PTB Group (ASX:PTB) is an aircraft engine business which repairs, replaces and leases the the PT6 and TPE 331 turbo prop engines. I have previously written about why I find PTB Group interesting, and as a shareholder I was pleased to see PTB Group report a profit of just over $6m and record half-year revenue of $55.6 million in the six months to December 2021.

What Is The PTB Group Business Model?

PTB Group is a maintenance, repair and overhaul (MRO) business. It has four business segments: Aftermarket plane engine maintenance in Australia; Aftermarket plane engine maintenance in America; Engine leasing, and; Sale of spare or recycled engine parts.

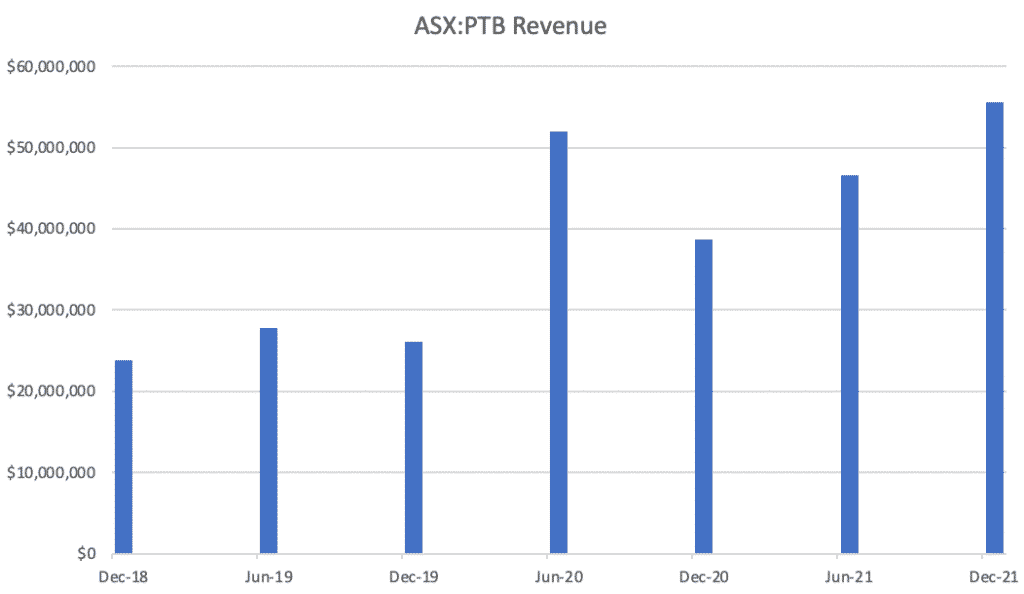

PTB Group Revenue Analysis

As you can see below, PTB Group has had somewhat bumpy revenue over the last few years. The biggest impact was the acquisition of Prime Turbines, in February 2020, which thus contributed to the increase in revenue in the six months to June 2020. However, the company was also saw a negative impact in the six months to December 2020, due to the pandemic, because its largest customer Trans Maldivian Airways was severely impacted by the drop off in international travel.

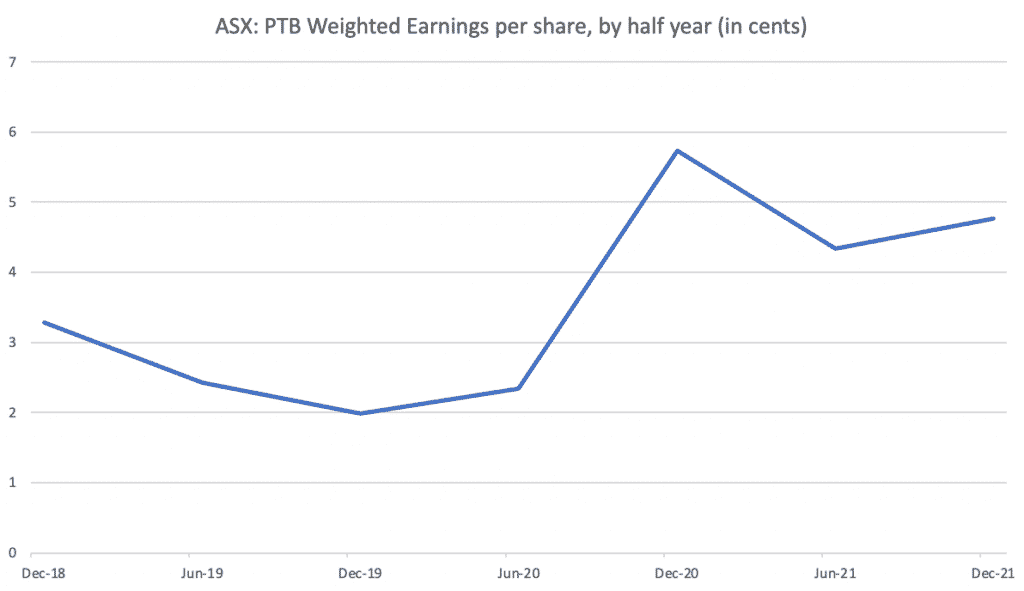

PTB Group Earnings Per Share Analysis

When it comes to earnings per share, the performance has been even further muddied. First of all, we have a negative earnings impact arising from transactions costs plus the 1-for-2.35 entitlement offer in 2020, which raised $22m at 69 cents per share to help fund the acquisition of Prime Turbines. Then we have the one-off sale of real estate property in early calendar 2021. On top of that we saw almost $3m in pandemic grants in H1 FY 2021, as well as a much smaller amount in 2H FY 2020, from both the US and Australian businesses.

You can see how bumpy the earnings per share has been, in the graph below.

