Macquarie Telecom (ASX: MAQ) is a telecommunications company that has been listed on the ASX for many years. In that time, it has undergone some notable transformations, and these days, providing actual telecommunication connectivity is a smaller (and vaguely shrinking) part of its business.

However, while its telecommunications business has been stagnant at best, it has built a strong business in managed IT services for government, as well as building various data centres, including high security storage located in Canberra, and specialising in serving government departments prioritising having an Australian owned supplier with top security certification.

I have actually been following Macquarie Telecom for more than a decade as it has been a founder-led small-cap exposed to long term tailwinds; just where I like to play. In that time, I have seen its data-centre business grow from next to nothing, to generating annual EBITDA of over $30m, as you can see below.

Of course, the problem with the data centre business is that it is very capital intensive. Personally, I have never understood the market’s enthusiasm for this business, because it is a perpetual cash vacuum.

For example, in FY 2022 Macquarie Telecom reported EBTIDA of about $88.4 million, but net profit after tax of only $8.5 million. In the same year, free cash flow, after taking into account both interest payments and lease costs, was actually negative $10.8 million. Instead of dollars, Macquarie Telecom is basically storing its profits in data centres; so you have to believe data centres retain their value, to believe Macquarie Telecom is creating value.

Recently, Macquarie Telecom took the conversion of dollars to data centres to the next level. Perhaps taking advantage of enthusiasm for data centres relating to the current hype around AI, the company recently raised $160m at a share price of $58.50, in order “to support the Company’s data centre business in the next phase of growth and strategically positions Macquarie Technology Group to capitalise on the fast-growing cloud and artificial intelligence megatrends.”

At the same time, “Macquarie Technology Group reaffirmed its FY23 EBITDA guidance of between $102 to $104 million, which represents the ninth consecutive year of EBITDA growth for the Company. EBITDA guidance for Data Centre business in FY23 remains at $32 to $33 million.”

Prior to this capital raising, Macquarie Telecom had about $131m in debt (and $21.4m cash) so after raising $160m, it should have tens of millions in net cash at June 30.

3 Reasons To Like Macquarie Telecom

As I will discuss below in the valuation section, I don’t think Macquarie Telecom shares are cheap. However, I do think that there are sociological reasons to own the stock.

First of all, Macquarie Telecom is increasingly marketing itself as a beneficiary of “the cloud computing and AI megatrends.” While this is a bit of a stretch, the ASX doesn’t really have many large, profitable companies that genuinely benefit from the (forecast) rise in artificial intelligence. Therefore, relatively few companies may stand to be the beneficiary of hot money looking to capitalise on this trend.

Macquarie Telecom says:

“As our economy becomes more digitised, organisations are moving their data and software applications to the cloud. Clouds live in the latest generation of data centres, like ours. Data Centres are digital infrastructure along with our cloud and cyber security platforms. AI is the next significant megatrend for data centres and the digital economy driving higher power density and demand for capacity. As these two megatrends combine, we expect to see very strong demand for the latest generation of data centres.”

More importantly, with a market capitalisation of about $1.45 billion, Macquarie Telecom was already one of the largest companies excluded from even the S&P/ASX 300. When I scanned the ASX for companies that are in the S&P/ASX All Ordinaries, but not the S&P/ASX 300, then sorted the companies by market capitalisation, Macquarie Telecom was in the top dozen.

Now, the S&P/ASX 300 methodology is designed to consider float adjusted market capitalisation, not normal market capitalisation. Given that the founding brothers owned more than 52% of the company prior to the recent capital raising, and other individual insiders own another 3%, you can assume that the adjusted market capitalisation of Macquarie Telecom is a lot lower.

Even after the new shares hit the market, the float adjusted market capitalisation would be much closer to $800m than the market capitalisation of ~$1.6 billion.

That said, a float adjusted market capitalisation of $800m is larger than around 50 of the companies in the ASX 300, many of which are retailers who are suffering significant share price drops as consumer confidence falls.

Of course, the other major consideration for the ASX 300 is liquidity. I can’t predict when – or if – Macquarie Telecom will have enough trading in its shares to justify inclusion in the ASX 300 (or ASX 200). However, there have been an increased number of shares trading lately.

Sometimes, a lack of liquidity can keep a stock out of the ASX 300 and ASX 200 for very many years. And that could very much happen here. However, I also think there is a chance that the recent capital raising, and the investor relations marketing around AI hype, could improve liquidity in the stock.

On top of that, because the share price is quite highly valued, and because data centres are capital intensive, I could definitely see Macquarie Telecom raising more capital in the future. With time, this should improve liquidity.

