Mining equipment maintenance company Mader Group (ASX: MAD) produced strong results in FY 2022, contributing to a strong reputation built since its the Mader Group IPO in September 2019. Since then, the Mader Group share price has achieved a compound annual growth rate of 36.1%.

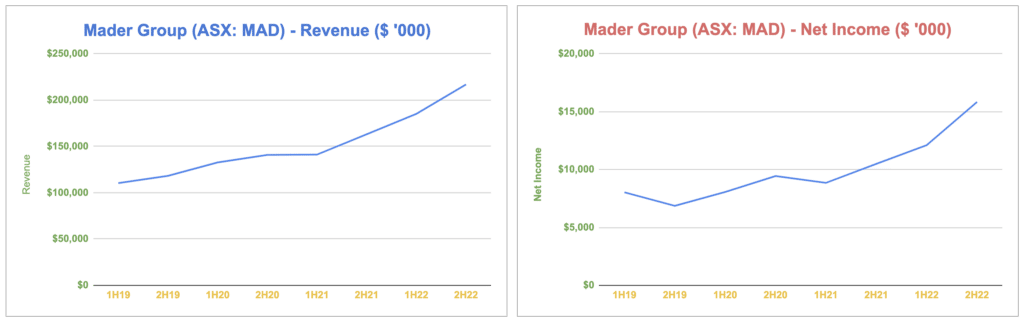

In the FY 2022 Mader Group results, revenue surged by 32% to $402.1 million with the US segment contributing $50 million. Mader Group net profit lifted by 34% to $26 million and the US recorded $10 million in EBITDA and $7.4 million in EBIT for FY22, being about 19% of the total group adjusted EBIT.

Despite strong growth in net profit, Mader is was not free cash flow positive in FY 2022, with free cash burn (excluding gains on sale of associates) around $4m. This was mainly due to a significant ramp in capital investment in property plant and equipment of $39.5 million. In saying this, Mader appears to be on the right trajectory based on how revenue and net income have grown in the past few years.

The Australian segment has been leading from the front and continues to perform well, but Mader flagged in its prospectus that the US opportunity presents one of the biggest growth runways. Let’s zoom out and take a look across the US landscape.

The US Opportunity

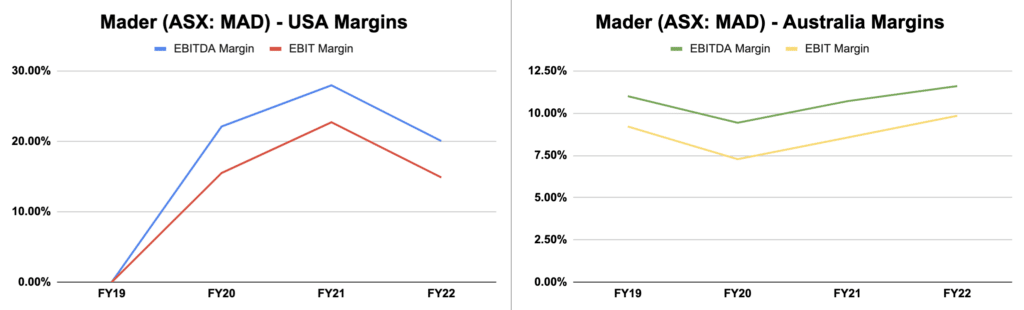

Mader Group commenced operations in the US around 2018, opening a corporate office in Denver. The heavy equipment repairer has grown revenue from $1 million in FY19 to $50 million in FY22 in the US. It is still early days for Mader in the USA, considering Australian revenue still makes up more than 85% of overall revenue. Despite the lower absolute amounts, the EBITDA and EBIT margins for the US segment are more than double that of Australian operations, as depicted below.

In the half-yearly earnings call for FY22, Mader Group CEO Justin Nuich addressed a question on the main differences between Australia and North America, in terms of competitive landscape and market dynamics as follows. He said:

“With the Aussie market, I guess it’s quite mature, and we see some smaller competitors doing similar sorts of things. What we probably see less of in the US is this type of business model. It tends to be more OEM dealers and local businesses that do similar things, but just in regional areas, supporting local towns, so to speak. So I guess [the reason that the] Mader business model comes to its own is that we are fully flexible. We are OEM agnostic, and we can provide people from sort of anywhere in the country to anywhere in the country to conduct work. So that flexibility and [being] OEM agnostic is what we see as a real advantage for us over there and probably a difference to what we see over here in Australia.“

Mader Group’s Competitors In The USA

On the basis of Nuich’s response, it sounds like there are fewer similar businesses operating in Mader’s space of OEM agnostic repair and maintenance of heavy mobile equipment. My initial search for Mader competitors in the US came up with quite a lot of OEM dealers, especially global heavy and construction equipment manufacturer Caterpillar (NYSE: CAT). I managed to find two private enterprises that provided similar services to Mader, being L&H Industrial and Bulk Equipment Corp but neither of them is purely focused on repair and maintenance. When you look for direct Aussie competitors, it’s a different story with an abundance of small to medium-sized heavy mobile equipment repairers available like Santrix Diesel, Superservice, BTP Group, CJD Equipment and Elite Heavy Equipment.

