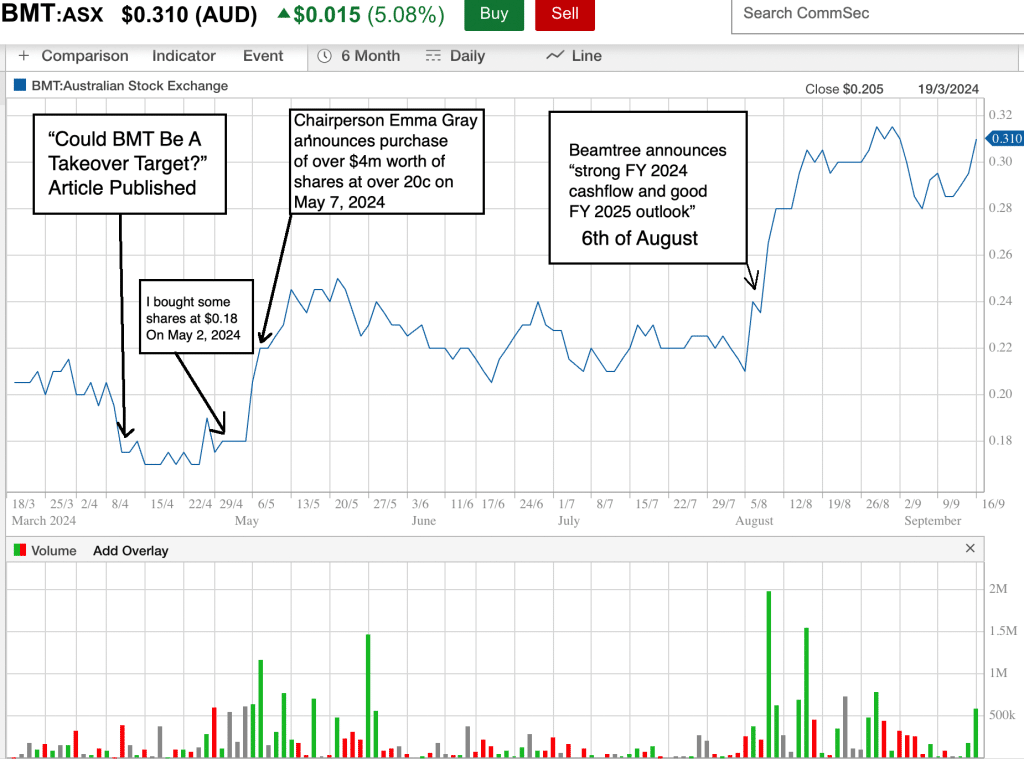

Slightly more than 5 months ago, I wrote an article about pathology software provider Beamtree (ASX: BMT) asking: Could Beamtree (ASX: BMT) Become A Takeover Target? The goal of that article was to “examine whether the company might be approaching the end of its cash furnace era, and consider whether the current share price of $0.195 presents an opportunity.” I concluded:

“…even though I don’t rate management or the board, the Beamtree share price does indeed seem like it may present somewhat of an opportunity… I would have thought Beamtree would be a decent option for investors who would like to own a basket of potential takeover targets.“

The Beamtree FY 2024 results boasted that the company had “moved into profitability in FY24 with an operating profit of $0.4m, an 129% increase versus the prior year loss of $1.4m as the Company continues to focus on profitable growth.” However, the statutory figures compare starkly with the company-defined “operating profit” metric reported by Beamtree. As you can see below, the losses have continued at Beamtree (ASX: BMT), albeit with a considerable improvement half-on-half in H2 FY 2024. However, if you compare the earnings before tax to the second half of last year, the second half loss was actually 45% worse than the prior corresponding period.

Beamtree (ASX: BMT) also included their ‘Bombora Special’ aspirational projected ARR growth chart.

I call it a ‘Bombora Special’ because Beamtree’s “Long term horizon” chart reminds me of Janison’s “Long Term Outlook” chart, and Bombora Group is a major shareholder in both companies.

Back when Janison released the chart above, it said it had confidence in surpassing the FY 2025 analyst consensus estimates of $60.6m. But Janison’s FY 2024 growth came in at 5%, boosting annual revenue to $43.1 million, so Janison has a lot of work to do to hit those old FY 2025 estimates.

While the ‘Bombora Special’ might be a similarity, the conviction of Beamtree Chairperson Mrs Emma Gray is a big point of difference between the two Bombara investee companies

That’s because Mrs Gray spent over $4m buying Beamtree shares at over 20c per share not long after my previous article, and just after I bought shares myself (a few weeks later). Subsequent to that, the company announced its “operating profit” for FY 2024 and ARR growth of 12% to $25.5m. You can see below how these event impacted the share price below.

My Beamtree Thesis No Longer Holds

My reasoning for owning Beamtree at ~20c per share was that it was very cheap relative to its revenue. I argued that it was trading on “just over 2x forward revenue, which is quite low for a software company.” However, after the events described above, the Beamtree share price is now 31c per share, and the market cap is just below $90m. In FY 2024 Beamtree grew recurring revenue 10% to $23.7m. If it repeats the performance, that would be FY 2025 recurring revenue of just under $26.1m. That means the market capitalization is currently almost 3.5 times forward recurring revenue (and it is usually recurring revenue that software acquirers are interested in.)

On top of that, the Chairperson now owns over 10% of the stock, which would definitely reduce the chances of a takeover that she did not support. That’s not necessarily a bad thing, but combined with the increased share price, I don’t think Beamtree is very likely to receive a takeover anymore.

On the flip side, I doubt that Beamtree will grow ARR at a compound annual growth rate of over 40% for the next 30 months, which is what is implied by their “long-term horizon” of ~$60m ARR by the end of calendar year 2026.

Therefore, I will look to start selling my Beamtree shares later this week. I will not be in any particular hurry to sell my shares, and I may end up holding a small holding for quite some time. I think it is always possible the share price could rise higher, especially if the company announces some good contract wins. It is also possible new information could make the investment more attractive. But ultimately, my thesis for owning the stock doesn’t really hold up now, so I will divest my holding.

Disclosure: the author of this article owns shares in BMT and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.