One of the most painful aspects of the current market is that I have largely prevaricated about some of the few ASX small-caps that actually have good share price momentum. Over the last year or so, I have identified each of these 5 stocks as potentially interesting, put them on my watch list, but not bought shares (or worse, bought then sold shares).

Then I watched the prices go up, over many months.

These companies are now all trading at close to their highest prices in the last 12 months, and each have shown strong earnings growth.

The common thematic is that these businesses are benefiting from demand associated with the growth in demand for certain natural resources. As a result of inflation, electrification, and the war in Ukraine, prices of most resources are relatively strong, with iron ore being a notable exception. Another thematic, therefore, is that these businesses are at least somewhat cyclical in nature, and may be better suited to a short to medium term trade than a long term hold.

Finally, it is noticeable that these are very much industrial stocks operating in the real world and most of them have real physical assets. While this may make business growth capital intensive, an inflationary environment can mean that the existing assets held by such companies are worth more, because they would now cost more to replace.

Without further ado, let’s look at five stocks with good momentum and good fundamental stories, that I might look to buy shares in. If I did buy shares in these stocks, my idea would be to hold for the short to medium term, as long as the business momentum and sociological story remains favourable. Therefore, I would sell more easily than I would sell a long term “quality fluffy dog stock”, so to speak. I also would probably have lower conviction on any single stock below; but am considering simply buying a small holding in each of them, in the near future. I haven’t made any decisions yet, but here are my notes.

IPD Group (ASX: IPG)

IPD Group is an electrical distributor and service provider that listed at the end of 2021, raising $40 million at a share price of $1.20. Of that $40 million, half was paid directly to pre-IPO shareholders cashing out of their investment. The other half was kept to accelerate the growth of the group.

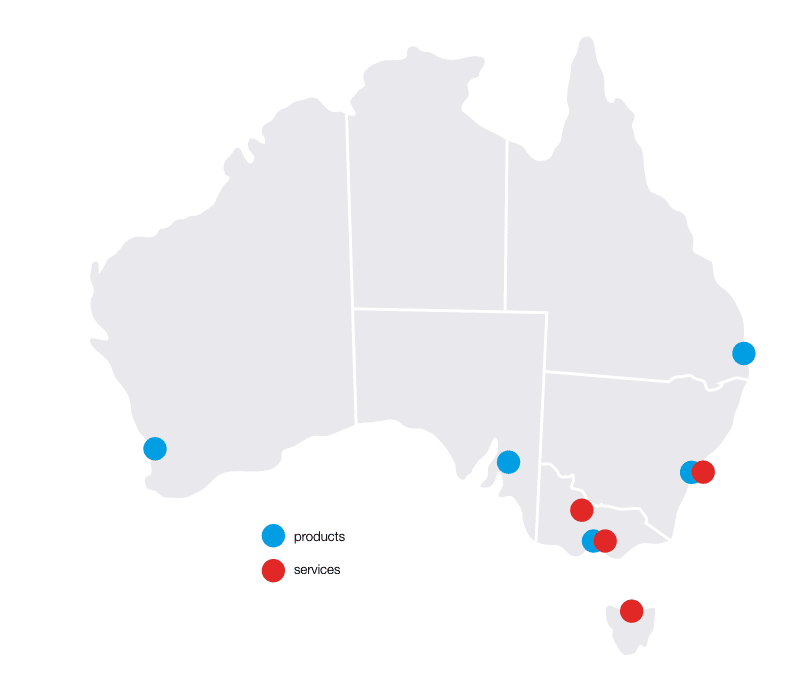

According to the prospectus, “IPD’s customers are predominantly switchboard manufacturers, electrical wholesalers, electrical contractors, power utilities, OEMs and system integrators.” Its operations are split into two segments, services and products.

According to the Annual Report, the services segment offers “design, installation, testing and commissioning, maintenance, and calibration of electrical and distribution assets…” and its capability has been “further enhanced in FY22 by the additional products and solutions of HTC, particularly in regards to high energy consuming HVAC equipment and Gemtek, with respect to electric vehicle charging infrastructure.”

Meanwhile, the products business offers “compliant and innovative electrical infrastructure products with value-add custom-made solutions, engineered and manufactured locally,” with a core focus on “power distribution, power monitoring, motor control, automation and industrial communication, and electric vehicle charging solutions.” The company says “Best-in-class product supply is maintained through increased stock holding across 130,000 cubic metres of warehouse space.” You can see the company’s products and services geographic footprint, below.

Importantly, IPD Group has been built via acquisitions, and the annual report said management are “in discussions with multiple potential acquisition targets.” Therefore, the company is clearly classed as a roll up.

As a distributor (at least in part), IPD Group should at least benefit from additional scale. However, on the downside, it clearly has significant inventory holdings, so it is possible that growth requires that plenty of the profit is invested in working capital.

