There are many reasons that mining is an unattractive place to invest. First of all, it seems the industry is full of charlatans, perhaps even more so than biotech. Second, most so-called mining companies are in the exploration phase, and their main mission is to raise more capital, in hopes of reaching development. Third, even when you do stumble upon a profitable resource company, they tend to be extremely pro-cyclical, meaning that they ride high when things are booming, but crash hard in a recession, when demand fades.

And yet, despite all this, mining create enormous wealth. Essentially, the act of mining is just harvesting something nature made. And essentially, low cost mines do have a competitive advantage, whether that be due to access to transport infrastructure, a superior resource, a low cost workforce or optimal procedures and automation.

If only there was some way to clip the ticket on mining companies.

A Pre-Eminent Mining Company Enterprise Software Company

Enter RPM Global (ASX: RUL) a software and advice company focussed on helping mining companies run their own operations more safely, efficiently and profitably. RPM Global has a long history as a listed company, having originally been more focussed on its advisory business, both under its original name, Runge, or subsequent word salad appellation, RungePincockMinarco.

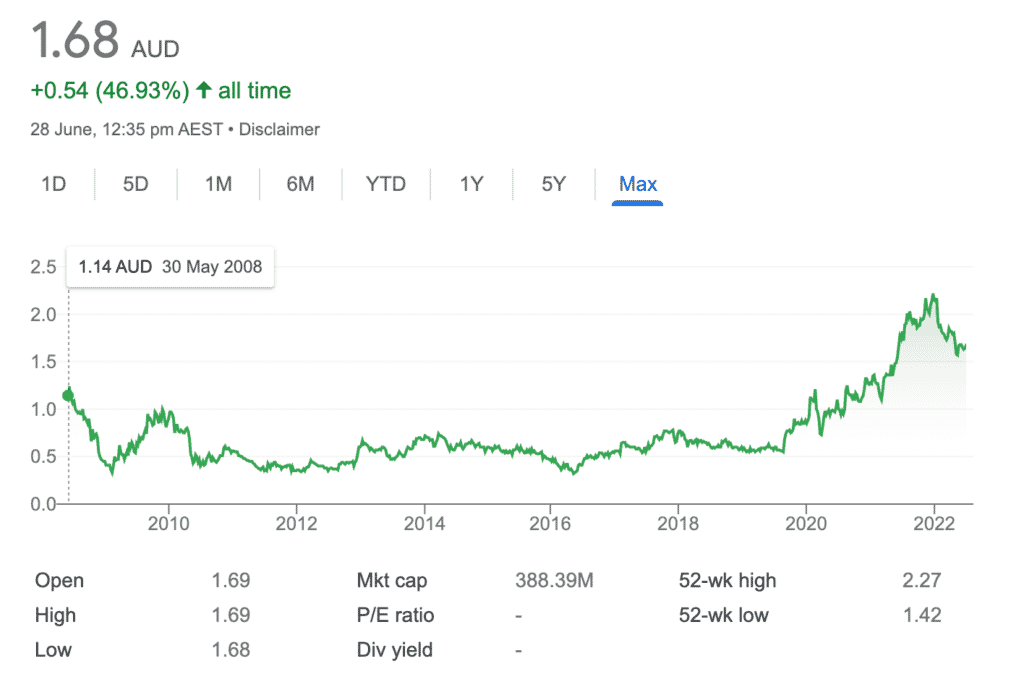

As you can see above, the company briefly traded above its $1 IPO price, before doing what some mining services businesses seem to do best; destroying shareholder wealth.

The story became interesting in 2012, when experienced enterprise software executive Richard Mathews became CEO and purchased a significant stake in the business, on market. He began the lengthy process of refocussing the company on its more resilient software division. By the time I started following the company closely in 2014, it was fair to say that the company already provided mining firms with a wide selection of software solutions, though the software suite has since greatly expanded through a combination of in-house development and acquisitions.

One example of their software is the XERAS Enterprise solution, which was developed in collaboration with the world’s leading provider of business software, SAP. You can see an explainer video for that product, below.

