Property digital platform business REA Group (ASX: REA) displayed resilient results across H1 FY 2024. REA managed to wade through interest rate and inflation concerns through implementing price rises, upselling customers and a relatively strong listings in Sydney and Melbourne.

Source: REA H1 FY 2024 Results

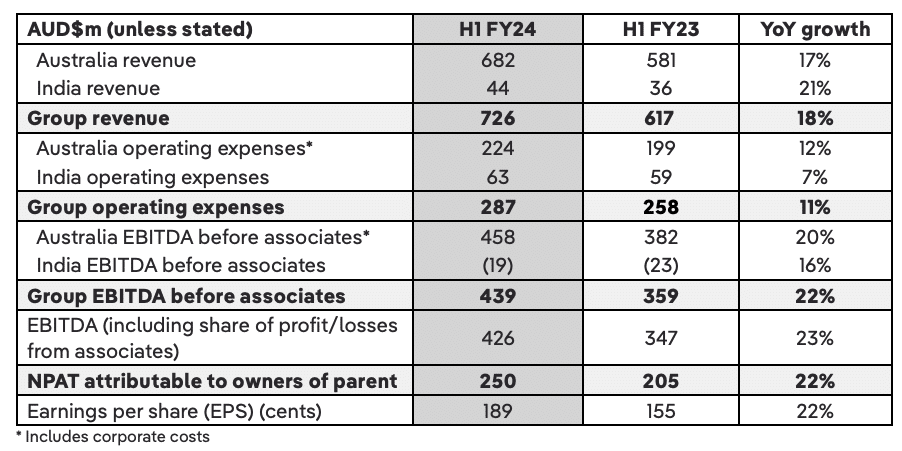

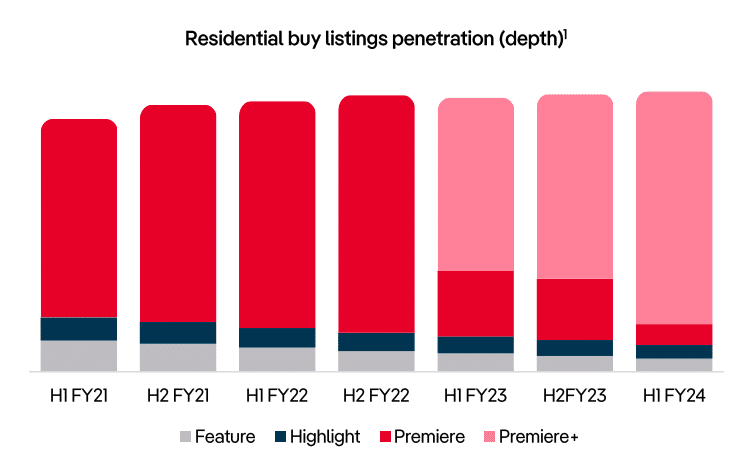

Revenue rose 18% to $681.5m relative to H1 FY 2023, primarily driven by a strong performance across the Australian residential segment. Residential revenue lifted 19% to $505m due to a 13% average price increase for residential purchases and an 8% average price rise for rentals. More property agents seem to be digging deeper into their pockets to increase residential sales by upgrading to REA’s highest-tiered offering ‘Premiere+’ as seen below.

Source: REA 1H FY 2024 Results Presentation

Reported net profit fell 37% to $127m due to a $120.3m downward adjustment to the valuation of PropertyGuru. REA holds a 17.3% interest in PropertyGuru, which operates similar property sites across Malaysia, Singapore, Thailand and Vietnam. It’s listed on the New York Stock Exchange and its market capitalisation has continued to decline since June 2023 as a result of revenue downgrades stemming from softening outlooks across Vietnam and Malaysia due to government policy interventions and greater macroeconomic pressures.

If you exclude this revaluation along with non-controlling interests, REA’s core businesses produced a net profit of $250m, representing a 22% uplift compared to 1H FY 2023. Management has agreed to pay an interim dividend of 87 cents per share fully franked, an increase of 16% year on year. At a trailing twelve months price-to-earnings multiple of around 58x, investors are pricing REA to continue its dominance in Australia, even after today’s REA Group share price fall of over 4%.

But I think that this price could be justified due to the growing business in India.

Before diving into India, let’s try and understand how REA achieved such dominance in Australia. Around a year after REA was listed on the ASX in 1999, News Limited acquired a 44.2% stake. In return, REA received $2.25m in cash, the co-branding of 94 suburban newspapers’ real estate sections Australia-wide and other operational services like advertising, marketing and technology. This may not seem much now but at the time, this was considered a huge announcement given News Limited was founded and operated by media mogul Rupert Murdoch.

At one point in 2011, it was reported that Murdoch’s News Limited commanded nearly three-quarters of daily metropolitan newspaper circulation. In 2016, News Limited still held a 65% share of the national market according to a report by ABC in 2021. So, you can imagine how much of an advantage REA had in accessing the biggest pool of eyeballs over more than two decades. In contrast, REA’s nearest competitor Domain had been operating through a subsidiary of Fairfax Media Limited, which presented feeble competition.

REA managed to turn a net profit of $2.5m in FY 2004 from $19.1m of revenue in Australia.

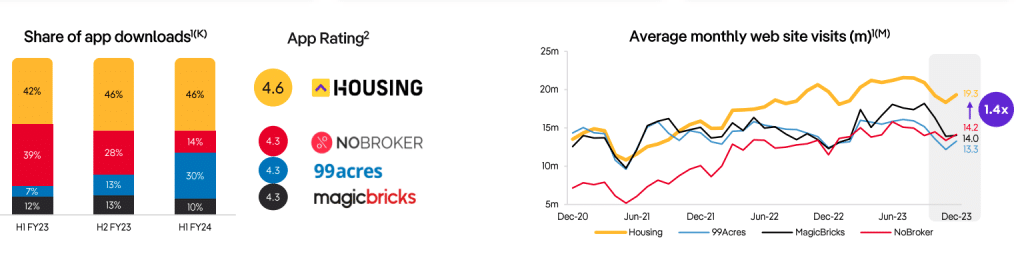

Despite Housing’s leading position in web traffic, profitability remains elusive at this stage. REA’s Indian business Housing continues to struggle to reach profitability, posting an EBITDA loss of -$19m from $44m in revenue for H1 FY 2024.

Comparing the competition dynamics between Australia and India may provide some answers. At the time when News Limited dominated physical media in Australia, it was apparent REA had a sizeable advantage over Domain in terms of distribution. However, competition appears to be highly fragmented in India as shown in the charts below, and housing is far less dominant over there, than realestate.com.au is here in Australia.

Source: REA 1H FY 2024 Results Presentation

99acres is also chowing down a lot of app downloads and remains hot on the heels of Housing. 99acres is operated by an Indian technology company called Info Edge (India) Limited and competition appears to be fierce based on the managing director’s comments in its FY 2023 annual report. Most notably, margins seem to be under pressure as key players chase market share through promotional strategies and investments in staff to develop better platforms.

Whilst Housing holds no apparent advantage, REA seems to be executing well at this stage. But the important question is whether it can widen the gap and establish greater dominance over its rivals. I can’t see any of the players in India possessing a helping hand similar to that of News Limited for REA in Australia. Nonetheless, a leading position is still desirable; and Housing has that. Given India’s size and emergence as one of the leading economies, the opportunity has the potential to change REA’s valuation significantly. However, this relies on competition giving way to pricing power at some point in the future.

Disclosure: the author of this article does not own shares in REA. The editor of this article does not own shares in REA. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.