I wanted to align my ASX portfolio with my recommendations so that I would be more motivated to write recommendations. The downside of that approach, however, is it removes my ability to make fast, impulsive decisions, which is actually a very reasonable way to behave. As Druck explains, “investors who wait two or three weeks before moving while they investigate an idea often miss 60% to 70% of the move”.

I don’t want readers to miss out on what I think are pretty interesting ideas, just because I can’t act on them myself, so I thought I’d write a quick note on Priobiotec, which is a contract manufacturer and packager of pharmaceuticals and contract packager of canned food, confectionary, alcohol, tea and coffee, vet supplies and other assorted consumer goods.

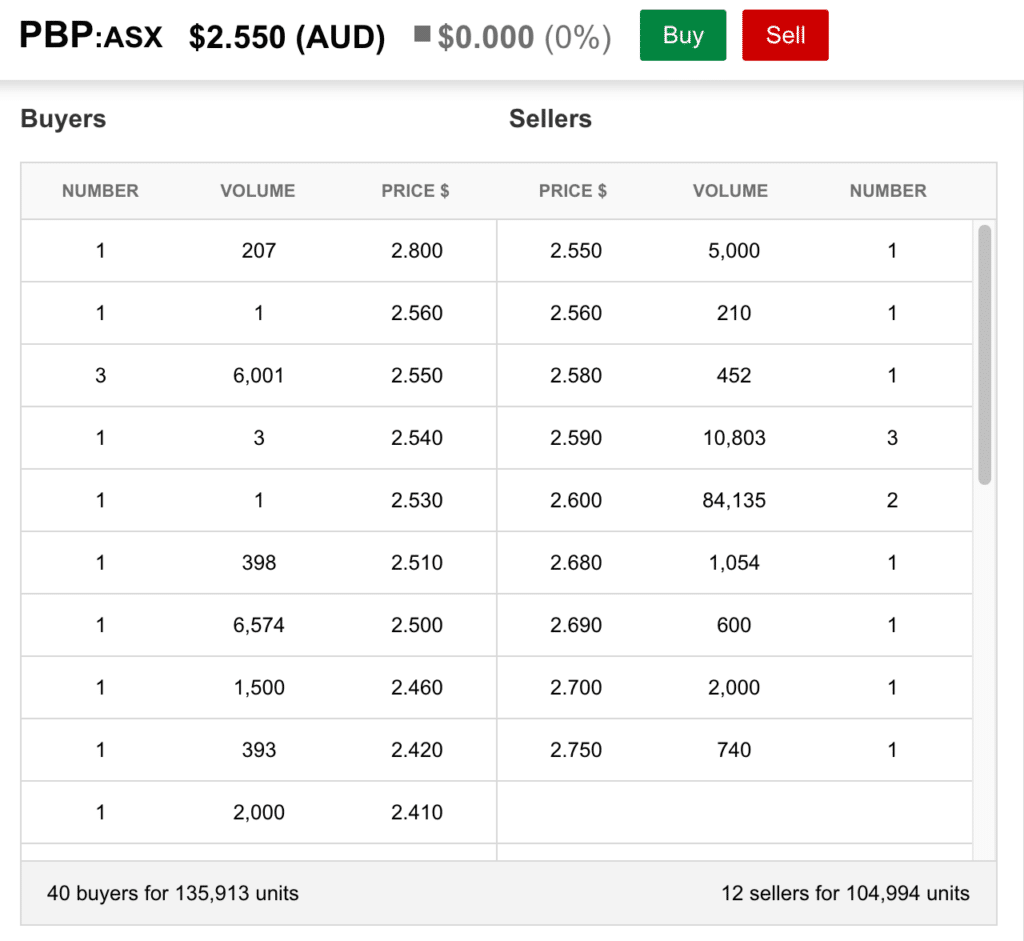

I think Probiotec (ASX: PBP) is interesting at the current price of about $2.55, though it initially piqued my interest when it was around $2.40.

However, before I had a chance to reach a decision on whether I wanted to buy at $2.40, the Australian Financial Review has published an article claiming that recently “the company received an unsolicited approach and had decided to parlay it into a traditional process”. This saw the share price increase about 6%.

I now note the stock seems to be praised by a high profile trader and fund manager on twitter. This makes me a bit cautious, since there is no guarantee that current shareholders talking about the stock won’t turn around and sell into any rumour driven share price rise.

While takeover rumours and stock discussion are liable to boost a share price briefly, if takeover rumours lead nowhere, and existing shareholders cash out thanks to new buyers, then the share price can easily revert.

So while I think that Probiotec shares look attractive, I wouldn’t want to rush to recommend it, given it is getting unusual attention in the AFR, and on twitter, just now.

