Biome (ASX: BIO) is a small, risky, loss-making company with a new probiotic content experiencing gradual organic sales growth. At the current share price of 34c, Biome has a market capitalisation of $74.5 million. It is forecasting FY 2024 sales of $12.5m and says it is “sufficiently funded to execute its FY24 strategy.” Arguably this wording implies it will need to raise more capital for its FY 2025 strategy. It is quite possible that any future capital raising could depress the price.

Despite this, Biome has caught my attention because I suspect that the organic sales growth may continue for quite some time.

Probiotics Use Should Grow

While antibiotics are life-saving medicines that greatly enhance quality of life, they are not the most delicate tool. For people who have to use antibiotics too often, there is a real risk of doing damage to the gut biome, a living array of bacteria that help humans digest food, absorb nutrients and even regulate their moods. On top of that, the increasing prominence of processed foods in our diets removes the varied home-grown produce that we evolved with. As a result, many humans can benefit from reintroducing helpful gut bacteria into the mix.

Biome Should Take Market Share

Biome’s brand, “Activated Probiotics” is different from competitors because of how it delivers the probiotics. Biome freeze dries the bacteria, stabilises it by coating it with a thin layer of plant-derived lipid, then packages it in individually sealed blister backs of aluminum. All this help protect it from temperature changes and preserves the active bacteria all the way until consumption.

In comparison, competitors generally store the pills in a glass jar, or potentially a standard blister pack. Some competitors even require constant refrigeration for the product.

I have habitually taken probiotics after having to use antibiotics, over the years. While I think they helped, my digestive system would often take a while to recover, perhaps due to having had to take antibiotics so many times. Recently, I tried taking “Activated Probiotics” and was very surprised at how quickly I felt better (basically 24 hours). I have continued to use the product, and it has changed my perspective of how effective probiotics can be.

Now, of course, this is an anecdotal sample of one, and is not proof of anything.

However, my anecdote supports the potentially quite logical argument that much of the effectiveness of probiotics is lost before they are finally consumed by the patient. Even if the probiotics are in good shape at the time of sale, it makes sense that more protective packaging and storage would increase the potency at the time of consumption. Who else forgets to put things back in the fridge, sometimes?

It is also possible that I just randomly stumbled upon a formulation that was right for me.

However, I think it is fair to say that Activated Probiotics has strong branding that helps to highlight all the diverse issues they say that probiotics can help with.