Once Macquarie Telecom reaches the ASX 300, the next milestone will be inclusion in the ASX 200. This could take a few years, but we quite often see funds frontrunning inclusion in the ASX 200, so even inclusion in the ASX 300 could mean extra attention on the stock.

Either way, inclusion in the ASX 300 and ASX 200 means passive index funds will start buying the stock. These investors are not sensitive to valuation at all, as the simply must buy to fulfill their mandates. While this can sometimes be a bit of a nothing burger, when combined with a sprinkling of (largely fatuous) AI hype, I think it could provide a nice opportunity to take at least some profits (assuming there are any).

The final reason to like Macquarie Telecom is that it has honest, competent, aligned management. The CEO is David Tudehope and the Managing Director is his brother Aidan Tudehope. Together, they own over 11 million shares, worth over $700m. They have been leading the company for more than 20 years, taking the share price from under $6 to over $60, in the last decade. On top of that, three other directors all bought shares just under $60 in the last year.

My Main Concern About Macquarie Telecom

While there are a number of risks to consider regarding Macquarie Telecom, the main reason I am hesitating to make it a recommendation and buy shares myself is that the valuation is very high. Now, I’m not ruling out taking the plunge, and buying shares for a sociological trade, but the missing piece of the puzzle is whether too much success is already baked into the share price.

The company has given FY23 EBITDA guidance of approximately $102 to $104 million, which seems achievable since EBITDA for the first half was $51.3m. However, NPAT for the first half was only $8.6m. So if the EBITDA converts to profit at roughly the same rate in the second half, the full year profit will only be around $17.2m. With a market capitalisation of $1.585b, that’s a P/E ratio of 92!

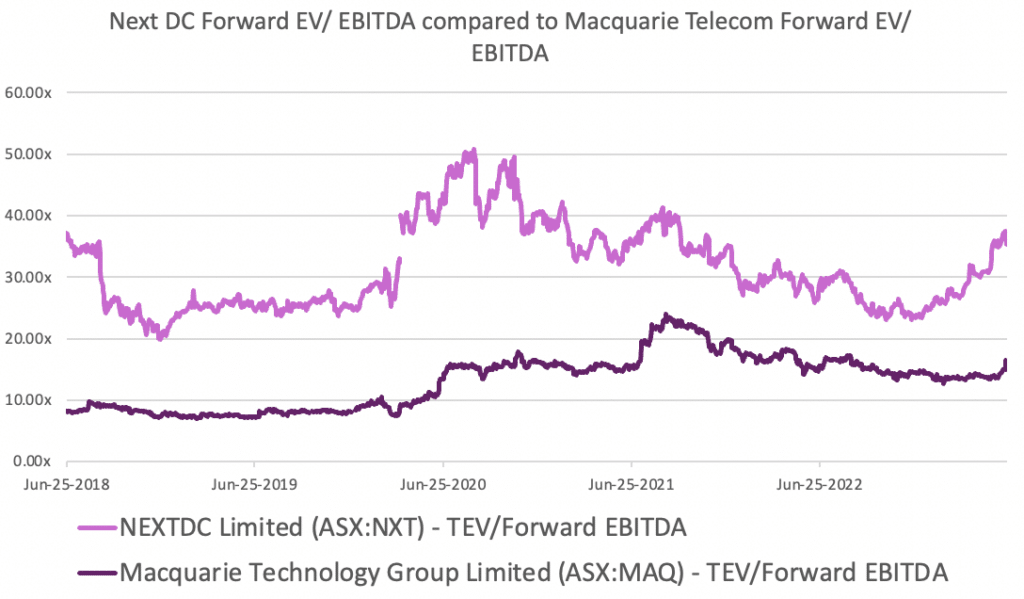

On the other hand, probably the closest ASX comparable to Macquarie Telecom is NextDC. Now, I’m not for a minute suggesting they should trade on the same multiple, since Macquarie Telecom has a significant portion of its business that is more of a shrinking legacy telecom business. But at the same time, I would not be surprised to see the gap between the NextDC and Macquarie Telecom EV/ EBITDA multiple close, over time.

So What’s The Takeaway?

I can find plenty of reasons to like Macquarie Telecom stock, in both the short term and the long term. Over the last few months it has been on the top of my watchlist while I’ve been thinking about whether I should recommend (and therefore buy) the stock myself. While I haven’t quite yet dared to take the plunge, due to the stretched valuation, part of that is simply because I’ve been very cautious in general, keeping most of my investible money in cash. Once inflation and interest rates start to flatten then fall, I would imagine a stock like Macquarie Telecom would do very well. In the meantime, I still think it is fairly attractive.

Disclosure: the author of this article does not own shares in any of the above mentioned companies, and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.