One of the most popular ASX stocks over the last few years has been data labelling specialists Appen Ltd (ASX: APX). I first looked at Appen, and met its CEO, when it was trading at around $1.50. In hindsight, that would have been an excellent time to buy, but at the time I did not foresee the boom in demand for data labelling that was about to commence.

You see, at that time, Appen looked to me like a labour hire firm. First, they would contract with a huge distributed workforce of casual data labellers, and then they would contract with large tech companies (principally Microsoft at that time) to use the contractor workforce to provide data labelling services. Appen’s profit was the difference between what they were paid by the tech companies, and what they paid the contractors.

What I underestimated then was that in the period between 2015 and 2020, deep learning neural network artificial intelligence was taking off as a system. The upside of deep learning is that it is an extremely powerful way to train artificial intelligence, the downside is that it required tonnes more labelled data than prior versions of artificial intelligence.

To take the example of computer vision technology used to recognise pastries, in Japan, the older system would be able to learn about a new pastry with just a few labelled pictures, but the newer neural network systems would require hundreds of pictures; or even more. However, the new system had the advantage that the computer would not need to be told or helped to solve problems like shadows, or pastries that were touching each other. It could just figure it out.

This advent of deep learning as the preferred AI system drove a huge explosion in demand for data. Appen is, and was, the shovel shop in a gold rush. Growing demand lead to growing revenue and growing profits. The share price increased more than 20-fold, to $43 per share.

Personally, I may have missed the start of the run but I figured it out eventually. I bought the stock for the tailwind (in the teens) but I never forgot that it was a labour hire firm, and found myself selling above $20. Most recently, I bought the shares below $20 in March 2020. Subsequently, I warned readers that the price had gotten too high, sold half my shares in August 2020 (at over $37!), after explaining my intention to readers. Finally, in December 2020 I sold my last Appen shares, as I explained to David Koch on The Call.

But the question now is whether I should buy shares once again, at under $14. To answer that, we first need to understand Appen’s business model, and the key drivers of its profits going forward.

The Truth About Appen (ASX:APX)

In the past, Appen has been a little coy about its reliance on Google, Facebook, and Microsoft for its revenues. This might not have been obvious to the average punter, but it was always a well known fact. Indeed, way back at a share price of $1.50, it was my main concern. Concentrated powerful customers create significant business risk.

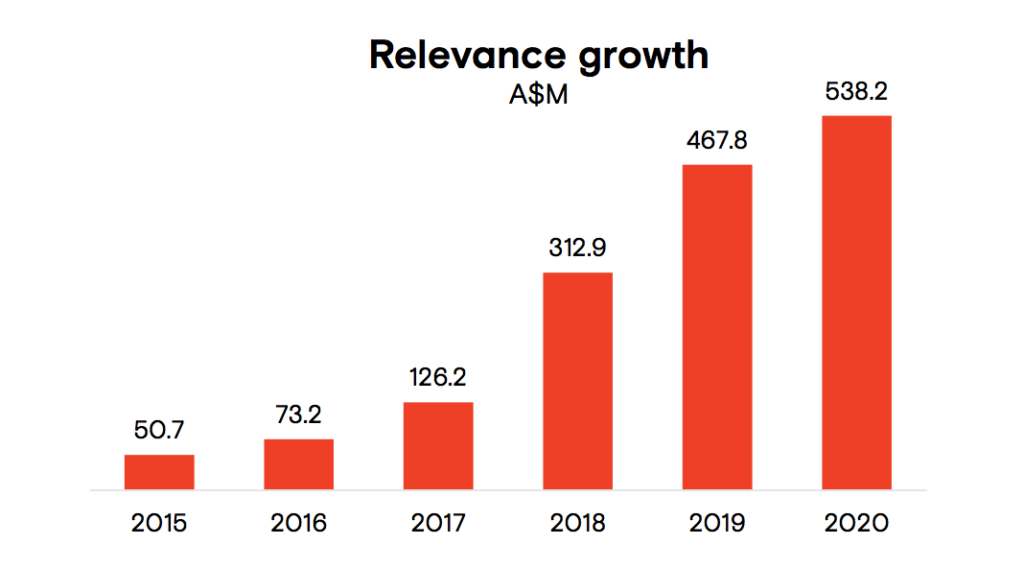

In the last year, demand for relevance data from these customers has stopped growing so quickly, as you can see below.

