One of my friends suggested I take a look at Keypath Education (ASX: KED), this morning, because it had just reported its quarterly. I have done so, an placed the company on my watchlist, as a result. I thought I’d share my notes, since there has been minimal public domain coverage of Keypath Education, lately.

Keypath Education is an online program manager for higher education companies. To quote the AFR, “Universities provide the course content and deliver the courses; online program managers such as Keypath, design the course and market the program, while also dealing with recruitment, support and the retention of students.”

The keypath IPO was exquisitely timed; just not for the retail investors who bought it. Take a look at the carnage, below.

Anyway, just as you would expect for a company that has the above share price chart, the company is not yet profitable, and is guiding to “adjusted EBITDA profitability from H2 FY24.” I shudder to think when statutory profitability will be achieved.

The recent quarterly 4C however caught my eye because it was strongly cashflow positive during the quarter. Receipts from customers at $42.7 million USD were well ahead of revenue which was $31.4m USD. This lead to strong quarterly free cash flow of US$8.2 million, bolstering cash reserves to US$41.7m. Of course, it is quite likely future periods will see cash outflows, so I wouldn’t put much weight on a single quarter.

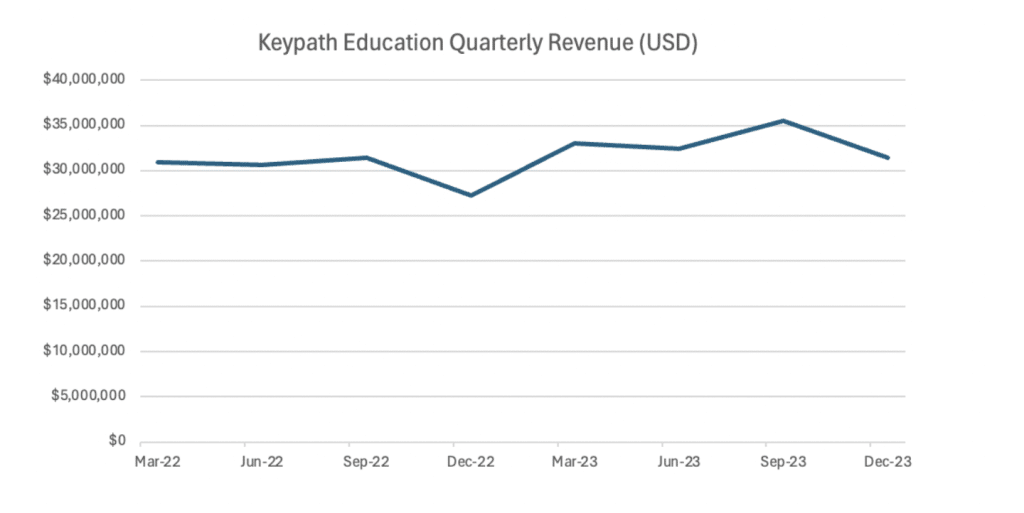

As you can see below, revenue has been pretty flat over the last couple of years. Nonetheless, the December quarter was well ahead of the prior corresponding period.

Keypath says it expects to be funded through to breakeven, but it’s not certain to be the case. I would assume a fair chunk of the cash it holds will be needed to reach breakeven. That said, the current market capitalisation is only about $84m AUD at a share price of $0.39.

While there is no guarantee Keypath will reach profitability, it is fairly reasonable to imagine the company could make 5% margins on annual revenue of (say) US$200m. That would amount to around US$10m or around $15m AUD at current exchange rates. That level of earnings would give a P/E ratio of around 5.5 at the current price, but if it actually reached that level of profitability, then I imagine the multiple would be much higher.

On top of that, this latest quarter lends credence to the claim it will be able to reach breakeven without raising capital.

In contrast to RocketDNA, which I also looked at today, there are no recent posts about this stock on hotcopper, and most chat on social media is (understandably) focused on how terribly overpriced it was at IPO. While I’m not defending the ridiculous price at IPO, I do think that current sentiment is low, which is a good sign. I’ll be keen to follow its Keypath’s progress from here.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in KED and will not trade them within 2 days of publication. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.