Arguably the worst micro-cap ASX stock in my portfolio right now, a little family law company called AF Legal (ASX: AFL), released its H1 FY 2025 results after 8pm on Thursday last week.

The AF Legal H1 FY 2025 results were a disappointment, with net profit after tax attributable to shareholders coming in at $282,000, down on $564,000 in H1 FY 2024. Worse still, this result displayed reverse operation leverage, because revenue was actually up over 18% to $12.7 million. This means that the company is increasing costs faster than it increases revenue, a classic sign of business immaturity.

In response to the H1 FY 2025 results, the AF Legal share price plunged around 20%, to 11.5 cents per share.

Free cash flow was negative if calculated by taking operating cashflow, and subtracting each of investing cash flow, dividends paid to minority interests, and lease repayments. In fact, in that analysis, AF Legal burned through more than $1.2m during the half year. It ended December with net debt of around $2.3 million, with the increase mostly associated with acquisition expenses.

If you exclude the cash spent on acquisitions, then free cash flow would have been positive; coming in at more than $1.8m. However, since AF Legal does not seem to be capable of much organic growth, the easiest way it can reach a reasonable scale – and achieve sustained profitability – is through acquisitions. Therefore, in the absence of a change in strategy, acquisition expenses seem unlikely to be one-off in nature, and I would not exclude them when thinking about earnings.

In H1 FY 2025, the very real expenses that AF Legal excludes from normalised earnings are due diligence expenses, which as discussed are a recurring feature of its growth model, and legal defence fees. This latter category is not one I had previously considered. To quote the company:

“Legal defence fees relate to engagement of lawyers to defend a formal proceeding and an industry regulator investigation. Both matters are at discovery stage, with no certainty on possible liability. The matters date back to 2022 and 2021 respectively. Discussions with insurers regarding coverage is ongoing at the time of writing. Regardless, the company has decided to be conservative in its approach and expense incurred legal fees during the half year in the H1 FY25 accounts.”

There is obviously some possibility insurance will cover these expenses in the future, but even if insurers are on the hook this time, insurers may consider a history of past proceedings when considering the price of future insurance coverage. So I doubt that these expenses will be without ramifications for AF Legal

Is The AF Legal Glassdoor Score Improving?

Ever since AF Legal has had a management change, I have been hoping to see some kind of improvement in their 1-star glassdoor ranking.

However, to my surprise, there have been no new reviews since 2023, and the company still sports a 1-star ranking from 3 reviews on Glassdoor, the lowest possible rank you can achieve on that website. Please note: I do not suggest that the claims in the negative reviews are true (or were ever true), only that they exist and may discourage new lawyers from joining the company, to the extent that they are relied upon.

Nonetheless, this is still a negative in my mind because one risk in the AF Legal business model is that lawyers who are more successful may be inclined to set up their own businesses.

Obviously, the better the reputation of an individual, the easier it is for such an individual to set up their own business. If this dynamic is real, then the employees AF Legal would least like to lose are possibly the most likely to depart.

It isn’t really possible for me to know if AF Legal is doing a good job retaining the most popular lawyers, because I don’t know who the most popular lawyers are, and it operates under a number of different brands, anyway. For example, subsidiary Watts MCray scores 3 stars on 5 Glassdoor reviews, significantly better than the parent company, though the most recent review was still 1 star and negative.

I always take Glassdoor reviews with a grain of salt. For example, I tend to discount 5-star reviews if they contain zero negatives and slapstick positivity, and sit in sharp contrast to opposing 1-star reviews. My view is that “disgruntled employee” is a genuine negative signal, but an over the top positive review with no negatives is more likely to reflect the incentives of a non-anonymous reviewer.

The classic line is “no cons that I can think of.”

In contrast, a smattering of neutral or positive 3-star and 4-star reviews, with some genuine negatives, is a good sign. That’s because these more balanced reviews are more likely to genuinely reflect anonymous positive sentiment towards the company.

3 Reasons I Will Sell My AF Legal Shares

I plan to sell my AF Legal shares because of the falling profit, increasing debt, and failure to improve Glassdoor reviews. However, I will hold on to my AF Legal shares for at least 2 days after this article is published, and possibly a while longer.

