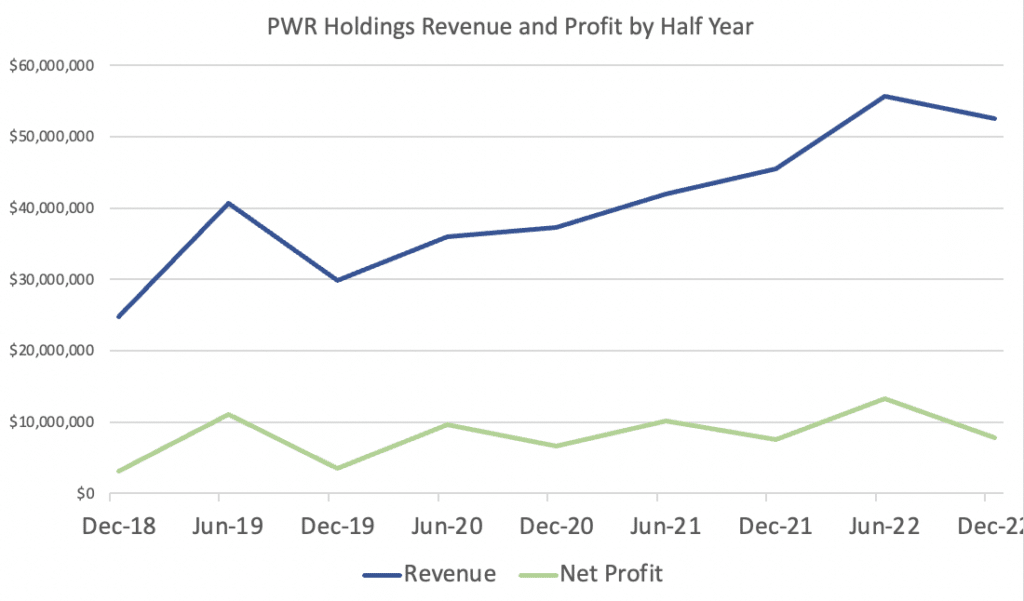

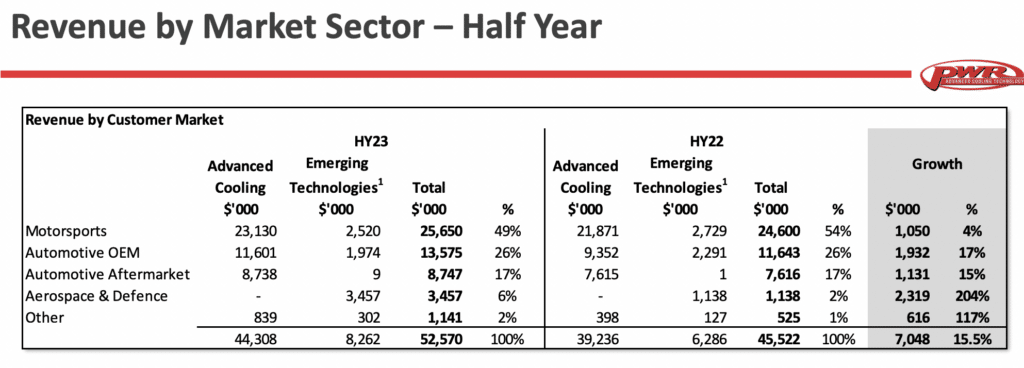

In February, high end cooling component manufacturer PWR Holdings (ASX: PWH) announced its half year results. In H1 FY 2023, PWR Holdings boasted revenue of $52.6 million, up 15.8% on the prior corresponding period. However, profit after tax was only up 4% to $7.8 million.

PWR Holdings always has a lower profit margin in the first half, with a higher profit margin in the second half. However, as you can see below, revenue was actually down in H1 FY 2023 compared to H2 FY 2022.

The company said margins were lower due to, “Changes to product sales mix, investment in customer engagement and marketing, cyber security, and enterprise resource planning (ERP) system development, and, Increases in headcount, labour rates, and insurance premiums.” Many of these expenses were inflation related, while the investment in cybersecurity is necessary as PWR Holdings aims to do more projects in the aerospace and defence industries.

