Xero shareholders are no doubt celebrating the 8% increase in the Xero share price today, following the release of the Xero FY 2023 result, in which new CEO Sukhinder Singh Cassidy took out the trash accumulated under prior CEO Steve Vamos. For the FY 2023 result, Xero therefore reported revenue growth of 28% to about NZD $1.4b but a statutory loss of $113.5 million up on a loss of $9.1 million last year.

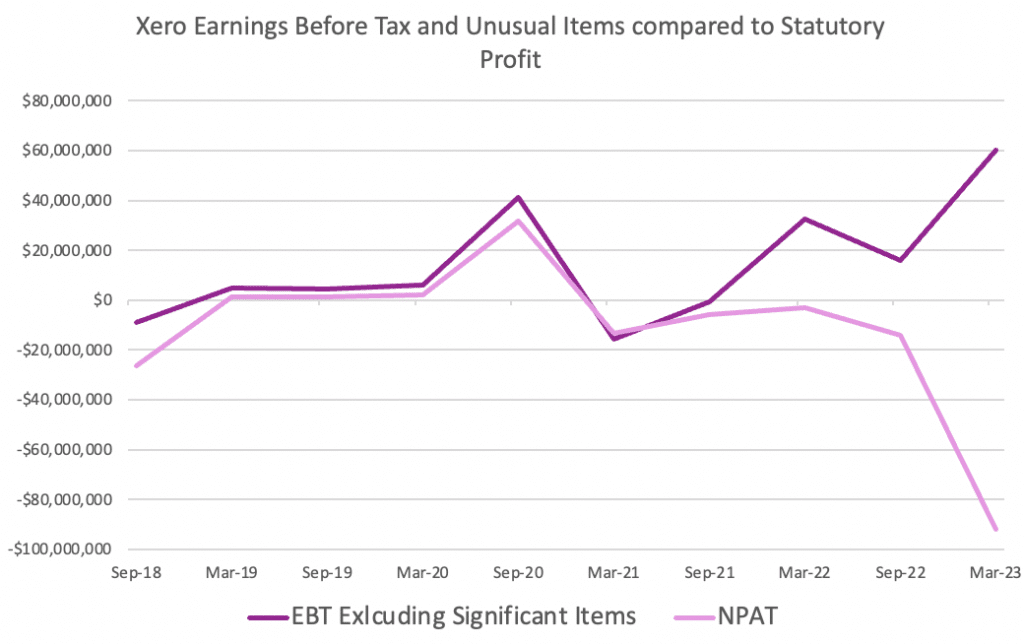

As you can see from the chart below, this half actually saw a record result in earnings before tax and unusual significant items, but the write downs ensured the actual statutory result was a steep loss.

New Xero CEO, New Xero Strategy?

It was only 6 months ago that I was decrying a pathetic profit result in our H1 FY 2023 Xero Results Coverage arguing that “the business could easily make a profit but it looks like the near term priority is to grow revenue, even if that revenue growth comes at the expense of profitability.”

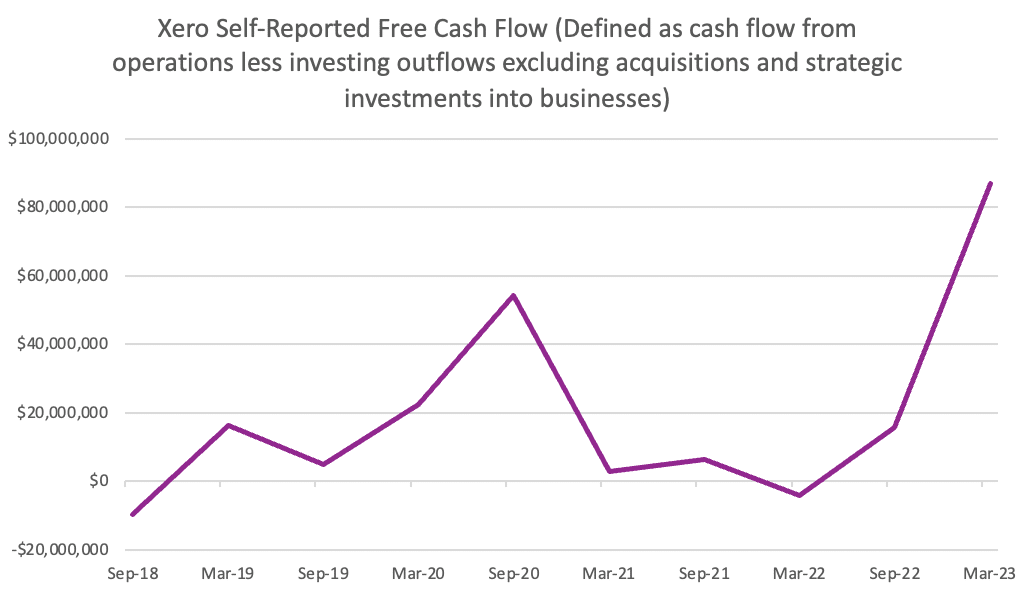

However, the new CEO Sukhinder Singh Cassidy has struck a completely different tone than the old CEO. She says that the company will now be “more balanced and look to Rule of 40 as a useful performance evaluation measure in managing the balance of growth and profitability.” The Rule of 40 dictates that the free cash flow margin and the revenue growth rate should equal at least 40. Given the prior CEO was running a free cash flow margin of around 0%, and falling well short of 40% revenue growth, it is easy to interpret this as increasing free cash flow.