What the chart above does not capture is that the relevance data, in the first half of 2020, was $273.9M, which means the second half was actually down, to $264.3 million. This should be viewed as evidence that the demand tailwinds that once blew, are no longer so prevalent.

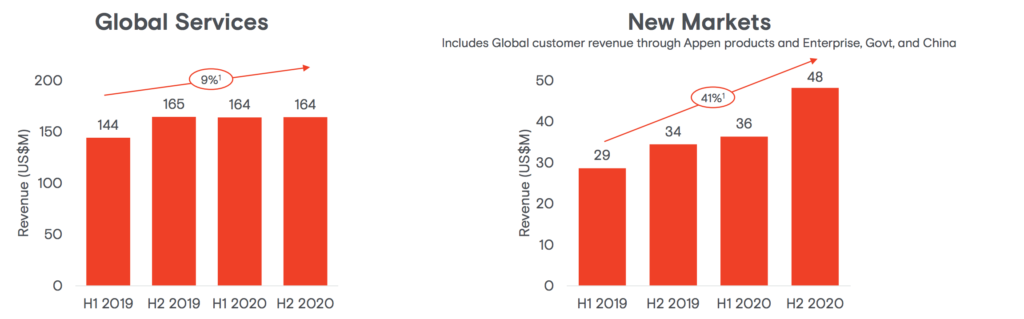

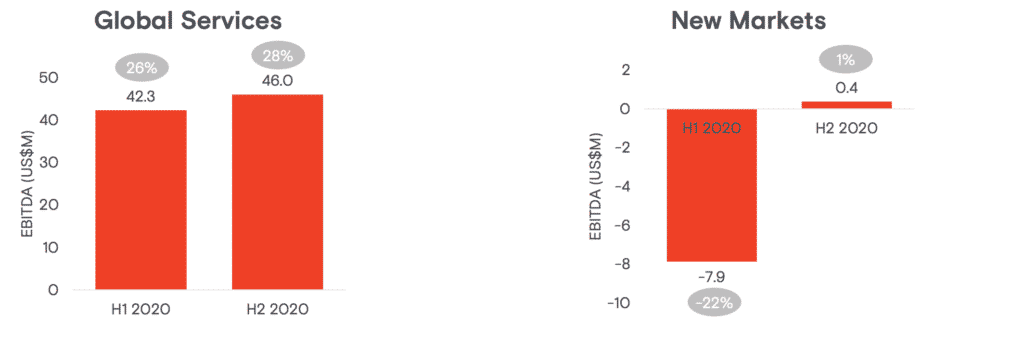

Last week, Appen did a big presentation to the market where it hoped to convince investors that it was realigning itself to be less reliant on these large “global” customers, from whom demand appears to be stablising at best, reducing at worst. Below, you can see an indication of how important these customers are to its overall revenue and profitability.

Putting all this together, it would appear that the demand for relevance data labelling from its big three clients is weakening. If this were a software as a service business, with recurring revenue, we’d have more clarity about where Appen is losing business, because they would have to explain revenue churn.

But in fact, most of Appen’s revenue is project based, so if Facebook simply fails to replace one large project with another, leading to reduced revenue, Appen does not have to tell us. Yet, the financials we are seeing are consistent with that hypothesis.

Why Might Google, Facebook and Microsoft Need Less Data Labelling?

One of the features of most analysis of Appen stock is that no consideration is given to the underlying drivers of demand for its data labelling services. Rather, the company achieved this reputation for being the best ASX exposure to AI, despite the fact that it is largely just a labour hire firm. It’s high time to examine what is driving demand for Appen’s services, and how sustainable that is.

As discussed above, deep learning on neural networks requires a lot of labelled data, and as large companies built those neural networks, they needed extreme amounts of labelled data. However, no sooner did it become apparent that billions would be spent on data labelling, there existed an incentive for others to automate that process, thus reducing the ballooning data labelling expense line.

One trend to watch out for is the advent of projects like Snorkel, a Stanford University initiative started in just 2016, after Appen listed. It “set out to explore the radical idea that you could bring mathematical and systems structure to the messy and often entirely manual process of training data creation and management, starting by empowering users to programmatically label, build, and manage training data.”

Today, Snorkel, which explicitly seeks to reduce reliance on human contractor data labelling, is “used by many of the big names in the industry (Google, IBM, Intel),” according to this machine learning specialist. The 2019 version of Snorkel brought with it an improved capability to automate data labelling.

