One of the most successful strategies that have helped me as an investor has been to look for companies that are using superior technology to make resilient industries more efficient. Ideally, I am looking for some sort of technological tailwind that makes it possible for such companies to win new customers, by providing a better solution. In particular, I like to look for software companies because software scales so well. Once software is built, it should not cost a great deal extra to supply it to a new customer, so after a certain point, revenue falls to the bottom line. In the best case scenario, this can drive rapid profit growth.

Case in point is Pro Medicus, which benefitted from the tailwind of improving internet infrastructure, which drove deconstruction of the radiology image archiving system. Once upon a time an imaging machine would take a radiology image, and the radiologist would have to use a terminal attached to that machine. Now, the image is sent to a vendor netural archive where it is accessed by the Pro Medicus viewer, which was able to stream these very large files to the user (rather than force them to download the file). This technological edge provided for extra efficiency.

Similarly, mining software company RPM Global, which I covered yesterday, benefits from the fact that improved broadband satellite communications technology is now facilitating mine-sites to move to the cloud.

Today’s subject, Janison Education, follows a similar theme. Just as mining minerals and healthcare provision are rather essential, the ongoing assessment of school children is very important indeed. Generally speaking, most societies value education quite highly, as it is seen as an equalising force in society and also allows an economy to generate higher value profit. Education might not be as non-discretionary as healthcare, but it’s pretty darn close.

You can see the thought process that leads me to Janison Education in the Venn diagram, below:

Unlike RPM Global, which is already generating a small profit before tax, Janison Education still is still making losses. In fact, in the first half of FY 2022, its net loss before tax increased to almost $3 million, compared to a loss of just $677,000 in H1 FY 2021. For this reason, Janison has been heavily sold off in the last six months.

As I’ve explained before, higher interest rates are bad for growth stocks, and unprofitable growth stocks are definitely, the worst hit.

However, the main reason that Janison made a bigger loss this half is because operating expenses increased by over $5m. This was partly due to “Further expansion of the Sales & Marketing team and resources to support new business”, and partly due to the acquisition of two assessment content businesses, Quality Assessment Tasks and Academic Assessment Services.

While it is certainly sub-optimal that Janison is growing via acquisition, rather than purely by winning new contracts. However, in the half year financial report the CEO said he was “encouraged by key financial performance indicators, most notably +23% YOY growth (+17% organic growth).” This implies that even without acquisitions, Janison can grow revenue.

Janison’s Gross Margins Are A Concern

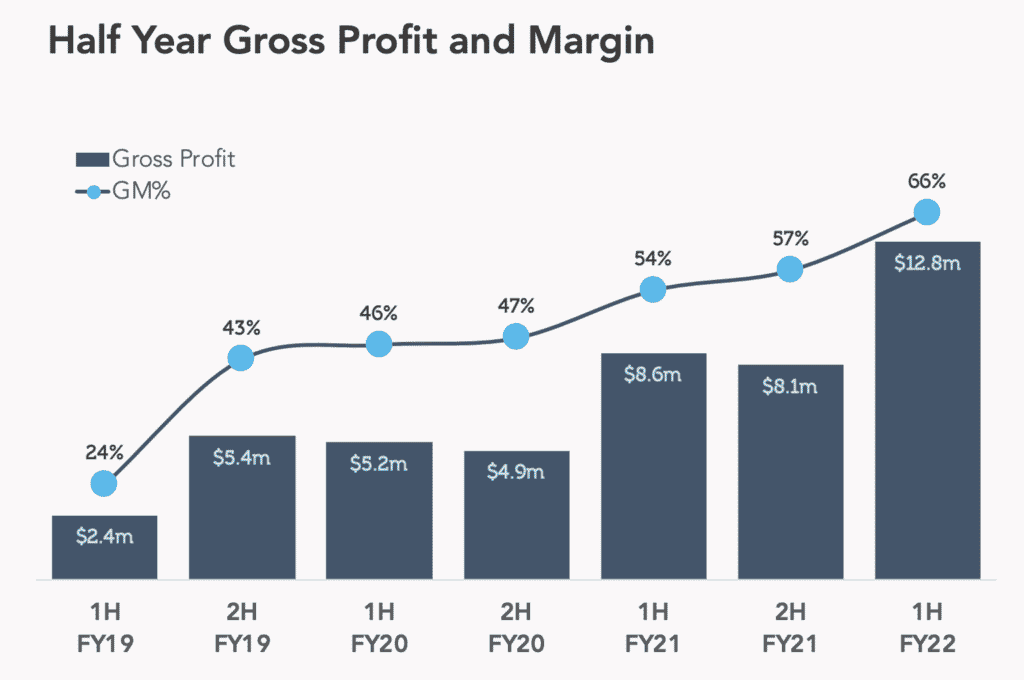

The main reason that I am a bit cautious about Janison Education is that its gross margins are quite low compared to most software companies. This implies that the implementation and running costs of the business are fairly high, and also implies that a lot of their clients demand customisation or specific help using the software.

As you can see below, however, gross margins are improving. The company says that “Shifting to offering a fully configurable yet standardised assessment platform has driven margin expansion considerably over the past two years and is expected to continue to do so for the medium term.”

Janison’s Business May Improve While Its Share Price Declines

One of the features of the current market is that money losing companies are getting sold off considerably. At the time of writing, Janison has a market capitalisation of about $100m, and a share price of about 44 cents per share. This compares to a share price peak of around $1.45 in late 2021.

I do not expect the price to reach all time highs any time soon, as those peak prices were supported by recommendations from popular newsletters, and essentially reflect a bubble in loss making tech stocks.

However, I do think the business will almost certainly survive the current market conditions. In FY 2021, the company made positive operating cash flow of $4.4 million. In H1 FY 2022, the company had operating cash outflows of $0.6m. However, free cash flow was negative $10.6 million, due to a combination of product development and acquisition costs. While I’m certainly not claiming Janison has amazing cash flow, the point here is that most of its cash burn is due to investment, and while it couldn’t cut investment completely, this is nonetheless an expense it does control.

If we exclude acquisition costs, cash burn was about $4.2 million last half. Even if we assume that rate of burn continues (and I do not think it will), Janison has more than 18 months worth of runway, since it has about $15m cash on the balance sheet.

Personally, I think that gross margin is a decent measure of Janison’s growth. It made $12.8m in gross profit in the most recent half, and that’s likely to improve through a combination of growth, and proper integration of recent acquisitions. It is not a stretch at all to imagine Janison making $30m gross profit in a couple of years, especially if margins continue to improve, as forecast.

For a company that is mostly a provider of software, it is not at all difficult to imagine that, once it slows down investment, it could convert about 10% of gross profit into net profit. In fact, that would be a very low net profit margin at maturity, and many mature software companies easily have net profit margins well over 10% (based on revenue, not gross profit!) Using this super conservative measure of what could be the case, in a couple of years, Janison is currently trading on about 33 times this (very hypothetical) profit estimate.

Now, that’s not necessarily cheap, but it does seem pretty reasonable to me.

I have no idea if the Janison share price will keep falling; but I will be checking its full year report closely, to see if it is consistent with the future I have imagined. I would like to see operating expense growth slow considerably, while gross margins and gross profit continue to improve. I’ll want to see minimal cash burn (excluding acquisitions).

Ultimately, if I can be convinced that Janison will reach breakeven without having to raise capital, then I think that any market capitalisation under around $80 million looks very interesting indeed, given the market may be over-reacting to short term unprofitability.

Please remember that these are personal reflections about stocks by an author. I own shares in RPM Global but not Janison Education. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Sign Up To Our Free Newsletter