That said, Probiotec still seems to combine a low price to earnings ratio with strong growth prospects, and that should make it interesting to more nimble investors.

Is Probiotec Growth At A Reasonable Price?

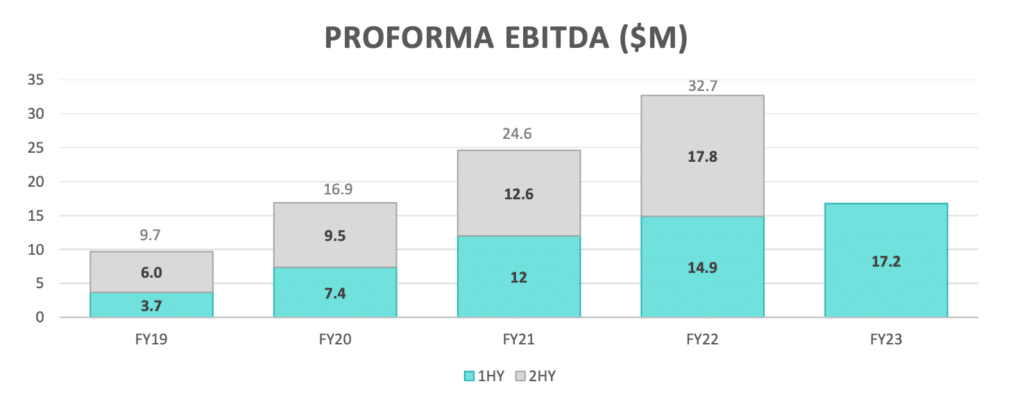

In H1 FY 2023, Probiotec earned net profit after tax of $5.46 million. Putting aside a $617k gain related to reduced contingent consideration on the January 2021 acquisition of Multipack-LJM, the profit would have been around $5m for the half year. Free cash flow was strong, at around $6m.

Looking back at past history, Probiotec usually earns a stronger profit in the second half. In H2 FY 2022, Probiotec earned $9.3 million in profit after tax. If the company repeats that performance, then the FY 2023 profit would be around $14.3 million, even ignoring the gain on reduced contingent consideration.

At a share price of $2.60, Probiotec has a market capitalisation of about $211 million, implying a FY 2023 P/E ratio of 14.7, even if it doesn’t grow in the second half. Since Probiotec has net debt of about $26 million, its enterprise value is about $237 million. A reasonable estimate of normalised EV to FCF might be around 16 – 18.

That might seem reasonable for a low growth business, but the commentary coming out of Probiotec is very positive. For example, the company says it will make EBITDA of $34.5m to $36.0m for FY23. Given first half underlying EBITDA was $17.2m, this implies a second half at least as strong as the second half last year.

Looking beyond that, FY 2024 should also see growth, given “price increases come into effect fully by 1 July 2023.” Furthermore, after a lull during lockdowns, “Cold and flu sales expected to reset above historical levels for the foreseeable future.” Finally, the company only expects the “full impact of the pipeline of new business opportunities continuing to be realised in FY23 and beyond.”

Essentially, the story here is that inflation pressures are easing while on-shoring of manufacturing is driving demand for Probiotec relative to international competition. To quote the Chairman:

“I believe as a result of the pandemic there has and will continue to be a fundamental shift in global supply chains. As such, the outlook for domestic manufacturing, especially in specialist industries such as the pharmaceutical industry in which Probiotec primarily operates, is materially improved. The pandemic has brought to the forefront the need for Australia to have increased sovereign manufacturing capability. Along with this, brand owners need to bring their supply chains closer to or within region to provide greater responsiveness and flexibility to the market and world events. We have seen widespread supply chain disruption and significant freight cost increases along with political and global instability. All of these events have fundamentally shifted the pendulum in favour of local manufacturing and supply or at least a diversification of supply chains resulting in more domestic supply. This onshoring of manufacturing has certainly commenced and we see this as an industry tailwind that is likely to benefit Probiotec for the foreseeable future.”

Whether this tailwind will truly drive earnings higher is a matter for each of us to consider. Personally, I think it might well do exactly that. But on top of that, I also think that this narrative could drive the Probiotec share price multiple of earnings higher.

In H1 FY 2023, Probiotec actually beat its guidance. If that happens again, the combination of another upgrade, solid growth, a reasonably defensive business and a compelling growth narrative could easily combine to see a multiple re-rate. In my view, Probiotec could easily trade closer to 20x earnings than 15x earnings, leaving considerable upside for shareholders.

As a result, it’s fair to say Probiotec is one of the more interesting stocks on my watchlist.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in PBP, and will not trade shares in PBP for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.