Skyfii Ltd (ASX:SKF) sells software which helps organisations understand how their physical spaces are used by people. Current customers include shopping centres, stadiums, airports, universities, gyms, smart cities, casinos, cultural centres, retail outlets and hospitals. The company has offices on six continents and is growing rapidly both overseas and in Australia. Its software collects data from multiple sources including wifi, customer relationship management software (CRM), weather, CCTV cameras, beacons and people counters. The company currently has over 900 customers and has deployed its technology in over 10,000 venues.

Skyfii offers three software products: IO Connect, IO Insight and IO Engage. IO Connect captures and stores data from various sources such as wifi, security cameras and the weather. IO Insight presents this data in real-time customisable reports to show how people use a venue over time. IO Engage sends targeted messages to end users based on information from IO Connect and IO Insight. Customers typically start off with Connect and Insight and upgrade to Engage over time and so these products currently generate the majority of Skyfii’s software revenue. In addition to selling software, Skyfii offers bespoke services through its IO Labs division which help customers to extract additional value from their data.

Sustainability

In order to make a judgement about the sustainability of the Skyfii business it is necessary to assess the value of analysing physical data. This varies on a case by case basis, but overall there are plenty of worthy applications.

For example, spend per head is a key metric in the restaurant trade to drive sales so automatically recording the number of customers over time is very useful. Museums can use the same data to understand the relative popularity of exhibits. A retail chain can improve benchmarking between stores by comparing sales in the context of footfall. IO integration with point of sale (PoS) systems and customer loyalty schemes can help retail chains use promotions more effectively. Universities can use Skyfii’s technology to monitor student attendance and airports can use it to reduce queue times at bottlenecks such as security and taxi ranks.

These are just some examples and whilst Skyfii’s platform may not be relevant to every venue, the addressable market is huge.

The value of Skyfii’s technology also depends on the ability of an organisation to effectively analyse the data to extract insights. This condition plays into Skyfii’s hands given it has invested in marketing and data science expertise to assist its customers through IO Labs. The company claims this differentiates it from competitors who typically just provide software. I have verified this claim by checking the websites of four main competitors (discussed in more depth later). The IO platform combined with Skyfii’s expertise can deliver tangible business outcomes such as enhanced stores layouts, improved staff utilisation and commercial property rental pricing optimisation.

A third consideration is the accuracy of the data which IO Connect ingests. Currently, most of Skyfii’s customers rely solely on wifi data despite the platform’s ability to ingest many other sources. This is because most venues already have a wifi network installed. IO Connect can detect devices which have wifi enabled but are not connected to the network as well as those that are connected which is important because often people do not use guest wifi. More data can be collected from people who do sign up to the wifi network and IO Engage pushes targeted marketing to these individuals.

Some devices will not have wifi enabled and so the network won’t be able to detect them at all. This can be solved through additional data sources and Skyfii has invested heavily in increasing the number of sources compatible with its platform. In particular, the acquisition of Beonic Technologies in July 2019 enhanced the group’s capability in people counting and camera data capture. Additional data sources enrich the information that IO Insights provides and typically Skyfii upsells these to customers over time. It claims that this is another thing that sets the company apart from peers (again, I have verified this based on competitor websites).

Another consequence of multiple data inputs is that obsolescence risk is reduced. For instance, should wifi become redundant then Skyfii’s customers will still be able to access data from people counters. Having said that, most customers currently rely solely on wifi data so it would be a major blow to Skyfii if people stopped using wifi imminently. However, this is unlikely to happen for various technical reasons discussed in this Fortune article. Furthermore, networking giant Cisco anticipates that next generation 5G mobile technology will work in tandem with wifi and not replace it.

Skyfii does not collect personal data without permission, only anonymised location data mitigating regulatory risk. It is fully compliant with European General Data Protection Regulation (GDPR) which is considered the most stringent data security regulation in the world.

Profitability

Skyfii earns three revenue streams.

- Recurring software revenues (85% gross margin) is generated in return for access to the IO platform. Monthly subscriptions range from $50 per month for a small space such as a quick service restaurant up to $15,000 per month for the largest venues such as airports and stadiums. Software contracts are typically signed for three or five years and customer churn has been less than 1% since inception.

- Services revenue (50%-60% gross margin) is generated from providing data science and marketing services to help customers get maximum value from the platform. This revenue is sometimes recurring and varies in size by project.

