Over recent days it has become increasingly obvious how difficult it will be for Australia to contain the delta variant of the coronavirus. In my view, the most likely short term beneficiary of this is Australian Clinical Labs (ASX: ACL) which is a pathology business that recently listed at a price of $4 per share. At the time of publication of this article, the share price is $3.60.

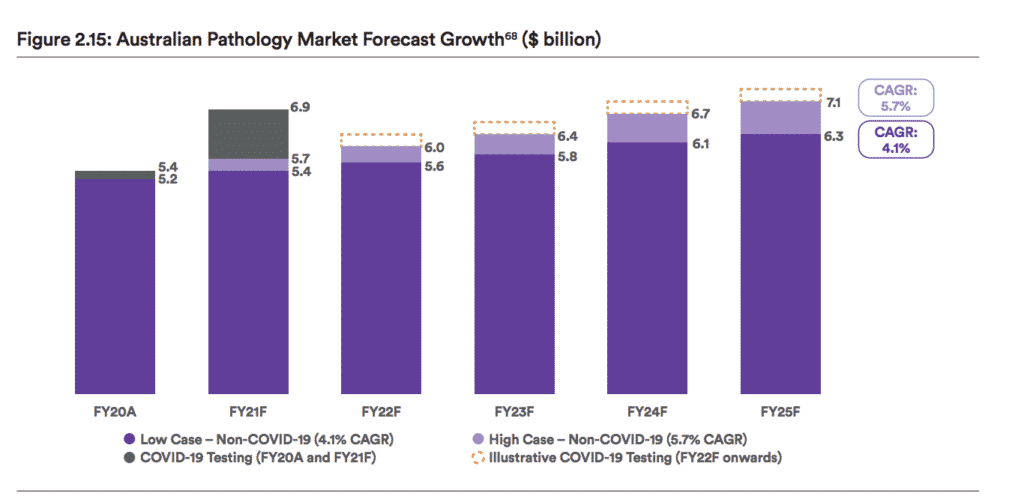

Since listing, ACL has languished below its IPO price, partly because it is obvious there is a large private equity overhang, with is largest shareholder Crescent Capital likely to exit the investment in the comping years. Furthermore, the company is obviously listing at a time when its profits are swollen by covid 19 testing. You can see the massive increase caused by covid lately:

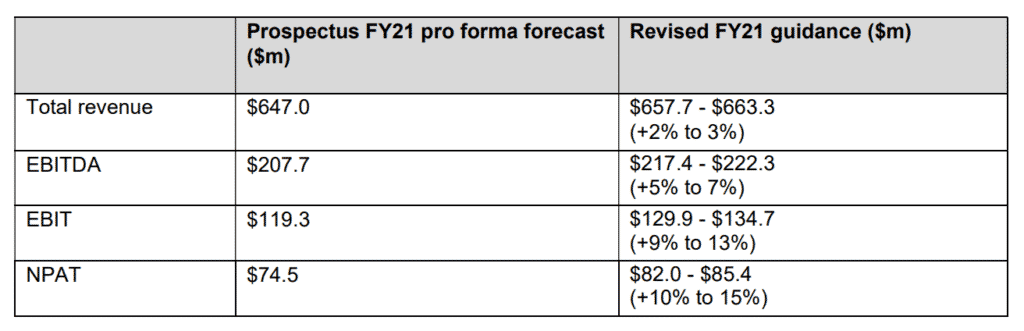

Having said that, in contrast to other recent listings such as Nuix or Cleanspace, ACL has actually upgraded its guidance for FY2021. You can see what I mean below:

At a share price of $4, ACL has an enterprise value of about $900m, and is forecasting about $83m in profit, so it is trading a about 11x its FY 2021 profit, and on a forecast yield of at least 3.4%. And as I write, the share price is sitting at about $3.60, suggesting the stock is even cheaper still.

