Radiology software company Pro Medicus (ASX: PME) today released its full year results to June 2022. It reported a 37.7% increase in revenue to $93.5 million and a 44.1% increase in profit after tax, to $44.4 million. Earnings per share of 42.5 cents easily supports the full year dividend of 22 cents per share.

Pro Medicus achieved very strong EBIT margins of 63% in H2 FY 2021, and 66% in H1 FY 2022, which were each record margins at the time, and well above the (still impressive) hypothetical ‘mature’ EBIT margin of 58% that I used to model in my valuations. In H2 FY 2022, Pro Medicus achieved an astounding EBIT margin of 68.6%, bringing the FY 2022 EBIT margin to 67.5%.

As you can see by revisiting our historical collection of Pro Medicus Results Analysis, the company has continually increased EBIT margins over the last few years. I’m impressed with the second half margin and was pleased to hear the CFO say on the conference call that “We do believe we’ll be able to maintain our margins going forward”.

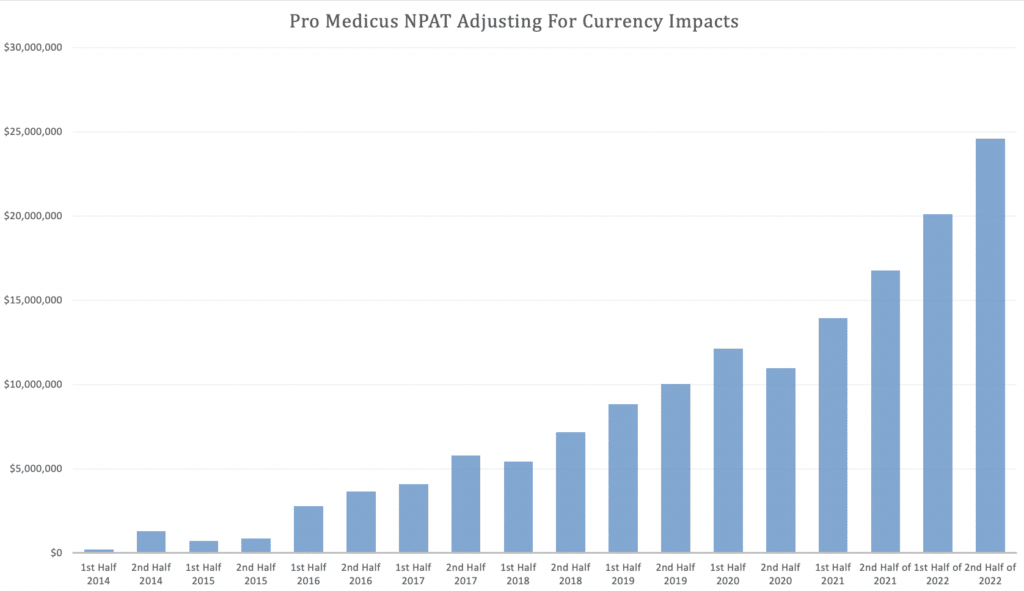

On an absolute level, the increase in profit between H1 FY2022 and H2 FY 2022 was a new record, and the percentage gain was above average since 2018.

Pro Medicus free cash flow was up 68% on last year to $52.8 million, excluding the investment and sale of financial assets. The financial assets excluded include hybrid and convertible debt instruments, which contributed an expense of $1 million in FY 2022.

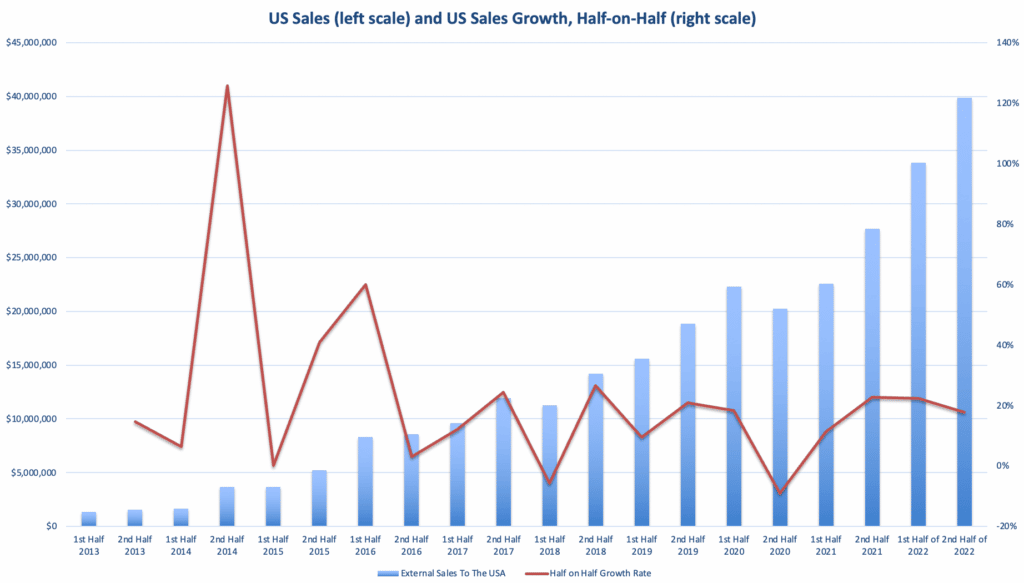

Pro Medicus Results Show Strong Growth In North America

With the release of the Visage Worklist product, Pro Medicus (ASX: PME) now sells three products in North America, being the vendor neutral archive, the viewer and the worklist. As you can see below, half year sales were almost $40m, though the half on half growth rate moderated ever so slightly to about 17%.

In terms of project wins, Pro Medicus announced 3 big ones during the year Novant Health, Inova, and Allina Health, all three of which are expected to be implemented and generating utilisation revenue by the end of H1 FY 2023.

