While this article focuses on the share market during the pandemic, it in no way seeks to minimise the very real human tragedy that is occurring.

When markets opened on Thursday 2 April, the share price of accounting software provider Xero (ASX: XRO) fell 5 per cent in 10 minutes. But this was not on the back of some dramatic, market-sensitive announcement. In the current environment, such jitteriness seems to be the new normal, at least for the time being. At the time of publication it’s up 4.5% in a couple of hours since market open.

From the start of the crash in the third week of February, Xero’s share price dropped by a third on 23 March, down to $58.75 from a high of $89. It currently trades just under $68.

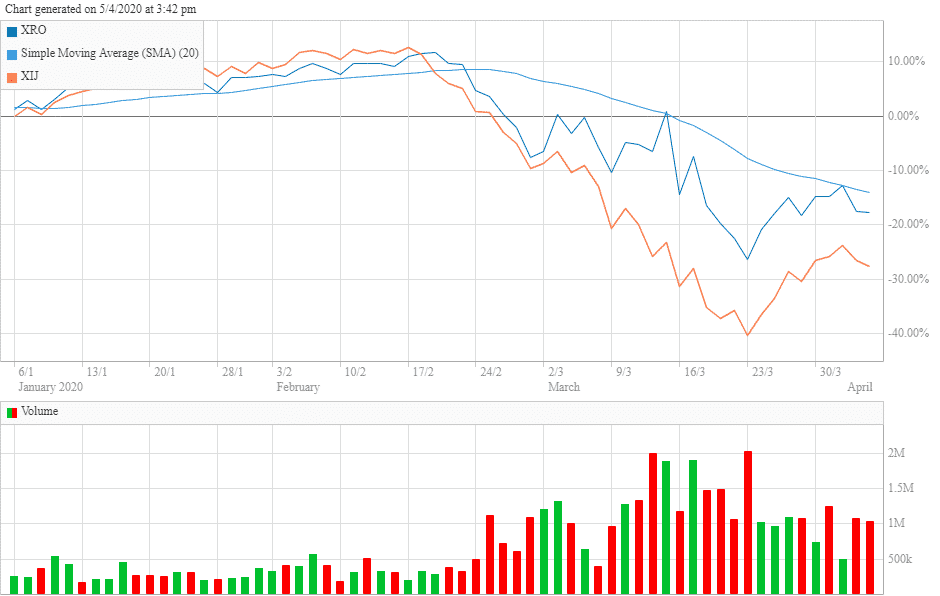

Despite the retrace, Xero (shown in blue in the chart below) has held up well relative to the other ASX tech companies (the XIJ index, shown in orange).

For the record, the falls on the tech index closely parallel the falls on the ASX as a whole.

During the pandemic, it makes more sense to think on a case-by-case basis about tech companies’ clients and how they might be affected by the pandemic and the coming recession, instead of grouping all tech companies together.

Wisetech Global (ASX: WTC), for instance, a software developer for international logistics, was remarkably stable through January and February as the news about coronavirus was piling up, before its share priced crashed after results in February. It’s currently down about 50% from its pre-results share price. Given the prominent criticism by short-seller Jcap, and the large write-back of contingent consideration, this is not particularly surprising.

In contrast, Appen (ASX: APX), which produces data to train machine-learning algorithms for big tech, is only trading 20% below its February highs, roughly the same as Xero.

However, there is a big difference between Xero’s customer base and Appen’s customer base. The small businesses who are the primary customers for Xero’s accounting solutions have understandably been hit hard by the pandemic. Many of its clients must be on the brink of going out of business.

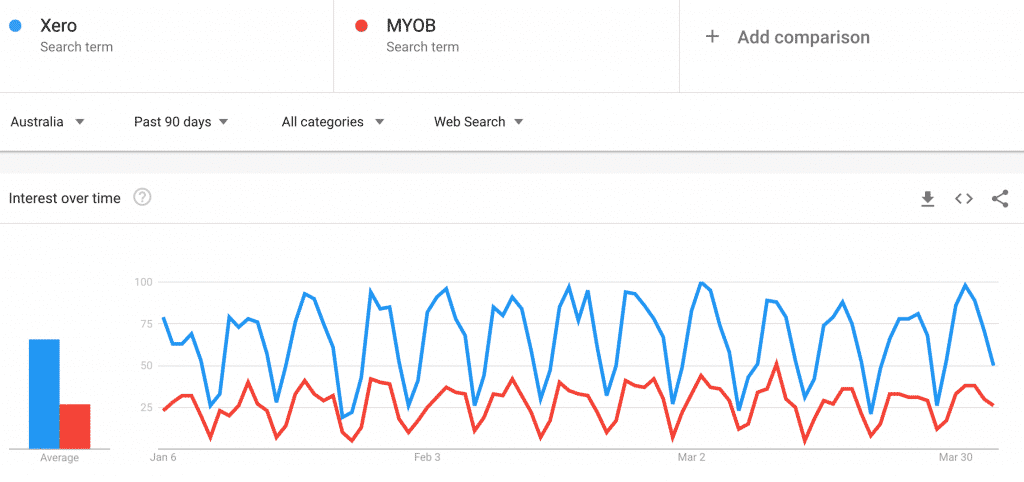

On the other hand, government support for small business and the jobless in Xero’s main markets (Australia, the US and the UK) will help stabilise the situation for those customers. At this point, google trends is not showing any drop off in searches for Xero or its main Australian competitor.

Nevertheless, we would have thought a pandemic would have a more severe impact on the Xero share price than on the Appen share price.

Perhaps one argument in favour of the Xero’s relatively modest share price decline is that Xero could benefit from the crisis, as established businesses (disproportionately using its older competitors) vanish and younger people start up their own ventures using a more modern cloud accounting platform.

Although it’s currently trading above our target buying price range, Xero earns a spot on our Fluffy Dog Watchlist For Investing In A Pandemic because of its mission critical provision of software to over 2 million customers. On top of that, the software platform continues to improve off the back of external contributors thanks to the company’s App ecosystem, which allows customers to plug in over 800 specific applications.

Our biggest concern is that the impact of the pandemic has not yet shown up in the numbers, so it’s hard to gauge how bad it will be. If the impact is more severe than the market currently realises, the lifetime value of Xero’s customers could turn out to be a lot less than the company had envisaged. This would have implications for its unit economic (that is, the balance between the value of a customer and what it costs to acquire a customer).

Christian Tym does not own shares in Xero.

This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.