Backing out IPO costs, FY 2022 net profit could have been about $12 million, and the company says “pro forma” profit would have been $12.6 million if you exclude IPO related expenses, include three months of HTC prior to acquisition, five months of costs as a listed company and excludes HTC acquisition related expenses.

The company has about 86 million shares on offer (of which around 53 million were held by pre-IPO shareholders at the time of the IPO). At the current IPD Group share price of $2.58, it has a market capitalisation of about $222 million. It is therefore trading at about 17.6 times pro forma profit. This seems a bit rich to me. However, the share price has responded to the fact that the actual results were considerably better than prospectus forecast.

Major risks include the fact that this business is probably fairly cyclical, and that the pre-IPO shareholders are now free to sell more shares (at more than twice the IPO price). While the stock has had a strong run, it has mostly seen only thin volume, and it is quite possible that a large sell down by a large existing holder could depress the share price considerably, and potentially stop the share price momentum.

Although it is up 23% already since I mentioned it on Ausbiz on 11 October, there hasn’t been much discussion of the stock, though 1851 Capital did mention it on Livewire recently. I should have bought this one to play electrification trend, and I’m wishing I did. Even though it seems a bit too highly priced for me now, I could also see the share price maintaining strong momentum for a while, so I still like the idea for a smaller or lower conviction medium term trade.

As we saw with DGL Group, these kind of industrial roll ups can enjoy a strong run as long as the story stays positive; but once the sentiment turns the business gets much worse, because its can’t create value by using higher priced shares to buy businesses on lower multiples of earnings.

Overall, distributors can increase margins as they scale, sometimes, so there is at least a possibility this is a decent business long term (and may improve in quality over time). However, margins are generally slim, and working capital needs are high. For this reason free cash flow is likely to lag profit. On the bright side, the company has $25 million in cash so it is funded to expand a little. As long as demand for IPD’s products and services remain strong, I think this could be a reasonably good stock to own, even despite the risk of buying a relatively recent IPO.

XRF Scientific (ASX: XRF)

XRF Scientific makes its money by selling lab equipment that heats up mining samples, melts them down, and analyses them to understand the constituents. It has a reasonably attractive model due to the razor plus blade model where they sell the analysing machines, but also the consumable products. This means that there is a degree of ongoing revenue from customers, not just a one of sale. It also exposes the company to the mining cycle; the more exploration, the more testing, the more business for XRF Scientific.

One big risk is that the products it sells (including the consumables) are likely to become more expensive due to inflation, and this could impact on margins. Of the companies discussed in this article, I’d argue it is one of the more cyclical, and may struggle in a weaker commodities environment.

On the bright side, the company said “We expect the December 2022 quarter to be a positive period, with high levels of activity occurring in the mining industry and new product developments being progressed,” and two directors have recently bought shares at around current prices. The board collectively own a fair chunk of shares, though the long serving CEO has less than $1 million worth at current prices. Overall, it would be fair to say management have a good track record.

The XRF share price recently responded to a positive market update reporting $2.4 million profit before tax in the first quarter, implying a full year profit after tax of over $7 million could be possible. The current market cap at the share price of 82 cents is $112 million, or about 16 times this “rough run-rate” forecast for FY 2023. It has a trailing dividend yield of about 3% and seems around reasonably priced to me, but with good business and share price momentum, it definitely catches my eye.

Sign Up To Our Free Newsletter

Mader Group (ASX: MAD)

Mader Group makes money by providing maintenance services to mining and heavy equipment companies. Generally speaking, different mines will have a wide range of trucks, diggers, haulers, rigs and other heavy machinery. Mader competes by making it more convenient for mining companies to service and maintain this equipment (especially older equipment). There are some advantages of scale but a significant driver is the fact that original equipment manufacturers (OEMs) generally only service their own products.

The stock has been on my radar for a while, in large part because of Matt Joass, but also because Raymond wrote this compelling article about the USA growth opportunity for Mader. I was thinking of buying it a few times, always hoping it would just be a bit cheaper, down the track. One of the reasons I prevaricated is that I do think the business is quite likely more exposed to the business cycle than people would realise (given the current strong environment). Either way, for now business is strong.

The Mader Group share price recently responded to a guidance upgrade for FY 2023 announcing “revenue is expected to be at least $550m, with an NPAT of at least $35.5m.” I have particularly noticed a confluence of social media and general media interest in the stock recently. Clearly it is a favourite of momentum traders too, so it is important to be aware that there is a fair bit of hot money in the stock; it could crash hard and fast if and/or when the short term strong narrative breaks. I’m a bit cautious for that reason, and must also note some director selling (though the board is still well aligned). I’m also a little cautious because increased investment in plant, property and equipment has produced negative free cash flow despite strong profits.

Beyond pricing, I do think it seems like a decent quality business with good long term prospects, even if return on invested capital gradually reduces from here.

At the current share price of $3.47, Mader Group has a market capitalisation of about $695 million, so it is trading on about 19.5 times forecast profit. That’s not outrageous; and if the company stays in an upgrade cycle, there could well be more gains despite a strong share price run, already.