Global pathology company Sonic Healthcare (ASX:SHL) is forecast to have $1.25b in debt at the end of FY 2021, and has a market cap of over $9b, so it will have an enterprise value of at least $10b if it remains at its current share price of around $39.50. It is forecast to make a profit of about $1.25b, putting it on a P/E ratio of around 8.

Now, both of these companies are trading on low multiples of FY2021 because the market does not expect that they will be able to maintain current levels of profitability, as the pandemic subsides. In my opinion, it’s quite likely that covid testing will continue to contribute to their profits for many years to come. On top of that, it’s quite possible that there will be more pandemics in the future and also some pent up demand for tests that have been delayed during covid outbreaks.

You can see below how ACL is forecasting the covid testing market to decline:

Personally I sold my Sonic shares a bit early, at around $35, which was a mistake. However, I would argue that ACL has a better potential for growth because it is smaller. In its recent prospectus, ACL says it will consider, “Strategic acquisitions in both Australia and internationally,” just as Sonic Healthcare did when it was a smaller entity. However, if Sonic found an acquisition that added $10m in profit, it would only increase annual earnings by less than 1% of current levels. In comparison, if ACL added $10m then it would grow profit by around 12%. Therefore it should be much easier for ACL to grow via acquisition.

Australia Tests A Lot

You could argue that businesses like Sonic and ACL have become structurally more important with covid but it seems reasonable to me to argue that the pandemic reversal in testing numbers will be lower in countries that are covid ridden countries because they have basically given up on track and trace. In comparison, in the early days of FY 2022 we are seeing record testing in Australia as we valiantly struggle to protect our unvaccinated and vulnerable population.

Betting on big volumes for ACL is literally a bet on the human decency of Australians.

But it also takes into account the ineptitude of a federal government which didn’t figure out you should buy enough of a variety of vaccines. As a result, we are not going to have serious vaccination availability in this country until the end of the year, and it will take longer than that to actually vaccinate 80% of the population (including children). Only once super-high vaccination levels are achieved would I expect a sustained reduction in demand for covid testing. That means I think that ACL has a tailwind that blows until at least the end of FY2022.

If ACL achieves strong growth in FY2022 and pays a dividend as planned then it may start scanning well and even make it into an index. That would be the best case scenario.

In the worst case scenario this is another “stitch up” IPO with covid tailwinds fast abating. For that reason I believe it would be sensible to think of this more as a trade than a long term investment. I am looking for (at the very least) positive momentum in the business to sustain. I think that will happen, but the market (understandably) treats recent private equity IPOs with skepticism.

