I placed nano-cap RocketDNA (ASX: RKT) on my watchlist at the suggestion of a reader. So when it reported its quarterly results for the quarter to December 2023, I decided to take some notes. I thought I’d share those notes with you today, so here they are.

RocketDNA is a drone services company offering a wide range of products. For example it offers AeroMap, a service that allows customers to “Gain access to qualified, on-site Drone Engineers supported by next-gen surveillance hardware and processing software…” and PitComply which allows customers to “generate comprehensive conformance reports on key geometric parameters, assessing how well your open pit mining aligns with the mine design.”

On top of that it offers IntelliSky, a service allowing customers to “locate possible threats or strategic geophysical features.” Overall on the website I counted 12 different products separated into Drone-in-a-Box, Hardware & Software (re-selling) and Data products.

RocketDNA does not seem software company. Rather it seems to sell services and re-sells software. For example, it is “an accredited distributor of Strayos Software in Australia and Africa”.

The company says, revenue from continuing operations was “$1.640m in the December quarter, Q4 FY2023, was up 6% on Q3 FY2023 and up 2% on Q4 FY2022”, so it is hard to argue the company is demonstrating much growth. In the last quarter, only about 46% of its revenue was recurring revenue, so I would expect fluctuations rather than smooth growth, in any event.

During the December quarter RocketDNA burned through about $600k in cash. It also conducted a small capital raising worth $1.1m at a share price of 0.9 cents per share.

However, given RocketDNA only had about $2.3 million in cash at the end of the quarter, I would expect another capital raising quite soon, within a year or less.

That might mean RocketDNA is going to spend some of the money it raised on investor relations, promoting its investment story to investors. This may increase the share price, given the market cap is so small.

However, it is not clear to me what margins would be possible in this sort of business, even at maturity. It seems to be partially reselling software and partially selling the services of experts (who use expert equipment, including software). I can understand how that could make money but I would have thought margins would be pretty low. Without sustained faster revenue growth, it is hard to say when, if ever, RocketDNA will reach breakeven.

It will be interesting to see if major shareholders Altor Capital want to sell more shares. Their recent change in substantial holder notice shows a reduction in the number of shares they own.

RocketDNA has a diluted market capitalisation of between $6m and $6.5m, depending on how many performance rights vest. While I could see the potential for the stock to become overhyped amongst retail investors seduced by the idea of investing in a drone-related business, I don’t see what the competitive advantage of the business is.

RocketDNA might be interesting to people who like to buy loss making nano-caps with a relatively high number of hotcopper posts considering their tiny size. But that is not me.

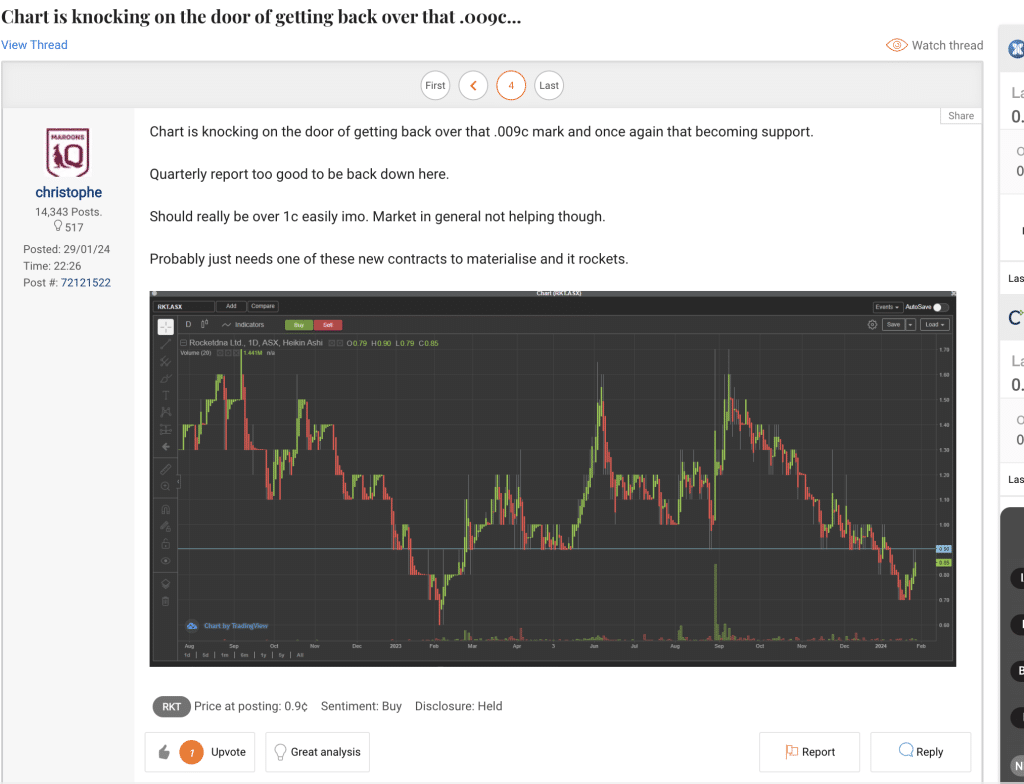

I offer the screenshot below only as an example of what shareholders are saying on hotcopper, and nothing more. For now, I’ll be removing RocketDNA from my watch-list and checking back in a few years.

Disclosure: the author of this article does not own shares in RKT and will not trade them within 2 days of publication. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter