StepOne (ASX: STP) is a relatively simple business selling bamboo underwear online, for a slightly premium price. Yesterday, it reported its results for FY 2023, which were largely in line with reasonable expectations, except for three key factors: free cashflow improved, inventory declined, and a generous dividend of 5c was declared reflecting the board’s confidence in the business.

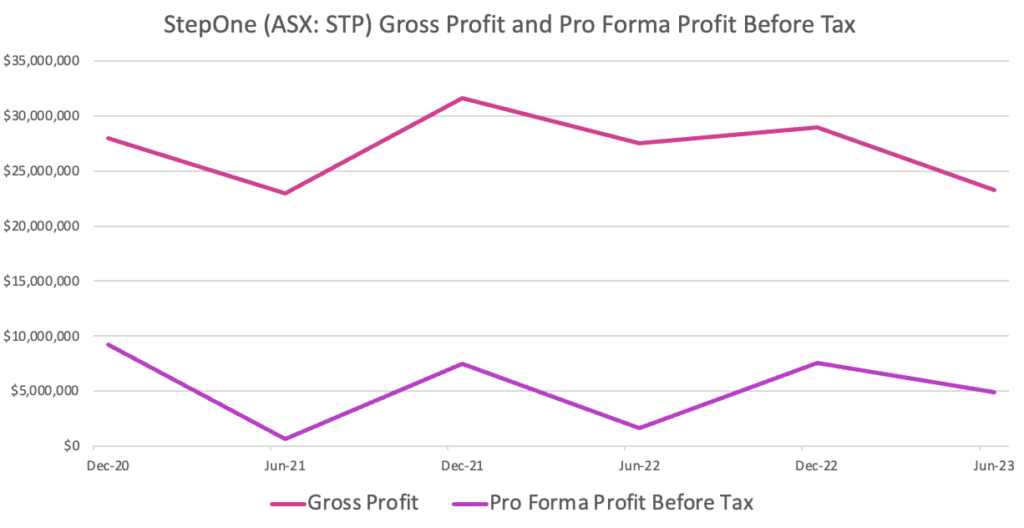

Revenue declined about 10% to $65.2 million, with the second half being a little weaker than the first. As you can see in the chart below, both gross profit and profit before tax declined in the second half.

Earnings per share of 4.65 cents put the stock on a P/E ratio of 11.4 at the current share price of $0.53.

Why I‘d Buy StepOne Shares

Prior to this result, I had StepOne on my watchlist as a potential turnaround play. With plenty of cash, as well as accounting profits in the first half, StepOne looked like it could be very cheap.

However, the risk was that the cash would be trapped in the business, destined to be frittered away on the failing US expansion plan, if the board chose not to make distributions to shareholders.

However, yesterday’s result shows that the board will share that cash with shareholders. The CFO said:

“In future reporting periods it would consider returning surplus funds generated from profits to shareholders. This demonstrates the board’s confidence in the ability of Stepone to fund our operations and future growth.”

Moving into FY 2024, The CEO said that “We will continue to balance profitability with growth moving forward,” and that marketing costs would see moderate changes, but be at broadly similar levels.

Free cash flow was just under $4.6 million in FY 2023, compared to a profit of $8.6 million, demonstrating fairly weak cash conversion. On top of that, revenue and gross profit declined. For this reason, it is arguable that the fairly low P/E ratio of around 11.4 is quite appropriate. Essentially, StepOne was only able to grow profits by cutting advertising cost, and that in turn saw reduced revenue. The company simply won’t be able to grow profits indefinitely in that fashion.

Furthermore, the dividend of 5c per share exceeds the statutory profit, and greatly exceeds the free cash flow. Therefore, unless the company sees some growth, that sort of dividend won’t be sustainable, either.

Risks

StepOne still carries too much inventory, and had to make a $1m provision for obsolete stock in FY 2023 result. It is quite possible further write-downs of stock could hamper profit. Furthermore

Leadership

The CEO and founder Greg Taylor owns 124 million shares in StepOne, being about 67% of the shares on issue. Around 105m shares will come out of escrow on August 31, though I don’t think that’s a big issue, since Taylor and Chief Commercial Officer Michael Reddie who own the escrowed shares could already sell shares if they wanted to.

When StepOne (ASX: STP) listed in late 2021, it told the market it would make a pro forma net profit after tax of $10.5 million in FY 2022, then proceeded to deliver a pro forma net profit after tax of $5.3 million, so I personally would not believe any forecasts that the CEO shares in the future.

For this reason, I’m hesitant to make StepOne an official buy recommendation. On top of that, the stock is very illiquid. As I have learnt the hard way, by the time I make a recommendation, and then can buy shares myself, the stock might be significantly higher. Similarly, if, for some reason, I decided I’d like to sell my shares, the process of issuing a sell recommendation, waiting a day, and then selling, could see the share price decline considerably.

StepOne shares will do very well from here if only the company can continue to improve its advertising efficiency. In the long term, I think that will happen. The reason for this is that StepOne gets a significant number of repeat customers, due to the quality of its product, and it has quite high gross margins, of over 80%. This puts it in a much stronger position to advertise effectively compared to lower quality online retailers such as Redbubble, which has gross margins below 40%.

Overall, it looks to me like the ship has most certainly been steadied. But for the fact that I’m currently aligning my portfolio with official recommendations, I would buy shares in StepOne. The only reason I don’t want to make it an official recommendation is because I find it too stressful to recommend a company if it has a track record of giving bad forecasts and overly optimistic guidance.

If not for my efforts to optimise for alignment with my official recommendations, I’d probably already have bought shares yesterday at around 47c. I still think the shares are attractive, but I lack the kind of margin of safety I need to confidently go through the recommendation rigmarole. Therefore, I thought I’d at least share the story with subscribers in case any of you think, as I do, that StepOne has an excellent product that will probably succeed in the long term.

Though this is hardly the most convincing idea, I do find the combination of a low earnings multiple, great product and high insider ownership alluring as an opportunistic investor.

Disclosure: The author of this article Claude Walker does not own shares in StepOne and will not trade shares in StepOne for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).