I currently have quite an uncomfortable case covid so forgive me if I keep this brief, but I wanted to explain why I’m about to dump my last lot of DGL Group (ASX: DGL) shares, this afternoon. First, a little background.

At the end of last year I started buying DGL Group shares at under $3, because I thought it would fare well in an inflationary environment, and because the CEO Simon Henry was buying shares on market.

Then, luckily for me, I started taking profits on DGL shares last week, at $3.90, right after writing this article. In brief, my reason for taking profits was because the share price moved from ~$3 to ~$4, and the release of shares from escrow would likely push the share price down. That was lucky, because since then the stock has come down partly due to market volatility, partly do to bad publicity around the company’s CEO.

And indeed, these recent revelations discussed below have also made me more bearish the stock.

I Have Less Confidence In DGL Group CEO Simon Henry

According to New Zealand website NewsHub, DGL Group CEO Simon Henry has made inappropriate comments about a prominent New Zealand Busineswoman, Nadia Lim. NewsHub writes that during an interview with NBR last month, Simon Henry said:

“I can tell you, and you can quote me… When you’ve got Nadia Lim, when you’ve got a little bit of Eurasian fluff in the middle of your prospectus with a blouse unbuttoned showing some cleavage, and that’s what it takes to sell your scrip, then you know you’re in trouble.”

He further suggested that Lim was using sensuality to sell stock in ASX-listed My Food Bag.