Supporting that idea, the actual free cash flow in the second half of FY 2023 was a record, with the company generating around $90 million of free cash flow in the half.

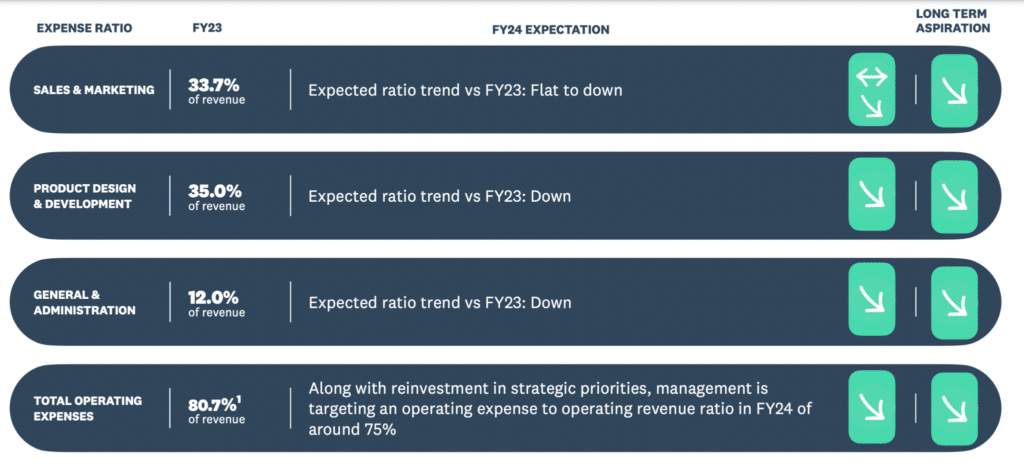

With revenue growth of 25%, and a free cash flow margin of 15%, we could expect to see over $200m of free cash flow per year. This kind of target would be consistent with the new strategy to reign in reckless spending and reduce operating expenses to 75% of revenue, as shown in the graphic below from the FY 2023 Xero Results Presentation.

This is a sharp reduction from the previous target of 80% to 85%, and strongly suggests that the new balance of revenue growth and free cash flow will be more weighted to free cash flow than previously. The other notable improvement is whereas previously management had intended to keep G&A expenses flat at around 13% of revenue, that figure is now expected to trend lower.

Xero Shares Looking Better

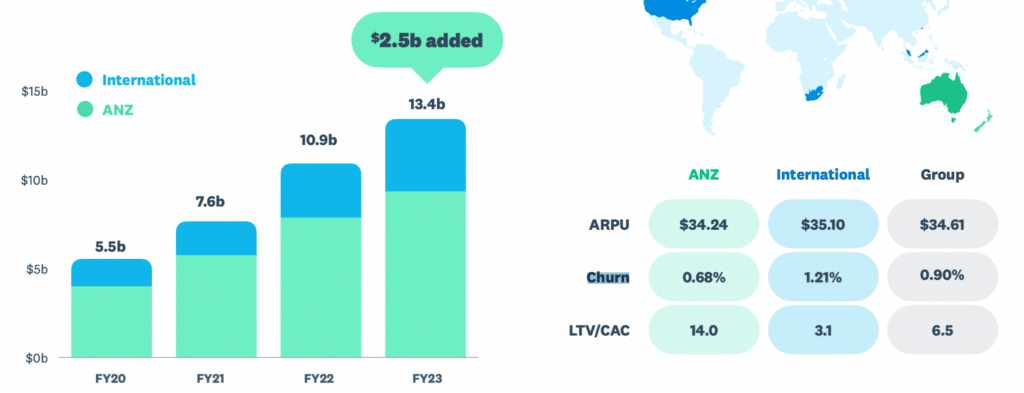

Previously, my main concern with Xero shares was that all the profits from this wonderful sticky business were accruing to employees. You can see below how difficult it is for customers to leave Xero, thus showing the value of its existing recurring revenue. With monthly churn of less than 0.7%, the Australian and New Zealand business is truly top notch.

While continued losses in the US may well dampen Xero profit growth, the biggest problem with the stock has been the purchases of Waddle and Planday, both of which have lead to write-downs, and in the case of Waddle, pure divestment.

The new CEO didn’t take acquisitions off the table, but did state repeatedly the idea that Xero would make some short term investments, some medium term investments and some long term investments. She said that “as a company is to be disciplined across all of the horizons of investment.”

When asked about new markets, she said that “We already play in a lot of big markets” and “we’re not going to discuss expanding to new markets today.”

Overall this set of Xero results make me much more optimistic about the business. Even if it does reliably produce NZD $200m in free cash flow (which I think it can) then at the current Xero share price of around $100 AUD, it is still trading on around 82 times free cash flow. This may prove totally reasonable in the long term but it obviously would assume plenty more growth beyond the $200m in yearly cash flow (which itself the company is yet to achieve.)

It is great to see Xero on the right track and although I now consider the business much more worthy of investment, trending in the right direction, I cannot convincingly argue it is cheap. While it is tempting to buy some Xero shares just because the narrative is clearly trending positive, I would probably consider that narrative speculation more so than long term investing.

With net cash of almost $100m (and balance sheet liquidity of over $1.1b), Xero deserves a spot on your watchlist (at the least) because it has pricing power, solid revenue growth, and an improving balance sheet.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in XRO and will not trade in XRO shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.