Fresh from selling their clients shares in ASX listed hype stock Nuix (ASX:NXL), at almost twice its current share price, Macquarie Bank has on Friday published research on Sezzle shares. This Sezzle (ASX:SZL) research is laughable because it notes the recent extreme change in Sezzle’s app ratings, without adequately explaining the bizarre shift, which looks like it might be driven by fake ratings.

Specifically, Macquarie’s research note sub-titled “There’s something about Sezzle…” focusses on the increase in app-store rankings for the company’s Google Play and iOS Apps.

It says: “Sezzle’s growth in comments has dramatically increased vs. the previous month… Coincidentally, the ratings have been very positive boosting the company’s average star ranking across both Google and Apple stores to 4.9; the highest amongst peers.”

Furthermore, the research continues: “Interestingly, Sezzle’s comments has [sic] seen a surge in numbers of 37% m-o-m. This was the case across both Google Play store (+27%) and iOS Appstore (+42%).”

The millionaire factory (note: this refers to employees, not clients) continued:

“Beyond seeing a surge in app ratings, Sezzle’s has also seen the largest improvement in star rating amongst peers. We think this could be related to the company’s increase in US news flow over the past month, including intention to file registration statement for US IPO announced on 30 April, Long-term financing partnership with Ally on 20 May and Lamps Plus Partnership announced on 26 May 2021.” [My emphasis].

What is utterly incredible about this “analysis”, is that it doesn’t bother to investigate the nature of Sezzle’s sudden change in fortunes, when it comes App ratings. Hilariously, it seems to attribute the change merely to “news flow” around a listing in the USA.

Now, the note does not explain why the announcement of a dual listing of a lower-tier buy now pay later company would suddenly cause a huge increase in app ratings. Nor is it clear why a BNPL user in America would be influenced by the announcement of the Lamps Plus Partnership on May 26, or financing deal with Ally on May 20.

Because Macquarie’s analysis is so far below the quality I would expect of any analyst I have ever worked with, I thought I’d ask the question any reasonable investor would ask:

How Did Sezzle’s (ASX:SZL) App Ranking Skyrocket?

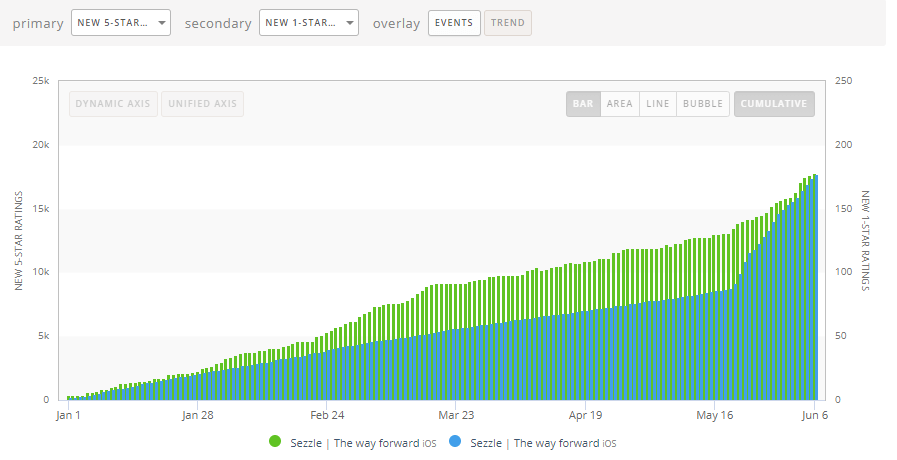

What we know is that something changed around May 20, this year. As you can see in the chart below from appfigures, Sezzle’s 5 star reviews for its iOS App jumped from around 50-100 per day, to 372 on May 20 then almost 800 on May 21, to a peak of 945 on May 22.

Macquarie proposes that this is due (in part) to Sezzle’s announcement at the end of April that it would list in the USA. There is no logic to this claim. Why on earth would consumers wait until May 20, three weeks after the announcement, to suddenly start giving 5 star ratings with gay abandon? Is this something Macquarie in all their wisdom seriously believes, or have they simply not bothered to consider other possibilities?

