Water management service provider Vysarn (ASX: VYS) has just upgraded its full year profit before tax (NPBT) guidance from $5.1 million to a range of $6.0 million to $6.5 million. Vysarn shares have languished recently, due to an expectedly soft HY1 2023. The soft first NPBT of $1.6m means that the second half must be much stronger, at least $4.4 million NPBT. According to the company the first half was impacted by the need to upgrade some of their machinery.

If we applied a standard 30% tax rate to the low end of guidance, we can assume a normalised net profit after tax of at least $4.2 million, putting the stock on less than 11 times earnings at the current price of $0.115 per share.

What Does Vysarn Do?

Vysarn is an ASX company that is in the process of becoming an end-to-end water management service provider based out of Western Australia. Up until September 2021 the company focused solely on providing hydrogeological dewatering drilling rigs to mining companies. Recognizing the need to diversify their income streams away from this capital intensive avenue, they have since added various revenue streams organically and by way of acquisition. As of today they operate 4 main divisions, the original Pentium Hydro division, along with newly added Pentium Test Pumping, Pentium Water and Project Engineering.

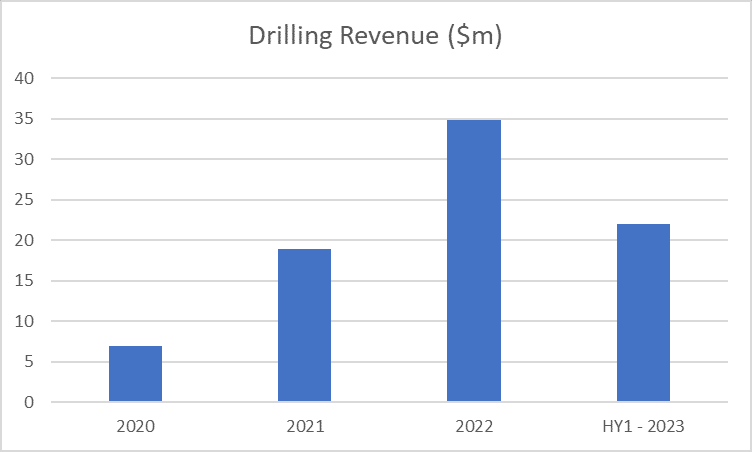

Firstly, let’s look at the Pentium Hydro division. Formed out of Vysarn’s purchase of hydrogeological dewatering drilling rigs from Ausdrill Waterwell back in August of 2019, this division looks to have organically reached scale very quickly since which can be seen from the revenue growth from 2020-2022 below:

This sort of business is traditionally considered low quality due to the large amounts of capital required to grow earnings, meaning these earnings don’t convert to free cash well.

The way Vysarn have structured this segment, with 12 rigs all signed up to long term contracts with tier one companies such as FMG, Roy Hill and BHP, means capital expenditure should be limited to maintenance of around $4m per year. With no intentions to significantly increase their number of rigs unless for a specific long term contract, this means the $12m earned off these rigs at full utilization should convert to free cash of about $8m per year, much better than traditionally in this type of business. From this base, they can further their integration into the water management value chain.

The other segments of the business are where I see the potential for growth. Firstly, let’s start with the Pentium Test Pumping segment, which was started through the purchase of ‘Yield test Pumping’ back in September 2021. After the integration of this business throughout the 2022 FY, this segment added just under $400k in earnings in HY1, 2023. From here, the company has targeted this segment to add $1.2m of earnings for the full year 2023 and $1.35m of earnings in 2024 and they are currently in the process of constructing a second rig to be operational by the end of the 2023 FY due to solid demand for the services experienced throughout the 2023 FY to date.

The third segment of the business is Pentium Water. This is a high-end water management consultancy arm that was organically formed in February 2022. While this segment isn’t adding much in the way of revenues and earnings to the business at this point in time, moving forward I see this as an integral part of the value chain of the business. This segment will allow Vysarn to stay with its clients from the planning of their water management solutions all the way through to the construction, implementation and maintenance and will be crucial to becoming the end-to-end water solutions company they desire to be.

The Project Engineering division was added in September 2022 with the purchase of ‘Project Engineering’ for $4.2m, at the time, this was a PE of about 5. This is a water management consulting company that was based out of Perth, WA, that specializes in designing and constructing Managed Aquifer Recharge (MAR) systems.