A preliminary search indicates Nuich’s words ring true with respect to the main differences between Australia and the US in terms of competitive landscape and market dynamics. So, less competition in the US appears to be helping Mader achieve higher gross margins. As for the key operational expense being labour, I believe this is the other key factor explaining higher EBITDA and EBIT margins in the US.

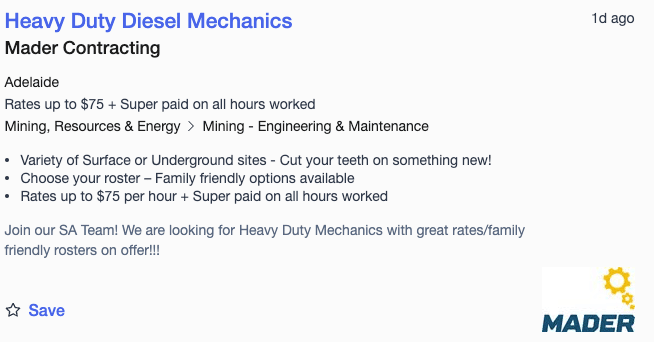

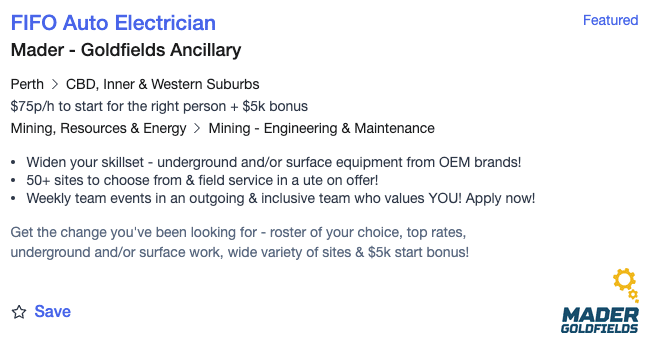

The automotive electricians, heavy-duty diesel mechanics and field service technicians seem to make up a majority of the workforce at Mader. According to the US Bureau of Labor Statistics (BLS), the median pay for heavy vehicle and mobile equipment service technicians is US$25.85 per hour, which equates to around AU$35 per hour based on current foreign exchange rates. However, the BLS advises the pay can get as high as US$32 per hour. The pay in Australia trumps that of the US, with numerous Mader job openings listing pay rates of between $60 to $85 per hour plus superannuation, as seen below.

If Mader continues to benefit from more favourable labour market conditions in the US, this makes the US growth opportunity all that more attractive.

US Mining Boom To Propel Mader Group Growth

One of the most highly accretive ways for a business to grow is when its underlying customers grow alongside them. As Mader’s customers expand, it creates more opportunities for growth. In the prospectus, Mader noted there was a growing number of Australian companies developing mineral projects in North America. And this has only accelerated when President Biden announced a $30 million initiative dedicated to researching and securing the US domestic supply chain for rare earths and other key minerals in battery-making such as cobalt and lithium.

Lynas Rare Earths Ltd (ASX: LYC) has been one Aussie company that has benefitted from the increased focus on minerals in the US. It received $30.4 million in funding from the US government to build a light rare earths processing facility in Texas. Lynas has also locked in another contract with Blue Line Corp to build a heavy rare earths separation facility.

The importance of minerals like cobalt and lithium arguably present strong tailwinds for Mader because the US wants to reduce its reliance on China over the long term. That means more mines in the USA, which means more opportunities for Mader Group.

In conclusion, it seems like the US and Canada represent attractive growth runways but it still isn’t guaranteed that Mader Group will be able to reach its full potential in that market. One risk would be that new competition emerges, bringing margins in the USA lower, to be more in line with Australian margins. Finally, one area for future research will be to examine why (and whether) the competitive dynamic between OEM’s and OEM agnostic maintainers like Mader Group is different in the USA and Australia. For example, it may be that OEM’s like Caterpillar are more competitive in the USA, their home market.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author of this article does not own shares in Mader (ASX: MAD) and will not trade Mader shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.