The share price of communications management software company Whispir Ltd (ASX: WSP) has undergone one of the most brutal drops — then reversals — I have seen throughout this pandemic. After trading as high as $1.59 in February, it fell more than 50% during march, touching on 70c. Then, after stating that the virus had in fact “increased demand for communications software,” its share price more than matched the market on the rebound, hitting an all time high of $2.02 just yesterday. Of all the stocks covered in software week, this one is my favourite.

Whispir (ASX:WSP) Is Much More Than Email

As the world, and indeed businesses, have moved online the ways of communicating with employees, clients and potential clients are increasing. But the humble MailChimp account with its email lists doesn’t really cut it anymore. Businesses, big and small are looking to be able to text, call, send push notifications, and email.

More than that, they want to have useful ways of automating list creation. By way of (completely hypothetical) example, if a private health insurer is trying to warn someone they need to update their credit card details because a charge has failed (perhaps they lost their card) they might want to start with an email. If the person opens the email but does not action it, they might want to send another email, perhaps at a different time of day. So far, an email service would probably suffice.

But what if the emails just are not being opened? In that case, the insurer might want to send a text message with a live link in it that allows the person to go straight to the website and do the update. And if that doesn’t work, they might want to schedule a call from one of their call-centre operators to the client, directly.

When it comes to making the call, or managing the texting, many enterprises use Twilio (NYSE: TWLO) which just reported “total revenue of $364.9 million for the first quarter of 2020, up 57% year-over-year.” That result saw the share price soar over 50% in just a few days, from about $122 to $190.

Now, I’m not doubting the utility of Twilio’s communications API’s. They can solve the connectivity problem for just about any business. But for many businesses, especially those who don’t want to develop their own infrastructure from scratch, Whispir’s software can help them make the most of their various communication tools. Twilio sees that, and so partners with Whispir, and has reportedly even referred customers to them, to help them set up the API.

You can see below that Twilio shared Whispir’s marketing video on their channel a few years ago.

Of course, that does not mean that every company that uses Twilio should use Whispir, but it does suggest that, at least at one point in time, Twilio saw Whispir’s software as an attractive enabler for their clients.

Unfortunately, multiple attempts for me to get a free trial for A Rich Life to test Whispir’s software have failed. Posing as a potential customer, I can only assume that my request has been vetted and not prioritised. That makes sense, because Whispir says it is facing high demand, is generally designed for larger enterprises, and is largely sold through resellers anyway. We’re a long way from needing push applications.

But I’ve had enough experience in one-to-many communications to know that looking after customers can get fiddly. I struggle hard enough curating my MailChimp lists, and in a prior role I’ve seen the inefficiency of using one platform for mass emails, another separate one for SMS alerts, and a Zendesk for answering emails. It gets fiddly, and that’s before you get to the fiddly task of maintaining separate lists. It just makes sense to store as much communication with customers in the same platform so you can maximise the chance of successful communication.

The Coronavirus Pandemic Impact On Whispir

At first when it became clear that the coronavirus pandemic would be a major world event, I thought that Whispir might be in trouble, since it is not yet profitable and only has about one and a half year’s worth of runway, at current cash burn rates. I thought that a global recession might see companies look to cut costs. Given Whispir’s software is designed to increase efficiency and improve outcomes for business, it’s not hard to see customers doing it tough trying to cut their bills. With impacted companies like Disney on the books, you could definitely see how the epidemic could hurt Whispir.

However, with huge monetary and fiscal stimulus designed to keep dead companies walking, many of Whispir’s clients are deciding it is more important than ever to keep in touch. Many readers would have experienced the onslaught of Covid emails from every company they ever dealt with.

In actual fact, as big companies look to re-open their venues (under new rules), reaching out to customers will be ever more important. On top of that, Whispir tends to focus on large enterprise customers, rather than small and medium sized businesses. These larger companies have access to cheap credit, an enhanced negotiation position with suppliers and landlords, and a lot more to lose from shutting up shop, so all else equal they are more likely to survive than the small and medium businesses that provide so much colour and employment to our societies.

