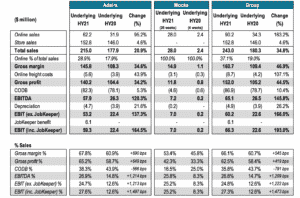

This morning bedding and furniture retailer Adairs (ASX: ADH) reported its results for the first half of FY 2021 showing a record profit of almost $44 million. However, the company benefitted significantly from JobKeeper, which it plans to give back to the government during the second half of the financial year. Adjusting for the $6.1 million JobKeeper subsidy (before tax), it would be fair to say that the adjusted net profit after tax would be just under $40 million, but I’ll use $39 million as a proxy just to be conservative.

This strong profit result was driven by a combination of revenue growth, the Mocka acquisition, and improved margins across the group. On the call management may have been understating it when they said operating leverage was a feature of the results!

However, on the call they made it clear that they are not expecting to maintain margins at these levels. That means that even if revenue keeps going up, profit could go down. In that scenario, it may be too generous to consider net profit of $39 million per half as sustainable. It may be reasonable assume that the combined business can earn $30 million per half in profits, and that Mocka can continue to grow strongly while Adairs grows more slowly. This would imply an earnings run rate of about $60m per year. That’s a bit below the median of 7 analysts per CapIQ right now. Their estimates range from $56.3m to $77.6m with a median of around $64m. My guess is these estimates did not include a JobKeeper refund, so it seems like the operating businesses is probably tracking to expectations one way or the other.

If we run with the conservative leaning $60m profit estimate then the company is trading on around 11 times earnings (while carrying sustainable debt). Its free cash flow was very strong this half, at over $59 million, but that is not typical. The company has had trouble with inventory, and will need to flow some cash back for JobKeeper. But to a degree, these numbers are mostly important because they show the company can simultaneously fund growth and pay a decent dividend. This half, directors declared a 13c dividend on earnings per share of 25.9 cents. That puts the company on a trailing dividend yield of more than 5.8% at the current price of $4.08.

With this kind of yield, I think it’s fair to say that if only Adairs can keep its business steady overall, then it is decent value at the moment. Probably, it is simply not catching any of the hot money driving zero revenue or high revenue growth small-caps. While I have no real affinity for investing in retail businesses, it seems like a pretty decent dividend payment to follow along with the company a little longer. After all, it does have some good features.

Omni Channel Integration

One of the things I like about Adairs is that it is truly an omnichannel retailer. The company can boast 900k subscribers to its Linen Lovers subscription. This enables Adairs to market directly to the customer, and allows the customer to access a discount on every purchase. 75% of Adairs sales are converted into the Linen Lovers group.

On the conference call, the CEO mentioned how salespeople inside stores are very effective at working Linen Lovers into the conversation and so it is easier to grow the list of subscribers when stores are open. This hints at a possible flow where someone can come in store to buy some new sheets, become signed up to Linen Lovers, receive a special offer by email, and make another purchase over the internet. This simply seems like good business and it is not unreasonable to think that an online + offline business with a large list can hold its own better than most retailers. In my view, the store closures have probably made this kind of model more effective, in some ways, because people are more likely to respond to email marketing with offers such as free postage (which Linen Lovers does offer). Yes, this is small fry stuff compared to Amazon Prime, but the point is that Adairs keeps looking like a good, competent retail outfit.

When I asked what shape the list was in, the CEO seemed to think the metrics were all looking positive. This is consistent with what you would expect during a socially distancing period, but I did take some heart in the fact that his response seemed to convey a genuine concern for keeping the list fresh. He didn’t try to hide the high churn (as you would expect for such a niche offering), but did make it clear his focus was more on active members than paid members. The subscription revenues are not the main game here, but they are a clever hook at getting people to make repeat purchases.

Mocka A Good Business?

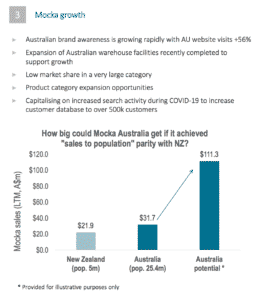

Even though the expectation seems to be that homemaker retails like Adairs will take a hit when parties and holidays are back in vogue, it was good to see that the recently acquired Mocka online only business seems to be going well. Arguably, the most bullish slide in what was a fairly humble presentation shows the “potential” they believe Mocka has in Australia.

In any event, Mocka seems more comparable to other online retailers like Temple and Webster (ASX: TPW), which trades on a much higher P/E multiple than does Adairs. While it seems like the market only has eyes for the pure online businesses at the moment, it may be that Adairs begins to attract more attention as Mocka grows. On the conference call, management said they are planning on trying to grow the business faster than 30% per annum and the company is investing in warehousing in Australia to ensure capacity for growth.

This post is not financial advice, and you should click here to read our detailed disclaimer, here. In terms of my own actions, I have more of an affinity for this business after these results. I was taking profits in Adairs above $4, prior to these results, but I take heart from the seemingly effective omni-channel integration of Adairs, and the considerable growth ambitions for Mocka. I currently plan to hold on to my remaining shares for a bit longer, as I watch the story unfold. At the very least, I expect a decent dividend.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

Be the first to receive some of our exclusive hidden content by signing up to our free newsletter below.