I’m not naturally drawn to dividend investing, because the businesses that have the highest ability to compound are generally reinvesting available cash into their own business. However, I still love to have dividend paying businesses in my portfolio because in a sense, it doesn’t matter quite so much what happens to their share prices. For a truly great dividend stock, you’d hope that you could just hold on and be paid back (with interest) by dividends alone, given enough time.

One interesting dividend company is PTB Group (ASX: PTB) which is a terribly vanilla name, but I like to think of as Pacific Turbines. As stupid as it sounds I think they’d probably have a higher share price if they had a better name. At the time of writing, PTB Group shares last closed at $0.975.

Either way, PTB Group has four business segments:

- Aftermarket plane engine maintenance in Australia;

- Aftermarket plane engine maintenance in America;

- Engine leasing;

- Sale of spare or recycled engine parts.

Because PTB is in the business of providing aftermarket care to plane engines, they compete with the engine manufacturers to service propeller plane engines, so they can only survive if they provide better prices and/or service. Generally, I prefer not invest businesses that compete on price, but when you find a business that is really succeeding while competing on price, it’s worth paying attention.

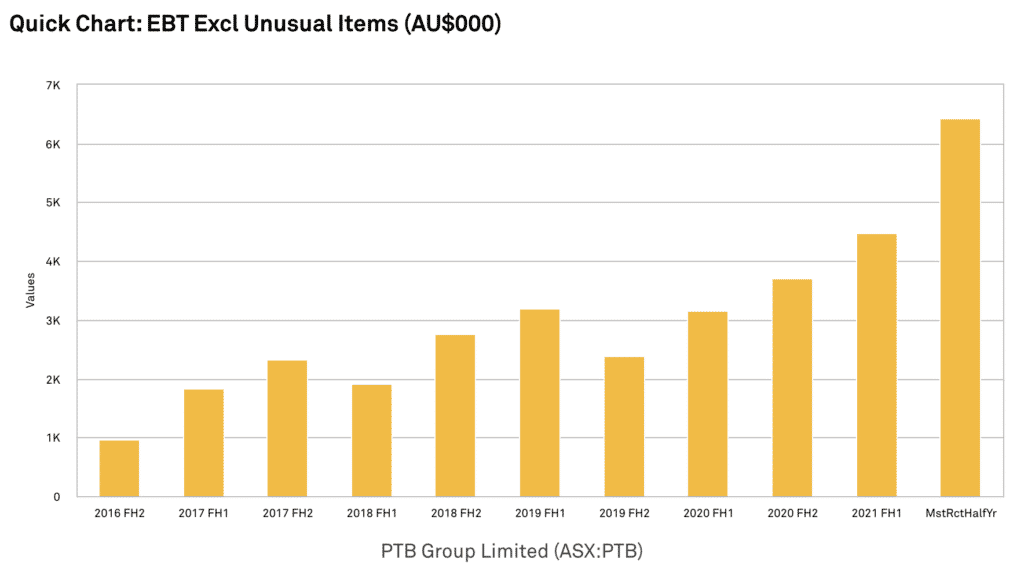

Now, PTB Group which is based in Brisbane, has also expanded into America via multiple acquisitions, so its growth is not organic (which, of course, I prefer to see). However, you can see from the chart below that it has been growing its profit before tax over the years. This suggests that it is successfully competing, and that’s important.

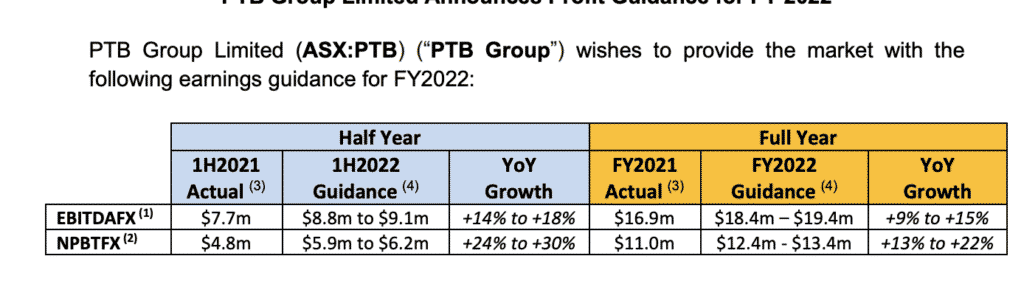

The table below shows PTB Group’s “net profit before tax, excluding foreign exchange gains/losses” which is a reasonable thing to look at, given that they can’t control foreign exchange gains and losses.

