The XPON Technologies (ASX: XPN) business model is premised on the sale of technological solutions to help customers grow their business through leveraging data. XPON Technologies was listed on the ASX in December 2021 at $0.22 per share and more than doubled its revenue in FY22, but its net loss deteriorated from $1.9m to $6.3m. At the time of publication, the XPON Technologies share price is below its IPO price, at $0.155 per share. This article will introduce XPON to ASX investors by looking at the XPON Technologies business model.

What Does XPON Technologies Sell?

To understand the XPON Technologies business model, we need to know what it sells.

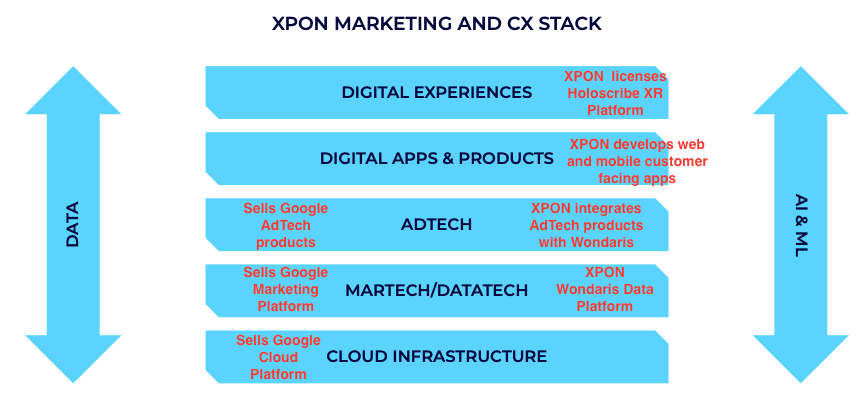

XPON Technologies is a sales partner for Google’s marketing and cloud platform solutions, but also develops proprietary solutions on top of this infrastructure to help customers achieve higher returns on their marketing and customer experience strategies. These solutions revolve around extracting more value from data to help clients understand their customers better and ultimately help optimise their online marketing methods.

In the prospectus, CEO and Founder Matt Forman advises that the aim is to build a single ‘full stack’ technology solution for marketing and customer experience modernisation.

A full stack technology solution refers to all the tools and equipment needed for a customer to optimise their marketing and customer experience. If we use consumer products and services as an example, a full stack company is one that develops technology that can provide its customer with a complete product or service, which handles the entire value chain of its activity. So in Apple’s case, it develops its own software and distributes the phones itself across its own stores. This enables it to control and shape its user experience.

The full stack solution that XPON Technologies is aiming to provide is illustrated below. Investors should be careful and not assume that all the solutions in the stack are developed by XPON Technologies though.

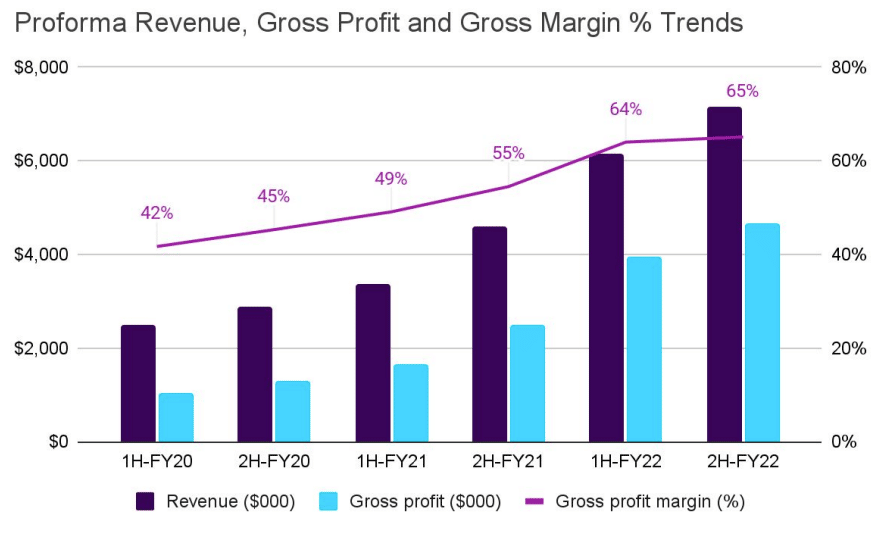

I’ve added notes in red to highlight who the underlying developer of the particular solution is. This is why XPON Technologies’ doesn’t exhibit gross margins of pure software providers like Pro Medicus (ASX: PME) and Xero (ASX: XRO). However, XPON Technologies has accelerated its gross margins over the last two years as illustrated below. This is mainly due to a change in the revenue mix, which I’ll delve into more later.

As you can tell from the full stack solution image above, Google essentially provides the infrastructure to store, capture and manage the data that flows through a customer’s business. However all this data must be compliant with privacy regulations, and that is where XPON Technologies comes in to ensure the data is compliant and can be used in collaboration with other data to extract insights about the client’s consumers. This solution is called the Wondaris Data Platform.

The other key platform that XPON Technologies provides is Holoscribe. Holoscribe is a platform that allows customers to build, edit and publish 360-degree, extended reality and virtual reality environments, in which consumers can control their journey and form emotional connections with brands.

How Does The XPON Technologies Business Model Make Money?