However, the good news is that the muddy water is starting to clear with this most recent set of results. The reason for this is there have been no major equity issues or one-off impacts. Rather, what emerges is a net profit before tax and foreign exchange gain of $7.4 million from revenue of $55.6 million, implying a net profit before tax margin (excluding FX) of about 13.3%. After a small FX gain and paying tax of about 19%, we have net profit after tax of just under $6.1 million, and earnings per share of 4.77 cents per share.

Do PTB Group Shares Have A Bright Future?

On top of that, the company has given FY 2022 guidance for “Net profit before tax, excluding foreign exchange gains/losses” of $12.4m to $13.4 million, being $12.9m at the mid point. This implies that the second half will only generate a net profit before tax and foreign exchange of $5.5 million, being a fair bit weaker than the first half. Now, it’s not clear to me why the second half would be weaker than the first half, but it’s certainly possible given the business can have lumpy ups and downs for various reasons. Suffice it to say I feel more comfortable with guidance that implies a weaker second half, than the near ubiquitous promises for a stronger second half, that often go unfufilled.

Turning to cashflow, PTB Group generated $8.2 million in free cash flow (including lease expenses), which was much stronger than its profit. This fed into a relatively strong balance sheet, with net debt of just $7.9 million. The company says it is “well capitalised to execute on its global growth ambitions with strong cash balance and significant capacity for additional debt funding.”

The company did not declare an interim dividend but reaffirmed its plan to pay 30% – 50% of full year earnings per share as a dividend. Assuming guidance is accurate and net profit before tax and FX converts to net profit at the same rate, we might see 8.3 cents in earnings per share and a dividend of around 3.3 cents. This would be a reduction in dividend from the prior year, and thus might lead to some disappointment in the market, but would still be a yield of about 2.75% at current prices of about $1.20 per share.

Going forward, there is no doubt PTB Group will continue to try to roll-up businesses serving these kind of propeller engines. In the full year report the Chairman Craig Baker said “… we are currently the largest non-OEM aligned PTA/6 maintenance, repair and overhaul provider in the world. Pleasingly, we continue to see further consolidation opportunities within the US market.”

Four of the five board members have over 1 million shares, so I believe there is a decent level of alignment with shareholders. This is supported by the fact that remuneration seems reasonable and the company pays a dividend. Therefore, although I find roll-ups to be risky, and sometimes suboptimal, I believe that there is some chance of success here.

Furthermore, I also think there are some synergies, since the company also sells spare parts. As it acquires more servicing businesses, arguably it can favour its own parts suppliers, thus increasing the profit from its parts business.

Importantly, after talking to investor relations contact Andrew Kazakoff, I have a better understanding of the competitive moat that PTB has. You see, apparently their specific know-how means that they can keep engines in the air more safely and efficiently due to 20 years of experience with engines in tough coastal or mountainous environments. This means it is difficult for anyone else to set up shop as a competitor. On top of that, maintainers need to have local regulatory approvals in the jurisdictions in which they operate, creating yet another barrier for entry.

These barriers for entry means that there is a greater likelihood that acquired businesses will retain their value, since unlike (for example) lawyers or accountants, a aircraft engine maintenance provider cannot simply sell her business, wait a couple of years, then instantly start a new business. While a dentist or doctor could easily do this, the regulatory approvals alone would make it difficult for an MRO business proprietor to simply set up the same business, again.

PTB’s scale allows them to offer a “power by the hour” service whereby they pre-arrange maintenance with the operator, scheduling the likely service under the program… but also being available for ad-hoc work as needed. A smaller operator cannot necessarily make that commitment, and the traditional way for the industry to operate would be for the client to basically put each bit of maintenance work out to tender. The “power by the hour” option requires certain scale (and some risk for PTB if all the work came in at once) but it offers greater certainty and obviously sticker customer relationships.

On the down side, as far as I can tell there is no real tailwind that will drive growth in this business, and I would expect growth to continue to be lumpy as the company makes, digests, integrates and streamlines acquired companies. Furthermore, it’s not entirely clear to me why non-OEM aligned maintenance, repair, and overhaul (MRO) companies would be favoured over the OEMs, other than a lower price, and some technical know-how. As a result, I wouldn’t expect much margin improvement, even with greater scale.

Of course, I don’t think it’s a terrible business model either. An OEM would not want to put the non-OEM MRO companies out of business, because the main job of the OEM is to sell the engines. Making them more expensive or difficult to maintain would only make their engines less attractive.

Personally, I slightly increased my position in PTB Group after these results, given I believe that the guidance the company has given has been conservative. Arguably, the Maldives, where the company does quite a lot of business, has further upside, since in 2021 it only reached about 80% of its pre-Covid tourism numbers.

On top of that, the company has announced that it will look after “Additional engines for TMA in Maldives with engines under management growing from ~80 to ~110 engines,” and it also won a “New contract with Manta Air to provide parts and off-wing maintenance, repair and overhaul services for their fleet of 9 DHC-6 Twin Otter aircraft.”

Based on a net profit before tax of $12.9m, and a normal tax rate of 30%, the company would make $9m NPAT in FY 2022. At $1.20, it has an enterprise value of about $160m, putting it on less than 18 times earnings. That’s not particularly cheap, but it’s not unreasonable either when you consider some highly rated roll-ups trade on up to 30x earnings, and generally speaking even languishing roll-ups trade on 10x earnings. Given that I think this guidance is probably conservative; and given I think that this business is actually of quite good quality with reasonable competitive moats, I suspect that the current price remains attractive. However, I have now reached my full allocation and do not currently intend to buy any more shares.

Please remember that these are personal reflections about a stock by author. I own shares in PTB Group and will not sell any for at least 2 days after publication of this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Sign Up To Our Free Newsletter