wins contracts precisely so one would expect some uneven lumpiness in that regard.

What Will The Next Half Look Like For Pro Medicus?

I am getting towards my 10 year anniversary of owning Pro Medicus shares. Not every set of results is as impressive as this one but I have definitely learnt to trust the company to make decisions in favour of the long term. The CEO was clear that margins would fluctuate, so it may be that next half sees a lower EBIT margin. Either way, it won’t change my long term view of the company.

Having said that, I think the most likely way Pro Medicus will disappoint next half will be through a lack of contract wins, which is likely to be a timing issue. The company re-iterated as usual that it had not lost any contracts out of its tender pipeline. That means a lack of contract wins would simply imply a timing issue, rather than eroding competitive advantage.

The company will benefit from a full half of its Intermountain Health revenue in the next half, rather than just three months in this half, so that should boost its revenues somewhat. On top of that the company said that “We are seeing some of our clients growing not only organically but also via M&A, and that is certainly benefiting us”.

On the other hand, it is quite likely that its half on half growth rate will be lower in the next half, because the company may not repeat the $1.3m license sale that it achieved this half. It is great to see these results come in ahead of expectations but it is also possible future results come in below expectations.

Ultimately, I don’t mind too much where results come in, relative to what brokers think. What I care about is that Pro Medicus grows revenues, profits, free cash flow and most importantly, its competitive advantage. That appears to be the case in these results and I am even more enthusiastic about the business quality after this result, than I was before it.

The author owns shares in Pro Medicus and will not sell for at least 2 days after publication of this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Sign Up To Our Free Newsletter