Cloud accounting software program Xero Ltd (ASX: XRO) yesterday reported their full year 2024 results. In response, the Xero share price gained around 8% to trade above $134 AUD. For FY 2024, Xero reported a 22% increase in revenue to $1.7 billion marginally ahead of analyst estimates.

A weaker New Zealand dollar had a favourable impact with 21% growth in constant currency. Please note, that Xero reports in New Zealand dollars, and so that is what we refer to in this article unless otherwise noted. You can review our previous coverage of Xero here.

Xero continued in its free cash flow growth with the company reporting an impressive $592 million in operating cash flow, growing 52% compared to the prior year. Free cash flow, as defined by Xero, reached a record level in the second half, and came in at $342.1m for the full year. That means at current prices Xero trades on around 65x free cash flow. While that obviously implies optimism about growth, it sure is a lot better than in the past, when the company was shunning free cashflow altogether.

Profit returned to growth in 2024 following a decline in 2023. With the trash cleaned out in the prior year a material subsequent impairment write down did not repeat in 2024. Xero continued to maintain a strong gross margin of 88%. The company saw a 75% increase in adjusted EBITDA, hardly the best measure of profitability, to $527 million.

More importantly, Xero recorded a net profit after tax of $174 million, with diluted earnings per share growing from a loss of $0.76 in 2023 to a genuine profit of positive $1.14. That’s about $1.05 in AUD, putting Xero on about 127 times historic earnings.

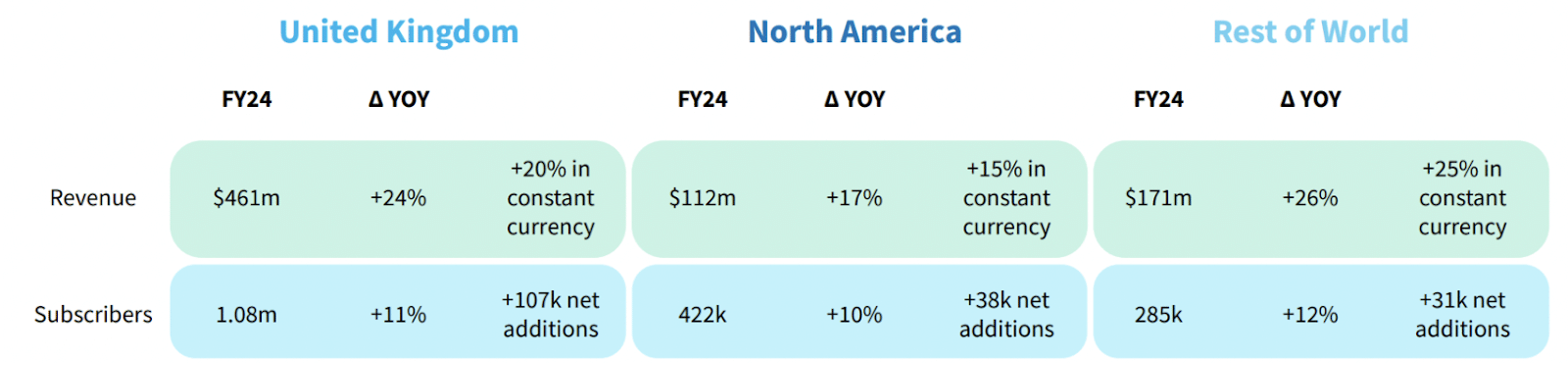

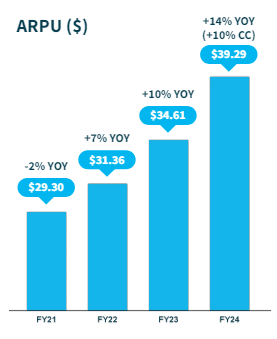

Xero’s subscriber growth continued to slow, but was still up 11% on the prior year as the company balances subscriber growth and Average Revenue Per User (ARPU) growth. The mature markets of Australia and New Zealand grew 13% and 7% respectively. International markets including the UK, North America and the Rest of World markets grew by double digits. The North American market continues to be a weak spot, with a notable lack of enthusiastic market adoption, arguably reflecting the much weaker brand value and competitive position, in that market.

