Energy One is a small Australian company providing software to participants in the electricity trading industry. Products include their Energy One Trading platform and power market analytics for large Australian energy utilities, and retail pricing software (in Europe and the UK).

You can see a list of their current products and the geographies they are offered in below (on their website).

Over the years, Energy One has grown by acquiring other small software companies offering adjacent products. This gives rise to potential cross-selling opportunities. The most recent acquisition was the acquisition of French company eZ-nergy, announced in December 2019.

Following that purchase Energy One has over 250 customers in 18 countries. However, due to the timing of the acquisition, there was a negative impact (expense) recorded in the first half of FY 20, without a corresponding benefit from acquired revenue.

At the half year report, the company said that “We expect the transaction to be completed by the end of April 2020, potentially providing 2 months of financial contribution from the eZ-nergy business.” However, funding had not yet been secured, with the company commenting that “we will look to expand the existing Westpac debt facility,” and “we may also perform a small capital raise depending on debt sizing.”

Given the situation with the pandemic, there may be some uncertainty around funding for the acquisition, and the share price of Energy One has dropped from $3.71 to $2.31 as a result. However, even at the lower share price, the company has a market capitalisation of about $50million, and so would only have to issue less than 10% of its market cap in shares to afford the initial cash payment of around $3.25m.

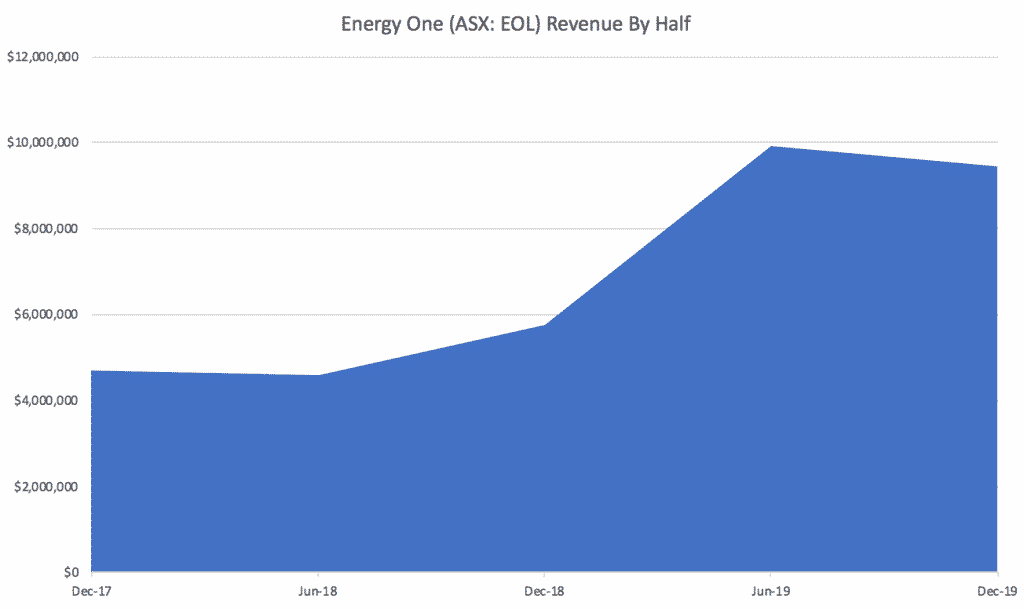

Zooming out, Energy One has had fairly stable revenue over the years, which it has grown through acquisition. Its last acquisition (debt funded) was Contigo Software, an energy trading and risk management platform which has customers in the UK and Europe. You can see how it impacted revenue, below.

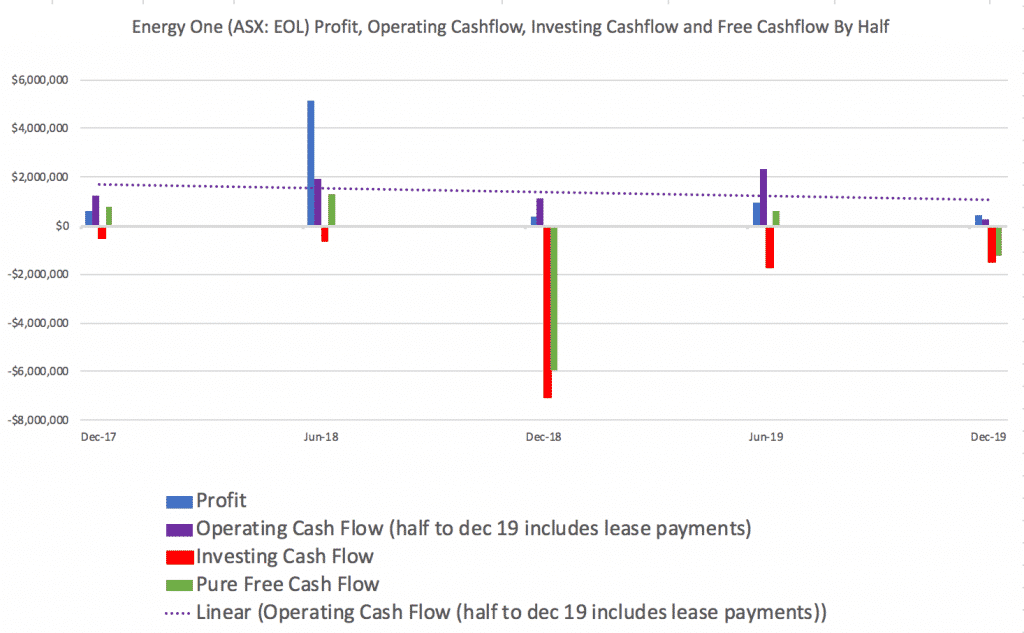

However, as a result of the company’s expenditure on both software development and acquisitions, its profit and free cash flow have been rather lumpy.