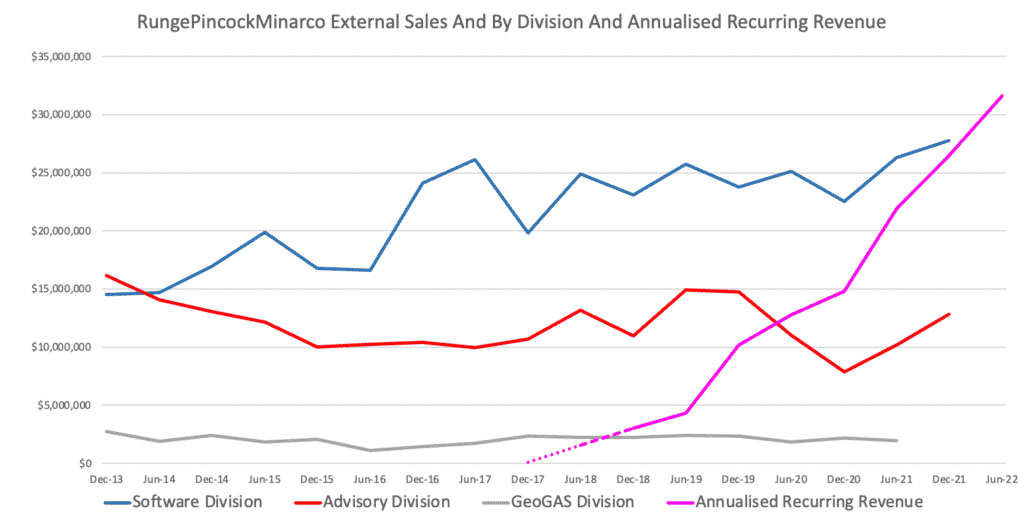

When Richard Mathews took over as CEO, the company had three main business segments. GeoGas, which is coal gas compliance and exploration content testing services for underground coal mining companies. It was finally sold for $500k, last year taking a $4.9m impairment. I have long believed RPM Global would be better off without GeoGas, and was glad to see it go.

The second business segment is the Advisory business, which the company touts as using “deep domain knowledge” to “help organisations solve their most complex challenges across every stage of the mining lifecycle.” Personally, I think this business can be best thought of as a management consulting firm, focussed specifically on mining companies. That kind of business can be reasonably profitable when going is good, but has nasty operating leverage when demand weakens, because you still have to pay for the expert employees who provide that “deep domain knowledge”, no matter how busy they are.

I personally do not think this business adds much as a standalone operation, but clearly it is a gateway to selling (or upselling) the software solutions, so it makes sense as part of the overall business.

The most important part of the business has always been the software. This business has been undergoing an important change over the last few years.

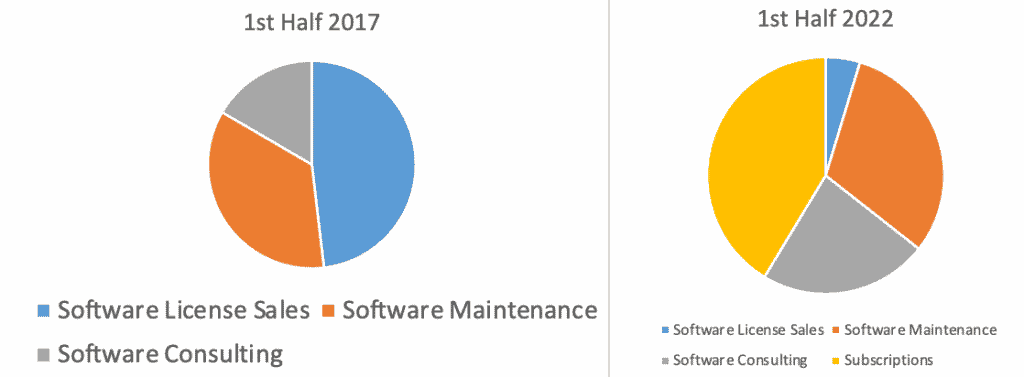

Five years ago, the vast majority of the company’s software revenue was from one-off license sales. The second biggest chunk was from ongoing maintenance sales, but there was a significant portion of the revenue from software consulting, often part of an implementation project.