Yes, there may be a dystopian future in front of us where the big get bailed out and the small perish. In that case, Whispir should thrive. In the alternate case, where we do have a really bad recession, Whispir should still be able to survive given plenty of its existing customers, including educational institutions and governments, are not going anywhere. On the other hand, we do note that the company unwisely highlighted Virgin Australia as a customer in its prospectus. That probably didn’t help when Virgin went into administration as soon as the crisis hit!

Whispir Ltd (ASX: WSP) Financial Performance

This post is not financial advice, and you should click here to read our detailed disclaimer.

Whispir fits into the classical business-to-business software as a service (SaaS) framework. Key metrics to consider therefore include customer acquisition cost, lifetime value of customer, annualised recurring revenue, and customer expansion rate (that is, how much a customer increases their spending).

According to the prospectus, customer churn is about 12%, which implies a customer retention rate of around 88%, which isn’t mind-blowingly fantastic, but is definitely good enough to build a very valuable business on. On the bright side, though, the company loves to tout its “revenue retention rate”, which I call customer expansion, of over 120%. Now, this figure excludes certain customers, so it’s somewhat manufactured, but it does show good evidence that as Whispir’s own customers flourish, and benefit from their platform, Whispir will benefit in term.

This sort of whale barnacle growth strategy is a key feature of any good enterprise facing SaaS company. Whispir announced it has 558 customers with annualised recurring revenue of $40.5m, which implies under $70,000 per customer. While this seems like a lot to you and I, this is not a large spend for customers like Telstra, the Victorian State Government, or BHP (though I’d assume those large customers spend more than the average!)

Thus, Whispir can attach itself to successful companies or enduring organisations like a barnacle on a whale — it will go where they go. So while as a group its customers may face a hard time with covid-19, Whispir has an opportunity to grow its customers more rapidly, at lower cost.

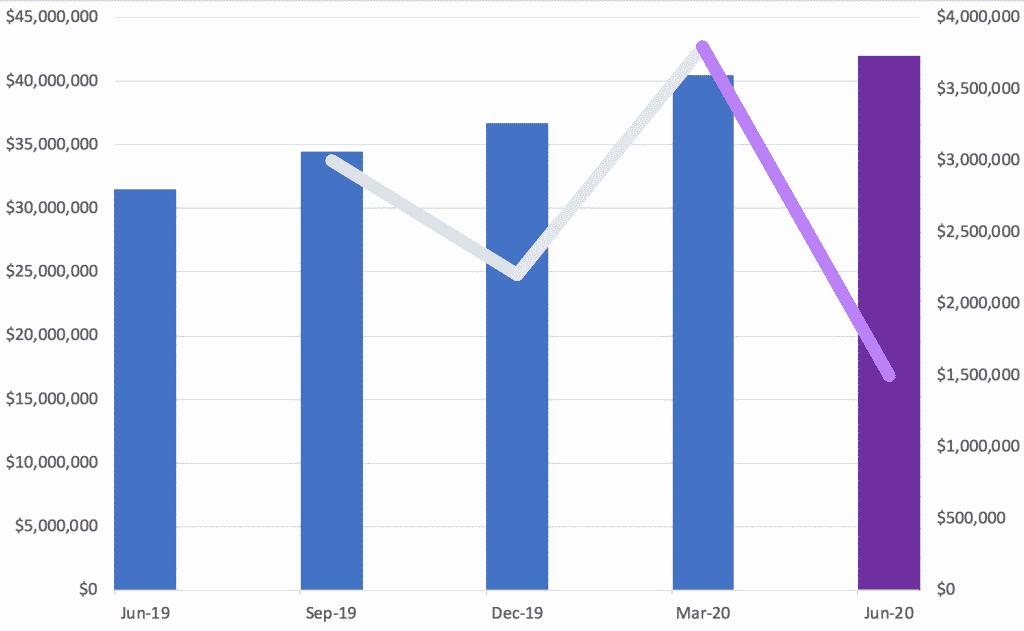

That brings me to the latest quarterly. In it, Whispir had weaker receipts from customers, though that was partly due to unexpectedly high receipts last quarter due to more successful cash-collection (that is, a reduction in working capital relative to revenue). Importantly, it did expand its customers by 49; that’s 9.6% in a single quarter. That’s a significant acceleration, given the other 509 customers took the company more than 15 years to accumulate, and the company kept its sales and marketing expenses completely steady. You can see the corresponding increase in ARR, below.