The point here is not that Appen is a bad company, but that the public narratives around Appen are inadequate to explain its recent results. We live in a world where market participants are variously incentivised not to dig too deeply into the weaknesses of the business models of high flying stocks. That is why you still see unquestioned claims that it is not possible to realistically automate the data labelling services that Appen provides.

And yet, if stock market researchers dared to delve beyond the confines of company presentations, they would see this is a problem that smart people are actively attacking. Appen is an expense for big tech; do you really think no-one will try to undercut them?

Data Labelling Can Be (Partially) Automated, At Appen’s Expense

The authors of this study state that “As machine learning models continue to increase in complexity, collecting large hand-labeled training sets has become one of the biggest roadblocks in practice. Instead, weaker forms of supervision that provide noisier but cheaper labels are often used…” Their goal is to improve the weaker, cheaper labelling techniques, and they conclude that “our approach leads to average gains of 20.2 points in accuracy over a traditional supervised approach, 6.8 points over a majority vote baseline, and 4.1 points over a previously proposed weak supervision method that models tasks separately.”

Oh, and by the way, those authors are the same people running Snorkel, you know, the data labelling tool used by Google and IBM.

But it gets worse than that for Appen. You see, when Facebook was just starting out with deep learning neural networks, every new project would have started from just about zero, in terms of labelled data. These days, “A procedure called ‘transfer learning’ takes a neural network trained on a vast data set and specializes it with a small supplement”, according to Alex Krizhevsky, one of the early proponents of neural networks.

Put simply, “Transfer learning allows us to deal with these scenarios by leveraging the already existing labeled data of some related task or domain”, and “Andrew Ng, chief scientist at Baidu and professor at Stanford, said during his widely popular NIPS 2016 tutorial that transfer learning will be — after supervised learning — the next driver of ML commercial success.”

Finally, we have the spectre of unsupervised learning. I’m not quite sure how this will impact need for fully supervised data labelling like Appen provides, but I’m sure it will reduce demand. Below, you can see Facebook’s CTO boasting about a recent advance in image segmentation, without data labelling. Clearly, here, the change is that Appen was not required, whereas its services (or a competitor’s) would previously have been needed to achieve the same result.

Here’s our new computer vision system achieving state of the art results in image segmentation, without needing any labeled training data. This new model was trained on random, unlabeled data, but quickly achieved state-of-the-art results. It’s awesome. pic.twitter.com/6Y4zjaImFY

— Mike Schroepfer (@schrep) April 30, 2021

Are Appen Shares Worth Buying At $14?

At a share price of $14, Appen (ASX: APX) has a market capitalisation of about $1.7 billion. If we accept the company’s “underlying NPAT” as a true reflection of its profitability, then it would trade at a P/E ratio of 26.5. However, I note that statutory NPAT has been significantly lower than underlying NPAT in the last couple of years.

The business strategy seems to be to reduce reliance on its largest customers and take advantage of the demand for data labelling from customers who do not have the same resources for weakly supervised data labelling. This strategy only really makes sense if you have the view that demand growth from the largest “global” customers will no longer be increasing so strongly.

In a scenario where demand for relevance data labelling from the biggest global players is flatlining for the foreseeable, I think that Appen’s growth will be only modest. In that scenario, the company is probably fairly priced at around $14.

In a scenario where demand for relevance data labelling re-ignites, Appen is outrageously cheap, as its most profitable service offerings will return to growth quite violently as operating leverage once again boosts profits above revenue growth.

But in the scenario where demand for relevance data labelling actually falls, if only for a year or two, Appen is likely still over-priced, since falling profits will increase its multiple and hamper its ability to grow. Remember, Appen needs a high share price to execute on its growth-by-acquisition strategy.

Ultimately, I think the first scenario is probably my best guess, meaning that I think the market has gotten it “roughly right” on Appen shares given what we now know. But I do not hold this view strongly, and frankly, I do not care to take a strong view. As an investor, I don’t need to. You can’t pat all the fluffy dogs and you can’t own every share that is undervalued.

What I think is wrong is the widespread bullish commentary calling Appen shares cheap, while characterising it as a tech stock, rather than a technology driven labour hire firm. The key question, in my view, is whether or not demand from Appen’s largest customers is flat, increasing or decreasing. Because that’s what will determine whether now is a good time to buy, or not.

The author has no position in Appen Shares. This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.