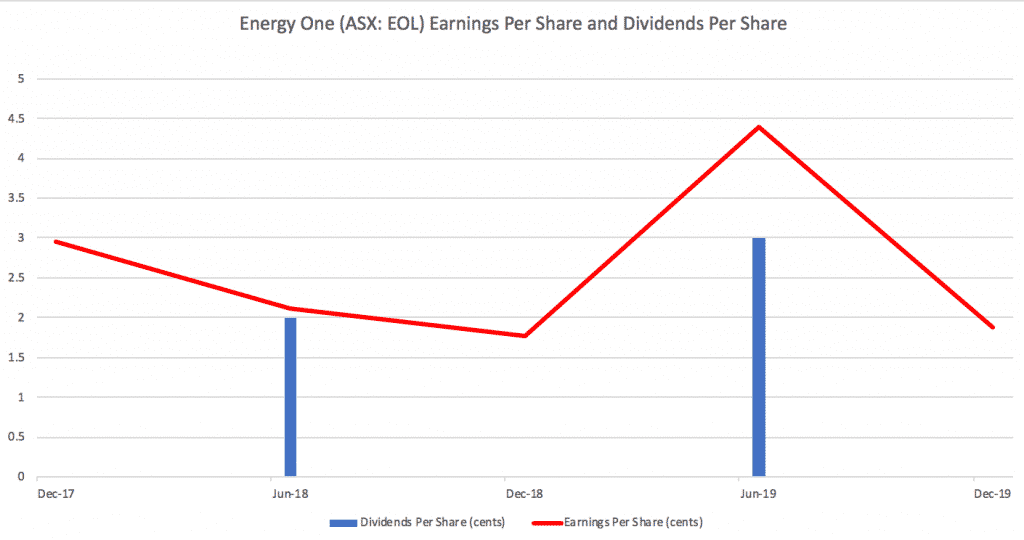

But while earnings per share has been up and down, the company has remained profitable and chosen to steadily increase its annual dividend.

Impact of Covid-19 On Energy One Limited (ASX: EOL)

The company recently announced that “EOL maintains its full year EBITDA guidance of $4.5M” and pointed out its “customers are predominantly corporations and government businesses operating in an essential industry so our counterparty risk is minimal.”

Looking forward, it said, “Over 70% of Group revenue is recurring in nature with the remainder comprising project related revenue. We have recently signed a new large customer and another customer has committed to a substantial upgrade. These two projects will provide ongoing project revenue to and beyond June 2020.”

Is The Energy One Limited (ASX: EOL) Share Price Good Value?

In the worst case scenario, the company suffers 10% dilution to pay for its most recent acquisition which performs poorly, and is in a position where it is raising capital at a tough time, leading to excess dilution for little gain. But given past success with growing the business this way, I’m willing to trust management to execute on the integration.

In the best case scenario, it simply borrows to fund the acquisition, which then integrates well, and it can use its free cash flow to pay down debt (though may have to cut the dividend).

Another possibility is that the acquisition falls through, which would be a set-back, but would leave us with a decent company trading on perhaps 30 times earnings. That would probably see a share price fall, but I’d be surprised if it went below 15x earnings, so the downside is probably 50% in this scenario.

One major risk is that the company’s software stack is in need of an overhaul. This often occurs when an established business is buying newer companies with more modern code-base. Eventually, the company may want to replace its older code as the technical debt of iterating on it becomes an increasing drag. Inevitably, that causes a painful increase in spending and a significant period of uncertainty, without obvious near term benefits (but which can be essential for long term survival.)

At the end of the day, though, I see a software company trading on about 10 x EBITDA, with significant growth potential. As with any investment, I’m assessing the probability and magnitude of my potential losses against the probability and magnitude of my potential gains. Merely by bedding down its Contigo and eZ-nergy acquisitions, I think the company could easily make profit of about $2 million on revenue of about $20 million, without being at all exceptional for a software company (if anything, I think steady-state profitability would probably be higher). That would put the company on a price-to-earnings multiple of 25, on a fairly conservative view of it.

Put another way, at current prices it would likely have an EV of around $60 million (it already has net debt of about $5 million), post acquisition of eZ-nergy and revenue of around $20 million, putting the stock on about 3x revenue. I’m not so sure that revenue multiples are a great way to value a small profitable software stock growing by acquisition, but the comparison between Energy One and sexier software companies like Volpara is extreme. For reference, Volpara is also using acquisitions to grow, is completely unprofitable, and trades on about 20 times revenue, based on its most recent half.

While I remain defensively positioned in this time of crisis, I do think Energy One is cheap on a relative basis, and with good execution, it will prove to be cheap on an absolute basis, too.

This post is not financial advice, the author owns shares in EOL, and you should click here to read our detailed disclaimer.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!