This morning, wholesale telecommunications provider Symbio (ASX: SYM) released its results for FY 2022, showing revenue from continuing activities up 0.8% to $202.6 million, and profit from continuing activities down a whopping 52% to $5.77 million. Profit from all activities, including a one-off gain on sale of the direct business, was down slightly to about $14.6 million, but I don’t think that metric is particularly useful. This one-off profit, enabled the company to declare a special dividend, bringing full year dividends to 8 cents, fully franked.

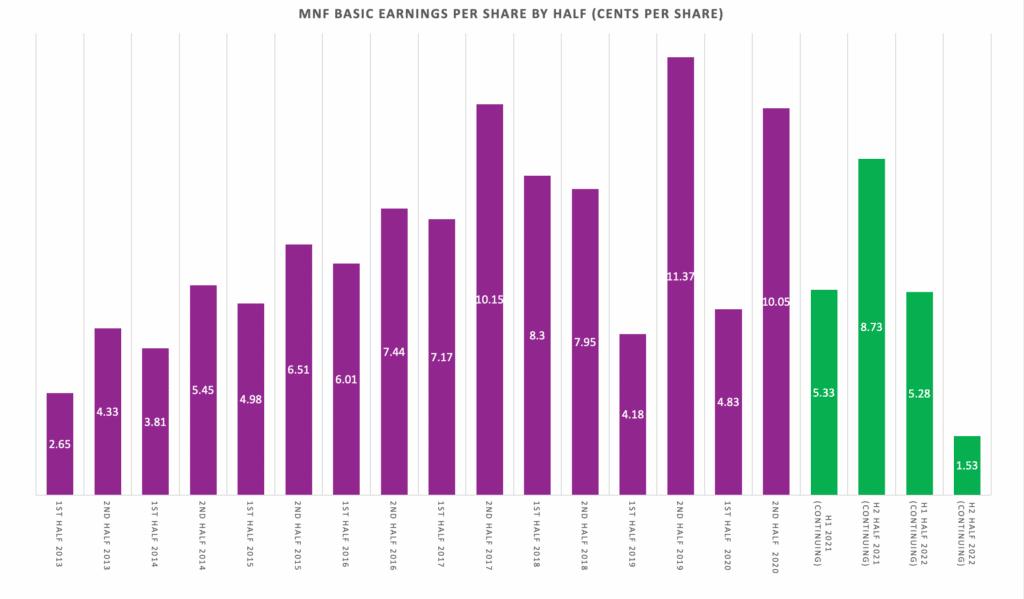

Going forward, I believe a more useful metric is continuing earnings per share from ordinary operations. As you can see below, the second half was the worst half for this metric, in many years. .

The good news is that normalised free cash flow, excluding investment in financial assets (and one-off acquisition consideration), was strong at around $8 million. This in part is because earnings per share was down because of accelerated brand amortisation worth $1.8m, resulting from the decision to coalesce behind the Symbio brand. However, even if you use continuing NPAT excluding Amortisation (NPATA), the full year result was down 9% to $14.4 million. Symbio did $6.7m in NPATA in the first half, so that means the second half was $7.7m.

Is The Symbio Thesis Broken?

The reality is that if you are an ‘earning per share’ investor you’re going to think a lot worse of Symbio than if you’re willing to accept their NPATA figure. At the current share price at $3.87, the market cap of Symbio is about $330m. Even if we accept the more generous NPATA figure as a proxy for profit then that is about 23 times (adjusted) profit.

Arguably, it would be just as reasonable to look at enterprise value to normalised free cash flow. Subtracting the future dividend payment, Symbio still has around $37m in cash so we could loosely call its enterprise value around $300m. Excluding acquisitions, the free cash flow was around $8m so it is on an EV / FCF ratio of around 37.5.

Either of these figures clearly involve some expectation of growth, which flies in the face of the fact that profit was down and revenue was flat. In that scenario, you can’t simply assert that Symbio is a growing business, even if it will likely return to growth in FY 2023.