In the chart above, the purple bars show the prospectus forecast, the blue bars show the past results and the line shows the quarter-on-quarter increase in ARR. As you can see, the company would have to achieve the smallest increase in a year, in the current quarter, in order to fail to surpass its forecast.

I think it’s more likely that the company will beat its original forecast ARR of $42 million, and book closer to $44 million in ARR by the end of FY 2020. At the current share price of $1.995, that would mean it is trading on less than 5 times FY 2020 ARR, even while growing it at almost 40% per year. Importantly, I would not expect this to command a high multiple of ARR, as the gross margin is only about 64%, which is towards the lower end of the range for SaaS companies.

Finally, Whispir reported in February that the LifeTime Value of a customer (LTV) is 7.6 times Customer Acquisition Cost (CAC). Xero Limited (ASX: XRO), a top notch B2B SaaS business today reported a ratio of LTV/CAC 5.8, though before you get too excited, keep in mind these figures are non-standard, can be calculated differently, and inevitably vary over time (usually, but not always, deteriorating).

On top of that, the most significant feature of the recently reported LTV/CAC of 7.6 times is that it is well below the 12.1 touted at the time of listing, and comprehensively disproves the prospectus claim that; “We expect this to improve as our investments in our sales and marketing activities deliver benefits in future periods.”

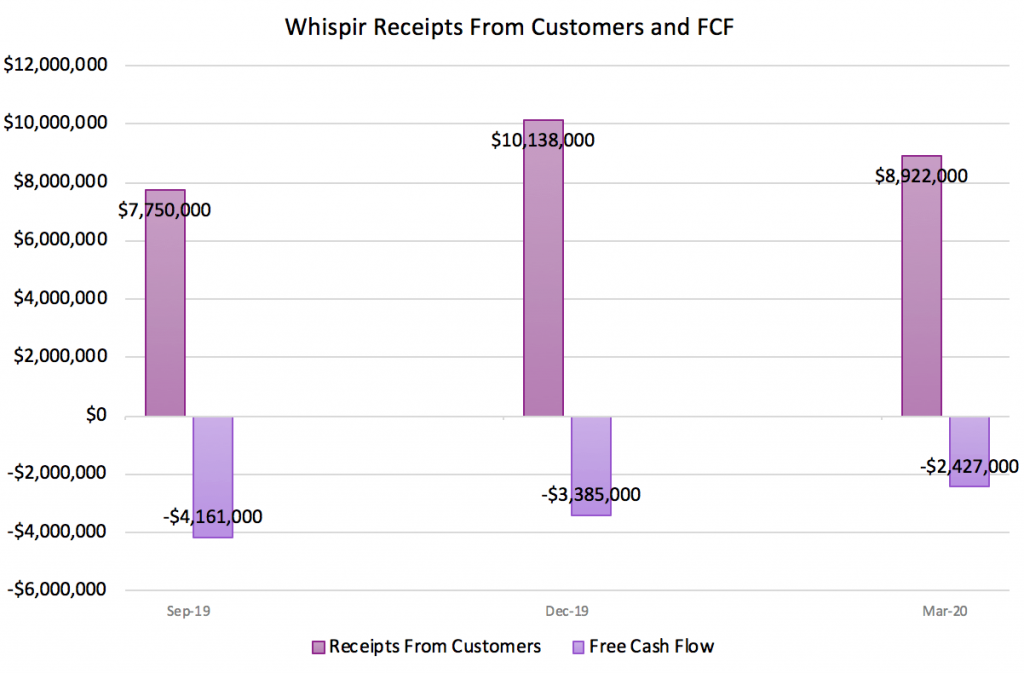

Finally, looking at the cashflow itself as a measure of Whispir’s optionality and resilience, we can see that it is actually edging towards free cash flow breakeven.

The company has over $16 million in cash, and it seems likely it can reach cashflow breakeven shortly after ARR hits about $50 million. If recent growth rates are maintained, that could be some time next year, and in any event, it seems likely that it wouldn’t be in dire need of cash to continue operations. This is important because it implies raising capital will be an option rather than a necessity.