Xero Operating Margin Target & Rule of 40

2024 was the first full financial year of new CEO Sukhinder Singh Cassidy, who has brought cost discipline to the table by aspiring to achieve the Rule of 40.

We have previously covered the rule of 40 but in short it is calculated by adding the free cash flow margin and the revenue growth rate. The free cash flow margin is generally calculated as free cash flow divided by revenue, while the revenue growth rate is the amount the revenue increased over the last year.

Xero managed to exceed the rule of 40 percentage landing at 41%, an increase from 32% in the prior year.

Xero’s calculation of free cash flow takes into account net cash flow from operating activities less capitalised development costs. While not true free cash flow the amounts excluded (such as rent) are relatively minor in this case. If you were to take a harsher free cash flow figure of $256 million, the calculation would have still been 38%.

Xero CEO Sukhinder Singh Cassidy commented:

“This result shows we’re doing what we said we’d do. We’ve delivered a strong and profitable FY24 result and Rule of 40 outcome, demonstrating our commitment to balancing growth and profitability. We have a clear and focused strategy to win on purpose, and Xero is positioned well as we move into FY25.”

A clear goal of Sukhinder Singh Cassidy is to see a more balanced improvement between subscriber growth and ARPU expansion.

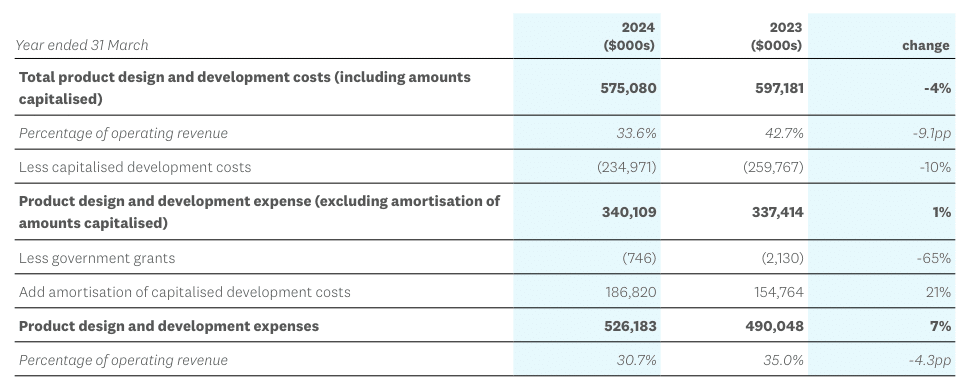

A key driver of this improvement and profitability was the restructure undertaken where headcount was reduced by 15%. Management has been targeting an operating expense to revenue ratio for FY24 of around 75%. Xero exceeded the target with the ratio coming in at 73.3%.

Impressively, the H2 ratio was 68%, down from 79% in H1. It’s important to consider with any software company whether this number could be manipulated, particularly with the capitalisation of software. Fortunately for shareholders this was not the case, capitalised development costs dropped compared to the prior year.

Looking ahead, total operating expenses as a percentage of revenue is expected to be similar in FY25 at around 73%. Management’s expectation is that product design and development costs as a percentage of revenue is expected to be higher.

Given the change in strategy we should see a slow down in revenue while profitability improves (hopefully) with the company even flirting with the idea of returning capital to shareholders in the future in the February Investor Day Presentation.

The focus is now on generating free cash flow and achieving a healthier balance between high quality revenue growth and profitability, which contrasts with previous strategies that prioritised top-line growth and risked huge amounts of shareholder capital on acquisitions (that then failed).

