Chrysos Corporation (ASX: C79) sounds like R2-D2’s nemesis modelled for disruption or a biotech on the brink of a major drug discovery. It’s not what you’d expect. Chrysos develops big PhotonAssay units that analyse mineral samples to determine the amount of gold present. This ground-breaking technology is swiftly displacing traditional manual processes and the biggest gold miners are hungry for more.

History

PhotonAssay was invented by Australia’s national science agency, CSIRO. It took 21 years for CSIRO to reach a commercial prototype in 2016. This prompted the formation of Chrysos, which acquired the exclusive global intellectual property (IP) rights over PhotonAssay. The invention involves the use of high-energy X-rays to activate gold or other elements in mineral samples. A PhotonAssay unit at a customer’s work site is pictured below.

As you can probably imagine, building these big units requires a lot of capital. Before listing on the ASX in May 2022, Chrysos’ operations were funded through three equity raisings from management and investors. Chrysos secured $85.7m in equity capital to primarily scale the manufacturing. A small portion was devoted to research and development to design a more mobile unit.

Business Model

The bulk of Chrysos’ revenue comes from gold mining companies like Barrick Gold (NYSE: GOLD) and Agnico Eagle. Its other key customer group comprises testing, inspection and certification (TIC) companies. Three of the world’s four largest TIC companies by revenue, ALS Limited (ASX: ALQ), Intertek Group Limited and SGS S.A. use Chrysos’ PhotonAssay units. But why are these customers using Chrysos?

PhotonAssay units attain results more efficiently and Chrysos claims it to be more accurate than the old-school way of using extreme heat in a furnace. Rather than requiring highly experienced operators and chemists to deliver results, the PhotonAssay unit does it all in as little as two to three minutes compared to three to four hours for fire assay. The PhotonAssay process also creates less waste.

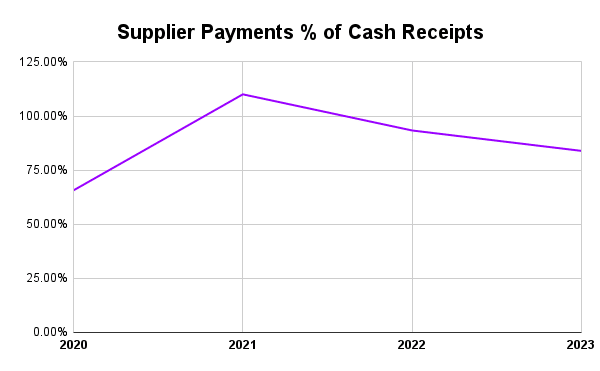

Chrysos outsources the majority of its manufacturing and assembly of its PhotonAssay units to specialist global security manufacturer, Nuchtech Company Limited based in China. A large chunk of costs are absorbed by payments to suppliers for components and manufacturing as seen in the chart below.

Customers don’t purchase the Chrysos units outright but rather have two lease options available to them. The units are generally leased over five years with an option to extend for another five. Customers can either pay a minimum monthly payment or a “take or pay” mechanism. The latter option allows the customer to pay a variable rate depending on how much they use the unit. Chrysos offers greater discounts or cheaper rates for higher levels of usage.

The beautiful aspect of the “take or pay” model is that Chrysos benefits from customer processing more than the agreed minimum usage. When customers process lower than the agreed minimum amount, they still need to pay Chrysos the agreed amount.

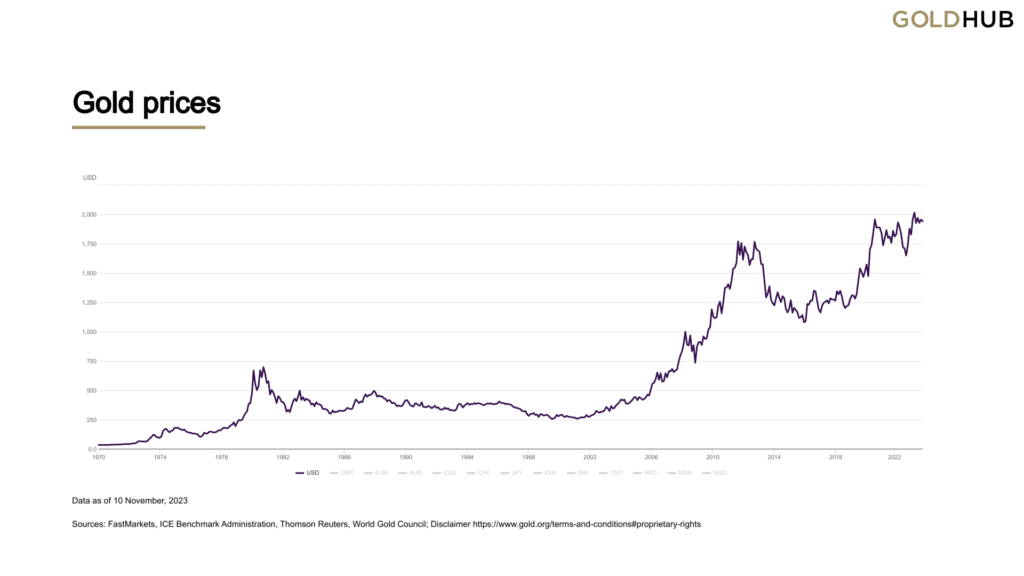

So, customer usage drives Chrysos’ revenue. Demand for gold drives customer usage, and gold mining companies are incentivised by the price of gold.

Revenue almost doubled from $13.5m in FY 2022 to $25.6m in FY 2023. It appears the resurgence of gold prices to record levels has benefitted Chrysos.

Source: World Gold Council as of 10 November 2023

The leasing model can capitalise on the cyclical nature of the gold price and is a much more commercial option compared to stumping a significant upfront cost. Overall, it’s a sound business model but how about the management team?

Management

Chrysos is led by CEO Dirk Treasure who holds around a 1.3% shareholding and possesses deep industry experience. Treasure is supported by Chairman and Co-Founder Robert Adamson, who is the third biggest shareholder (12%) behind CSIRO (33%) and Regal Partners (21%).

The lead inventor of PhotonAssay with CSIRO, Dr James Tickner is currently the Chief Technology Officer, who remains key to future advancements of Chrysos’ IP. Before co-founding Chrysos, Tickner worked at CSIRO for 19 years with eight years in a leadership role, focussed on solving measurement and instrumentation problems in the minerals and security industries.

The pedigree and industry experience of this management team appear formidable with one co-founder retaining a substantial stake in the business. I’m less excited about management incentives though.

At best, the incentive arrangements are vanilla with a focus on EBITDA, revenue and total shareholder return.

Watchlist Worthy

Various elements of Chrysos reminded me of the mission-critical nature of PWR Holdings (ASX: PWH), the business model of Nanosonics (ASX: NAN) and the first-mover advantage of Audinate (ASX: AD8). In light of these preliminary signals, I believe a deeper inquiry of Chrysos is warranted.

Disclosure: the author of this article owns shares in PWR Holdings (ASX: PWH). The editor of this article does not own shares in or have a position in any of the companies mentioned. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.