I am hopeful that the investor call today will entice some investors to push up the share price and I’m also hopeful that the falling share price will entice existing holders to top up their positions. However, hope is not an investment thesis and one way or another I will sell my shares in AF Legal within the next few months at most.

AF Legal Director & Significant Shareholder Peter Johns (Westferry Investment Group)

Fund manager Peter Johns is a director AF Legal as well as the portfolio manager of the Westferry Fund. In turn, Westferry is a significant shareholder of AF Legal, and so Peter Johns, himself formerly a practicing lawyer, can certainly influence AF Legal.

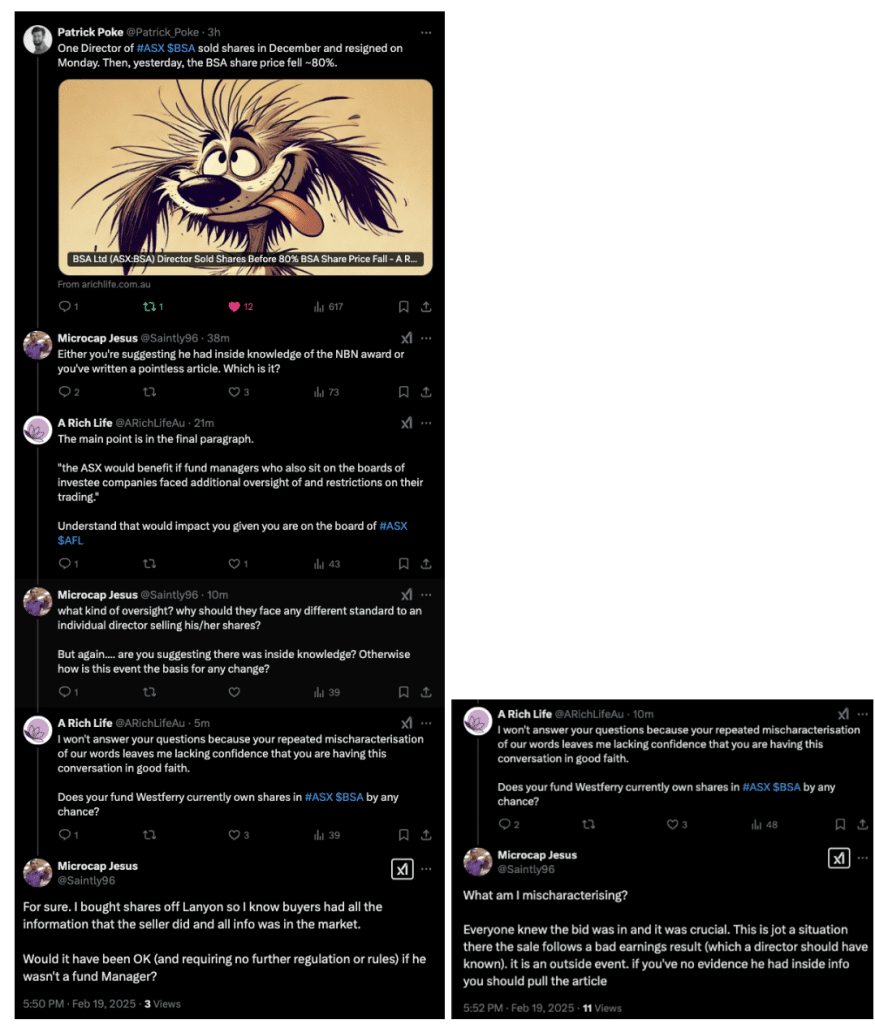

Recently, Peter Johns had some feedback in response to an article we published on BSA Limited (ASX: BSA), another company his fund owned shares in. Subsequently, Peter Johns appears to have deactivated his @saintly96 and @GroupWestferry accounts, for unrelated reasons.

Although I analysed the AF Legal report with a clear mind, the nature of my interaction with fund manager Peter Johns may have influenced my thinking subconsciously, and so I am sharing it below for posterity.

Disclosure: The author of this article owns shares in AFL and will not trade AFL shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Ethical Investment Advisers Pty Ltd (ABN 26108175819) (AFSL 343937).

Sign Up To Our Free Newsletter