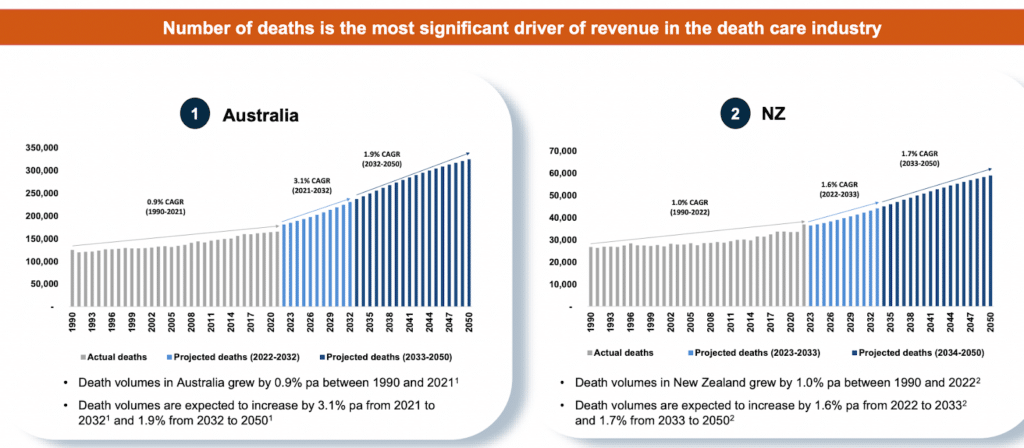

Propel Funeral Partners Ltd (ASX:PFP) provides services and products to the death care industry. These include funeral operations (which make up circa 90% of revenue) and cemeteries and memorial gardens (which accounts for almost all of the rest). The group has a presence in both Australia and New Zealand with a roughly 80:20 split of revenue between the two regions.

Propel Funeral Partners Management

Propel Investments Pty Ltd founded Propel Funeral Partners in 2007 and listed the stock in November 2017. The same team continues to run the business today although the nature of the arrangement has shifted.

At IPO and up until July 2021, Propel Investments managed Propel Funeral Partners externally via a management agreement. This consisted of an administration fee of $240 thousand per year (escalated by CPI) in addition to 20% of total shareholder return in excess of 8% per year. Under this arrangement, a total of $4.9 million in fees were paid to Propel Investments over three and a half years.

Then, in July 2021 the key members of Propel Investments responsible for managing PFP transitioned to being direct employees of Propel Funeral Partners. Those who made the switch include managing director Albin Kurti, executive director Fraser Henderson and CFO Lilli Gladstone.

At the time of the internalisation, the combined remuneration for the above three executives was set at $1.6 million per annum plus up to a further $1.9 million in bonus related pay. In addition, Propel Funeral Partners paid $15 million to terminate the original management agreement.

An independent expert report concluded that the transaction was not fair, but reasonable and that the advantages of approving the transaction outweighed the disadvantages of not approving it.

Directors of Propel Funeral Partners own a combined 22.5 million shares in the company worth $98 million at the current share price. Although I agree with the independent expert that the internalisation was not fair to other shareholders, at least interests are now better aligned as a consequence.

How Does Propel Funeral Partners Grow?

Propel Funeral Partners has grown primarily through acquisitions. This approach yields moderate competitive advantages including increasing bargaining power with suppliers, shared central services and improved internal career progression opportunities for staff.

Funeral homes are stable and durable businesses. Many operating in Australia have been around for decades and in some cases over a century. There are multiple reasons for this.

- Funeral services are necessary regardless of economic conditions.

- It is a reputation based business with trust established over multiple generations due to the extremely slow moving nature of the industry. This makes it difficult for new entrants to establish themselves.

- There are regulatory and capital requirements when establishing new funeral homes and crematoria.

The above factors mean that funeral homes enjoy quasi-monopoly-like positions on a local scale and explains why aggregators such as Propel choose to operate a multi-brand model.

When acquiring businesses, Propel typically also acquires significant land and buildings. It currently has $142.1 million of these assets measured at cost on its balance sheet limiting the potential downside for investors.