International Growth Despite North American Troubles

Xero maintains a strong market position in Australia and New Zealand, with solid revenue growth and high customer retention rates.

However, there have been concerns about the company’s performance in international markets, particularly the US and the UK, where profitability remains elusive despite significant investment. UK results surprised to the upside with 24% growth in revenue (20% constant currency) and 11% growth in subscribers with 107k of net additions. This is despite the lack of make tax digital (MTD) tailwinds which had previously driven subscriber growth in the UK.

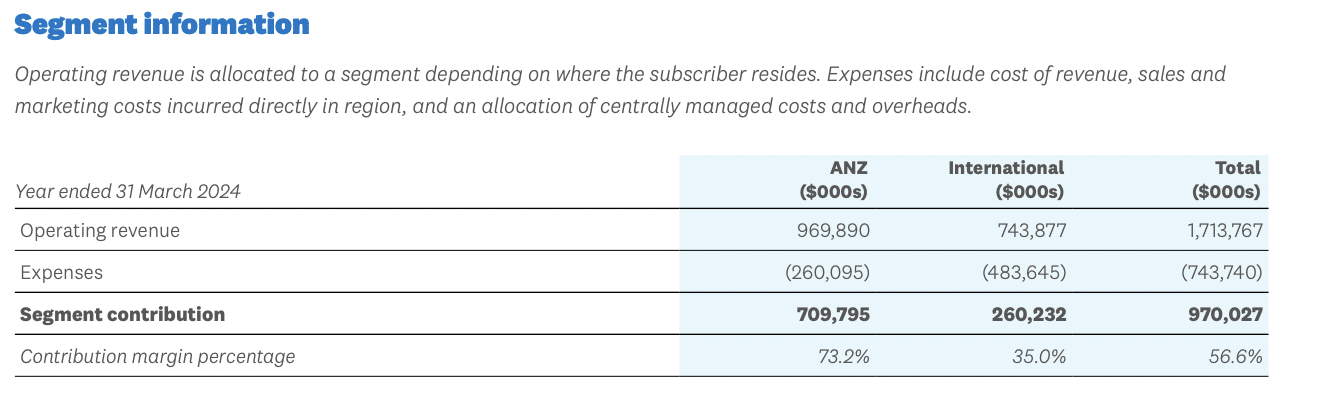

The jury is still out on the North American market following on from a strategic review detailed in the first half. Notably, business is far more profitable in Australia and New Zealand compared to International markets.

Within international, the UK is clearly the most valuable market, with North America being a huge disappointment relative to expectations from 5 or 6 years ago. It sure is a pity that under the prior CEO Xero wasted a huge amount of money on failed acquisitions, rather than spending that money gaining share in North America. It is a good reminder that the most important job of the CEO is capital allocation.

Despite lack of profitability in North America, the business is still growing in all markets, and free cashflow now puts the company in a position of strength. Given the notable absence of empire building acquisitions under the new CEO, Sukhinder Singh Cassidy, Xero is arguably in a safe pair of hands.

Sign Up To Our Free Newsletter

Xero Churn and the Impact of Increasing Prices

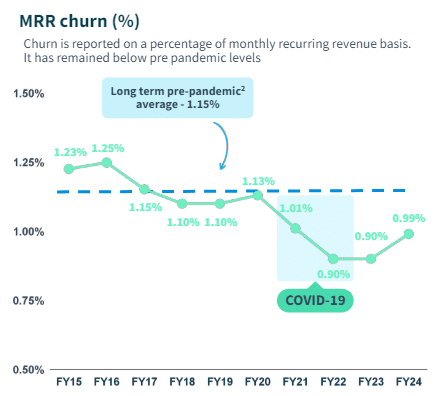

Xero has long proven the stickiness of its product with low levels of churn.

Even throughout the pandemic churn levels remained low. You could argue during this period that Xero (and other accounting software) was as important as ever with business owners needing numbers to prove eligibility for government stimulus.