Happily for shareholders, the pipeline remains strong across all customer types and sizes. On the conference call, Pro Medicus CEO Sam Hupert said, “We are seeing more inbound RFPs. There seem to be more healthcare systems particularly in the US looking to update their imaging systems… Clearly the dataset explosion continues relentlessly, and legacy tech just wasn’t designed for that kind of file size.”

The company thinks they have a bit over 5% market share in the USA, so there is still plenty of room to grow there, even if it can only ever get to 30%. This is reasonable if you surmise that the market will eventually be an oligopoly of 3 major providers, with 10% left over for challengers.

Zooming out to view the market evolution, Pro Medicus first made headway thanks to the deconstruction of the picture archiving and communication system (PACS), which now sees a greater emphasis on interoperability of different systems. Ironically given this history, Pro Medicus now offers the three of the major deconstructed elements, being the worklist, archive and viewer. I suspect these products scale better than the production of actual radiology machines!

Investing Cash Into Debt Instruments

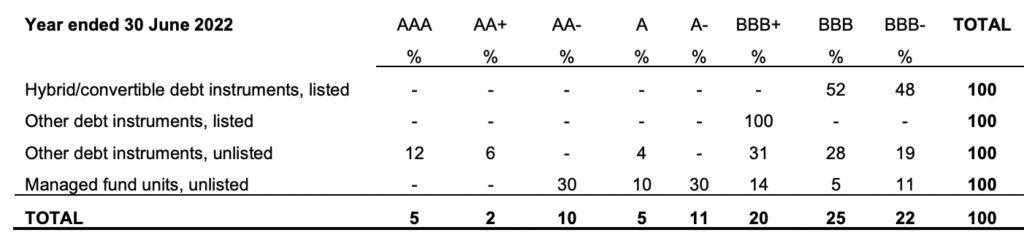

Over the last couple of years Pro Medicus has been searching for yield on its cash and currently holds a mixture of debt instruments. At 30 June 2022, Pro Medicus had $63.6 million in cash and $27.4 million in other financial assets, shown below. Clearly, the board decided to make this cash work a little harder and decided to shovel some of it into debt instruments and the like. Happily, they improved their disclosure around these investments, in this report. You can see the latest snapshot below:

I asked about the ~$1m expense on fair value adjustments regarding these assets on the conference call and Pro Medicus CFO Clayton Hatch said “we think some of those debt securities will come back to their coupon rate as they get closer to maturity.” So that would be nice.

We may well see greater allocation towards term deposits as interest rates rise, but I’m not particularly excited about the company investing in debt instruments, though perhaps that is just my reflexive wariness of the ‘search for yield’. In the past, the company has bought back shares at levels I thought were too high and that has turned out to be a good decision by the company.

Overall, I consider the Pro Medicus balance sheet to be in very good health with over $90m of cash and financial investments. I’m content for the board to invest in debt instruments but I’d probably prefer it if they just put it in term deposits. Then again, I’m no expert on debt instruments, so I don’t put much weight on my preference.

How Strong Is The Pro Medicus Competitive Advantage?

Pro Medicus has a strong competitive advantage over other radiology viewer software companies. The CEO says that “we charge the most but return the most to our clients.” He points to “significant infrastructure savings and radiologist efficiency that no-one has been able to match.” Importantly, the Visage systems also create better results for patients.

For example, a planar reformation “involves the process of converting data from an imaging modality acquired in a certain plane, usually axial, into another plane.” This can help with diagnosis, but it also takes quite a while with standard systems, so sometimes it may be skipped. It takes just a few clicks with Visage, and the CEO says that “we find that most of our clients do it, because it’s so quick and simple.”

Ultimately, Pro Medicus remains confident in its competitive positioning. The CEO said on the conference call that “We don’t know of anyone at this point who has come to the point we were a couple of years ago. I think that we can fairly lay claim to the fact that we are number one in speed, functionality, and scalability.”

Ever increasing margins, strong revenue growth, and an increasing number of partnership agreements for its relatively nascent AI Accelerator program all support this confidence. Pleasingly, the company also had a record number of abstracts accepted by the Radiological Society of North America where Pro Medicus is jointly involved with research partners. Finally, the company also released its injection fraction software for cardiology viewing. This may well mean that we will start seeing some cardiology sales in the next couple of years.

During the year the company spent $9m in capital expenditure, $8.7m of which is capitalised development costs. Depreciation and Amortisation was just $7.3m so if it had always expensed all development, then profit would have been about 3% lower. All in all, the company’s competitive positioning seems to be strong, and the return on development spend at Pro Medicus top class.

What Are Pro Medicus (ASX: PME) Shares Worth?

At present, Pro Medicus shares trade on about 125 times FY 2022 earnings, implying very strong profit growth going forward. I thought these results were impressive, and I’m amazed at how consistently the company has outperformed my EBIT margin expectations (which has caused me to undervalue it at times). After these results I’m increasing my desired buy price for Pro Medicus shares by about 20% compared to my old target. The main reason for this very large increase is because I’m upgrading my EBIT margin expectations. However, the current Pro Medicus share price of about $54 is still above my desired buy target range.

At the time of these Pro Medicus results, it is still the second largest position in my portfolio. Ultimately, I consider the business the best quality business on the ASX. In the past, I have trimmed my shareholding quite considerably, including at around current prices. This has the impact of reducing the overall weighted quality of my portfolio. As an aspiring “quality growth bro” long term tailwind investor, I have a deliberate bias towards holding high quality businesses, especially in the intersection of healthcare and technology. Therefore I am content to continue holding Pro Medicus as one of my largest shareholdings.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author owns shares in PME and will not trade PME shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.