If we believe their FY 2022 guidance, then we could assume at least $8.7 million in normalised net profit after tax. At the current share price of $1.05, PTB Group has a market capitalisation of about $135 million, so it’s probably trading on a forward P/E ratio of about 16 or less (assuming a normal tax rate), and a trailing dividend yield of about 4.5%.

Now, if it’s just a medium quality business with unexceptional management, that’s probably about right, or even too high. I’m not completely convinced that rolling up specialist engine maintenance companies automatically creates value, but I can see how it could be very synergistic for one of PTB’s segments, called International Air Parts. This business supplies parts to customers of its workshops. As it increases its number of workshops, that should also increase the profit from its parts business.

And while the company is largely focussed on growth by acquisition in the North American market, it is also growing in the Pacific. PTB Group already counts Trans Maldivian Airways as its largest customer, but it recently added Maldivian competitor Manta Air as a customer, to which it will be leasing some planes. Its leasing business is its smallest business, and doesn’t make much profit, but its growth also helps the maintenance business, because leased planes must be serviced by PTB Group itself.

Unfortunately, the strong reliance on Maldives tourism does mean that PTB Group has been somewhat impacted by the pandemic. In August, the company said that “PTB Group is observing increased levels of activity heading into FY2022 as restrictions on domestic and international travel are gradually being relaxed,” and while I doubt that international travel bans will come back, it is certainly possible that the forthcoming Omicron wave may well harm Maldives tourism anyway. Indeed, that may be one reason the market remains fairly cool on the stock.

Having said that, PTB Group is not a tourism business in the way that Webjet, or even Qantas is. That’s because many of the planes that rely on the smaller engines that PTB Group repairs are not passenger planes. Except for relatively remote places that need small planes (such as sea planes in Maldives) the majority of tourism relies on larger jet engine planes, which have nothing to do with PTB Group. The takeaway here is that while covid can harm PTB’s profits, it is not going to obliterate them.

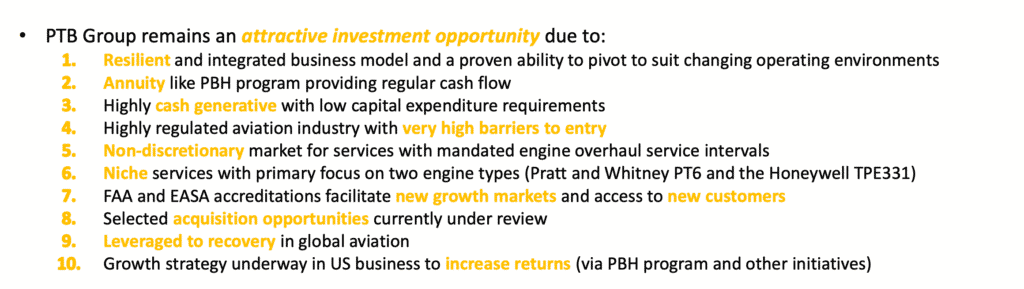

Finally, from a sociological level, I believe PTB Group is behaving in a way that will enhance its reputation (as long as it manages to keep meeting its guidance. I particularly like the fact that it has a small (but global) niche in the engines it primarily services. Generally speaking niches can be more defensible because they are often too small for a larger company to bother competing in organically, so you generally only face smaller competitors. In the case of PTB Group, it seems their strategy is to compete and acquire, and this niche may well be a profitable way to do it.

You can see how they outline the case for their own shares, in the image below:

Please remember that these are personal reflections about a stock by author. I own shares in PTB Group. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Sign Up To Our Free Newsletter