I have followed the development of listed software and services company Alcidion (ASX: ALC) since it listed quite a few years ago, so I thought it might be worth telling you what I know about its history. On top of that, I’ll also explain why I hold some shares in it (as well as mentioning some of the things I worry about).

Alcidion reverse listed on the ASX in 2015. For those unaware, reverse listing has lower hurdles than a proper IPO, and so is often used by sub scale businesses or by dodgy operators. However, plenty of great and genuine businesses are reverse listings, such as Vocus Communications, so it’s just a risk factor.

While the company certainly was sub-scale in 2016, it didn’t seem to be spending cash like crazy, and the basic idea was good. It sold software to help nurses and doctors better manage patients in wards (including checking their test results and medications).

However, at listing time the company was deeply involved with Nathan Buzza and Brian Leedman, both of whom have also been involved with ResApp (ASX: RAP) over the years. Indeed, I had previously encountered Buzza as a shareholder of Azure Healthcare (ASX: AZV) where he had sold a large number of shares a couple of years before the share price collapsed.

My gambit was that Leedman and Buzza would sell a good story but might not do great things for the business long term, so I bought shares and waited for them to rise on sentiment. I then sold shares and went back to watching. Alcidion did not do particularly well out of this promotional period, as it simply didn’t have the sales growth needed to back up the expectations.

While this saga initially made me suspicious of the company, after discussing the situation with the former CEO I took the view that Alcidion the company had been as much a victim of this hype as anyone else. After Leedman and Buzza left, the company has taken significant strides forward, and improved its communications with shareholders. It has introduced new products and undertaken the hard slog of selling them into public health systems. And it has made transformational acquisitions, as I will discuss below.

You see, Alcidion had been founded by people who had spent years working in public health systems, and it was built to compete on price (and to include implementation work). Therefore, public health was the natural market for it. Unfortunately, the products were still under development, so it was a relatively small part of a software solution for hospitals.

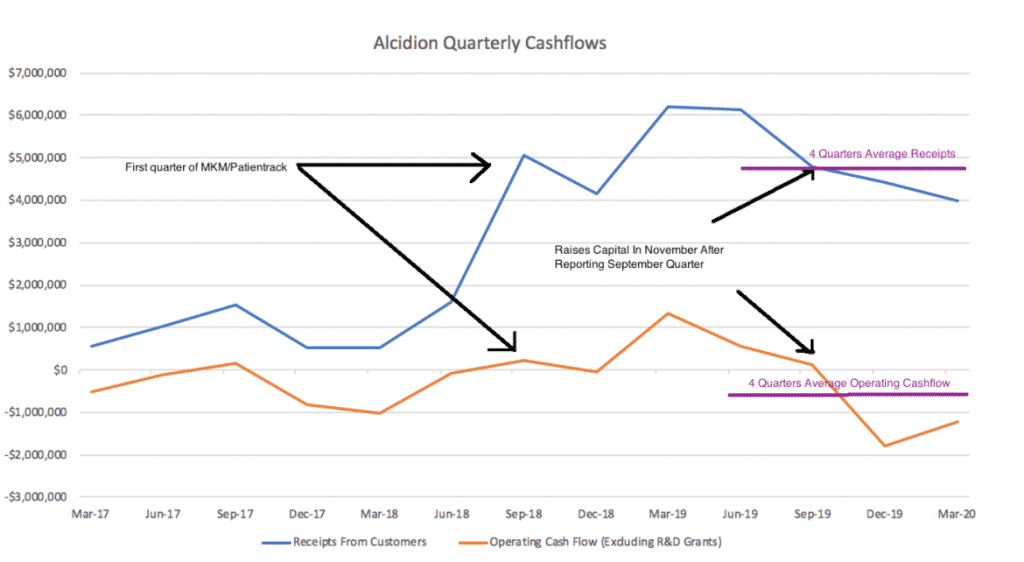

As you can see below, even as Alcidion brought more modules to market in the first couple of years after listing, its sales were flat or even down.

However, the big transformation in the Alicidion story took place when it acquired Oncall, MKM and Patientrack. Today, Alcidion essentially has three software products: Smartpage, Patientrack and Miya Precision/MEMRe.

Smartpage is an app based communication system designed to replace pagers, and acquired from Oncall. Patientrack tracks patients’ needs and status within a ward, and has a considerable installed base in the UK. And of course Miya Precision allows high level tracking of how a patient is moving through the entire hospital system from admission to discharge.

Increasingly, automated tools are designed to ensure that clinicians are alerted if the software picks up on information that implies a particular patient may need immediate attention. Something like Miya Precision has the potential to be win-win for hospitals and patients because it can increase efficiency (for example by ensuring that someone is discharged from the emergency department as soon as they no longer need to be there) and also improve patient experience. For example, when Emergency Departments are overcrowded, new patients in need may have to share bed-bays unnecessarily. By ensuring someone is moved to a ward earlier, this can be avoided.