As some of you will be aware, the process of transitioning a software license model to a subscription model reduces revenue in the short term. Under the old model, a company might pay $1m up front, and then $100,000 every single year, to maintain the software. Under the new model, a company might pay $250,000 every single year.

In 10 years, RPM Global will earn 25% more revenue for the same product (even without price rises), but in year one, its revenue will be 75% lower, from the same contract. This means the reported software revenue might look flat (or even down) simply because the company is converting license plus maintenance customers to subscription models.

And indeed, that is exactly what we have seen with RPM Global. In the chart below, you can see that the external revenue (the blue line) from was pretty much flat from 2017 to now, even while the annualised subscription revenue (the pink line) grew rapidly from virtually zero in 2017 to $31.6m yesterday.

A Quality Stock In The Making

Some of the key reasons I have been less than enthusiastic about RPM Global in the past are fast receding into the rear view mirror. I have never been a fan of their coal-focussed GeoGas business, and now it is gone.

The company was previously losing money, but in the most recent half it made a small profit before tax. The company burnt through $12.3m in cash during the first half, but it always has a much stronger second half cash flow, because maintenance payments are due on January 1 each year. That may see the company breakeven at a free cash flow level, excluding acquisitions.

Furthermore, the company has been buying back its own shares, suggesting that the management believe it has excess cash. This supports the view that the company is at a profitability and free cash flow inflection point.

There is an important tailwind that may also be blowing more strongly over the next few years; the appropriateness of cloud software, for mining companies. Chief Investment Officer of Maven Funds, Matt Joass, explains the opportunity, while also highlighting that there is some risk that mining companies may be more difficult to transition to the cloud. I quote his words below, with permission:

“The mining industry has been a laggard in its shift to the cloud. As we outlined earlier there were some good reasons for this, such as poor internet connectivity in remote areas. We now see this transition to the cloud accelerating due to low-earth-orbit satellites, Covid-19 accelerating digital transformation, and a new generation of Chief Technology Officers coming to the fore. RPMGlobal’s software is still primarily an on-premise solution as its customers were not previously ready to fully adopt SaaS. As the industry now begins to shift to the cloud it is a big opportunity for RPMGlobal to transition to a true SaaS business, and we think they have a lead on competitors. But the transition still requires more work from RPMGlobal. If RPMGlobal are sluggish to bring new SaaS products to market, or if a new cloud-first competitor emerges, it could see RPMGlobal lose their edge.”

Overall, I think RPM Global will need to continue to execute strongly to justify its current share price of around 12.4 times annualised recurring revenue. Compared to many software companies, that multiple is still quite high, given the sell off in growth stocks.

Having said that, RPM Global probably still has quite a bit of likely growth ahead of it, given that a substantial portion of its customers are still on a license plus maintenance model. That said, a sufficient number have already transitioned to subscriptions, so going forward the negative (short term) impact of the transition should lessen. That means we should see improving statutory results, over the next few years.

If RPM Global remains a well run company, it is quite possible to see it earning perhaps 20% net profit margins on software revenue of around $50m. Even assuming zero profit from its Advisory business, that would equate to around $10m in net profit.

The company would still boast solid growth rate, in that hypothetical scenario, and looking at profitable high quality software peers, I think a P/E multiple of around 50 would be quite possible. That would already imply a share price 25% above the current price, but the alluring part is that this is potentially a multi-year compounder that could keep on growing profits for very many years to come.

That means that I’m really keen to emerge from the current market conditions with a decent holding of RPM Global. I would like to buy it cheaper than the current price, but I’m willing to accumulate cautiously at these levels, and did buy a small parcel recently at $1.58.

I can’t be sure the right price to buy, but I can be sure that as a company with aligned, honest, and competent management, and an attractive business model, RPM Global is arguably the most attractive way to profit from the mining industry, on the ASX.

And that’s why investors should be watching the stock.

Please remember that these are personal reflections about stocks by an author. I own shares in RPM Global. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.