- Non-recurring (30%-50% gross margin) is revenue from hardware installations including wifi, cameras and people counters.

The business is currently being run to maintain an earnings before interest, tax, depreciation and amortisation (EBITDA) breakeven position, with all incremental margin reinvested to achieve global leadership.

International sales are building and making up an increasing part of the whole. Domestic revenue continues to grow (up 30% in FY 2019) but is losing ground because international revenue is growing faster (up 87% last year). Management’s decision to invest in establishing a global presence has suppressed profit in the short-term, but international sales growth to date hints at it proving to be a successful strategy in the long-term.

Skyfii primarily sells through partners such as Deloitte, Cisco and Optus who are typically paid between 10% and 30% of revenue from sales they generate and reported revenue is after deducting these costs. The company employs sales people in small three to five person teams to support these partners in each geography and is currently rolling out offices to this effect. The latter explains much of the recent increase in operating expenditure, but the model should ultimately generate high margins in each region that reaches scale.

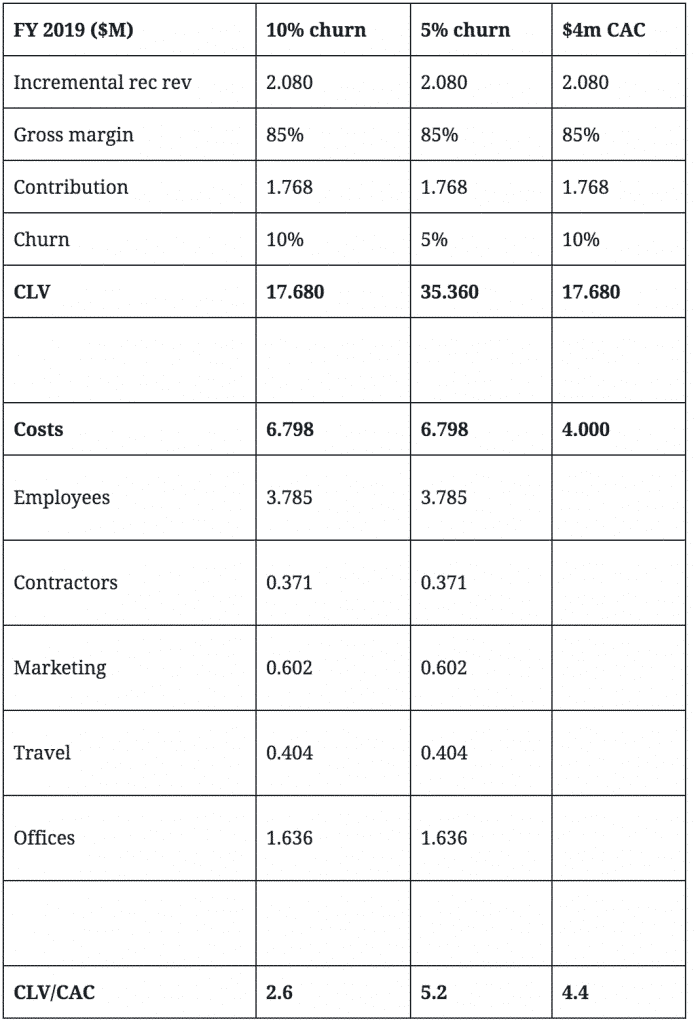

The above table is an attempt to calculate Skyfii’s customer lifetime value to customer acquisition cost ratio (CLV/CAC). CLV/CAC is a key metric for understanding the quality of growth in early stage subscription businesses. I have used FY 2019 figures and laid out three scenarios. Whilst the first column contains the most conservative calculation, all three versions probably understate the truth for the following reasons.

- I assumed annual churn rates of 10% and 5% when Skyfii has historically experienced churn of less than 1% since inception. I suspect that churn will increase over time but there is no reason to think it will be as high as 10%, particularly given most customers commit to at least three years at a time.

- All costs are included except for share based payments, depreciation, directors’ fees and finance costs to calculate CAC in the first two columns when in reality only a portion of these expenses are relevant. I did this because the company does not breakout customer acquisition expenses. The third column contains a guesstimate that relevant costs might have been $4 million last year which is still more than half of the total.

- The above calculations are based on recurring revenues only, but both non-recurring and service revenues also generate profit for Skyfii.