It was initially expected that this segment would add $800k in earnings annually, but the recent HY result released showed that this segment performed extremely well adding $740k in NPBT in the first half of the year, almost double that of what was expected on purchase. On top of this, management has flagged their desire to change the revenue model for this segment from just getting paid to just construct the systems, to more of an ongoing model where they would construct, install and maintain the systems.

A MAR system is defined as ‘the intentional recharge of an aquifer under controlled conditions for later recovery, environmental benefit, or to mitigate the impacts of water abstraction’. After speaking with an experienced professional in this space, I see this as a potential growth area for Vysarn. This professional believes that MAR as a form of water management within Australia is about 5-10 years away from being mainstream, stating that ‘WA will continue to embrace MAR via the mining sector and a few smaller localized schemes will emerge over the next five years.’.

Promisingly, it seems the USA has cottoned on to using technology to increase the supply of water within underground aquifer systems, pledging about $USD500b in investment in MAR schemes of the next 5 years. If Australia follows suit, this could open up a large potential growth market in Australia in this very specialized and niche area of water management.

At a high-level, I believe we will see increasing tension around water usage between energy companies, human consumption and agriculture. Governments will need to find new ways in which to store and conserve water supplies, with MAR being one potential solution.

The final part of the business which sits outside of the 4 main divisions is the company’s joint venture with Concept Environmental Services (CES). This is a 50/50 JV to provide large scale water storage systems. CES has a unique patented process for constructing and installing tanks that they claim reduces time taken by 75%, and cost by 30%.

This was announced with little fanfare in their 2022 AGM presentation, and is aimed at combining the CES containment solutions knowledge with Vysarn’s large clients in the mining sector on the West Coast.

Each CES tank can cost up to $5m, so assuming reasonable margins of 20-30% and taking into account the 50/50 profit split, each tank sold through this JV could add in excess of $500k to the company’s bottom line. If this is the case, just 1 or 2 projects a year could give Vysarn a significant bump in earnings.

Turning to management, there are 3 key people in charge of executing this vision of becoming a diversified end-to-end water management company. They are Peter Hutchinson, the Chairman of the board who alone owned 14.4% of the business at 30/06/2022, James Clement, the CEO and managing director, who owned 3.4% of the business at 30/06/2022 and Sheldon Burt, the executive director who was the co-founder of Pentium Hydro and owned 1.6% of the company at 30/06/2022.

Peter Hutchinson, the majority shareholder, who purchased $150k worth of stock in September 2022 and a further $10k in March 2023 now owns about 15% of the company and has a long history of being involved with ASX listed companies. He was the founding director of Forge Group who floated on the ASX in 2007 at a market cap of $12m and upon his resignation and subsequent share sale in 2012 was worth $450m.

However, just 2 years later the company was in liquidation, having taken on excessive debt to juice short term earnings per share growth, which was coincidentally a factor in management remuneration. So you could argue a wise investor would exit Vysarn promptly, if Hutchinson sells his shares or quits.

When Hutchinson, subsequent managing director David Simpson, and Forge were sued for breaching continuous disclosure obligations, in deciding where the case would be heard, a court commented that “it is very likely that, if Forge were to be found liable to Rushleigh, both Mr Hutchinson and Mr Simpson will also be found liable to Rushleigh”.

In the end the class action was settled for $16.5m, so it was never decided whether Hutchinson did indeed breach continuous disclosure obligations. For the record, Hutchinson strongly denied any breach of duty.

Aside from key personnel quitting and selling their shares, there are some key risks I see with this company. One is the concentration of revenue. In 2022 the company earned 71% of their Pentium Hydro revenue from 3 tier one mining operators. Although this was down from 94% in 2021, this is still a significant risk in that if they lose one of these contracts, it could mean a big hit to revenue and earnings.

The second is execution risk. With the strategy of adding different revenue streams, alot relies on management’s ability to integrate different business units, be it through organic growth or acquisition of bolt on companies.

Lastly, the company does have quite a bit of debt on the balance sheet ($10m), but with the majority of this secured against their equipment and quite a lot rolling off towards the back end of this financial year, I don’t see this as being a big issue.

At the current market cap of about $40m Vysarn seems an interesting proposition given the drilling segment alone if 100% fully utilized could generate $8m in free cash flow yearly.

In this optimistic scenario, investors are getting the drilling business for 4 times free cash flow and optionality of the other segments for essentially nothing.

Sign Up To Our Free Newsletter

Disclosure: the author Benjamin Sayers owns shares in Vysarn and will not trade shares of these companies within 2 days of publication. The editor Claude Walker does not own shares in Vysarn and will not trade within 2 days of publication. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.