On the conference call PWR Holdings CEO Kees Weel said of margins that, “We’ll see a big clawback in this second half”, and implied that he expected a net profit margin around 19% – 20%, implying a slightly bigger skew to the second half than usual.

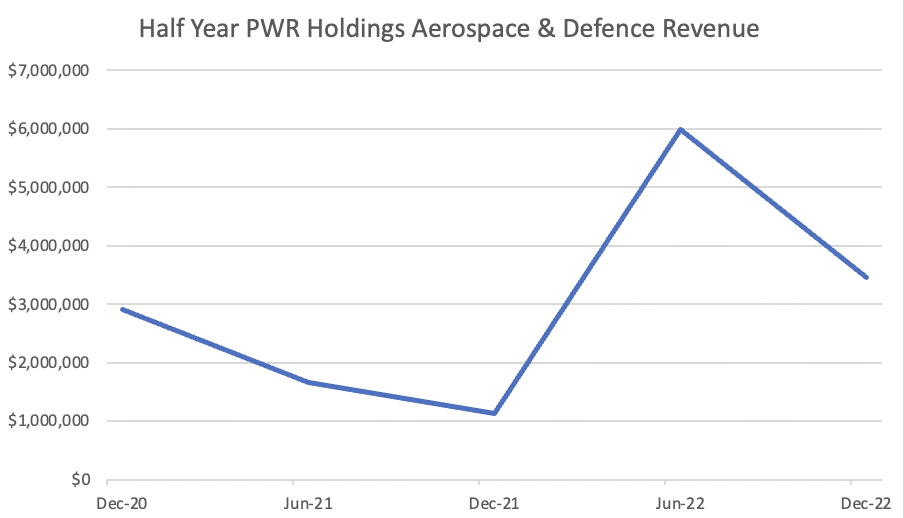

On the conference call, management sounded optimistic about opportunities in the Aerospace & Defence segment, talking of a large potential contract they hoped to announce in the next three months. The CEO said, that there are “Some projects afoot, they are sizeable… we’ve got quite a lot of opportunities there.” As you can see below, the aerospace and defense revenue can be a bit up and down… but the general trajectory is certainly positive.

Turning to cashflow, H1 FY 2023 free cashflow was down for PWR Holdings, coming in at just $100,000 after subtracting the lease payments, down on $2.85m in the prior corresponding period. This was largely due to “increased investment in plant and equipment, the acquisition of Docking Engineering and [an] increase [in] raw material stocks.” The company had $13m in cash at the end of December.

Earnings per share was 7.77c and an interim dividend of 3.6c was declared, putting the company on a trailing dividend yield of 1.17% at the current share price of $10.35.

As the company grows, its founder and CEO believes it can maintain profit margins around 20%, in both the short term and the long term. While the revenue growth from its motorsports and automotive divisions are not growing quickly any more, it is good to see the much smaller Aerospace & Defence business making good progress. From comments on the conference call, there is plenty of room for this division to grow.

This particular half was fairly weak, as the company reinvests in growth and suffers increasing costs due to inflation, but the company is forecasting a strong second half and the longer term thesis remains intact. Allowing for a better second half, the company could earn 23c per share for the full year (though this would be slightly above analyst consensus estimates per CapIQ).

In that case the stock would still be a P/E ratio of 45. Although this may well be justified if the Aerospace & Defence business takes off, the market might be disappointed if growth remains modest into FY 2024. Therefore, it would be hard to argue the shares are obviously cheap. That said, PWR Holdings remains a well run business with clear pricing power in most of its product ranges, and a strong balance sheet. Given it still has plenty of room to grow I still think it is one of the higher qualities in my portfolio and I will be sorry to see it go as part of this big change to my portfolio.

I would not be surprised if I own PWR Holdings in the future. I am very interested in buying it on share price weakness (or potentially on share price strength, given the business may continue to increase in my estimation). Definitely on my list.

Disclosure: the author of this article owns shares in PWR Holdings mentioned and will not trade them for at least 2 days following the publication of this article. Please keep in mind the author will trade after this date. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.