While this article focuses on the share market during the pandemic, it in no way seeks to minimise the very real human tragedy that is occurring.

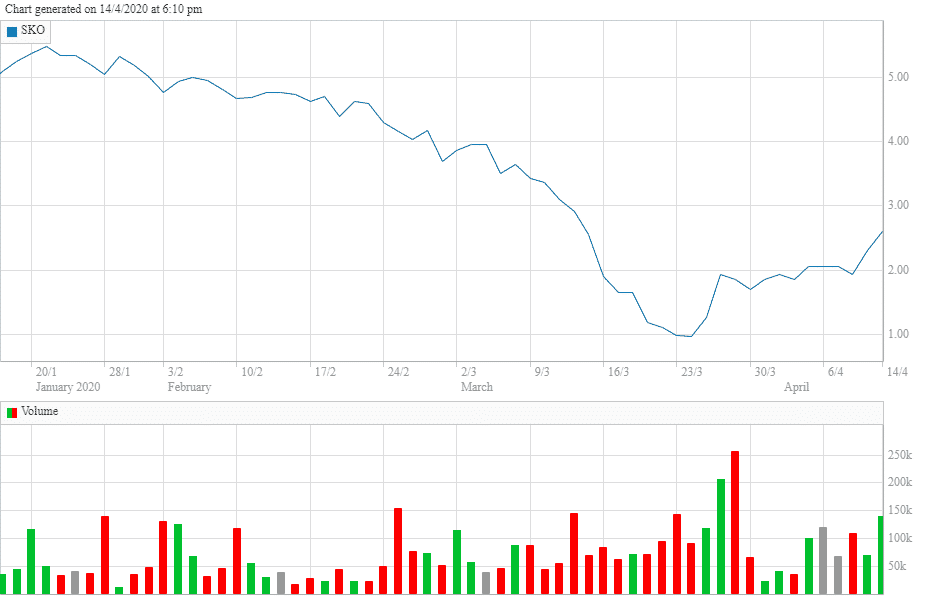

Serko Limited (ASX: SKO), a NZ-based software-as-a-service company, continued its share price rebound when markets opened after the Easter break. By market close on Tuesday, Serko Limited shares were trading at $2.60, a rise of 29 cents or 12.55%.

The jump on Tuesday follows a price up-tick that started late on Thursday 9 April. If we take the benchmark of around $2.20 per share on Thursday afternoon, Tuesday’s market close constitutes an increase of over 15%.

Yesterday’s move continues a strong bounce over the previous three weeks. Indeed, Serko’s shares have now jumped $1.63 in that time, an increase of over 160%.

Serko’s core product is an app called Xeno. The app allows businesses and their finance teams to manage business travel and expenses on a single platform, streamlining the bookings, purchases and approvals processes for employees, supervisors and accounts.

For this reason, there has been understandable concern from investors in Serko, as with others affected by the shut-down of global travel, like Webjet (ASX: WEB) and Flight Centre (ASX: FLT). From a high of $5.48 on 21 January, Serko lost 82.3% of its value on its way to its low of $0.97 on 23 March. With the recent rise the company is now trading about 50% below its late January high.

Using A Rich Life’s ‘Framework for Sorting Investment Opportunities during a Pandemic,’ Serko could be described as a survivor if it has enough cash to survive the long period during which business travel will be suppressed. Its recovery will depend on the pace at which its corporate customers wind up their activities, and therefore will be shaped by the dynamics of the overall economic recovery.

The uncertainty surrounding future global travel policies brings an added degree of uncertainty, including whether we see reduced global economic integration overall.

These factors led Serko to withdraw its revenue guidance on 16 March. As the CEO commented, “The spread of the virus and subsequent increase in border access restrictions is making it difficult to predict the impact the virus is likely to have on Serko’s year end position.”

Yet despite these short- and medium-term shocks, the company does appear well-poised to outlast the Covid-19 crisis. Like fellow NZ-based company Volpara Health Technologies (ASX: VHT), Serko is fortunate to have raised capital in the second half of last year.

In its 3 April announcement, the company reported $42m cash in the bank as of 31 March, the end of NZ FY20. With various cost-cutting measures in place, management is targeting a monthly cash burn of $2m, which means the company could survive for almost two years, if achieved.

Serko also reported no exposure to customer refunds or credits, and does not anticipate having to rely on the capital markets to survive the pandemic.

In short, while Serko may no longer be flying at cruising altitude, the seatbelt signs are on and there is a good chance the company will land safely in the end. Due to its large cash holding, we have not considered it’s potential in this strategy to participate in discounted capital raisings, but if travel restrictions remain in place long enough, it could become a candidate.

Christian Tym does not own shares in Serko Limited.

This post is not financial advice, and you should click here to read our detailed disclaimer.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!