Duratec (ASX: DUR)

I have written about building contractor and maintenance company Duratec before, and even owned it, though I struggled to gain confidence due to minimal shareholder communications. My biggest concern has been that the company would struggle with inflation if it had agreed to fixed price maintenance contracts (but wages were increasing). That remains a risk, though I note that the Chairman said that the company is “selective in choosing which projects we tender for, in an effort to improve the Company’s overall operating margins, profitability and cash generation.” This gives some comfort.

In FY 2022, Duratec made about $7.7 million in profit from $310 million in revenue, so its net profit margins was a super slim 2.5%. Duratec has about 242 million shares on issue so at the current share price of $0.475 it has a market capitalisation of about $115 million, putting it on about 15 times earnings. Its trailing dividend yield is about 4.2%.

In FY 2022 the company grew profit by about 8.8% and revenue some 31.5%. Its outlook says “High work-on-hand and tendered-works position underpins strong growth prospects; expected to be in line with historical year-on-year growth rates.” It is hard to know what this would translate to in terms of profit growth, but moderate could probably come close to justifying the current multiple.

The annual report said that “The year ahead looks to be a period of significant growth for the Company given current work on hand and the pipeline of work to be tendered,” so it is at least feasible the company is undervalued at current prices.

Duratec’s largest segments, in terms of gross profits, are mining and defence. You would have thought it will therefore do well in an environment when mining is strong and defence concerns are growing.

Duratec had strong cashflow in FY 2022 and net cash of over $43 million at the end of June. Since then, Duratec has spent up to $18 million on Wilson’s Pipe Fabrication, which “provides onshore and offshore mechanical engineering services to tier 1 oil and gas producers.” If we assume that allows a small increase in profit, even just to $8.5 million, and if we give Duratec credit for say $20m of cash remaining, then its enterprise value is a bit under $100m. Arguably, an $8.5m net profit on an enterprise value of $100m is quite cheap. I’m kicking myself for losing my nerve on this one because I originally purchased it at around 40c; then sold for a small loss. It hurts to buy back higher, but it seems my fears (after a very weak first half) were unfounded. We often hear companies that promise a much stronger second half, but Duratec actually delivered! Fair play to them; if buying back in a bit higher is my punishment, maybe I should just take it.

Bisalloy (ASX: BIS)

Bisalloy is Australia’s only manufacturer of quenched and tempered steel plate. I bought shares opportunistically at $1.10, when Malcolm Turnbull became a substantial holder. I should have just held on, as it currently trades at $2.19, and a director bought shares at $2.09 quite recently. Even at these prices, it boasts a trailing dividend yield of 6.1% fully franked.

One of the huge risks for Bisalloy is that exports massive amounts of product to China, which has its own problems, and is often an unreliable trade partner. Some of Bisalloy’s products are designed as armour for military equipment (though I’m not sure how much of that goes to China). Either way, I’d classify Bisalloy as high risk because of its exposure to China. On top of that, it is capital intensive, so increasing steel prices mean increasing working capital.

Even though some of the drivers of Bisalloy’s performance continue, its FY 2022 result might represent a peak. At the AGM the Chairman said, “Looking ahead the headwinds that we have begun to experience in the second half of FY22 are expected to continue through FY23. Falling international steel plate prices, significantly increased shipping costs, disruptions to international and coastal shipping, and ever increasing gas and electricity prices are reducing our profit margins and supply chain predictability.”

As I see it, Bisalloy sits least well into this group, because its business momentum comes from cost cutting more than the others. The company aims to reduce its workforce by 20% through voluntary redundancy. But it’s not 100% about cost out. The company says that “the Armour and Export business efforts have generated much more interest from global defence primes, with several new accounts developed.”

Ultimately, assuming China maintains, Bisalloy’s biggest customer segment is the mining industry in Australia. Therefore in many ways it is a leveraged play on the money flowing into running and developing mines. Your guess is as good as mine where that goes long term but the current conditions are strong and that may provide some upside.

Due to the cautious guidance at the AGM this feels the riskiest of the 5 stocks in this article, and the least attractive to me. Its operating cashflow was slightly less than its dividend payment, implying the current yield may not be sustainable. It has over $10.5 million in debt, so if things went poorly, that dividend could disappear really fast. Overall, Bisalloy looks the least attractive of the lot, but I can’t deny the share price momentum, and the last 5 years of profit growth. However, please note that the P/E ratio of around 7 is potentially not so cheap, given the company is forecasting lower margins due to lower prices and higher costs. Given the operating leverage in this business, profit could drop very considerably.

Disclosure: the author of this article does not own shares in any of the companies mentioned in this article but reserves the right to buy shares any time from 10am Tuesday 8 November, more than 24 hours after this article is published. No undertaking is made to buy shares in any of these stocks and any purchase decision or lack thereof will be influenced by the whimsy of both the author, and the market. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.