I consider a CLV/CAC of 3 to be good and even in the most pessimistic case above Skyfii scores a respectable 2.6.

One issue with the above analysis is that Skyfii may be too immature for CLV/CAC to be meaningful. It is spending heavily on establishing international offices and only once this process is complete will the sales and marketing function be fully operational. In my view it is only then that it will be possible to truly gauge the economics of Skyfii’s business model.

Competitors

Zenreach

San Francisco based Zenreach was founded in 2012 and is backed by high profile venture capitalist Peter Thiel. It has raised a total of $94 million to date according to Crunchbase. The company is focused on delivering marketing solutions through guest wifi networks. It provides campaign managers to assist its customers to create targeted advertisements. Unlike Skyfii, the company does not appear to offer data capture from multiple sources or data science services.

Cloud4WI

Cloud4WI is headquartered in New York and was founded in 2014. According to its website its technology is used in more than 45,000 locations in over 120 countries. This is four times as many locations as Skyfii although the value of each venue varies by size and so does not necessarily imply a four-fold market share. Like Skyfii, Cloud4WI has an impressive client book including Aldi, Armani, Bank of America and Burger King. Cloud4WI is focussed only on wifi data and does not appear to offer consulting services.

Purple

According to The Sunday Times Fastrack 100, UK based Purple recorded £5.6 million of revenue in the year to January 2018, a similar level to Skyfii’s FY2019 revenue. As with other competitors, it does not offer additional data sources or consulting services.

Aislelabs

Toronto based Aislelabs was founded in 2013 and according to its website it has thousands of customers across enterprise and mid market. Skyfii is mainly focused on enterprise customers and has more than 900 customers. Aislelabs does not offer other data sources or bespoke consulting services.

The competitors I have looked at appear to be mainly focused on leveraging wifi networks to create targeted advertising. Skyfii does this as well, but it is just one part of its broader mission to measure, predict and influence how people interact with physical spaces. I think Skyfii’s approach is superior to that of its peers as in many cases people do not use guest wifi and so I’m sceptical that it is possible to collect enough permissioned data to deliver effective targeted advertising. Furthermore, as people become more aware of such data harvesting I think they are more likely to rely on their mobile connection rather than sign up to guest wifi further diminishing the effectiveness of such software. On the other hand, Skyfii’s technology and services offer much more than just targeted marketing and can help improve physical spaces to the benefit of end users.

Board, management & major shareholders

The board and management of Skyfii collectively own 68.8 million shares worth around $11 million at current prices. Non-executive director Jon Adgemis owns 33.3 million and is the former Managing Director of Mergers & Acquisitions at KPMG. Senior management hold most of the rest of the balance with CEO and co-founder Wayne Arthur in possession of 11.6 million.

Other substantial shareholders include Thorney Technologies with 26.1 million shares, Kathmandu founder Jan Cameron with 17 million and Precision Management with 22 million. Shaun Bonétt founded and ran the latter; and stepped down as a non-exec director of Skyfii last year. Precision Group was a customer of Skyfii before Mr Bonétt decided to invest.

When Skyfii listed in late 2014 it had under $1 million in revenue. Since then revenue has grown predominantly organically to almost $10 million as of last year. Investors have contributed roughly $28 million of equity in the process, but failure rates for startups are high and getting to this point is an impressive achievement by Skyfii’s management team.

Valuation

At the time of writing Skyfii has a market capitalisation of just over $50 million which is reasonable given its high margin recurring revenue run-rate of $9 million, currently increasing by $2 million per year on an organic basis. Management has said that is has enough funding to execute its strategy, reducing the risk of excessive share dilution. A combination of sticky customers evidenced by low churn, a scalable sales model driven by channel partners and a large market opportunity give Skyfii a fighting chance of becoming a much larger and highly profitable company.

If this happens then it will be worth multiples of today’s market value. However, only a very small percentage of companies achieve this kind of success and whilst I think Skyfii has a better chance than most, I am not “betting the farm” on the stock. A small position size is a prerequisite for such early stage companies.

The author holds shares in Skyfii, and does not intend to trade them for the next couple of days. This is an investment diary and does not consider your circumstances, is not intended to be financial advice and is certainly not a recommendation.

Click here for our latest articles on Skyfii.

This post is not financial advice, and you should click here to read out detailed disclaimer.

Click here to join the waitlist to become a Supporter.