Ten days ago, the FY 2022 Sequoia Financial Group (ASX: SEQ) results were released to market, showing revenue up 26.5% to $147.3 million, partly driven by acquisitions. Unfortunately, the FY 2022 Sequoia Financial results showed profit up just 3% to $5.7 million, due to acquisition costs, cybersecurity costs, and “unexpected claims in the advice business”. The CFO described this spending as “short term pain” to grow margins in the future.

Even excluding certain “non-cash and one-off or non-operational items,” underlying profit was only up 7.3%, so it is impossible to argue that the company is improving its margins. On top of that, the Sequoia CEO Garry Crole made downgrades to the 7 year plan targets, in large part because the current share price is less than 5x operating cash flow, and so the company does not want to issue shares for acquisitions. This reduces the growth outlook, but is sensible from a shareholder perspective, and cannot be convincingly criticised, in my view. Ironically, even though this is bad news about the business, it is arguably a good sign of management integrity.

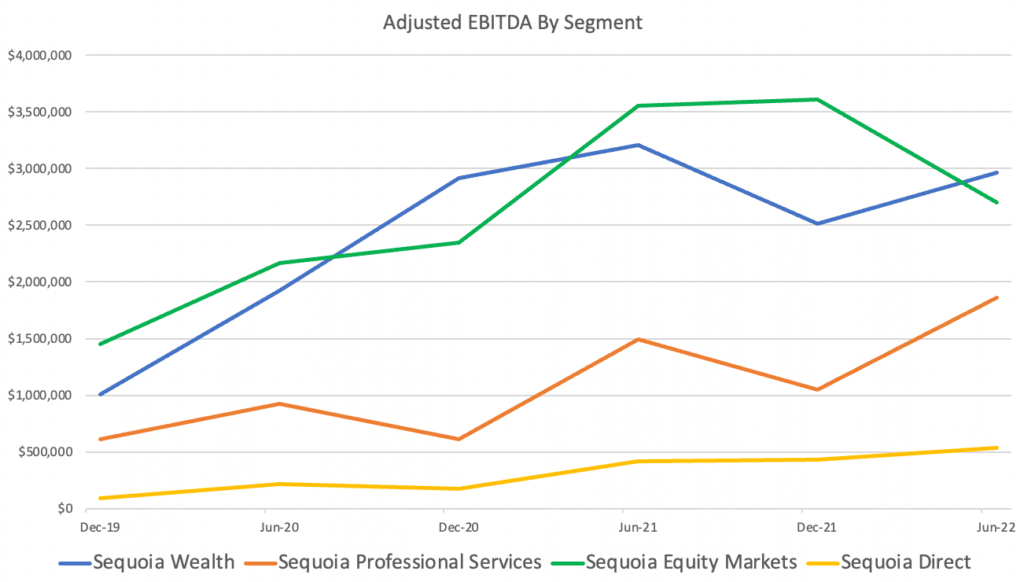

Moving on to the segment earnings, you can see below that second half growth was stronger in the professional services division (which seems to get a boost in the second half, due to end of financial year demand). Professional services include SMSF administration, general insurance broking, legal document establishment services and company secretarial services. The CEO said “The opportunity in adviser services and advice has never been better”.

Notably, the previously strong Morrison’s business (Sequoia Equity Markets) was down for the first half in ages, suggesting that its strong growth run is now over. This is in part due to the fact that the company has “invested very heavily, and expensed all of that” in FY 2022. Sequoia CEO Garry Crole forecast that the EBITDA margins from this business should improve next year. Therefore, the growth in this segment may not actually be over (though I won’t count my chickens before they hatch).

When it comes to operating cash flow and free cashflow, it’s fair to say that Sequoia runs a tight ship. Free cash flow was $4.6 million even after spending about $4.8m on various acquisitions. Cash on balance sheet increased to $14.9m from $13.7m

A Plan For Sequoia Financial Group (ASX: SEQ) Shareholders

In this report the company said that “we remain focused on steadily increasing dividends, whilst continuing to use a large part of our profit to fund acquisitions. Aligned to this strategy we are pleased to report an increase in the dividend pay-out ratio to 33% in 2022, representing 1.4 cents of fully franked dividend, which is a 40% uplift from the 1.0 cent distributed in 2021. Our intention is to increase the payout ratio from the 25% in 2021 to 33% in 2022, to 40% in 2023, 50% in 2024, 60% in 2025 towards a long-term target payout ratio of 70% post 2026, being the backend of our current long-term strategic plan.”

Now personally I neither appreciate nor put much stead by the “longer-term revenue target of $300m with more than 10% operating net cash flows pre-tax and EBITDA by 2026.” My personal belief is founders should keep long range targets inside their head where they belong, and that most of the time the publication of long term targets is intended to elevate market expectations. My personal belief is the “proof is in the pudding”.

However, even if we just assume earnings per share grows from 4.3 cents per share to about 5.3 cents per share in FY 2026 (very achievable in my view, being average growth of around 7% – 8%), then the company would pay a dividend of 3.7 cents per share. At the current share price of 60 cents per share, that would be a yield of 6.1%, fully franked. If those franking credits have value for you, then that’s an 8.8% franked up dividend yield, based on a purchase made 3 years prior. Even if the company just eked out a wee bit of growth from then on, it could turn out to be a decent little source of income for holders.

Is Sequoia Financial Group A Good Dividend Stock?

The trailing dividend yield for Sequoia is just 2.3% and my entire thesis for this business will become a good dividend stock in the next few years. There are two main questions to ask:

First, can the board be trusted to pay out an ever increasing share of earnings as dividend? And second, will the business be able to grow its own earnings per share?

Given that financial markets can be cyclical there is no guarantee my growth forecasts would be true. However, even if the business just remained flat then increasing the payout ratio would still create value for shareholders. Personally, I tend to be far less optimistic than management, but also I think management are competent and trustworthy.

The main reason for the flat result this year was that the company spent more money on “staff hires in sales, marketing and legal services, technology spend to enhance cyber security capability & technology upgrades.” I am guessing that some of the expense growth will reduce by FY 2026, and would hope to see some operating leverage kick in. On top of that the company will be buying back shares. Therefore I think earnings per share growth is reasonably likely.

After these Seqoia Financial results, I can’t be certain Sequoia Financial Group is a good dividend stock, but as long as it can achieve modest earnings per share growth I think it will be. I hold shares because I like management’s plan to pay out more of earnings as a dividends, and the Sequoia price to earnings ratio is only about 14, so the market doesn’t seem to have particularly optimistic expectations. Therefore, I think there is some upside possible if sentiment improves, though I suppose the multiple could also fall further.

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in ASX:SEQ. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. To the extent that this article is advice under the law, it is general advice only. It has not considered your investment objectives. To the extent that this article is financial advice, it is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.