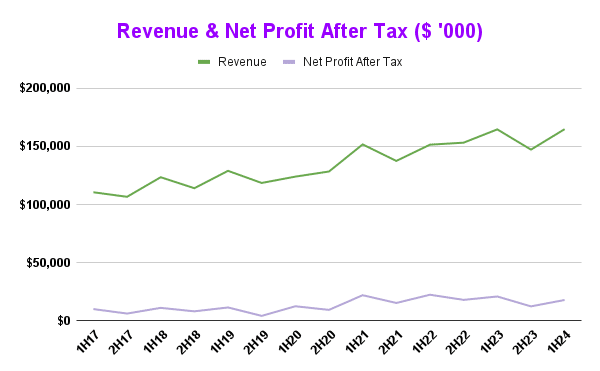

Lighting retail group Beacon Lighting (ASX: BLX) revealed a dim set of results for H1 FY 2024. Despite relatively flat growth of 0.1% in revenue and a 14% drop in net profit relative to 1H FY 2023, the Beacon share price still rose. It seems investors were expecting worse results. Strong performance in the trade segment helped Beacon offset slowdowns across the retail and emerging business segments.

Source: Beacon Lighting HY and Annual Reports

On the earnings call, management revealed the retail segment has been challenging for the last two years due to higher interest rates and inflation. The slowdown in international sales and other emerging businesses came as a bit of a surprise to management and failed to provide the same revenue lift as before. Gross margins remain elevated at 69.4% and management advised Beacon benefitted from lower freight costs and lower prices from suppliers in Asia. Management flagged that a lot of factories they work with have increased capacity and reduced their prices.

Management seemed quite frank and realistic when analysts pressed about the sustainability of gross margins. Refusing to provide an outlook, management rather outlined the number of different factors that may affect it e.g. freight rates, fluctuation in the strength of the $AUD and a greater mix of lower gross margin trade sales. I like how management responded, rather than leverage high gross margins to lift expectations, they took a more measured approach. However, this does mean there is certainly a chance margins will fall.

Operating expenses increased at historical rates with material increases in property outgoings, power and government-related costs. Operating cash flow nearly doubled and $5.2m was used for capex and $10m was invested in a term deposit, resulting in a net increase in cash at hand of $5.7m. Beacon currently possesses $26.4m in cash and is debt-free.

Beacon shares are currently trading at a forward price-to-earnings multiple of 20x, above the five-year average of 14x but at similar levels to a decade ago. Beacon is arguably a stronger business now though, and I’ll explain why.

Greater Resilience

A decade ago, trade customers represented a negligible piece of Beacon’s revenue. Management disclosed on the earnings call that trade revenue now makes up between 30-35% of group revenue. Beacon’s emerging business segment is also becoming a bona fide contributor. These two segments have enabled Beacon to offset the inevitable impact of macroeconomic pressures on its core retail customers.

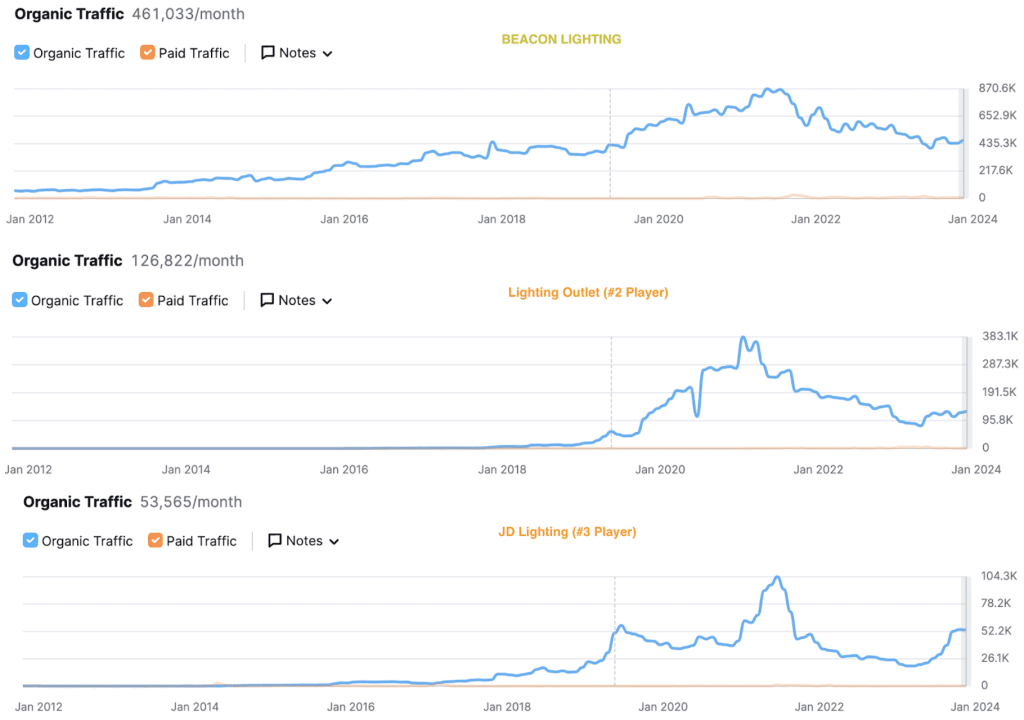

Quality businesses tend to better cope with challenging macroeconomic conditions. When inflation and rising interest rates applied pressure to consumer wallets, Beacon experienced a slower decline in organic web traffic than its competitors. The below organic web traffic graphs of the top three lighting-only players.

Source: Semrush

Lighting Outlet and JD Lighting only operate one store and rely heavily on online orders. Despite Beacon’s significant store footprint of 123 stores, it still recorded more resilient organic traffic. Physical presence and brand familiarity seem to make a difference. And this will only strengthen given Beacon’s potential target of 195 lighting stores in Australia.

When management was asked if the plan was to roll out new stores at historical rates of 4-6 per year, management emphasised only if compelling opportunities presented themselves. Location and rental costs play a key role. Whilst the runway for growth across retail, trade and emerging business remains long, these results serve as a timely reminder of how swiftly net profit can compress when sales slow down.

Yes, sales are cyclical but it doesn’t mean it won’t grow over the long run. As Australia’s population grows, so will the need for housing supply, infrastructure and community amenities. All this bodes well for long-term growth.

Just like sales, the Beacon share price is cyclical. Fortunately, this means mispricing opportunities will arise. Given Beacon is now a much more resilient business and run by prudent operators, I’m eager to capitalise on any irrational PE multiple compression like mid-last year when the forward PE multiple fell to as low as 9x.

Disclosure: the author of this article owns shares in BLX. The editor does not own shares in BLX. The author will not trade in these shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.