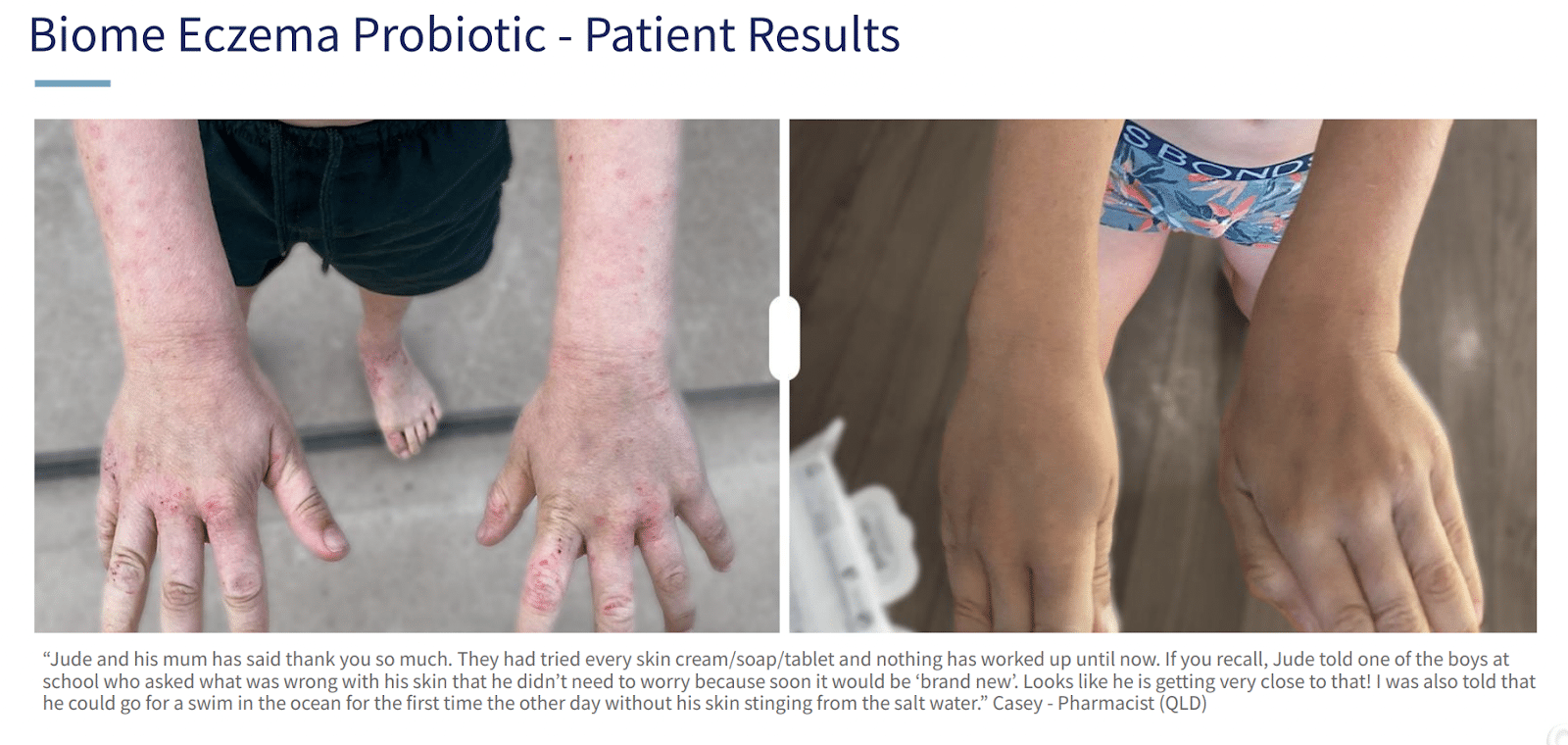

Whereas I might generally take testimonials proffered by a company with a grain of salt (see below), in the case of Activated Probiotics, I find myself adding my own.

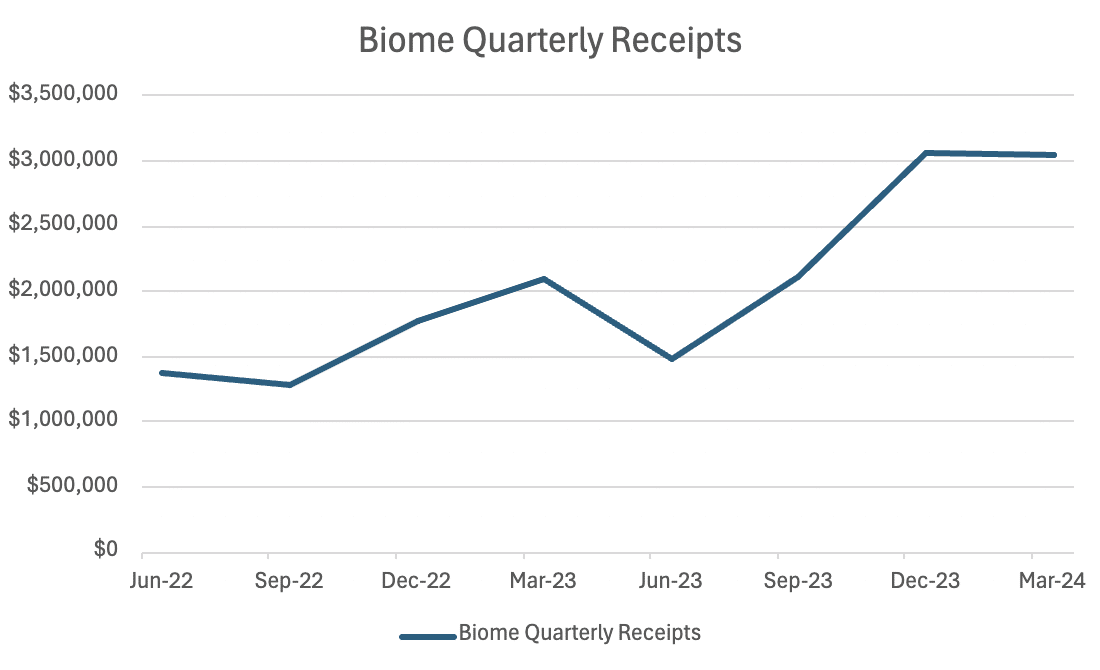

Now, if Activated Probiotics truly was a better product, you would expect to see some decent growth. Below, you can see how Biome’s quarterly receipts from customers has increased over time.

In the most recent quarter, sales revenue fell from $3.3m in the December quarter to $3.2m in the March quarter. Notably, the company said “the March quarter is consistently the weakest quarter across the category due to the pharmacy and practitioner distribution channels slowing over the holiday period.” Therefore, I would expect the general sakes (and cashflow) growth trajectory to continue in the next few quarters (noting cashflow is often more lumpy than sales), if Biome truly does have a better product.

Biome’s Delicate Financial Position

Biome is close to breakeven, having achieved a skinny $50k in free cashflow in the quarter to March.

Biome had about $2m cash and about $1m debt at the end of the March quarter, so it is on thin ice, and will be in trouble if it cannot maintain breakeven. It really needs to build up some cash to ensure it can weather any setbacks; and fund its growth more cheaply. At present, it pays over 10% on its debt, so in my opinion the current debt funding is a real threat.

Overall, on a financial level, I don’t think Biome is attractively priced, and it is not the kind of stock I generally look for. The company isn’t very stable given its thin balance sheet and ongoing working capital needs. Debt and losses are a combination I generally avoid.

However, on a product level, I wouldn’t be surprised if they have an edge. I am tempted to buy a small amount of shares and hold them with low conviction, just on the basis that Activated Biotics seems to be taking market share from incumbents. It is also possible a small shareholding would entitle me to participate in a discounted capital raising in the future. Biome might be a bit “ugly” — but could this “ugly” duckling actually be a swan?

I would love to hear whether your local Chemist thinks these products have a brighter future, or if you have used them yourself.

Disclosure: the author of this article does not own shares in BIO and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.