Whispir’s Capital Structure

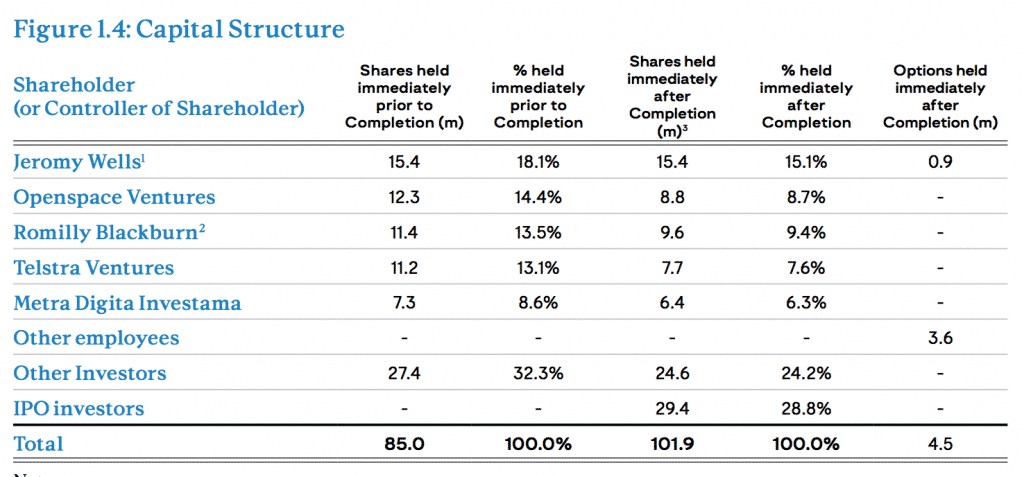

At IPO, Whispir was priced at $1.60 per share, and existing holders did not sell very many shares (and the CEO did not sell any). What you can’t see below is that 42.5 million shares are held in escrow until the release of the FY 2020 results.

It’s anyone’s guess how those shares exiting escrow will affect the share price: it could be an opportunity for funds to get in, giving the company more attention, or it could see large lines dumped on the market. I suspect that the venture capital investors may look for an exit at some stage, at the very least. In any event, the FY 2020 results will be very important.

Does Tomorrow Look Better Than Yesterday For Whispir?

In our framework for sorting opportunities in the pandemic, Whispir would be considered a short term beneficiary (through increased demand), a long term beneficiary (through retaining clients won during this period) and a paradigm shift beneficiary (as digital commerce makes communications more frequent, and in-store visits less frequent).

At a company level, I’ve had concerns about the Glassdoor reviews that describe the company as a “dumpster fire”. I know for a fact that many companies game their glassdoor reviews by encouraging happy employees to flood it with positive feedback. These reviews are seldom interesting or useful and should be taken with a grain of salt. The fact that Whispir is too busy to game Glassdoor does not bother me in the slightest.

Critical reviews do not mean a company is bad. Rather, they give you an external way of measuring how the company manages its growing pains. If it is not dealing with issues, that could be a problem. But if it is, that can be a good thing too. Happily, I note that over the last few months Whispir has hired a new Chief Technical Officer and a new Chief Product Officer. That’s a fairly big move to refresh company leadership and culture, and I’m cautiously optimistic it shows that the CEO (and co-founder) is fairly open to improving the team.

Whispir’s Spot In My Portfolio

To quote Stanley Druckenmiller “The risk-reward for equity is maybe as bad as I’ve seen it in my career.” Overall, that makes me cautious, and I have about 30% of my portfolio in defensive assets to give myself optionality in a worst case scenario. In that case, I imagine Whispir will prove over-priced.

However, should markets keep rallying on central bank liquidity, I see Whispir as having a long way to run from here. To quote Stanley Druckenmiller again, the “biggest surprise [is] how unbelievably well [leaders] can run their companies remotely.” In this scenario, I can see Whispir becoming increasingly relevant as the SaaS service is well suited to simplify what can be complex communications with both staff and customers.

This post was originally published exclusively to Supporters of A Rich Life. You can join the waitlist to become a Supporter right here.

This post is not intended as advice and should not be used as the basis for a buy or sell decision. You should click here to read our detailed disclaimer.