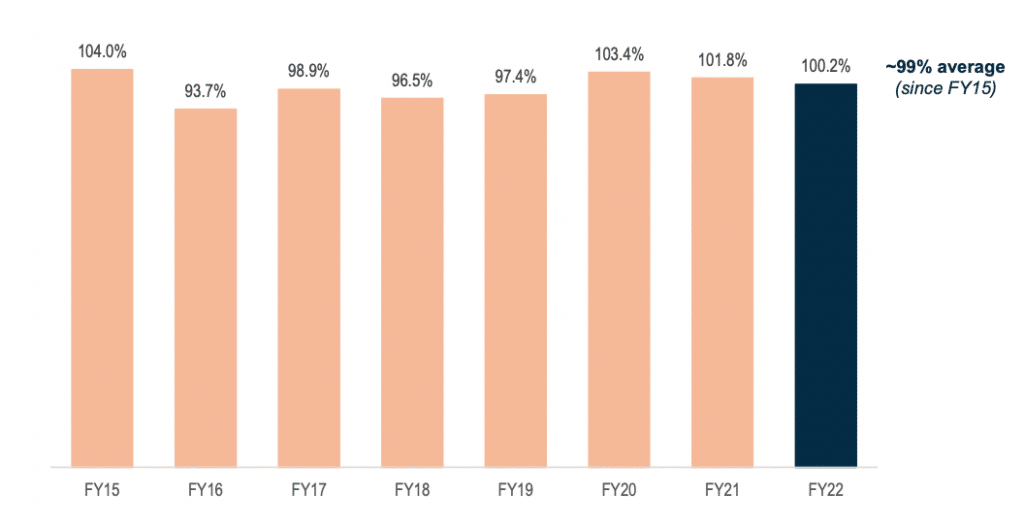

Propel enjoys a short working capital cycle and limited inventory requirements and consequently cash conversion is very strong, averaging 99% since FY15..

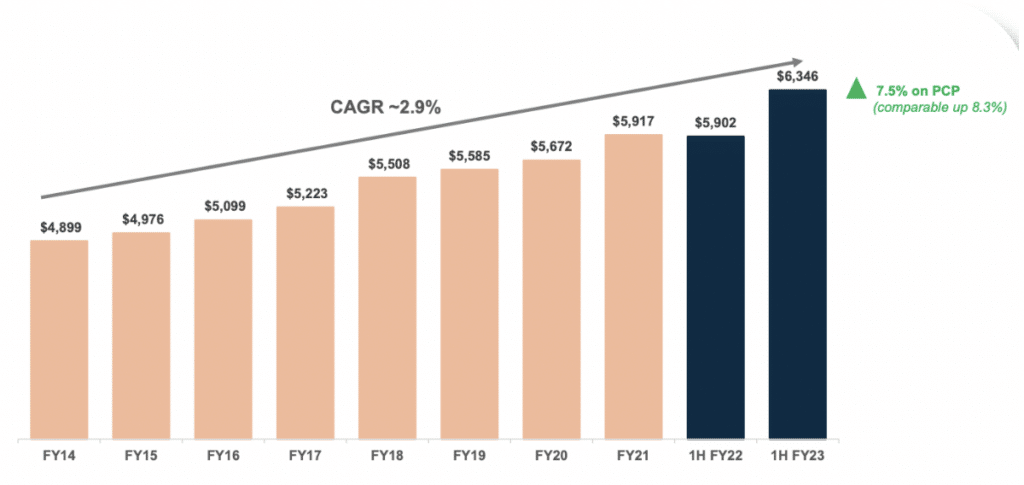

Propel’s average revenue per funeral has comfortably kept up with inflation over the years.