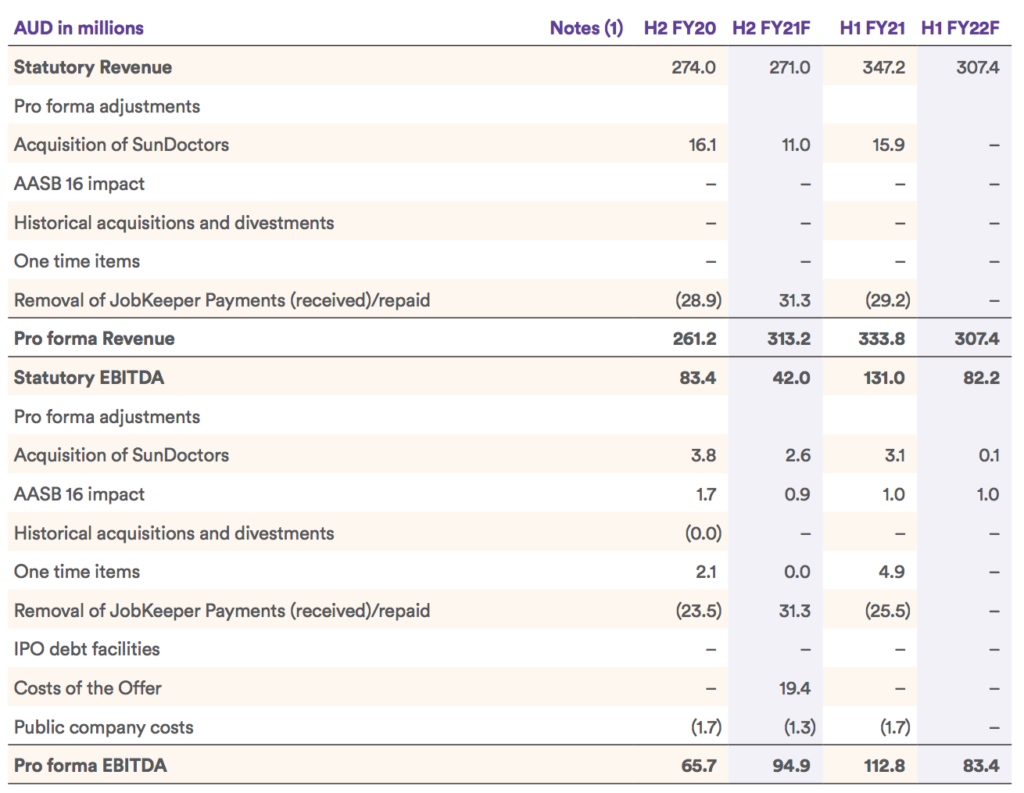

There is also some small possibility that this is a genuinely good business opportunity. If the company did manage to expand profitably overseas, that would be a positive. Currently it is the third biggest player in Australia, and the top three have about 80% of the market between them. Either way I think I just want to own it because it gives me exposure to the number of tests Australia is doing. ACL is my best exposure to this I think. You can see what is happening below.

Now I’m the first to admit I don’t know this newly listed company very well, and I’ll need to learn a lot to understand it better, but for now I have to say I’m thinking maybe they have been too conservative in their near term forecasts, which suggest revenue will be lower in the first half of FY 2022.

A Big Risk

Finally, one of the big risks is that we switch to rapid antigen testing. This kind of testing detects people who are symptomatic and contagious but will miss many people who are infectious. In covid ridden countries they use antigen tests because they a cheaper. However, according to the CDC “Antigen tests are relatively inexpensive, and most can be used at the point of care. Most of the currently authorized tests return results in approximately 15–30 minutes. Antigen tests for SARS-CoV-2 are generally less sensitive than real-time reverse transcription polymerase chain reaction (RT-PCR) and other nucleic acid amplification tests (NAATs) for detecting the presence of viral nucleic acid. However, NAATs can remain positive for weeks to months after initial infection and can detect levels of viral nucleic acid even when virus cannot be cultured, suggesting that the presence of viral nucleic acid may not always indicate contagiousness.”

Also, in many covid ridden countries people still have to pay for covid tests. In America people were worrying about the cost of getting a test, at least as late as September 2020, according to the New York Times. We face massive issues in Australia and unless the federal government steps in with income assistance, we may not be able to stamp out Delta because people are in insecure work and need to be paid to stay home.

It will be a sad day if we give up and resort to charging people for properly accurate PCR tests. But until that day comes I would have thought ACL will do well, even though most of its clinics are in places other than NSW where the current outbreak is. In my view there will a lot of testing as we fight this fight. Good luck to all of us.

For early access to content like this, join our Free newsletter!

Selling Some Shares

I have already bought more shares in ACL and I plan to buy some more tomorrow. To fund these purchases, I will look to exit lower conviction holdings and trading positions such as Raiz, which I have already sold earlier in the week. Tomorrow, I’m probably going to sell my shares in Finbar, which I was previously trying to sell in the 90c to $1 range.

Please remember that these are personal reflections about a stock by author. I own shares in ACL and may even trade the stock in the coming days (although I will not sell any shares for at least 2 business days after this article). I own shares in Finbar and SomnoMed and will probably sell them all tomorrow. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.