Fast forward to the last couple of years and it’s clear that while the acquisitions have built a bigger company, the revenue growth and cashflow breakeven are yet to be attained. Nonetheless, the company saw a strong share price run at the end of 2019, and used that to raise capital at 18c per share. It hit lows of 10c in March after reporting revenue growth of just 12.3% for the first half, with revenue of $8.2m.

Since then, Alcidion has announced that it expects $17.2m in FY 2020 revenue, of which $10m is recurring in nature. That’s a 37% increase in recurring revenue in a year, and indicates half-on-half revenue growth of just under 10%. That’s not too bad.

More important to understand, however, is the distinction it makes between recurring and non-recurring revenue. You see, Alcidion is not a pure software company because plenty of its revenue comes from being an outsourced provider of health system IT support. Some of this revenue is considered recurring because it is provided on multi-year contracts and likely to be renewed. For example, the company recently announced that it “will continue to provide ongoing technical support services to ACT Health for their integrated patient management system.”

That contract will bring in over $600,000 per year, but brings with it significant employee costs as it is not simply for the provision of software. The reality is that for Alcidion, revenue is nowhere near a high margin as it is for a company like Pro Medicus.

Having said that, some of its revenue is software revenue, and we get an idea of the value of a renewed software contract from the recent announcement touting a 5 year deal worth almost $1.5 million. As always, some of that will be in implementing an expansion, but a large chunk is simply renewing the use of the software.

Overall, $9.8m of FY 2020 revenue is for software products. Given that only $10m is recurring revenue, and that includes some services, its safe to conclude that recurring software product revenue is less than $9.8m, but still meaningful. This is the kind of sticky high margin revenue that could make the company extremely valuable over time.

At present, the company is burning through cash despite having previously achieved a few cashflow positive quarters. This isn’t a big problem given that it has $16 million in the bank and has clearly stated its plan to increase staff costs consistent in order to further scale-up sales and marketing capabilities.

Essentially, Alcidion is making an investment in sales and marketing, right at a time when its products have never been more relevant. For example, it has provided patientrack for free to certain NHS operations designed to cope with the Covid pandemic. And in any event, as the company grows reports of the benefits of its software solutions are growing too. So I believe the company is benefitting from both short term and long term tailwinds.

Unfortunately, we won’t really know if the company’s investment in sales and marketing will pay off for another year or so. Essentially, I’d expect to see a strong result in the first or second half of FY 2021, if the expanded sales teams are having the desired effect. This could see the company breeze past $20m in revenue.

In the meantime, annual revenue growth will be lacklustre in FY 2020 up just 2%. The company will (correctly) point out that is a result of lumpy ‘non-recurring’ revenue, but that isn’t overly comforting. Ultimately, there is only one short-term reason to own this stock, which is to bet that the investment in sales and marketing will pay off.

In terms of pattern recognition, this could be a favourable time to buy. For example, fellow med-tech stock Volpara (ASX: VHT) invested heavily in selling itself a few years ago, and has certainly burnt a lot more cash than Alcidion. Happily, Volapara’s spending had the desired impact on revenue which has been increasing strongly. If Alcidion can do the same then I suspect it will command a price closer to 10x its revenue, especially if it achieves growth without extremely unsustainable losses.

With revenue for FY 2020 fairly flat on FY 2019, the Alcidion story is at a low ebb. But with $10m essentially locked in for FY 2021, and potentially strong demand for new implementations (offsetting some delays associated with covid), we could easily see a strong year ahead. That could lead to a share price re-rate to above 20c per share.

Alternatively non-recurring revenue may continue to flounder. If that happens, I struggle to see any good share price performance, though it may provide a longer term opportunity if recurring revenue continues to improve.

The long term reason that the company may do very well is because it has proven and successful software products that are clearly good for efficiency at hospitals, as well as patient outcomes. Over time, the company is building reliable recurring revenue which may not be pure software revenue, but still has the potential to be very profitable. As it expands in Australia, New Zealand and the UK it becomes a trusted provider to a large reliable counterparty — the governments.

Finally, two directors bought shares in March, including the CEO Kate Quirke, who spent $137,000. She is aligned as a shareholder, holding worth over $8 million at current prices. Alcidion is certainly a high risk investment in my opinion, but as risk recedes I suspect the share price will rise. Ultimately, if the company can balance modest cash burn with consistent growth in recurring revenue from software products that save time, money, and lives, I suspect it will be worth a lot more than its current market capitalisation of $153 million, in the years to come.

For these reason I hold Alcidion shares today, and intend to follow its story over the long term (though I would not rule out selling if it became overhyped again). In my opinion the lumpiness of the revenue means that the market sentiment is particularly volatile, and that it is currently relatively out of favour.

This post is not financial advice, and you should click here to read our detailed disclaimer. The author owns shares in Alcidion.