Disinfectant solutions provider Nanosonics (ASX: NAN) held its annual general meeting (AGM) this morning. Despite recording strong growth in revenue and net profit after tax for FY 2023 in August, the Nanosonics share price has continued to fall. This is because investors held concerns over Nanaosonics’ future outlook. And management’s pensive commentary at the start of the AGM reinforced this.

Nanosonics CEO and Chairman Michael Kavanagh emphasised the macroeconomic challenges its customers and the broader healthcare industry are experiencing. Kavanagh noted hospital capital budget allocations are tightening. Rather than proactively upgrading equipment, hospitals are holding off until their budgets are finalised.

Trophon sales remained resilient in the first quarter with numbers largely coming in line with management’s internal forecasts. However, hospital budgetary pressures and unstable macroeconomic conditions have stopped management from providing an update on the outlook for the full year. Unlike most companies, Nanosonics has grown its workforce over the last year, up to 482 employees now. The company remains optimistic about the potential of its long-awaited endoscope solution called CORIS.

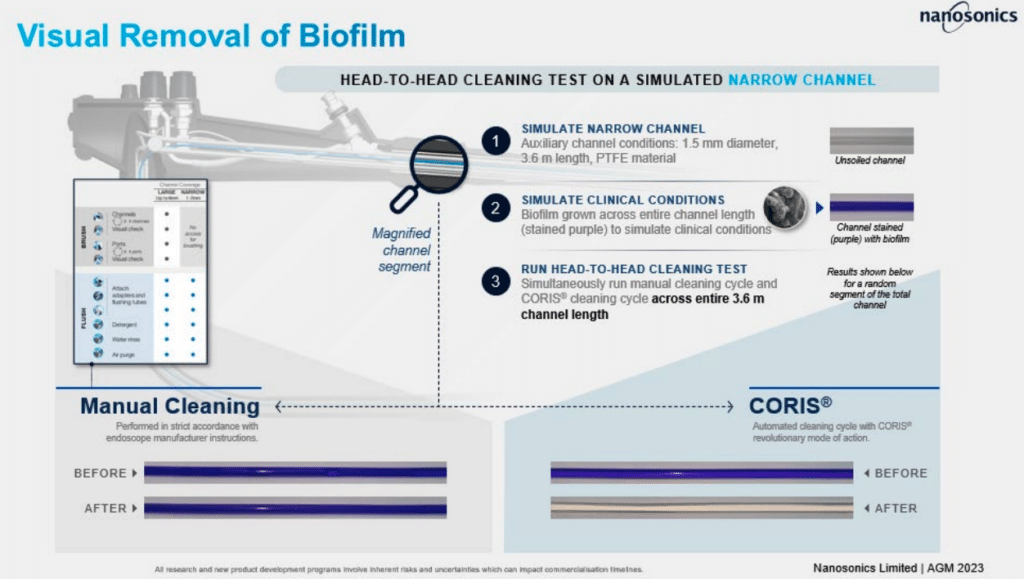

Management advised CORIS is on track to submit a regulatory approval request to the FDA in the third quarter of FY 2024. CORIS aims to remove laborious and manual tasks in disinfecting endoscopes of all sizes. Endoscopes are the thin and flexible tubes that doctors use to visualise your internal organs. Nanosonics has been working hard to convince the industry that CORIS is not only much more effective but will help reduce costs associated with manual workflow.

Nanosonics argues that even though endoscopes are thoroughly cleaned and disinfected after each patient use, they still possess certain materials on the surface that can allow bacteria to grow. These are called biofilms. CORIS is capable of eradicating these biofilms as depicted below.

Source: Nanosonics AGM 2023

CORIS seems to be the logical choice for hospitals. The market opportunity appears vast with more than 60 million procedures and growing at 6% annually according to Nanosonics. Excitement over this emerging segment ought to be disinfected with a rational assessment of Nanosonics’ current valuation.

With a market capitalisation of $1.23 bn and a trailing price-to-earnings multiple of 62 times. At 482 employees, this implies each employee is worth $2.5m of market capitalisation. While this doesn’t necessarily mean Nanosonics is overvalued, it does suggest an optimisitic assessment of the value creation ability of the average employee.

As interest rates remain at elevated levels, valuations of companies that have most of their profits well in the future can take a hit as Claude recently highlighted in this article on why he remains cautious due to inflation. I believe that the general pressure on growth stocks is very likely to impact Nanosonics, so the short term risk-reward of investing in Nanosonics may not be compelling at current prices.

Disclosure: the author of this article does not own shares in or have a position in Nanosonics. The editor of this article does not own shares in or have a position in Nanosonics. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.