Without getting into details, today’s results from church software company Pushpay Holdings Ltd (ASX: PPH) were impressive. The company has burst into profitability, as expected, and probably trades on a reasonable price, even after today’s rise.

After all, it is a fast growing software company with a digital solution that helps churches both engage with their clients and removes the need for cash or cheque giving.

There can be no doubt I got this one wrong. I thought that the massive unemployment in the USA would reduce giving. While this may or may not have occurred, what’s clear is for now at least the advantage of digital giving (which Pushpay facilitates) is more than compensating for a reduction in giving which may have impacted late March. It’s possible the pandemic impact is yet to show through, but the company is guiding for strong growth.

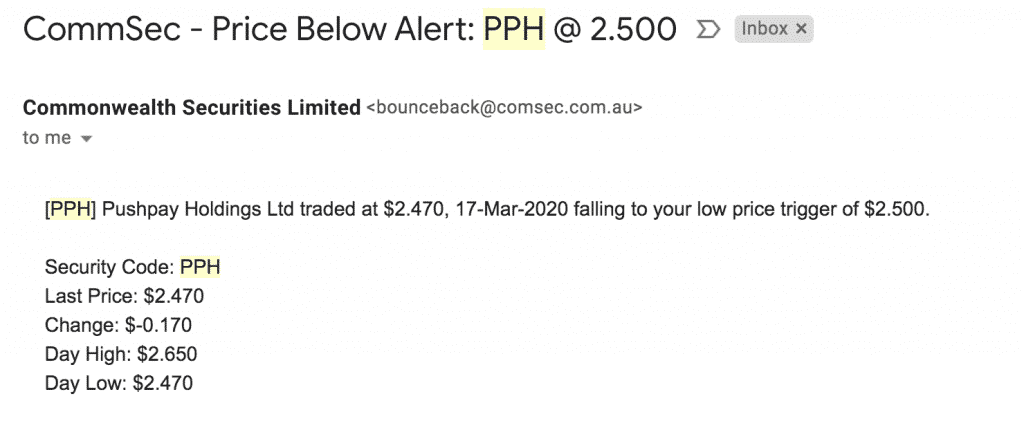

I exited my Pushpay position for a profit from January to March for an average price of around $4. From the looks of things, that will be about 20% below opening today. While the sell decision was wrong, given the share price dropped below $2.50 between then and now I’m more inclined to say that my mistake was to NOT buy at below $3. This is particularly true as I initially had set an alert so that I would buy the stock if it fell that low.

As you can see below, my CommSec price alert for Pushpay (ASX: PPH) was triggered on March 17.

Now, I could flagellate myself about selling in the first place, arguing I should have been patient and had more faith, I’m actually more annoyed that I missed the far more compelling buy at below $3. Why?

We can’t know for sure, but I reckon it’s because deep down I thought that giving to churches should go down. For example, I find the clip in the tweet below very offputting.

Even if you’re laid off work, don’t stop giving to #Jesus… 💰💰💰😳 pic.twitter.com/lN2EbNjAql

— 💧Johny Miller (@jmil400) March 19, 2020

I reckon that when push comes to shove I want people to save their pennies for the tough times ahead. I definitely wouldn’t be advising people to give away money if they lost their jobs.

Of course, what people spend money on is up to them. I have no problem if they do want to give their money to their church, I just wouldn’t encourage them to.

Pushpay did not trade below $3 for long. In part, that’s because Pushpay reassured the market it was doing well, in the middle of March. At that time, I could have bought shares around $3 with even lower risk. And I should have.

Ultimately, I think I’ve really struggled to put aside my personal bias with this stock, and as a result, I’ve made far lower profits from it than I otherwise would have.

Happily, I have many friends and supporters who do not share my particular flaw in this regard. I know there are more than a few of you who have looked past my own lack of faith in Pushpay and done very well indeed. I’m happy for you.

For me, well, all I can do is not lose the lesson. When I identify personal biases I should take steps to counteract them. There is an obvious thing I could have done with Pushpay. Instead of setting an alert at $2.50, I should have simply set a darn limit order to buy shares!

If I had done this, rather than adding another step (at which the process failed), I would be laughing today instead of crying. (Jokes.)

At least I won’t lose the lesson. And of course, I’ll comfort myself in the knowledge that I can’t pat all the fluffy dogs, but I can focus on finding the next one.