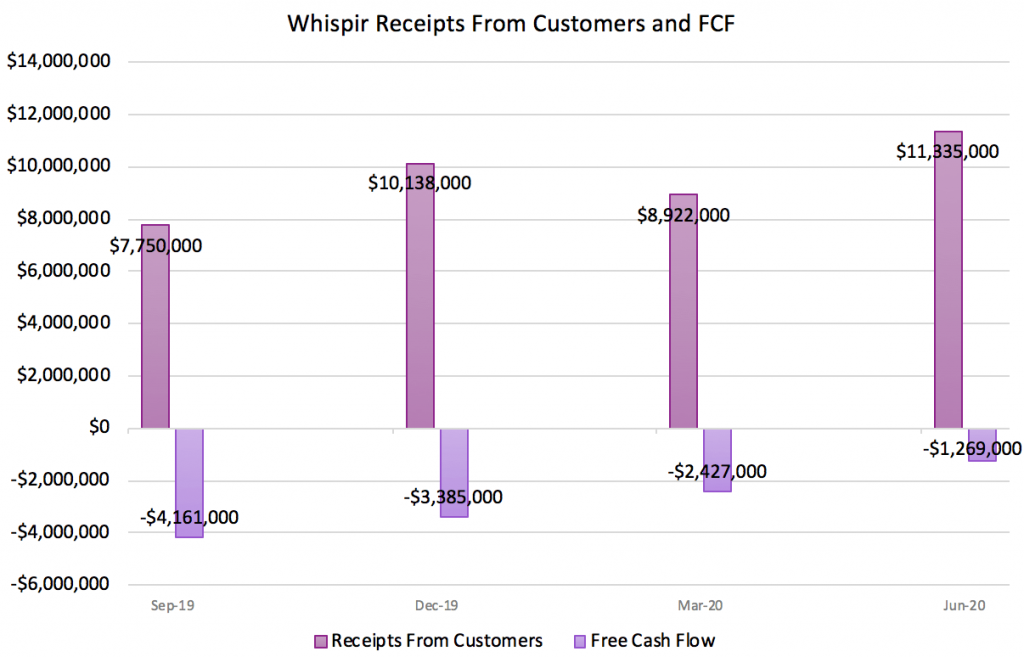

This morning, automated communications software platform provider Whispir (ASX: WSP) announced its quarterly results. The headline Annualised Recurring Revenue (ARR) came in at $42.2 million, which was $0.2m above my expectation of $42 million. However, the good news in the numbers was record receipts from customers which is translating into further diminishing cash burn, as you can see, below.

Notably, the CEO said on the conference call that June was a breakeven month at an EBITDA level, excluding non-cash payments, but the company is hiring more staff to deal with increased demand. This means expenses will rise, so it’s not particularly likely the company will be spinning off free cash flow any time soon. That’s unproblematic given it still has over $15 million in the bank.

A Strong Rise In The Whispir Share Price

At the time of writing, the Whispir share price is up over 15% to $3.90. This is a gain of 95% on the price just a few weeks ago when I published this piece titled Why Whispir Is One Of My Largest Holdings. Ultimately, I think things are playing out as expected.

Are Whispir Shares A Promising Long Term Investment?

Despite some blemishes outlined in the post above, I do still think Whispir is a decent long term business as the pandemic will have increased demand for its services, which were already becoming more relevant over time. On the other hand, the valuation at $3.90 is not as attractive as it was at $2.00.

I am nearly certain that investors overestimate the margin potential of the Whispir product, given that the sales process requires quite a lot of hand-holding and technical knowledge to get the platform set up in a way that works for each client. This high customisation potential means the product is useful for a wide array of customers but also (essentially) increases customer acquisition cost. This makes retention of customers particularly important. Happily, Whispir tends to “land and expand” with new customers so — at least in the current pandemic — the unit economics look good.

The repeated error I have made in the current market is to sell winners too quickly, and given that I believe Whispir has a decent product, I’m not in a hurry to sell, but will continue to manage my position in according to this plan, outlined in May.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer. The author owns shares in Whispir but will not trade them within 2 days of publication.