Audinate (ASX:AD8) Grows Customer Numbers In H1 FY2021 Results

Audinate (ASX:AD8) shares are back at pre-covid levels. While its revenue and profits are yet to fully recover, the business is improving.

Audinate (ASX:AD8) shares are back at pre-covid levels. While its revenue and profits are yet to fully recover, the business is improving.

Key figure corroborates US and Colombian state foreknowledge of the plot.

Energy One (ASX: EOL) is a high risk micro-cap stock but makes a profit and is in an interesting position for global growth.

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

Unconditional cash transfers have two-thirds support in many Western countries.

Even individual transactions are ridiculously energy-intensive.

Guinea and the Democratic Republic of the Congo face simultaneous outbreaks.

The company seems in great shape but the market is starry-eyed.

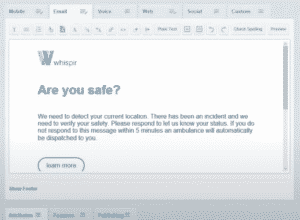

Whispir (ASX:WSP) grows revenue mostly because its customers are spending more, but the bigger issue is whether it can succeed in the USA.

For those who have been labelled ‘other’ tattoos have been an important component of claiming, displaying and celebrating identity, learn more in ‘Skin Deep’ at the National Art School.

Jewish International Film Festival – Ticket Giveaway! From 17 February to 24 March, the Jewish International Film Festival brings a new round of spectacular Jewish cinema to the big screen. WE have three double passes to giveaway!

‘Steam Dreams: The Japanese Public Bath exhibition at Japan Foundation Sydney invites audiences to explore the history, preservation, and future of Japanese public bathing culture.

A freak winter storm provided an opening for retrograde claims about renewables.

PM ignores chief recommendations from Respect@Work inquiry.

The Pro Medicus share price fell today (ASX: PME), despite stronger profits and record revenue, with volumes bouncing back as covid recedes.

Class (ASX: CL1) is growing its revenue nicely and it makes profits and pays dividends; but its earnings growth is not so flash.

New Zealand PM’s comments follow arrest of former Australia-NZ dual national at Syrian border.

Adairs (ASX:ADH) share price is lower on Adairs 1H FY2021 results, but its trailing dividend yield is over 5.8%. It could be interesting.

The federal government is spending $1.5 million per asylum seeker on Nauru from January – June.

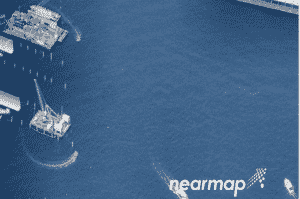

The Nearmap share price is up on what was, at a glance, a good report. But is the market underestimating North American competition?