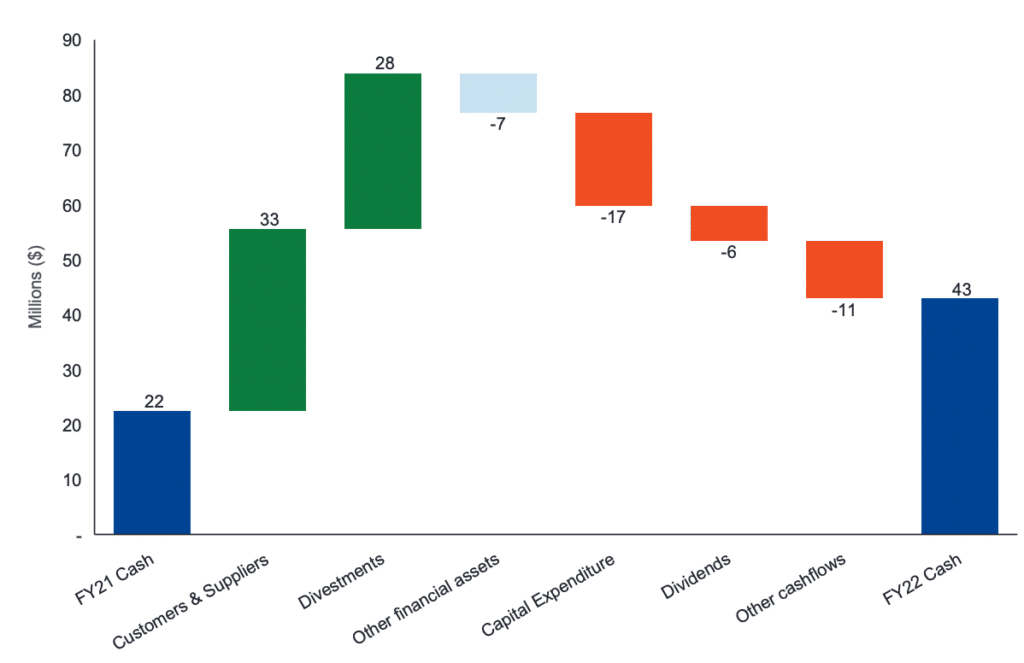

Finally, the most remarkable part of this result was the the CFO simply said “we invested $7m in other financial assets” when she talked about the balance sheet and cashflow on page 10 of the presentation, below.

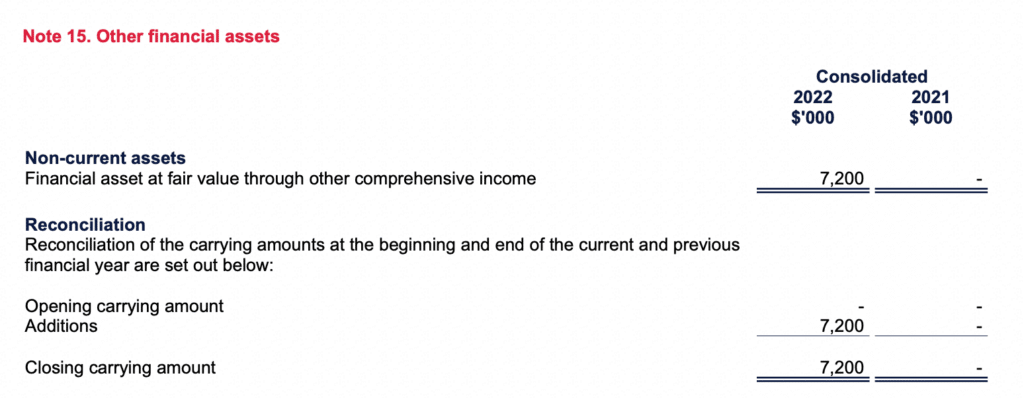

The slide above rounds the numbers to the nearest million, but the the actual investment was $7.2 million.

When asked about this investment in “other financial assets” on the call, the CEO of Symbio Rene Sugo said:

“…that investment was a way of putting some of our free cash to work to generate some recurring revenue through a bit of a partnership arrangement, so it’s nice to be able to deploy some of that cash to generate future recurring revenue… it’s a small investment for the future.”

While I like Mr Sugo as a person and think he has done a good job growing Symbio over the years, I am precisely 0% comfortable with that sort of vague disclosure for a $7.2m investment. I also disagree that it is small when it is actually more than the company paid out in dividends. I have no idea what this money was spent on, and for me the lack of detailed explanation is a red flag. After all, this sum is more than the entire year’s continuing profit!

Goodbye Symbio

While I think Symbio is an interesting business with a brighter future ahead of it, the massive decline in statutory earnings per share, the flat revenue, and the opaque investment of $7.2m without many details at all are inconsistent with the current share price. I believe the current share price implies an expectation of profit growth in the continuing businesses. While I have no doubt that the company can grow revenue, it’s not obvious when or if they will improve their profit result. For example, even if profit doubled from the second half run rate, in FY 2023, then the company would still be trading on around 65 times earnings. For me, there are simply too many negatives in this report, and despite the share price drop of 8% today, I plan to sell my shares tomorrow, or in the very near future. I may not sell them all at once, but I will look to sell, and redeploy elsewhere.

I would need to understand clearly what the $7.2m investment in financial assets actually was, before I would feel comfortable owning shares in Symbio. In the last few years my forecasts around Symbio have proved too optimistic. I was wrong. Sorry. I could definitely see how Symbio does well from here but at the moment I feel certain I could deploy the capital into businesses that inspire more confidence.

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in ASX:SYM but plans to sell them all, including at least some, tomorrow. [Edit: Tuesday, 30 August I actually forgot to put in my limit order today so will do it tomorrow]. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. To the extent that this article is advice under the law, it is general advice only. It has not considered your investment objectives. To the extent that this article is financial advice, it is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.