Last week, truck and bus part distribution company Supply Network reported its results for H1 FY 2024. Net profit after tax (NPAT) had already been pre-announced as being “around $15m”, and sure enough, in the end the result was a profit of just over $15m, up 18% on $12.7m in the prior corresponding period.

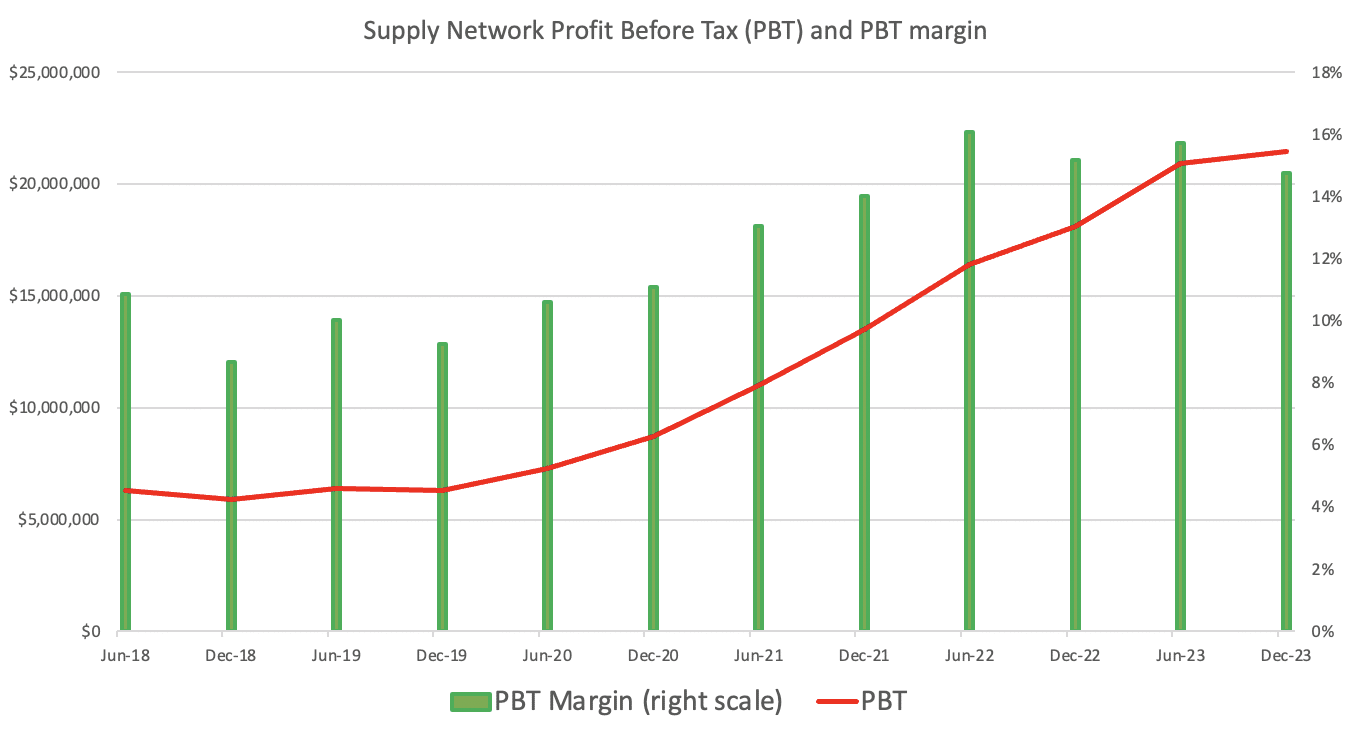

As you can see below, the net profit before tax was only up very slightly on H2 FY 2023, in part because margins slipped slightly. However, the margin was still very good compared to historical performance.

Due to the capital-intensive nature of building out a distribution network, free cashflow typically tracks well below accounting profit, and that was also the case in this half. In fact, free cash flow was particularly weak at just $2.94 million, due in large part to an $18m increase in inventory.

The truth is that as shareholders, we are accumulating a large portion of our profits in the form of bus and truck parts. The obvious trap here is that some of this inventory could end up being wasted. I have no idea if that is the case, and there is no easy way of checking.

Well, actually, perhaps it is better to quote Raymond who says it is “refreshing to observe a management team happy to fly under the radar.”

Turning to the balance sheet, the Supply Network debt increased slightly to $11.2 million.

Importantly, Supply Network typically offers a maximum price for the dividend reinvestment plan, which will be a maximum of $15 this year. Given the ~15% discount to the current share price of around $17.77, I am very happy to re-invest my dividend.

That said, at the current share price of $17.77, Supply Network has a market capitalisation of around $745 million. The half on half profit growth rate was only 2.4% in H1 FY 2024 (comparing it to H2 FY 2023). If we extrapolate that forward, then the FY 2024 NPAT would be only about $30.4 million.

That would put the company on a FY 2024 P/E ratio of about 24.5. That pricing seems pretty reasonable to me, and there was nothing in these results that would drastically change my view of the company.

However, overall, I would say this result was slightly negative due to the weak free cash flow. This is only a slight negative because free cash flow can bounce around a lot from period to period based on the timing of payments. Therefore, I would not read too much into a single bad half of free cash flow.

Nonetheless, the Supply Network forward P/E ratio has increased from around 21 when I recommended it to around 24.5 today. On top of that, the company has just produced a weak cash flow quarter, which is sure to have slightly negative flow-on effects since weak cash flow means more debt, which means higher interest expense.

Therefore, I am downgrading Supply Network to Hold, with one important caveat. The caveat is that I still think shareholders should reinvest their dividends, and I will be reinvesting my dividend personally.

The main things that would make me upgrade Supply Network would be a lower share price or improved free cash flow. The main thing that would make me want to sell Supply Network would be if free cash flow does not improve in the next couple of halves.

Please note that this advice is general advice only. I have not considered your investment objectives and this is not personal advice. This advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937). The author owns shares in SNL at the time of publication.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.