At 8.46 am on the morning of 13 November, insurance and absence management software provider Fineos (ASX: FCL) released a presentation to the ASX, which was not marked “market sensitive.”

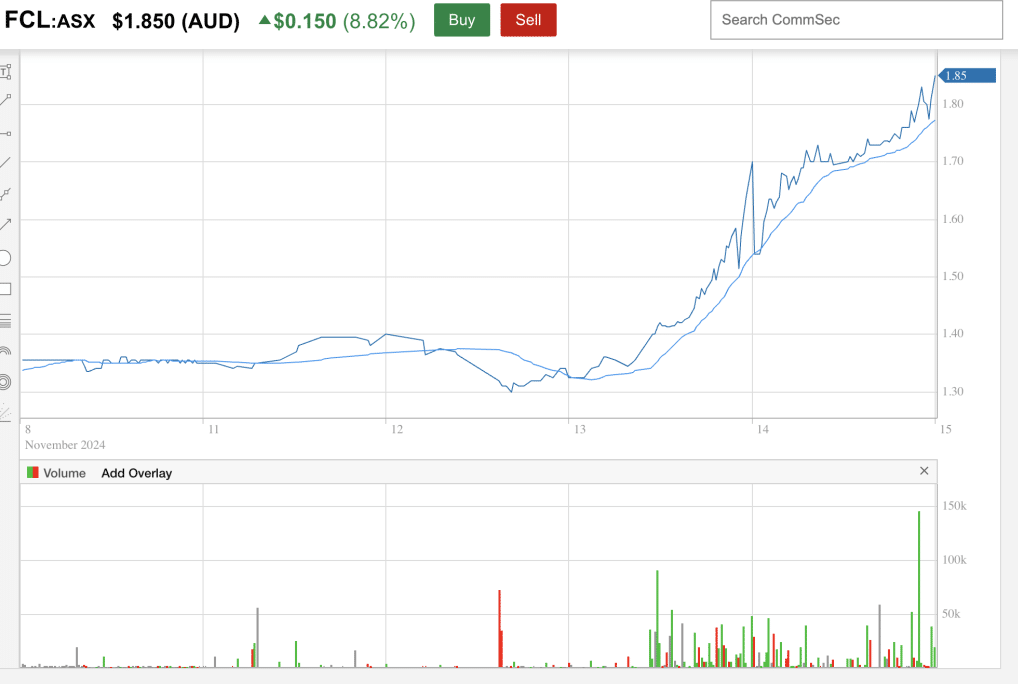

When trade opened at 10 am, there was initially no discernible response to the announcement. However, more than 2 and a half hours after opening, at around 12.44 pm, the share price suddenly began to move. You can see what I mean, below.

Now, I’m not sure exactly what time the presentation was given, but what I do know is that there was an in-person presentation run by key executives, Michael Kelly, Ian Lynagh and Eoin Kirwan.

In my opinion, the timing of the Fineos share price movement suggests that it was the in-person communication with undisclosed market participants that drove the share price response, not the content in the investor presentation that was lodged to the market.

However, Fineos investor relations representative Howard Marks told me:

“FINEOS met its continuous disclosure obligations with the release of the Investor Presentation to the ASX platform pre-market open on the 13th of November 2024. An in person presentation to institutional investors was then conducted which included a page turn of the uploaded presentation with no new material provided. The presentation also included a testimonial from a FINEOS customer and systems integrator which they requested be kept off record, citing potential competitive sensitivity.” [my emphasis]

Since Fineos did not record or broadcast the presentation, I cannot be sure what the management team actually said.

However, if we assume that they only read out the presentation verbatim, without adding any other useful information, then logically, it may have been the “off-record” testimonial from “the Fineos customer and systems integrator” that moved the market.

Alternatively, there may have been something in the specific words said by the presenters, or the way they were said, that moved the market.

What we do know for sure is that after the presentation on 13 November, MA Moelis Australia Securities increased its EBITDA estimate for FY 2024 from $13.7 million to $15.6 million. This is more significant given that the company had already reported H1 FY 2024 results, so the $1.9m increase in the estimate must reflect a view of the second-half result.

When I asked the company’s CEO why he personally believed the share price responded to the presentation in the way it did, I received another answer from the aforementioned Howard Marks. He said:

“As the presentation clearly outlines, this was a “line in the sand” moment for FINEOS where it outlined the operational and financial progress it has made since the Company’s listing 5 years ago. The FINEOS CFO then discussed the company’s financials (slides 17-22) and reiterated previous guidance that FINEOS would move towards a positive free cashflow position in FY25. This was well received by the market demonstrating the company’s confidence and negating any suggestion that there is a need to raise further capital. The CEO then outlined the total addressable market of the industry before covering 3 and 5-year target financial metrics. This was the first time such metrics had been released by FINEOS and was also positively received by the market.”

I don’t personally agree with this assessment because the 3 and 5-year financial metrics would not really provide much basis for MA Moelis to increase their FY 2024 EBITDA estimate by as much as they did, and in my experience the market generally doesn’t move a stock just because the management releases 3 – 5 year “target.” And if the release of a 3 – 5 year target was market sensitive, I would have expected the presentation that published those targets to be marked market-sensitive; but this presentation was not marked market-sensitive.

In the past, Fineos has itself reported that representatives of Unum, NYL-GBS and Beneva (Canada) tell “stories about how they have moved to the FINEOS Platform to retire legacy systems and deliver real benefits.” I was, therefore, surprised to hear that certain testimonials had to be withheld from retail shareholders on the basis of potential competitive sensitivity.

What could possibly be so sensitive, given that Fineos already discloses customer testimonials on its website?

Retail Shareholders Treated Like Second-Class Citizens

As you can see below, the Fineos share price reaction to the private presentation and testimonials (as well as the publicly released set of non-market sensitive presentation slides) had an extreme impact on the Fineos share price.

Imagine you were a retail shareholder who didn’t know that the public submission of a non-market sensitive set of presentation slides might actually signal that other market participants were getting access to information you were lacking.

Imagine if you saw the share price spike from ~$1.40 to ~$1.60.

You might just take the gain of around 15% simply because you did not understand that the buyers probably had better-informed views nourished with the richer information one gains from hearing an enthusiastic management team present.

Not having experienced whatever occurred in that private setting, you’d have watched the share price – inexplicably – gain another 20%, even after rising the initial 15%.

I asked the Fineos CEO why he chose to have a private presentation and not record it for the benefit of retail mugs such as myself. To his credit, he answered this question himself. He offered to have a Teams call with me and wrote:

“We have never released recordings of investor update presentations in the past and to be honest you are the first person who has suggested we should. We invite all the analysts we know to our meetings so they can advise their clients of our updates. Several analysts attended our recent meeting, and we also offered them one on one’s after we released our presentation on the ASX website. This approach has worked for us to date.”

If the CEO of Fineos is waiting for one of the investors who was invited to a private presentation to suggest he make that presentation public for all, thus negating any potential advantage they may have, he may be waiting a long time.

It is, of course, only the people who miss out on a private presentation who would ask for it to be made public.

At least someone has asked him now.

Disclosure: The author of this article owns shares in FCL and will not trade FCL shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Ethical Investment Advisers Pty Ltd (ABN 26108175819) (AFSL 343937).