The most obvious answer to this change in app rating is that the company itself has done something to prompt more ratings. For example, it could have instituted a pop-up prompting people to leave ratings.

It’s also possible that someone (not the company itself, just anyone) could have paid to have fake ratings in the App Store. This is not uncommon to see with growth companies wanting to raise more capital or conduct a large sell down. One memorable ASX-listed example with fake looking reviews was a company called ZipTel, which was all the rage back in 2014. Memorably, Brett Lee was an ambassador for ZipTel. The mystery is that you never know who is buying the ratings, since anyone can become a customer of a fake review farm. But I digress…

Another strange thing about Sezzle’s ratings is that the number of 5-star ratings has massively increased, but the number of 1 star ratings not so much. Lets take a look at the daily new 1 star ratings in the image below.

You could argue there is a slight increase, but really, the number of 1 star rankings hasn’t changed much. So, if Sezzle itself has prompted the massive, sudden increase in 5 star ratings, it may have found some way to only prompt happy customers. That’s possible, though I’m not sure how they would have done it.

Of course, it’s also possible that someone has paid for 5 star ratings, but not 1 star ratings. In any event, it is reasonable to ask why the ratio of 1 star ratings to 5 star ratings has changed massively, in the absence of a fundamental change to the business. It’s not reasonable to simply attribute the change to a few company announcements to a bourse on the other side of the world from where the consumers are.

This next image is a chart of Sezzle’s cumulative 1 star (green) ratings versus 5 star ratings (blue) over the calendar year 2021. Now, I don’t know about you, but I’m nowhere near drunk enough to accept Macquarie’s hypothesis that this intense and dramatic improvement in popularity amongst US-based consumers (many with poor credit), expressed by a massive sudden change in the ratio of 1 star ratings (green) to 5 star ratings (blue), is due to ASX announcement news flow.

Now,I can hear some Sezzle Shareholders, or stock brokers hoping to sell shares in the upcoming US listing saying: “oh, but Claude, blah blah blah.” Well to them I say take a look at the same chart, but for Klarna.

Now, to me, Klarna’s chart is what I’d expect to see in a company that is gradually improving its cumulative ratio of 5 star ratings (blue) to 1 star ratings (green). Not a sudden uplift, but a gradual shift.

Next, lets also take a look at the number of 5 star ratings (blue) versus the number of 5 star written reviews (green). As I understand it, a “review” is when the person writes a message, but a “Rating” is just when they give a 5 star rating.

In green, we see the daily new 5 star “reviews” for the Sezzle iOS App (right hand scale), set against the daily new 5 star ratings for the Sezzle iOS App (left hand scale) in blue. As you can see, we have a large sudden uplift of 5 star ratings, almost at the same time as a large sudden drop off 5 star reviews. How strange!

The only explanation I could think of for this is if someone was paying for 5 star reviews, but in May they decided they’d prefer have a better rating, so they shifted their spending on fake reviews to spending on fake ratings. However, there may be another explanation. Below you see the same chart for Klarna. For Klarna, the 5 star reviews roughly correlate with the 5 star ratings, whereas for Sezzle, they have an inverse correlation. Again, how strange!

Macquarie’s Analysis Of Sezzle’s App Ratings Is Inadequate

As everybody knows, good data is important to good analysis. But you also need to engage your critical thinking skills and ask: “why?”. Now, I don’t know if someone is manipulating Sezzle’s App Store Reviews and Ratings. They might be, and they might not be. There might be totally reasonable explanations for the sudden change in consumer behaviour in May, when it comes to rating Sezzle’s App.

Notably, I’ve relied on data from AppFigures, which is used by professional App store fraud detector Kosta Eleftheriou, but if their data is wrong, then my own analysis may be flawed.

In any event, I believe it is insulting to the intelligence of the reader to suggest that this bizarre change in App store ratings is caused by a handful of ASX announcements with no bearing on the end user. Having said that, I’d prefer someone insult my intelligence than sell me Nuix shares at $5.31, right before it downgraded its revenue forecasts (again, and again).

The author has no position in Nuix, Macquarie Group or Sezzle. This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.