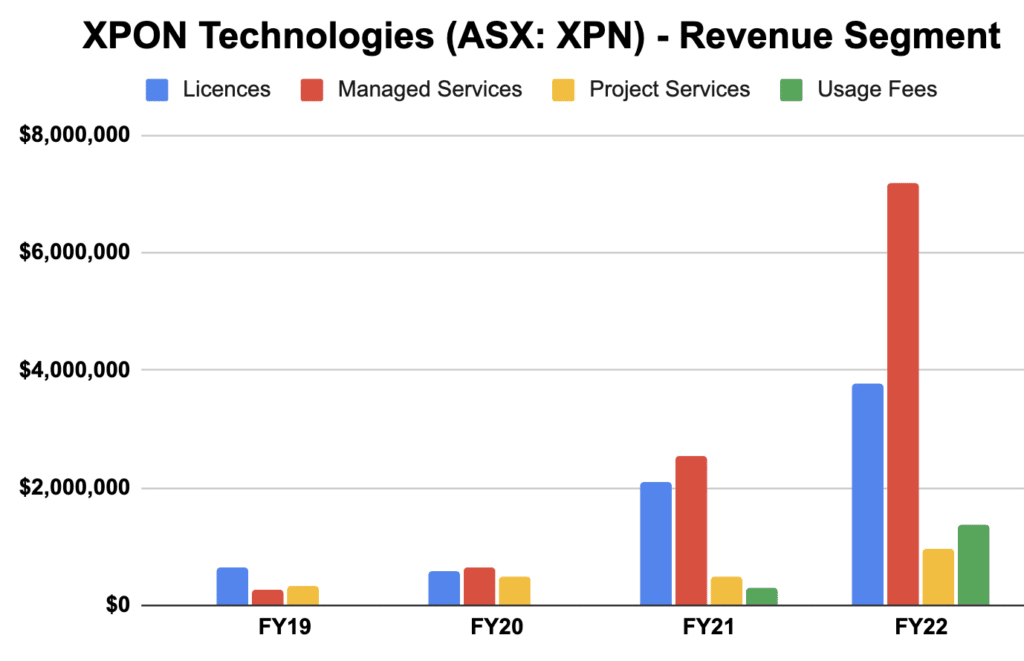

XPON Technologies generates recurring revenue through the software licences for Wondaris and Holoscribe as well as charging a margin on top of the Google products. Since Google provides the actual products (and gets paid for it) this managed services business earns lower margins. Recurring revenue is also derived from selling integrated managed service subscriptions to implement, support and scale the tech it sells. Clients are charged usage fees for the consumption of the software and cloud technologies.

As seen below, revenue growth across licence, managed services and usage fees has accelerated.

The rise in licenses and usage fee revenue seems to be contributing to stronger gross margins because XPON Technologies does not need to incur any additional costs when the client pays for the software when the client uses more of XPON Technologies’ proprietary solutions. XPON Technologies has no problems with growing gross profit, but the massive uptick in managed services revenue seems to have also brought significant employee expenditure.

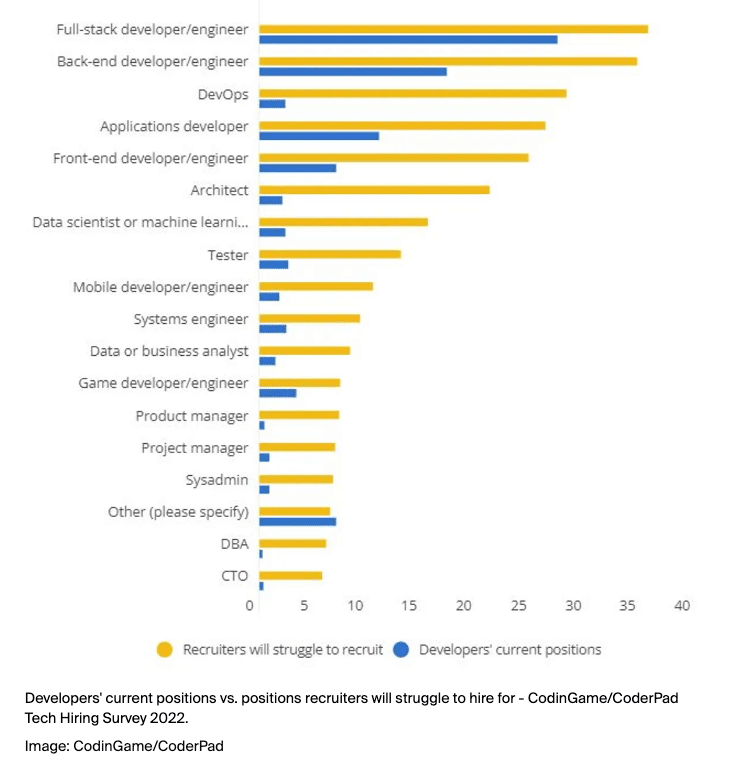

In order for XPON Technologies to scale, employee costs associated with implementing, supporting and scaling the solutions for customers needs to stabilise. This may be challenging given I estimate that around 47 or 43% of the total workforce is in engineering or IT, based on what I can tell from scouring LinkedIn. These jobs are experiencing a strong period of salary growth, in particular full stack developers, who remain in hot demand based on the following survey from this ZD Net feature article.

Employee expenditure more than doubled from $3.39 million in FY21 to $7.76 million in FY22, contributing to XPON Technologies’ net loss going backwards from $1.93 million to $6.3 million.

The reliance on Google for the infrastructure puts XPON Technologies in a weak negotiating position. Meanwhile, the rising employee costs causes a concern that the company may need more capital, since it had only $8.2m in cash at the end of FY 2022. These are the two key reasons keeping me away from investing in this business.

On the flip side, XPON Technologies might benefit from a tailwind created by the prevention of the use of third-party data by some companies (eg Apple), and the new cookieless age could facilitate strong revenue growth over the long term. If it can demonstrate stronger signs of scalability, I would be more inclined to consider buying XPON Technologies shares, but not for now.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in XPON Technologies (ASX: XPN) and will not trade XPON shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.