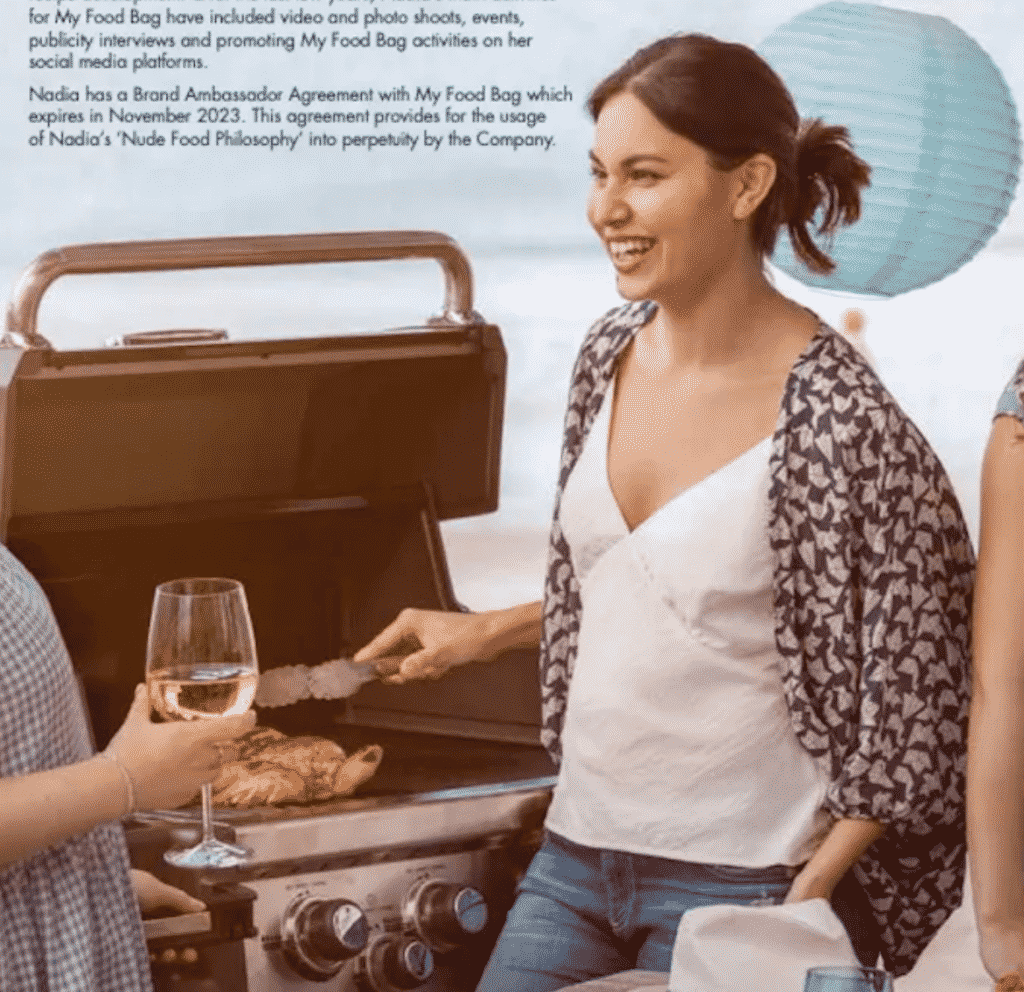

Not only are Henry’s comments inappropriate, but when you look at the actual photo used in the prospectus, his comments are also inaccurate, and indeed ludicrous. You can see the supposedly “sensual” picture he was referring to, below.

In my opinion, reasonable person would agree that the above picture does not actually use sensuality to sell stock, even in the slightest. But even if it did, Henry’s comments would be inappropriate, in my view.

Certainly, this incident causes me to lose confidence in Simon Henry’s judgement.

On top of that, a young woman has previously accused Henry of harassing her via email and text message according to this NBR article. Not only do the emails and texts shown in that article also give me reason to question his judgement, but he also reportedly told the journalist: “I get regular blackmail threats from every corner of the world, in Auckland, from every event, wherever I go.”

In the course of my research I also discovered, Simon Henry has changed his name from Simon Whimp. I was not actually aware of this before today, despite the information being on the public record.

Why Am I Selling?

DGL Group has made very many acquisitions, and acquisitions bring risk. They also require that management exercise good judgement in choosing acquisitions, as well as good judgement in how they report the underlying earnings excluding acquisition costs. Therefore, my opinion of Simon Henry’s judgement is definitely relevant to my investment in his company.

On top of that, DGL Group is in the business of managing hazardous chemicals. Like waste management generally, and also mining rehabilitation, this is a very risky industry, and has a lot of regulatory risk involved.

For example, let’s take a look at one of DGL’s subsidiaries, Hyrdromet. According to this AFR article DGL acquired Hydromet in 2012.

In 2017, the EPA fined HyrdroMet $30,000 “for inadequate storage of waste materials at their Tomago facility and the resulting pollution of a nearby drainage line.”

More recently, in Environment Protection Authority v Albiston [2020] NSWLEC 80, the court also identified wrongdoing by a different company, 3R, which was a contractor for Hyrdomet. The LEC Judicial Newsletter Volume 12 Issue 3 October 2020 (pdf will download) said:

“Under a contract with HydroMet Corporation Pty Ltd (HydroMet), 3R was paid to transport HydroMet’s battery waste from Murrell’s Freight Services Pty Ltd (Murrell’s) and “take ownership” of it at the premises (contract). Between 29 June and 28 September 2016, the waste stored at the premises was between 1,548 and 10,000 cubic metres. The estimated weight of the waste by 28 September 2016 was between approximately 1,500 to 2,312 tonnes. On 23 August 2016, Mr Greg Newman, an Environment Protection Authority authorised officer, discovered the waste stored on the premises. On 13 September 2016, Mr Newman e-mailed Mr Albiston and informed him that his conduct was unlawful and that an EPL was required to store waste on the premises. None was obtained.“

Obviously, I am not suggesting this equates to wrongdoing by HydroMet, as the case was against its contractor, 3R. But if there were to be a pattern of Hyrdromet contractors doing the wrong thing, then that could become an issue for the company. I am not suggesting such a pattern exists, and I am only aware of this one incident.

Either way, to my mind, DGL Group is very much in the risk management business, and I would like to see the CEO behaving in a different way, to give me more confidence.

Given everything I now know about the CEO, I am going to sell my remaining shares today. When the facts change I change my mind. What do you do?

Please note I hold shares in DGL, and plan to sell all of them this afternoon. This article should not form the basis of an investment decision, and my thinking around any of these stocks may change at any time for any reason. It is an investment diary valuable only for the cognitive process it demonstrates and you should cultivate your own thinking. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer. If you are seeking financial advice, which you should, you are in the wrong place.

Sign Up To Our Free Newsletter