As you can see from the below graph, the churn rate has started to tick up ever so slightly. Despite 0.99% churn per month, still being incredibly low, the impact of subscription price rises, the biggest of which are coming in the not too distant future, has no doubt had an impact. There is evidence these price rises are already frustrating users and accountants.

It is the ultimate test of Xero’s stickiness and whether the company’s pricing power will play out, particularly with small businesses already feeling the inflation pinch. Xero’s ‘standard fee’ which will convert to ‘Xero Grow’ from July has seen a 40% increase in 4 years and a 19% increase in the last 12 months.

Xero stands by the cost increases and suggests that users will receive more features while simplifying the number of plans. You can review the product releases through their website. To the untrained eye it may seem like they have been doing plenty but, for the end user, in my opinion as an accountant, it has been minimal.

Let’s not choke on the spin: Xero is clearly flexing pricing power. As a shareholder, I’m happy to see the Average Revenue Per User (ARPU) growth arising from price increases.

By pulling the price increase lever, Xero has continued to show exceptional growth in the amount of revenue it can extract per customer. If this growth can continue, even with an increase in churn, the business should be better off.

Following these price increases will subscribers actually change? Or is it all huff and puff and businesses will just accept the increase and move on? Clearly, price rises well in excess of CPI cannot continue forever.

I believe we are more likely to see those using payroll only options for ATO compliance purposes switch to an alternative as there is less administration required to change. In my experience as an accountant, I am yet to see anyone request a move away from Xero due to pricing, but this latest run of hikes may start this process.

Competitors like Quickbooks are offering cheaper pricing with significant discounts on the initial 6 months upon signing up.

Quickbooks offers migration of data from old files for free on certain plans. Following the initial 6 months, the price reverts back to an amount still lower than Xero, but is the overall saving worth the hassle of learning a new program? After the initial 6 months the savings may only be $15 – $20 per month.

Xero’s Financial Position & Outlook

Xero’s balance sheet remains strong with cash and short term deposits of $1.5 billion and net cash of $422 million. Outside of the increased cash position, the balance sheet had very little movement of note.

Other than the previously mentioned operating expenses ratio and development costs, Xero management provided little forward guidance. Arguably, this is also a wise decision because it reduces the risk of undermining confidence in management should results disappoint relative to guidance.

The company emphasised that while the rule of 40 is a target, it is not to be considered guidance and may be impacted by future investment strategy.

Are Xero Shares Cheap?

From a valuation standpoint Xero is rarely obviously cheap, given the high quality business model with pricing power and sticky customers is well appreciated by all.

At the time of writing Xero’s share price was up 8.5% to $134.54 converting to a market cap of over $20 billion! It does feel odd being able to apply a price to earnings ratio to Xero. With earnings per share of about $1.05 in AUD, and a share price of $134, the PE ratio as mentioned above is about 127!

It currently has a trading operating margin of around 10%. If it could continue to grow revenue in the mid teens over the next few years and improve this operating margin to 20% over time, it may trade closer to 50 times earnings. That is still priced for growth, but is not unusual for a high quality business model trading on the ASX.

Xero and profitability was often considered an oxymoron so it is nice to see that management is beginning to balance quality revenue growth and profitability. Time will tell as to whether price increases will ultimately grow the rate of churn, although I do believe that the quality of the product and stickiness of the program will keep this in check. The firehose of superannuation funds looking for the reducing number of high quality tech stocks on the ASX will probably keep the businesses valuation high, though whether this kind of sociological observation is enough to justify a share purchase will depend on the approach each investor takes. I am a happy shareholder and will continue holding.

Disclosure: The author of this article Nick Maxwell owns shares in XRO. The editor Claude Walker does not own shares in XRO. Neither will trade XRO shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

If you would like to be among the first to receive articles like these, and even suggest small-cap mailbag articles yourself, then you can click here to join the waitlist to become a Supporter.