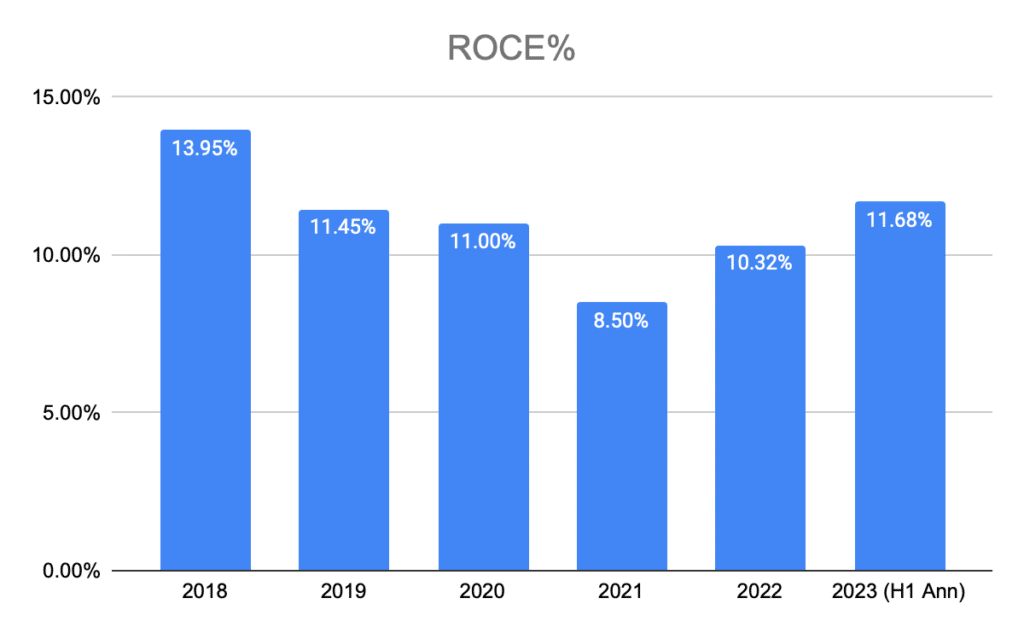

The strengths of the funeral business means that Propel must pay up for acquisitions and this is reflected in the group’s mediocre return on capital employed (ROCE).

The above slump in 2021 was related to Covid, but more interestingly, the trend of steadily falling ROCE may be reversing based on the result for the first half of 2023. This could be because we may have reached a demographic inflection point.

Propel Funeral Partners Competition

Propel is the second largest company operating in the funeral industry in Australia and New Zealand after listed competitor InvoCare Limited (ASX: IVC). Most of the remainder of the market consists of small local outfits.

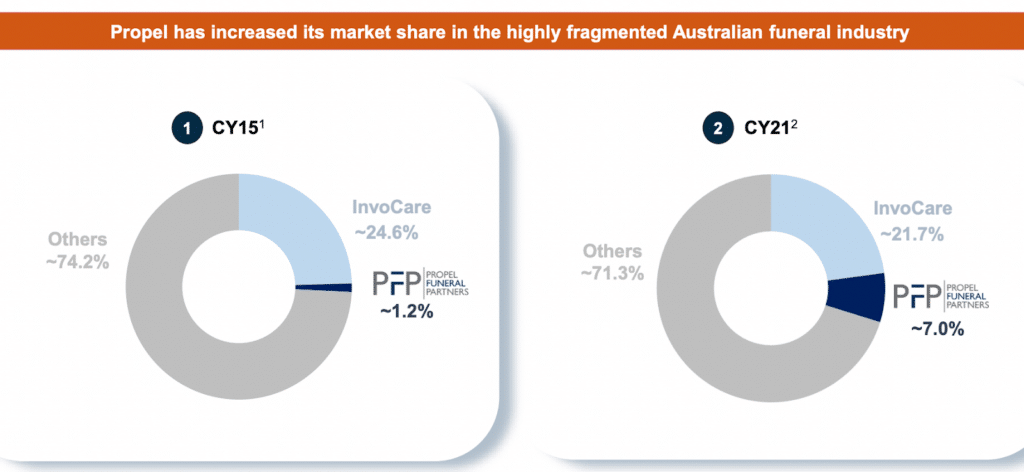

We can see below that InvoCare has lost market share in recent years (measured by volume) whilst Propel has gained considerable share.

Invocare earned $8,536 per funeral in calendar year 2022 compared to $6,346 for Propel in the six months to December 2022 and this price differential may explain why Propel has fared better in recent years.

Despite its lower average funeral price, Propel earns better EBIT margins at 21% compared to 14.4% for Invocare whilst ROCE is broadly similar at 11.7% and 11.6% respectively.

Invocare trades on a higher consensus forward earnings multiple of 31.6 and a lower dividend yield of 2.2% compared to 23.4 and 3.2% respectively for Propel. On a price-to-sales basis, Invocare is the cheaper business with its stock trading at 2.7 times trailing twelve month sales versus 3.2 for Propel.

Recently, private equity firm TPG Global made a $12.65 per share offer for Invocare, a 13% premium to the current share price. The offer has since been withdrawn following reluctance from the Invocare board to provide access to full due diligence. Still, this demonstrates the potential price an acquirer is willing to pay for this type of business.

Why I Own Propel Funeral Partners (ASX: PFP) Shares

Propel Funeral Partners is a defensive and resilient business operating in a growing market with relatively high barriers to entry. Although potential shareholder upside is limited by the high prices that Propel pays to acquire new businesses, double digit returns seem likely going forward due to improving demographic trends, a reasonable share price and ROCE consistently in excess of 10%. Meanwhile, risks to investors are limited given the company’s land and building portfolio, modest gearing and exemplary cash generation track record.

Disclosure: The editor (Claude Walker) of this article does not own shares in any of the stocks mentioned, whereas the author (Matt Brazier) owns shares in PFP (but not IVC). Neither will trade shares in any of the stocks mentioned for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter