Yesterday, my second largest holding, energy trading software company Energy One (ASX:EOL) reported its results, a strong uplift in profits to $2m for the half. However, this result benefitted from a spike in non recurring revenue, which is unlikely to repeat next half. As a result, full year profit is expected to be $3.7 million, with only about $1.7 million in the second half.

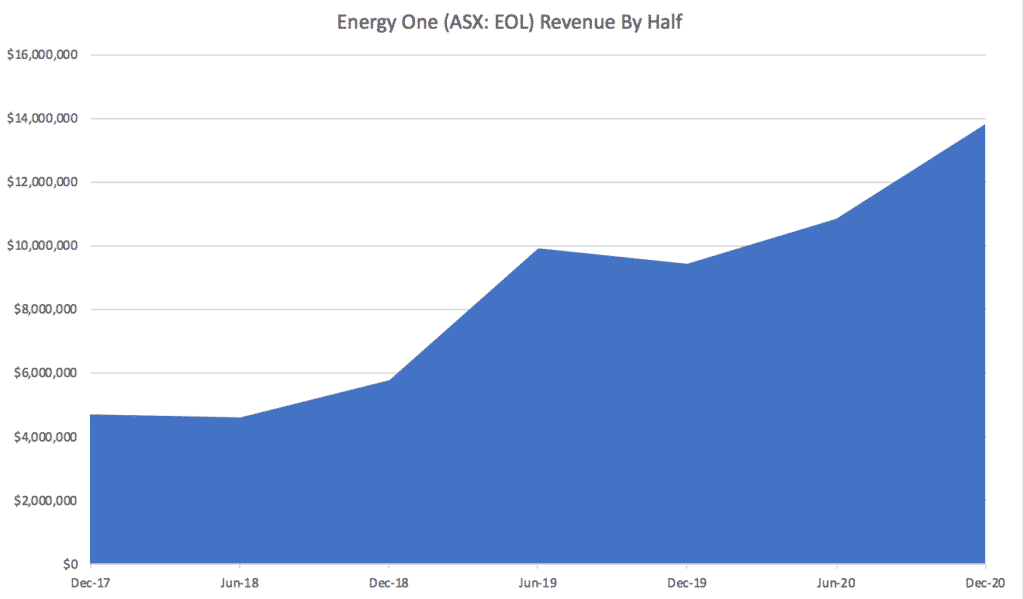

For the first half of FY 2021, Energy One did $13.8m in revenue, but it is only expecting $27.5m for the full year, indicating a slight decline in the second half.

This article is not intended as advice but is merely my notes about these results. Investment notes, or diaries can help an investor remember why she did what she did or why he didn’t do what he might have.

In the graph below, you can see the impact of the acquisitions of Contigo and eZ-nergy, with Europe now contributing around half of total revenue.

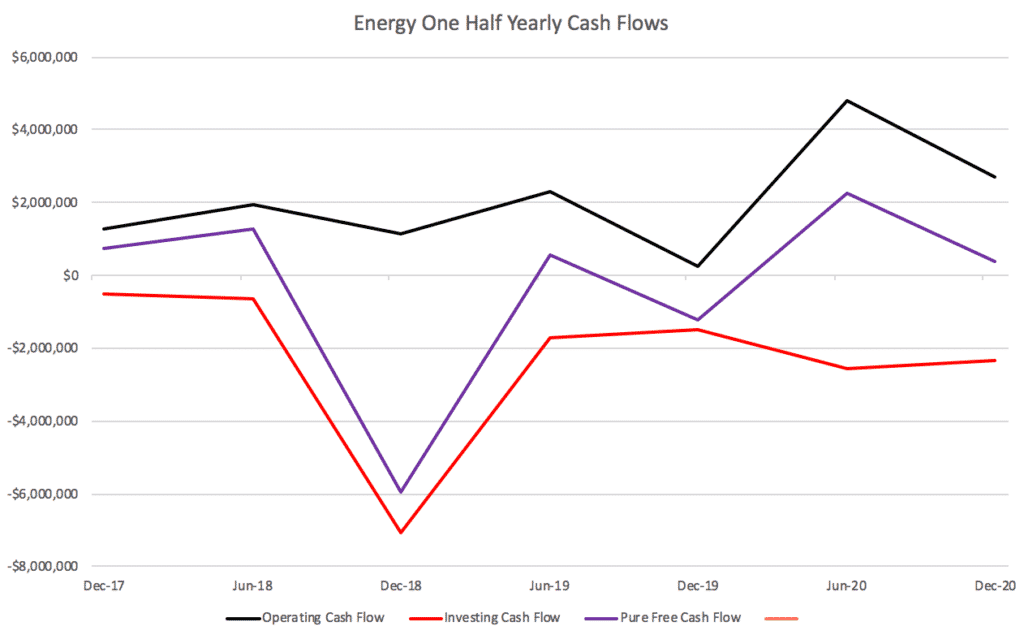

Energy One (ASX: EOL) Free Cash Flow

Free cash flow lagged profit, even adjusting for deferred acquisition costs. If we just deduct software development from operating cashflows to get an ‘ex-acquisition’ figure then free cashflow would be about $1.2m. To be conservative, you could use this as a proxy for owner earnings.

Below you can see the strict free cash flow. This is relevant because the business strategy does require cash for acquitisions.

In a very strict sense, then you could maybe budget for $2m in fcf per year from this company as a ‘worst reasonable case scenario’. Then, you could easily imagine in a down market the stock trading at lower than 30x this very conservative estimate. So we could still see the stock fall around 50% from here. It doesn’t seem overly cheap.

Having said that, the apparent success of the recent acquisitions is a good sign that the strategy has been well executed.

On the conference call, the company made the point that they only have around 5% market share in Europe so they have plenty of room to go if they compete well. That seems to be the plan and that is certainly heartening. On top of that, due to population and electricity maket structure, I understand that the number of customers are much larger in Europe.

Harking back to my initial article on why I own Energy One shares, it’s not impossible to imagine a company with 50% market share in Australia could do well in Europe. That’s because although we are few, Australia is a big geographic energy market with plenty of complexity.

Indeed, the company has long been thinking about the opportunity to develop solutions for the new 5 minute settlement regime. On the conference call, the company said, “the software for 5min settlements is now complete, and we are ready to roll-out when the market is”.

Importantly, this change can be both a conversation starter with new clients and an upsell opportunity with existing clients. However, this change has been delayed before, so I wouldn’t count my chickens before they hatch.

Going forward, management said, “In the fullness of time we’ll be moving into the US market as well”. That would likely mean some sort of acquisition, so one hopes they are able to find a good one. Each acquisition brings new risks, and good companies often mess up by acquiring a bad one.

With $3.4m in cash and only around $200k in debt, Energy One would seem to be in a reasonable position to make a small acquisition, but it would arguably be just as heartening to see successful organic growth in Europe. While neither outcome is guaranteed the business still has multiple ways to win and is well positioned in an environment where buying and selling power on wholesale markets is becoming more complex.

In some ways, I see Energy One as a fortunate beneficiary of the very necessary transition to renewable energy. Overall, I remain a happy shareholder.

Please remember that these are notes on the recent results only and should not influence an investment decision. This article is not financial advice, it is general in nature, and our disclaimer is here. The author owns shares in Energy One.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.