It was not long ago that online homewares retailer Temple and Webster (ASX: TPW) was one of the star stocks on the ASX. The Temple and Webster share price is currently down more than 50% from its highs, and today’s FY 2022 result arguably provides good reason to put the stock back on your watch list. The market clearly feared that the result would be worse than it was, because the Temple and Webster share price gained about 30% today, to close at $5.71.

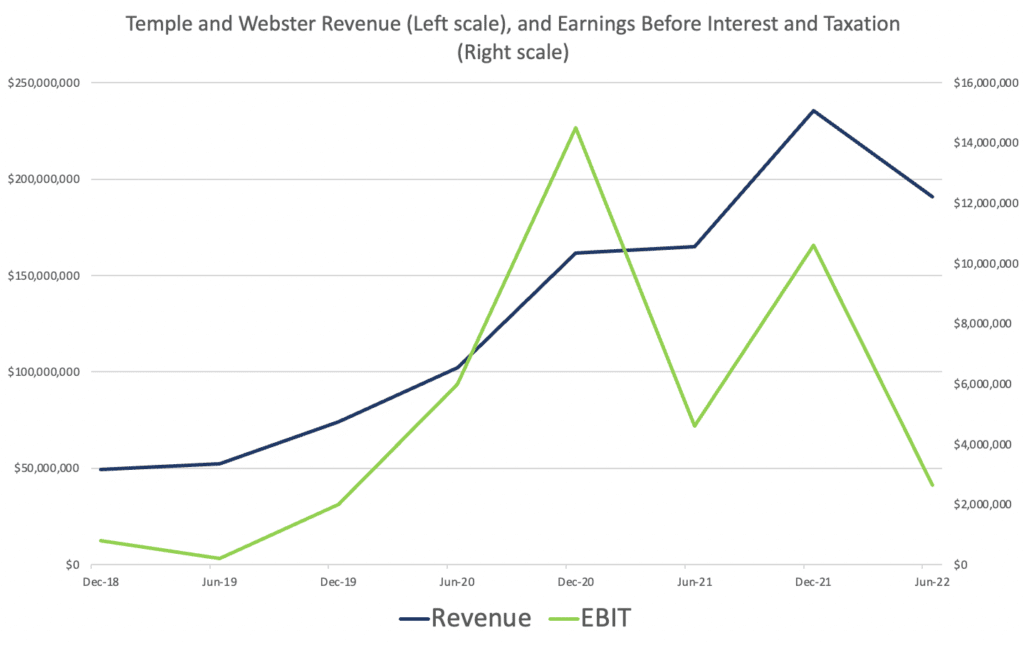

Temple And Webster’s headline results were revenue of $426 million, up 30% on the pcp, and profit of $12m, down 14%. These results looked disappointing because they are compared to FY 2021, which was buoyed by covid lockdowns (and the stimulus measures that got the economy pumping). Looking at just the second half of the year, H2 revenue was only up about 13.6% against the pcp, but profit before tax was down about 13%, roughly in line with the full year.

In the chart below, we’ve looked at profit before tax as a measure of profitability, because otherwise differing tax rates would distort the trend.

Temple And Webster Preparing For A Tough FY 2023

Generally speaking, the tone of the conference call was that Temple and Webster had identified tougher business conditions and was easing off on growth investments, as a result. Ironically, the company shifted their EBITDA margin target to 3% – 5% up from 2% – 4% because of a decision to spend less on growth. Temple and Webster CFO Mark Taylor said on the conference call that the company took swift action to respond to inflationary pressures and slowing consumer demand, during the last three months of the year. Temple and Webster CFO Mark Taylor said:

“We focussed on improving delivered margin levels, negotiating better outcomes with suppliers, and increasing pricing points where there were opportunities to do so whilst remaining super competitive we focussed on proven ROI marketing channels which ensured our 12 month marketing return remained stable. and the substantial step up in people during FY 2021 and H1 FY 2022, enabled us to slow some of our longer term investments in the second half to ensure profitability metrics remained strong.”

Pleasingly, the company reported its 3.8% EBITDA margin, after growth expenditure on its new website, thebuild.com.au. For me it would have been a red flag if they excluded that expense, and I was pleased they did not. However, they attempt to suggest that one day the company could make EBITDA margins of 15%. I am not saying this is wrong, but I do not like it when management try to get the market to focus on potentially far-off margin improvement. My favourite companies who generally suggest whether margins are likely improve or get worse but do not provide long distance margin forecasts. If you give massive long distance forecasts of tripling your margin, it elevates expectations and could lead to unnecessary distrust if progress is slower than hoped.

Temple and Webster has around 123 million shares on issue so its market capitalisation is about $700m. The company has cash of about $100m, and says there is “certainly some surplus cash on the balance sheet,” but keeping in mind that “we think having a strong balance sheet into FY 2023 is vital.” For now, let’s put the cash aside from our analysis.

In the last half the company made just $2.65m profit before tax. July is supposedly down 21% and August down 17%, but these are reductions on the company’s second strongest ever half, in which the company made $10.6m. So given the variety of possible business conditions (inflation, soft consumer, spending moving to services) we might reasonably pencil in anywhere from $5m – $10m profit before tax in the second half. If we assume that H2 FY 2023 is similar to H2 2022, then we could reasonably expect around $10m in profit before tax and around $7m in net profit after tax. That would put Temple and Webster on around 100 times earnings.

Management guidance is that “macro conditions and timing of COVID restrictions will be challenging for revenue growth.” So if we conservatively assume contracting revenue of about $400m, and an EBITDA margin of 4%, then the EBITDA might be about $16m, which is roughly the same as FY 2022. Therefore, I think one could reasonably expect $10m to $12m in FY 2023 profits, with considerable potential for a result outside that range.

Why Temple And Webster Deserves A Spot On Your Watchlist

In FY 2022, Temple and Webster made positive free cash flow of just over $5.4m and on the conference call management said they “expect this year to be cash flow positive, even with the investments we are making in inventory.” Guidance would also suggest they expect a lower marketing spend as a % of revenue.

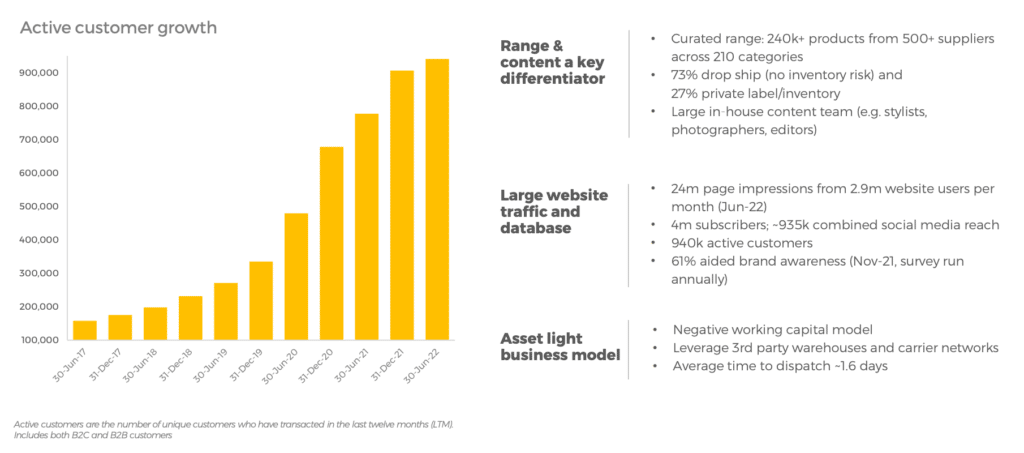

The longer term story here is that Temple and Webster has transitioned into a stable, financially strong, and sustainably profitable company. It is now facing a tougher macro environment, but it is reasonable to believe that on the current long term market share trajectory, Temple and Webster could double its revenue. That would likely see profit more than double, and it’s not unreasonable to suggest the company could make ~$50m in profit in the next 5 years, if both revenue and margins doubled. At that point, I suspect the current share price would look a bargain.

On the other hand, operating leverage and negative working capital work both ways. Where Temple and Webster’s business model rewards growth with increasing margins and a swelling bank account (since it gets paid for items, before it pays suppliers), any shrinkage could be painful indeed. Therefore, if we do enter a consumer recession, then Temple and Webster could see already modest profits shrink.

To my mind, share price weakness could present an opportunity. I don’t love investing in retail businesses, but I’ve owned Temple and Webster before (long since sold). These results are consistent with my view that Temple and Webster is a good business. I don’t generally buy stocks on a strong up day, and I’m not currently enthusistic about discretionary retail. However, I think Temple and Webster is one of the better ways to get exposure to the “clicks to bricks” mega trend. It deserves a spot on your watchlist, for that reason.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author does not own shares in TPW. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.